The Advance Report on Monthly Sales for Retail & Food Services was published on May 15, 2024, at 8:30 AM. The report contains information about changes in the prices (inflation/deflation) of a wide array of goods and services purchased by consumers in the U.S. during the month of April 2024.

According to the BEA, total nominal retail sales grew by +0.02% on a Month-on-Month (MoM) basis – -0.38% less than the median forecasted growth of +0.40%. Considering our estimate of retail sales inflation of +0.18% (derived from detailed analysis of CPI data), inflation-adjusted “real” retail sales contracted by -0.16%.

The question now is: Based on a thorough analysis of the consumer inflation data, and the initial market reactions to it, should investors make any adjustments to their economic forecasts, and/or to their investment strategies?

The right answer is never an obvious one. Success in investing largely depends on finding difficult-to-obtain information and/or insights that supply an informational and/or analytical edge. This requires both diligence and skill. Our method, focused on five key questions, helps us generate an edge from analyses of just-released economic reports:

-

Was there any surprise?

-

What caused the surprise?

-

Did the surprise alter the macroeconomic outlook?

-

Is anything in this report being misunderstood or overlooked?

-

Has the initial market reaction given rise to any actionable opportunities?

In this article, these questions will be addressed as we walk readers through a four-step process. First, we will perform a comprehensive analysis of the just-released report. Second, we will update macroeconomic forecasts, based on this analysis. Third, we will adjust our investment assessments of major asset classes. Finally, we will deliver actionable insights that will enable readers to capitalize on our analysis.

Headline Data & Analysis

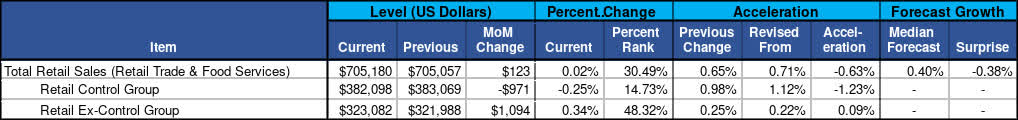

We begin our analysis of the Advance Retail Sales Report by reviewing summary information highlighted in Figure 1. We recommend that readers pay particular attention to the percent rank of Month-on-Month growth, MoM acceleration, and the surprises relative to forecasts.

Figure 1: Change, Acceleration, Expectations, and Surprise

Retail Sales Summary (Census Bureau & Investor Acumen)

The “Advance” sample of Retail Sales (Retail Trade & Food Services), totaled $705,180 million (seasonally adjusted) during the month of April, compared to the prior month’s $705,057 million, representing a Month-on-Month growth rate of 0.02%, which ranks in the 30th percentile. This MoM growth rate represents a deceleration of -0.63% versus last month’s +0.65% (revised down from 0.71%). April growth was significantly below the median forecast of 0.40%.

As will be discussed later in this article, the retail sales data for March and February were revised downward. Therefore, the “net surprise” in this month’s retail sales report was extraordinarily negative.

A Deep Dive Into The Retail Sales Data

In this section of our report, we will walk our readers through a comprehensive analysis of the latest Advance Retail Sales data. The analysis is broken down into three subsections: 1) Analysis of the impacts of inflation. 2) Rates of change and momentum of Real Retail Sales components. 3) Attribution analysis. Our goal in this section is to pinpoint the specific causes of any deviations from forecasts (i.e., surprises) and to uncover anything which may have been misunderstood or overlooked by market participants.

Prices Matter: The Impact of Inflation and Deflation on Retail Sales

In this section, we highlight the impact of inflation on the interpretation of Retail Sales data. Price inflation impacts the quantity of goods and/or services that a given amount of money can buy. To track the actual quantity (as opposed to mere dollar value) of goods that retailers sell, it is necessary to adjust the nominal sales figures (reported in “current dollars”) for the impact of inflation. In Figure 2, we show Retail Sales in both “current dollars” and in “real” terms. The “real” figures represent the economic value of goods sold by retailers, after they have been adjusted for inflation in specific retail goods/services categories.

Figure 2: Real Sales in Current Dollars and Adjusted for Inflation

Retail Sales Inflation Adjustment (Census Bureau & Investor Acumen)

In nominal terms, Retail Sales decelerated rapidly by -0.63%, however, in current dollars Retail Sales decelerated by an even greater amount still (-0.74%). In fact, in real terms, Total Retail Sales actually contracted by -0.16%. Notably, the Retail Control Group, which excludes less volatile items, declined by an even greater amount (-0.33%).

For the remainder of this article, all figures will be presented in “real” (inflation-adjusted) terms. This is important because the most important indicators of economic activity in the U.S. economy, such as Real Gross Domestic Product and Real Gross Domestic Output, are accounted for in real-inflation adjusted terms.

Rates of Change and Momentum of Real Retail Sales Components

In this section, we break down Retail Sales into key components, scrutinizing their annualized growth rates over various time frames (1m, 3m, 6m and 12m). The purpose of this analysis is two-fold. Our first purpose is to identify which components of retail sales are growing at a faster or slower rate than the overall aggregates. Our second purpose is to determine whether, and to what extent, growth rates are accelerating or decelerating over various time frames.

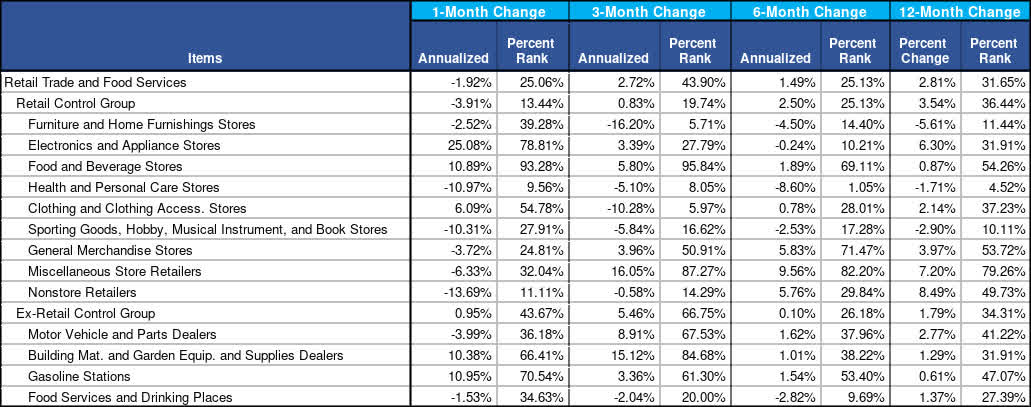

Figure 3: Real Annualized Growth Rates of Key Components

Real Annualized Change in Retail Sales (Census Bureau & Investor Acumen)

Strength and momentum of overall growth. As can be seen in Figure 3, overall real retail sales growth, on a 3-month annualized basis (2.72%), was in the 44th percentile, pulled down greatly by the rate of change for the most recent month that was in the 25th percentile.

Divergences in rates of change between categories. During the past 3 months the growth of the Retail control group was in the 19th percentile while the Ex-Retail control group was in the 67th percentile. This divergence is significant. It is of concern since the behavior of retail sales in the control group is generally more indicative of general economic trends.

Attribution Analysis: Change and Acceleration of Real Retail Sales

In this section, the analysis is focused on identifying which components of retail sales are driving the MoM growth (contraction) and MoM acceleration (deceleration) in the overall Retail Sales figures. We develop this analysis in three steps. First, we analyze the contributions of the Control Group and the Ex-Control Group to the reported overall MoM growth and acceleration of Retail Sales. Second, we focus exclusively on the Control Group and break down the component contributions to its reported MoM growth. Third, perform the same analysis for the Ex-Control Group.

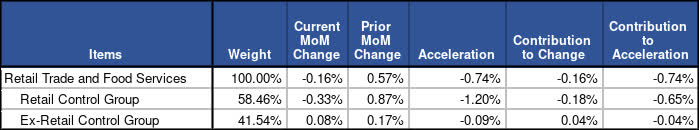

Contributions to Change and Acceleration from Control Group & Ex-Control Group

In this subsection, we focus on the contributions of the Control Group and Ex-Control Group to the MoM growth and MoM acceleration of Retail Sales.

Figure 4: Control Group & Ex-Control Group Contributions to MoM Retail Sales Growth

Contributions to Real Retail Sales (Census Bureau & Investor Acumen)

The Retail control group contributed -0.65% to acceleration, while everything else excluding the Retail Control group contributed -0.04% to acceleration.

Control Group: Analysis of Component Contributions

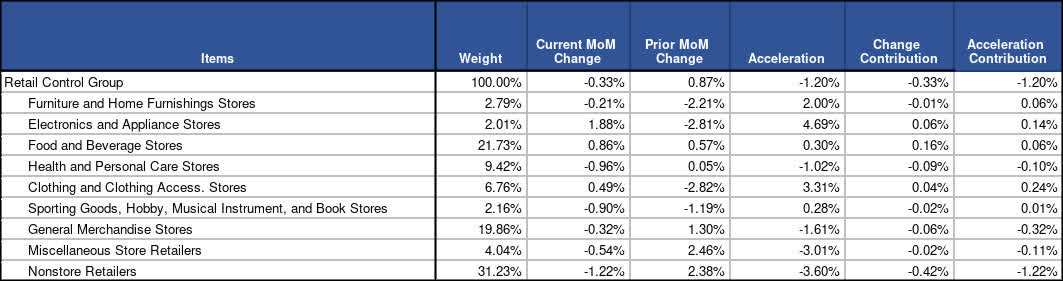

In this subsection, we focus the component contributions to the MoM Change and MoM Acceleration of the Control Group.

The Retail Sales Control Group excludes spending on automobiles, gasoline, building materials, and food services. By removing these volatile and/or otherwise unrepresentative components, the Control Group typically provides a better indication of underlying trends and tendencies in consumer spending.

Figure 5: Control Group: Contributions of Components to Change and Acceleration

Contributions to Real Retail Control Group (Census Bureau & Investor Acumen)

The largest contributors to the acceleration of the Retail control group were Clothing and Clothing Access Stores (0.24%) and Electronics and Appliance Stores (0.14%). While the largest contributors to the deceleration of the Retail control group were Nonstore Retailers (-1.22%) and General Merchandise Stores (-0.32%).

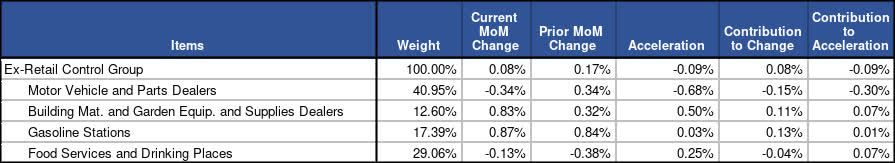

Ex-Control Group: Analysis of Component Contributions

In this subsection, we focus on the component contributions to the MoM Change and MoM Acceleration of items excluding the Control Group.

The Ex-Control Group consists of sales by retail vendors in four major categories: Motor Vehicles and Parts, Building Materials & Gardening Equipment, Gasoline Stations and Food Services & Drinks. Monthly growth in these categories often tends to be volatile and/or otherwise unrepresentative of overall trends and tendencies in consumer spending. Therefore, monthly Ex-Control Group sales growth numbers need to be analyzed in an appropriate context. However, taken as a group, it is important to note that the overall incidence of Ex-Control Group sales is important, representing 41.78% of total Retail Sales for this month.

Figure 6: Ex-Control Group: Contributions of Components to Change and Acceleration

Contributions to Real Ex-Retail Control Group (Census Bureau & Investor Acumen)

The largest contributors to the acceleration of the Retail control group were Food Services and Drinking Places (0.07%) and Building Materials and Garden Equipment and Supplies Dealers (0.07%). While the largest contributors to the deceleration of the Retail control group were Motor Vehicle and Parts Dealers (-0.30%) and Gasoline Stations (0.01%).

U.S. Economy Outlook

In this section, we address the following question: Based on our comprehensive analysis of the just-released Advance Retail Sales data, what (if any) changes should we make to our macroeconomic forecasts and/or our overall outlook for the U.S. economy?

Updates to U.S. Economic Forecasts

Let’s begin with a brief review of forecasters’ expectations leading into this report. The median forecast of professional economists expected to report that Real Total Retail Sales grew at +0.22% percent during the most recent month (47th percentile). Assuming that this forecast had been entirely correct, and that there were no revisions to prior data, the 3-month annualized change of Real Total Retail Sales would have been a +5.87% growth rate, a very strong result, that would have ranked in the 71st percentile historically.

As it turns out, the reported data (including the figures for the most recent month and revisions to prior months) surprised to the downside and indicated that Real Total Retail Sales grew at just a 3-month annualized rate of +2.72%, a rate of change which ranks in the 44th percentile historically. This represents a very significant decline in the estimate of retail sales during the past three months.

This will cause a considerable downgrade of economists’ estimates of consumer spending and overall GDP in the past three months. It will also cause many economists to downgrade their forecasts for U.S. economic growth during the second quarter of 2024.

Update of the Overall Outlook for U.S. Economy

How do these updates to our forecasts for the above macroeconomic conditions affect our overall outlook for the U.S. economy? Currently, the overall outlook for the U.S. economy is dominated by whether the US economy will achieve a “soft landing.” How does our thorough analysis of the just-released Advance Retail Sales data impact the analysis of this question?

Retail Sales grew at a very weak rate in April – in fact, retail sales actually declined after adjusting for inflation. This disappointing result may suggest a significant potential slowdown of economic growth. If so, the question is raised: Will the “landing” for economic growth in the US economy be “soft” or “hard”? Among economic analysts, opinions are varied, but it will take several more months of data to gain any clarity.

One thing that is clear is that, rightly or wrongly, the weak retail sales numbers have raised hopes for rate cuts in 2024. Currently, the Fed Funds futures market is currently pricing in two rate cuts starting in September. The market is only pricing in a probability of 9% that rates are not cut at all before the end of 2024.

Our own view is that there are under-appreciated risks to the inflation outlook which could severely restrict the Fed’s ability to lower interest rates in 2024, even if the economy is slowing. The most important of these risks is a potential oil price shock due to instability in the Middle East.

Therefore, we believe that financial markets are not prepared for the risk that financial conditions could remain tight, or that they could even tighten, while the economy is slowing.

Market Outlook

U.S. bond and equity markets rose sharply based on increased hopes for rate cuts. However, we are less sanguine about what the data in the Retail Sales report and CPI reports (see our CPI analysis) are suggesting.

First, the latest CPI report very strongly suggests that inflation remains “stuck,” and is even re-accelerating, from unacceptably high levels relative to the Fed’s mandate. As such, the Fed is not in a position to lower interest rates any time soon.

Second, the retail sales report suggests that the U.S. economy might be slowing at an alarming rate. Given stubbornly high, and even accelerating inflation, the Fed may not be able to “come to the rescue” to prevent the slowdown from becoming a full-blown recession.

In sum, while we are not yet prepared to forecast a major decline in the U.S. equity market, we believe that the risk of such a decline has risen materially, based on the aforementioned developments in CPI and retail sales.

In terms of the fixed income outlook, we think long-term yields may fall substantially if there are further indications of a slowdown in economic growth. Particularly, we think that implied long-term real interest rates, reflected in TIPS yields, could fall considerably

Concluding Thoughts

Our Investing Group team has been positioning our portfolios in a manner that accounts for various risks. First and foremost, we are positioning our portfolios for the risks of severe oil price shocks, particularly in the second half of 2024. Second, we think that the risk of a severe slowdown in U.S. economic growth – and potentially even a recession – is rising.

In this context, we believe that very extraordinary opportunities are going to emerge in the second half of 2024, starting sometime between June and August.

Read the full article here