Investment Thesis

StoneX Group (NASDAQ:NASDAQ:SNEX) continues to be a compounder of capital by growing revenues and earnings consistently for the past few years. With high returns on equity and a well diversified business, StoneX continues to surprise me with its resilient growth and attractive long-term growth opportunities. Even at fair valuations, I believe the stock is still attractive given its track record of compounding capital and high ROEs. To me, StoneX seems like a wonderful business at a fair price which leads me to rate the stock as a buy.

Company Overview

StoneX aims to connect their clients to whatever markets they need to manage risk, trade strategically for opportunities, and handle their operational business needs. Their strategy according to their annual report is “to be the one trusted partner to our clients, providing our network, product and services to allow them to pursue trading opportunities, manage their market risks, make investments and improve their business performance”.

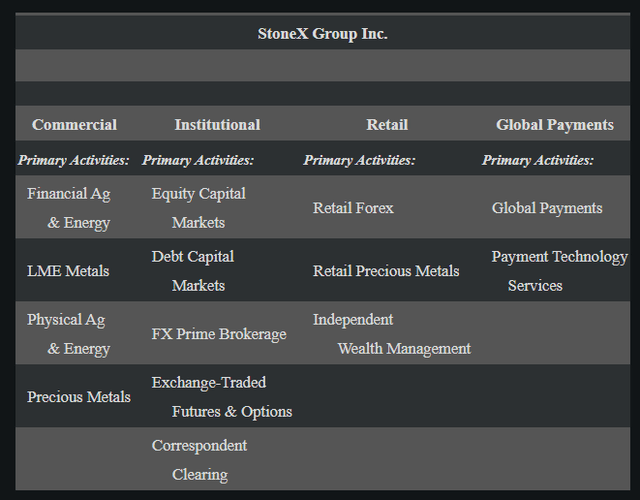

The company separates itself into four segments: Commercial, Institutional, Retail, and Global Payments according to the annual report. With “more than 54,000 commercial, institutional, and global payments clients, and over 400,000 retail accounts located in more than 180 countries”, StoneX has a track record of providing value to all kinds of clients by helping them trade more efficiently and strategically.

Commercial segment refers to “activities associated with the identification, management, hedging and monitoring of various commodity and financial risks faced by commercial entities in their business cycles”. As a one-stop shop for their commercial clients, StoneX offers risk management consulting solutions, execution and clearing services, and market intelligence and research.

The Institutional segment refers to a “complete suite of equity trading services to help them find liquidity with best execution, consistent liquidity across a robust array of fixed income products, competitive and efficient clearing and execution in all major futures and securities exchanges globally, as well as prime brokerage in equities and major foreign currency pairs and swap transactions”.

The Retail segment aims to “provide our retail clients around the world access to over 18,000 global financial markets, including spot foreign exchange and CFDs, which are investment products with returns linked to the performance of underlying assets, and both financial trading and physical investment in precious metals”.

Global Payments “provide customized payment, technology and treasury services to banks and commercial businesses as well as charities, NGOs and government organizations”. It focuses on helping clients with foreign exchange and currency exchanges, facilitating payments across countries safely and effectively.

10-K

As a diversified financial services company, StoneX is at the center of helping clients trade intelligently and managing risk carefully. I view it as like a giant matchmaker that comes with many built-in solutions to solidify itself as a household name in the financial space, becoming a true one-stop shop for all their clients’ trading needs. I like the business and believe the value they provide is substantial, judging from the consistent fundamental growth of the company.

Strong Q2 Earnings Reinforces The Growth Story

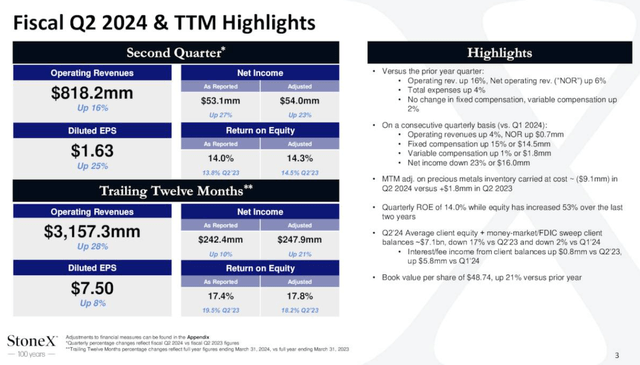

On May 8, 2024 the company announced what I believe are fantastic numbers for Q2 Earnings, reinforcing my belief that the consistent growth in the company should continue. According to this press release,

Quarterly Operating Revenues of $818.2 million, up 16%

Quarterly Net Income of $53.1 million, ROE of 14.0%

Quarterly Diluted EPS of $1.63 per share, up 25%

Most of this growth came from Retail and Institutional, with operating revenues increasing by 30% YoY and 28% respectively, compared to the last year’s second quarter. Management believes this is due to their “diversification of both our product offering and client base”, which leads me to believe they’ve come up with new products to attract new clients to further grow their business.

Returns on equity continue to be strong, and according to the transcript it was “14.8% ROE on tangible and a 14% ROE on stated book value, which as a reminder has increased 53% over the last two years with both measures close to our long-term target of 15%”. I believe that ROEs can stay at around 15% for the long-term due to their track record of retaining clients and creating innovative new products to diversify their offering. Thus, investing in StoneX is like putting money in a fund that compounds your capital at 15% annually, which to me is very attractive. Even at fair valuations, the return an investor earns will roughly approximate the actual ROE the business earns over a long period of time, in my opinion.

The retail segment was a highlight this quarter in my view, and management elaborates their growth in their earnings call,

We saw growth in segment income across all of our segments versus the prior year trailing 12 month period, led by the Retail segment, which was up 127%, followed by payments with a 24% growth.

I believe the Retail segment is gaining momentum and will become more important in the growth story as I view the commercial segment as relatively saturated and mature at this point. Funnily enough, StoneX’s website refers to retail investors as “self-directed clients” out of respect, and offers them physical investment in precious metals. I view StoneX Bullion (their physical precious metals business) as particularly attractive in today’s markets as many investors may use it as a hedge for inflation. Ultimately, I think management has been very innovative in coming up with new ideas to grow their product offering and reach new clients, especially the retail crowd.

A One-Stop Shop Strengthens Client Lock-in

My belief is that the mission to become a one-stop shop for clients needs has increased the lock-in making switching to another service provider even more difficult. The main competitive advantage I see here is switching costs, as clients are super dependent on StoneX’s back-office and trading services that they cannot leave StoneX easily.

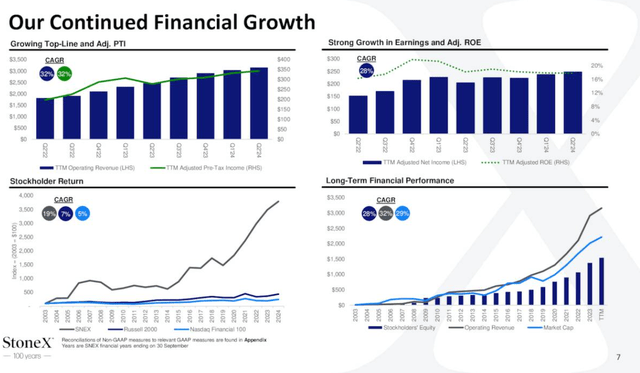

To back up this claim, I see tremendous growth year over year with no hiccups according to their presentation.

Investor presentation

A company that continues to crank out consistent earnings and ROE must have some competitive edge, and I believe a combination of high lock-in with attractive unit economics makes this business both extremely profitable and a fast grower. As a services company, they can earn very attractive spreads and commissions based on market activity and have a flexible cost structure that is predominantly variable to trading volume. Thus, even during a pandemic crisis their operating revenue goes up in a straight line according to the presentation, demonstrating its resilience to economic shocks.

I believe the bottom-right graph on page 7 says it all. In the long-term, the stock always follows the fundamentals in my view, and the market cap has followed operating revenue and equity closely. Assuming the company can hold their clients with strong lock-in, innovate new products and diversify their client base, the stock should continue to follow operating revenues in an orderly fashion. StoneX seems to be super resilient against economic shifts, so oil prices, pandemics, interest rates, and inflation don’t seem to be able to stop StoneX from marching higher and higher. As a financial services provider, they must actually benefit from this volatility as they provide the risk management and hedging tools to their clients to keep them safe from market volatility.

Valuation – A Long Term Compounding Machine

Valuing a long-term compounder can be tricky because I believe even though the multiples are in-line with the sector median, buying a wonderful long-term compounder at a fair price is actually a deceptive bargain. What I mean is that it may not look cheap, but once investors factor in the growth and high returns on equity buying this stock at a fair multiple is a good deal. So, I won’t use a ‘price target’ here because I think investors should buy and hold this name as long as the fundamentals grow.

Assuming revenues can continue to march up 15% CAGR for the next few years, I expect the stock to follow. At 10x Diluted EPS of $7.50, the stock is trading at a fair price but I expect the Diluted EPS to grow at around 10-15% CAGR for the next few years due to the strong retail and institutional growth and continuously high ROEs. Eventually, the stock should give investors around a 10-15% return with relatively low risk as the company seems to be super resilient against economic shocks.

Investor presentation

As assets under management grow over time, and more investors pop onto the scene, long-term economic growth should drive StoneX forward. There’s always some risk that needs to be hedged, and trading activity should go higher year after year leading to more fees and commissions for StoneX. I view this long-term compounding machine as a buy because of its growth and high ROEs, all trading at a fair price today.

Risks

Reputation is important and StoneX needs to be careful about managing their business to keep their brand intact. Compliance with regulations, continued innovation in making better services, and a diversified client base seem essential for this business to grow safely. StoneX needs to make sure all the stakeholders they deal with are doing business ethically and responsibly to make sure they don’t damage their reputation.

StoneX depends on continued volatility in markets to sell the derivatives necessary to hedge this risk. If there are no dramatic changes in commodity prices, demand for StoneX’s hedging services may decrease as people don’t need to hedge their risk so in a way volatility is a major benefit for StoneX. Investors should count on markets continue to be volatile, but any government intervention in terms of commodity price floors and ceilings could put a dent in StoneX’s fundamentals.

The industry is still very competitive with many offerings to choose from in terms of market makers and hedging solutions providers. StoneX must continue to be competitive on price and volume in order to attract new clients to grow their business. Also, StoneX must be careful about counterparty credit risk because some clients may use margin for their trading activities and may fail to meet their margin obligations.

Buy StoneX

I believe I’ve found a wonderful long-term compounding machine trading at a fair price. I think the long-term return of shareholders will roughly approximate the actual return on equity of a business (15%) over the long-term, so my expectation is that investors will receive a 15% return annually as long as they hold the stock. With resilience to economic shocks and poised to benefit from price volatility, I view StoneX as a safe-haven from market meltdowns and rate the stock as a buy.

Read the full article here