Despite giving in to the April rout amid renewed market jitters on a higher for longer interest rate backdrop and geopolitical unrest, Microsoft Corporation (NASDAQ:MSFT) remains poised as a resilient gainer. This is corroborated by its robust March quarter results and managements optimism on a solid outlook underpinned by continued capture of emerging artificial intelligence (“AI”) growth opportunities.

We believe AI continues to be an incrementally additive opportunity to Microsoft’s outlook. This is particularly due to its expansive business that spans across infrastructure, large language models (“LLM”s) and end-user software applications – namely, the three key segments of AI opportunities.

Looking ahead, Microsoft remains well-positioned for pent-up valuation gains as it continues to monetize on additive AI opportunities down the nascent technology’s value chain. Incrementally, we believe this also bodes favorably within a risk-off environment when paired with Microsoft’s robust balance sheet, which reinforces its haven characteristics.

AI Double-Dip in Inference and Software

We believe Microsoft’s competitive advantage amid AI transformation lies not only in its prescient investment into OpenAI and other related technology developments, but also in its expansive addressable market that spans across infrastructure, LLMs and development tools, and end-user software applications. Specifically, Microsoft’s diversified revenue sources for capturing AI opportunities remain a key mitigating factor against concerns about eventual demand risks and preserves its long-term growth trajectory.

Inferencing Opportunities

As discussed in our previous coverage on the stock, Microsoft Azure remains a key beneficiary in the transition from training-dominant to inference-dominance workloads in the AI adoption cycle. And we continue to expect this trend to pick up in momentum heading into the second half of calendar 2024. This is also in line with management’s continued expectations for further momentum in commercial business growth through the back half of FY 2024 and beyond, particularly as AI service adoption scales up.

Specifically, inferencing is expected to become the key driver of AI workload volumes, as industries start to scale up usage of AI solutions adopted over the past year. Industry currently forecasts inferencing activity to represent “2x the number of cycles and spend as training by mid-2025.” And the forecast trends are consistent with the growing share of revenue attributable to AI inference, and the industry’s increasing focus on addressing inference needs, as cited by Microsoft and its AI peers. For instance, AI darling Nvidia (NVDA) has referred to “inference” capabilities in its newest products eight times during the latest GTC keynote, while drastically reducing mentions of “training” compared to recent presentations.

We estimate in the past year approximately 40% of data center revenue was for AI inference…We are on track to ramp H200 with initial shipments in the second quarter. Demand is strong as H200 nearly doubles the inference performance of H100.

Source: Nvidia F4Q24 Earnings Call Transcript.

As AI proliferates and the world moves towards more AI integrated application, there’s a market shift toward local inferencing and smaller, more nimble models.

Source: Intel 4Q3 Earnings Call Transcript.

Mark Murphy

Yeah. Thank you very much. Is it possible to unpack the 6 point AI services tailwind, it’s just to help us understand which elements ramped up by the three incremental points.

Amy Hood

Mark, without getting into tons of line items, it’s more simple to think of it as really, it’s people adopting it for inferencing at the API generally…But this is primarily an inferencing workload right now in terms of what’s driving that number.

Source: Microsoft F2Q24 Earnings Call Transcript.

Accelerating inferencing activity is also in line with the increasing migration of workloads to the cloud, which continues to benefit Azure. Specifically, we remain confident in Azure’s market share gain prospects not only because of its leading position as a primary cloud service provider, but also because of its diverse selection of instances to fit every performance and cost requirement from customers.

In addition to instances powered by third-party chips from Nvidia and Advanced Micro Devices (AMD), for instance, Microsoft has also started to ramp deployments powered by its internally developed Maia 100 accelerator introduced last quarter. The chip was designed for optimized performance and cost efficiency for the Azure hardware stack, and enables “huge gains in performance and efficiency” with Microsoft workloads – especially as inferencing activity picks up. This continues to be an important link in addressing increasingly structural optimization demands from customers, despite stabilizing headwinds.

The favorable prospects of Microsoft’s capture of additive inference workloads is further reinforced by stabilizing growth at Azure. Specifically, Azure revenues have grown 31% y/y during the fiscal third quarter, with AI services remaining a key driver.

Looking ahead, we believe Azure remains well-positioned to be a key beneficiary of AI-driven cloud total addressable market, or TAM, expansion. In addition to its diversified instances to serve wide-ranging customer needs, Microsoft is also continuing investments into expanding its capacity to address emerging AI opportunities. This includes its recent partnership with OpenAI to spend more than $100 billion on the development of the next-generation “Stargate” supercomputer, which is expected to come online “as soon as 2028.” This is in line with hefty multi-year investments recently earmarked by rivals Amazon (AMZN) and Google (GOOG, GOOGL) towards data centers and server infrastructure, underscoring industry expectations for resilient AI opportunities ahead.

Software Opportunities

In addition to infrastructural opportunities, we also remain optimistic in Microsoft’s advantage in capitalizing on incremental AI opportunities across other key areas of the value chain – namely, end-use software applications. Specifically, as summarized by Amazon, emerging AI opportunities primarily span across three key layers – infrastructure, foundation models, and the application stack. And Microsoft remains a key beneficiary of emerging AI opportunities in the application stack as well, complementing its already-growing share gains in the infrastructure layer. Taken together, Microsoft’s leadership in software will be a key factor for extending its AI monetization trajectory over those observed at peers.

Specifically, Microsoft boasts a competitive advantage as the leading personal and enterprise software provider in the world, despite limited China market exposure. The continued integration of Copilot features remain key to expanding average revenue per user, or ARPU, from its massive installed base. And ARPU expansion remains a key growth driver for the company, given “continued moderation in seat growth rates given the size of [the Microsoft 365 Suite’s] installed base.”

And Microsoft continues to demonstrate strength on this front. Following the launch of its $30 per user per month Copilot add-on subscription for existing paid Microsoft 365 seats in late 2023, uptake of the new AI-enabled product remains strong. This continues to be supported by proven productivity gains from Copilot, with users citing 29% faster task completion times. With more than 400 million paid Office 365 seats, Microsoft remains well-positioned for further growth headroom for Copilot uptake.

At full penetration, the premium Copilot subscription at $30 per user per month would translate to about $144 billion in incremental revenue across 400 million existing Office 365 paid seats – and potentially more considering anticipated price increases in the long-run. And continued adoption is expected to gain further momentum with the influx of AI-enabled Windows PCs shipping later this year which will feature the new Copilot key, and complement the recent updates rolled out across the Windows 10 and Windows 11 installed base to incorporate Copilot features.

In addition to the Copilot add-on for Microsoft 365, Microsoft also charges between $10 (for individuals) and $39 (for enterprise) per month for GitHub Copilot – an AI-enabled coding tool for developers. To date, the company has acquired more than 1.3 million subscribers to the solution (Q3: +30% q/q). GitHub Copilot also remains the preferred AI-enabled coding tool among developers, likely due to its seamless integration with Microsoft’s productivity and cloud workloads in enterprise environments. This continues to highlight Microsoft’s competitive advantage in capturing opportunities arising from adoption momentum for low- and no-code development tools.

We believe Microsoft’s unmatched software leadership will be key to offsetting eventual headwinds when infrastructure-related AI demand normalizes. This is consistent with recent worries over the durability of the currently lofty semiconductor demand environment, which will potentially hit cloud service providers – another mission-critical backbone for AI-related developments – next.

Other Considerations

In addition to AI-related growth across its core Azure and software businesses, Microsoft is also well-positioned to benefit from the emerging PC recovery. Specifically, the emerging upgrade cycle of PCs bought during the pandemic era is expected to be reinforced by the advent of AI-enabled PCs and the Windows 11 refresh – two factors in which Microsoft remains a key beneficiary of.

In the first quarter, PC shipments grew by more than 3% y/y, gradually recovery from the trough observed in 2023. This is consistent with three consecutive quarters of Windows revenue growth observed in FY 2024, reversing persistent declines that have plagued the segment since late FY 2022. Specifically, F3Q24 Windows revenue grew 11% y/y, accelerating from 9% y/y in F2Q and 5% y/y in F1Q. As mentioned earlier, AI PC shipments are expected to gain momentum later this year, with industry forecasting up to 50 million units, or close to 20% of the total mix, by the end of the year. This should reinforce Windows OEM growth observed in recent quarters, and also potentially improve uptake of higher margin premium Microsoft devices ahead.

Microsoft also continues to exhibit key characteristics as a haven stock when markets turn risk-off. Given renewed geopolitical risks, in addition to increasingly structural expectations for a higher for longer interest rate environment, the set-up has increased investors’ angst. This is evident in the stock market selloff this month, with the biggest weekly drop observed in the tech-heavy Nasdaq 100 since November 2022 last week.

Although Microsoft has also sustained some losses in earlier April, its robust results and outlook reported this evening provides mitigation to risk-off sentiment. In addition to its sustained trajectory of growth and margin expansion, the company also boasts a strong balance sheet with substantial cash flows to weather any impending market uncertainties.

Fundamental Considerations

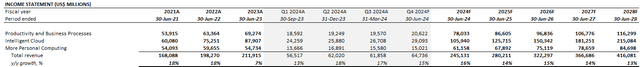

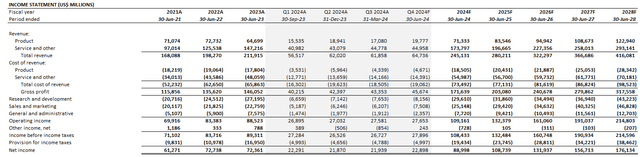

Adjusting our previous fundamental forecast for Microsoft’s actual F3Q24 results and outlook, with consideration of our foregoing analysis, we expect total revenue to grow 16% y/y to $245.1 billion in FY 2024.

Author

We remain confident in the Intelligent Cloud and Productivity and Business Processes segments’ outlook in capturing additive AI opportunities ahead. These include ARPU expansion stemming from Copilot adoption across Microsoft’s productivity software installed base, as well as incremental AI-driven cloud TAM expansion for Azure. Meanwhile, the More Personal Computing segment is expected to benefit from a continuously stabilizing PC market, with anticipated synergies from the Activision Blizzard tuck-in acquisition to become more evident as integration efforts ramp. This is consistent with management’s expectation for Activision Blizzard results to become “accretive to operating income” exiting FY 2024.

On the cost front, we expect continued margin expansion, driven by continued scale of AI service deployments and ARPU growth in PBP. This is consistent with management’s expectations for one to two points of operating margin expansion in FY 2024, as economies of scale on AI-driven deployments offset incremental COGS growth and non-recurring Activision Blizzard integration costs. Specifically, the continued scale of AI services will be a key factor in driving sustained margin accretion in Microsoft’s next phase of growth.

Author

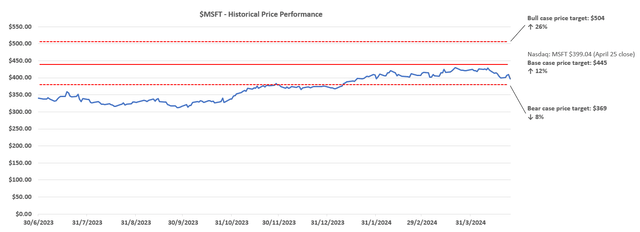

Price Considerations

With consideration of Microsoft’s better than expected fiscal third quarter results and robust outlook in capturing incremental AI growth opportunities, we are increasing our price target to $445 for the stock (previously $402).

Author

We believe Microsoft’s market cap continues to show durability in returning sustainably in the $3+ trillion market cap territory, given continued penetration of AI-driven ARPU expansion across its massive installed base, as well as AI-driven TAM expansion that remains in early stages. This will be key to supporting Microsoft’s sustained long-term growth and margin expansion trajectory, which is fundamental to its valuation outlook.

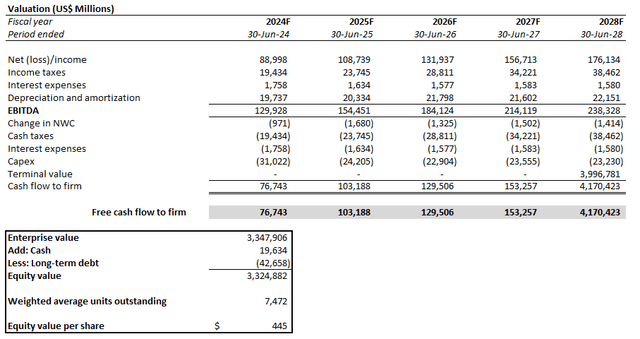

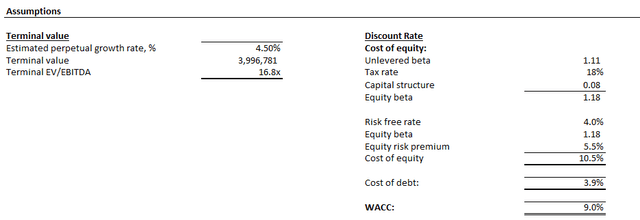

Our price target is derived using the discounted cash flow (“DCF”) approach. The analysis considers cash flow projections taken with the fundamental forecast discussed in the earlier section. A WACC of 9% is applied to reflect Microsoft’s risk profile and capital structure. Our analysis also maintains an estimated perpetual growth rate of 4.5% for Microsoft. This represents a valuation premium to peers, and exceeds the anticipated pace of longer-term economic growth in Microsoft’s core operating regions.

We believe this premium is warranted, considering Microsoft’s track record in delivering consistent double-digit growth and margin expansion at scale, despite its massive and moderating installed base. This is further reinforced by its leadership in capturing emerging AI opportunities, which remain in its early stages.

Author Author

Conclusion

Microsoft Corporation stock already trades at about 30% above its previous peak, set in 2021. It also exhibits a lofty valuation premium on a relative basis to its Magnificent 7 and broader tech sector peers. However, we remain confident in further upside potential at Microsoft, given its expansive reach into AI opportunities across different layers of the value chain. This will continue to reinforce its unmatched streak of double-digit growth and margin expansion through both AI-driven cloud TAM expansion and software ARPU expansion, which underpins further valuation upside potential.

Read the full article here