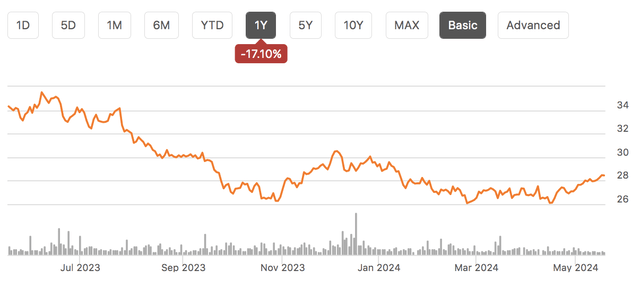

Shares of Getty Realty (NYSE:GTY) have been a meaningful underperformer over the past year. I last covered shares in January, rating them a “buy.” However, since that recommendation, shares have lost 1% while the market has rallied a further 11%. I continue to view Getty’s business as stable, given strong debt coverage and long average lease terms. My primary concern has been on its equity-funded acquisitions. Still, deals have favorable economic terms. Acquisition growth may slow, but I do not view this as a negative necessarily. Assuming interest rates do not rise substantially, I believe shares can outperform. In the meantime, investors collect a secure 6+% yield. With interest rates appearing likely to stay higher for longer, it is critical for real estate and dividend investors to consider the resilience of their investments; in this article, I will show how Getty is still attractive even if financing conditions effectively close capital market access for new deals.

Seeking Alpha

In the company’s first quarter reported on April 25th, Getty generated $0.57 in adjusted funds from operations (FFO), beating consensus by a nickel as revenue rose by 14% to $49 million. FFO per share was up 1.8% from last year. At first, this would seem like a narrow FFO increase given the revenue growth, raising concerns about margin compression. However, actual FFO was up 15.9%. The vast majority of this growth in per share metrics was due to the fact Getty now has $54 million shares outstanding, up 13.4% from last year. The company has been meaningfully expanding its footprint and relies on some equity issuance to support growth, which has reduced per share growth.

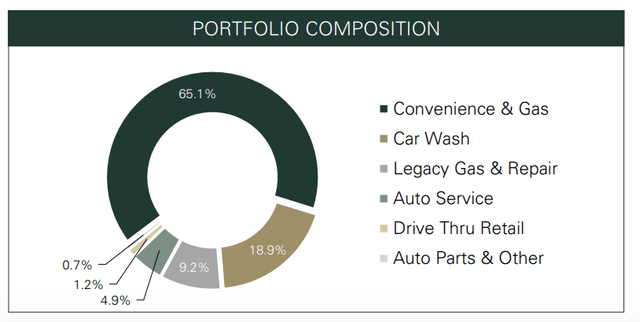

Getty now owns over 1,000 properties across 40 states. The company primarily owns convenience and gas stores. It is important to note that Getty does not operate locations; it merely owns and leases them out. Several years ago, it owned almost exclusively convenience and gas stores, but it has been seeking to diversify its business through property acquisition while maintaining an automobile focus, which is why it has been adding car washes, auto-service locations, and drive thru retail. Its focus remains convenience and car-related activities.

Getty Realty

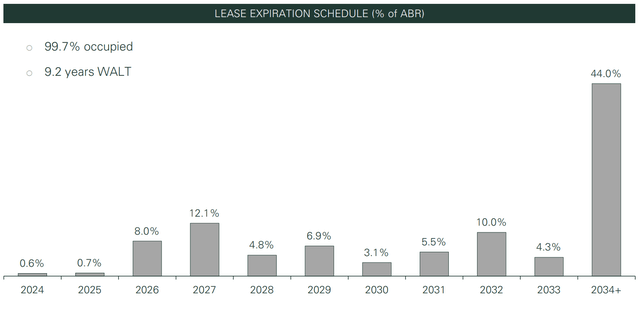

Importantly, existing results remain quite strong. Getty has 99.7% occupancy, and there is average tenant rent coverage of 2.6x, meaning property owners can see their business decline quite materially before facing pressure on making rent payment. Getty has essentially no tenants with sub-1x coverage, which can be a warning sign of imminent delinquencies. Indeed, only 15% have even 1-2x debt service coverage.

This strong underwriting standard makes me comfortable Getty will collect all rent legally owed to it. Additionally, on average, it has a 1.7% annual rent escalator. This helps to protect Getty’s cash flow from increasing operating costs, property taxes, and general inflation. I would note that only 64% of rents escalate annually with the rest resetting every 3-5 years, so while it averages to 1.7% per year on the overall portfolio, there is some lumpiness. Given the higher inflation environment of recent years, GTY has been able to push for 2% escalators on new leases, from as little as 1.5% on older leases, but we will only see the portfolio-level escalator change modestly over time.

These escalators have helped to insulate GTY from inflation; indeed, FFO rose more quickly than revenue, speaking to margin expansion. This came even as interest expense rose by 21% to $9.1 million. GTY has generated meaningful operating leverage as it has scaled up via acquisition. G&A rose about 6% to $6.7 million, about half of its revenue growth. Operating expenses have also been helped by lower property tax burdens.

Importantly, not only are current leases well protected, but GTY has limited lease risk. If many leases in a REIT’s property portfolio expire in a year, what looks like strong occupancy today can turn weak quickly. Getty has a 9.2 year weighted average lease term. The majority of its leases expire in 2032 or later. During the quarter, it had 2025 and 2027 tenants renew lease out another 10 years. It essentially has no meaningful maturities until 2026, adding to the certainty of its cash flows. The fact it had a 2027 tenant already extended, also speaks to the desirability of its properties. Its 2027 maturities are primarily with Getty retail gas stations, and I expect to see the company work proactively to extend these over the next 18 months.

Getty Realty

About 68% of properties are corner locations making them quite desirable, aiding it in maintaining occupancy. Additionally as discussed in my write-up of Murphy USA (MUSA), the convenience store industry has proven to be stable and resilient through economic downturns. This combined with the structure of its lease portfolio provides extremely predictable near-term cash flows. Management is guiding to $2.29-2.31 in FFO, an affirmation of guidance at the start of the year, and given Q1 results, it is well on track to achieve this.

While the results of its existing business are strong and also predictable in the near-term, there are two primary headwinds to valuations. First, while it is diversifying its business, its exposure to c-stores and gas stations will cause some investors to be concerned about long-term obsolescence risk from more electric vehicles. Now, this is a reason GTY has added car washes—no matter what fuel your car uses, it does need to be cleaned equally often. I would note though that more than half of federal funding for electric chargers is going to truck stops and gas stations. That makes sense because these are already located in convenient locations with significant traffic as America has built out and optimized its road network over the past century. In the long-term, GTY will be agnostic as to whether its tenant sells gas or a charging port. Its corner locations also means GTY could seek other uses for properties. Finally, so long as there are road trips, there will be needs for pit stops and bathroom breaks, making c-stores a very durable business. Moreover, even with electric vehicle sales rising, it will be much more than a decade away before gas stations are phased out, given the average life of a car.

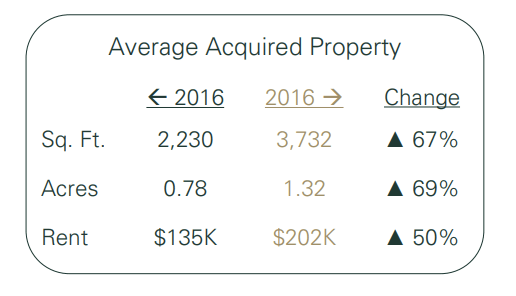

The other major area of focus for investors should be Getty’s own investment activity. Getty has aggressively added locations, building scale, while diversifying its business. As you can see through acquisition, it has transitioned its portfolio to bigger locations on more property where it can charge greater rents.

Getty Realty

This investment continues. Getty deployed $41 million in Q1, adding 12 car washes and seven auto centers. Additionally, it has a further $44 million under contract that it will aim to close over the next 6+ months, adding another 23 properties. Some of this spending is also for building 13 new tunnel car washes. These Q1 investments had an initial cash yield of 7.7% with an average of life 16 years on their lease. In its pipeline, older deals are at a 7% yield and new originations are 8%. As such, it has a blended cap rate in the “high 7% area” on its under contract investment pipeline.

Now, Getty currently pays a 6.3% dividend yield with about 1.28x dividend coverage. At this coverage, Getty only retains about $27 million of cash flow. As a consequence, Getty cannot fund all new purchases solely out of cash flow. It currently carries $800 million of debt leaving it with 5.1x net debt/EBITDA. This is a healthy level, but GTY is not under-levered either. As such with over $100+ million in spending plans per year, it cannot exclusively fund through debt. It currently has 35% debt to capital, and so its $27 million retained cash flow is simply not large enough to be its entire equity contribution to new deals.

This is why it has issued equity to support its growth ambitions. The company has $32 million of unsettled forward equity sales, which will add about 1 million shares to its share count over the coming months. This ongoing equity issuance creates the risk that new property additions do not materially boost per share results. Over the past year, nearly 90% of growth has been consumed by share count growth. Its shares currently have an 8% FFO yield and debt costs are over 6%, meaning it needs to earn 7% cash returns just to break even today on a per-share basis. Importantly, already-struck deals have been funded by its forward equity sales and term loan agreements, but we are in a punitive financing environment for go-forward transactions.

The other challenge is that if GTY stock underperforms, its cost of equity increases, making it even costlier to finance deals via share issuance. Of course, GTY does not want to do deals that merely break even on a cost of financing. It seeks to earn a deal spread, so that new investments are accretive to common shareholders. It targets 150bp spread to its current blended funding cost. To achieve that, it needs low to mid 8% cap-rates on new deals, but with the market closer to 8% today, it only has a ~100bp deal spread. On top of this, GTY is seeing operators “being more selective when it comes to growth.” This means there are fewer potential deals, and those deals it can do going forward are at narrower spreads, meaning they will only add modestly to FFO/share.

Now frankly given where the stock is trading, I would not be upset seeing GTY pull back on deals, as I would not want to see it issue equity in a dilutive fashion. Plus, with its retained cash flow and incremental debt financial, it can still securely do $50-65 million of deals per year without issuing equity. There is also no pressing need to do new deals for Getty shareholders to do well. As noted, it has a 6.3% dividend yield already, so investors are being paid to wait to an extent. Given the stability of its leases and the limited near-term maturities, I view this dividend as extremely secure.

Moreover, it has about 1.7% revenue growth from its lease base. Even assuming no operating leverage, which would be a worse performance than seen over the past year, that supports about 1.7%/share FFO growth, which can boost the dividend. Even reducing its acquisition program to its retained cash flow, it can drive another $0.04-0.06 in FFO growth at an 8% cap-rate, or just about 2%.

A 6.3% yield with a 3.7% growth rate provides a ~10% total return package, which I view as compelling for income oriented investors. With even selective equity-funded acquisitions, it can drive a slightly higher total return profile. I believe the capital markets-focused nature of its cap-ex program has weighed on shares given the prevailing rate environment. However, at $29, Getty can deliver low double-digit returns for shareholders without needing to tap equity markets.

I view Getty’s 8% FFO yield as attractive. There are several ways to compare valuations. One comparison is companies that operate the types of property as Getty owns. Murphy USA is a leading such company — as I detailed in my last analysis of MUSA, it has modest growth, with convenience store sales rising and gas sales very slowly declining. It’s per store growth is comparable to Getty’s 1.7%, and it trades at a ~6% free cash flow yield. I view this yield differential as relatively attractive, given it has less business risk. If sales fall 5%, operators’ profits would fall, but there is such a large cushion beneath rents that Getty’s rental income would be mostly un-impacted.

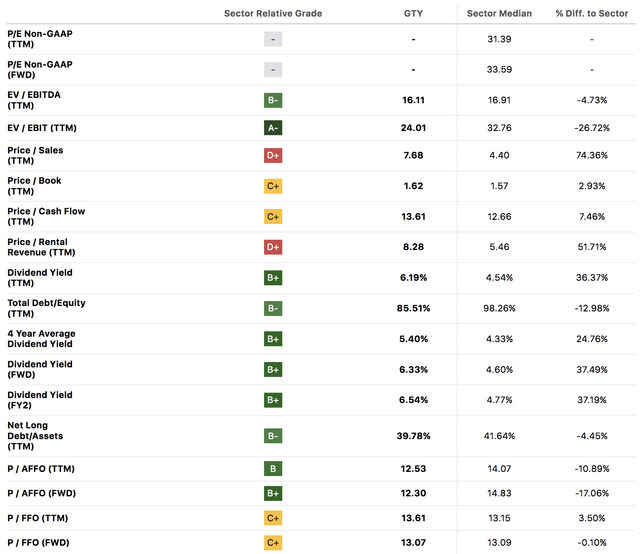

Secondly, we can compare Getty to the real estate sector, as a whole, via Seeking Alpha’s valuation screener. The company has a slightly lower debt/assets ratio than the industry, which I view favorably in this rate environment. Most notably, it trades at a price/AFFO discount on both a trailing and forward basis. Now, it does have less growth potential than multifamily or industrial REITs, but its contract life is longer than most office leases, and its asset base faces no more obsolescence risk than office, with much better current occupancy.

Seeking Alpha

Now, Getty has too small of a market capitalization to sit in many indices like the S&P 500, and so the lack of large index-related holdings could play a role in its compressed multiple. However, its lower debt burden and higher dividend yield are both positives. I believe much of this multiple compression is due to perception around its active investment pipeline in this rate environment. However, as outlined, its stand-alone prospects are solid, and I believe a 10+% discount to the sector is an attractive entry point.

I suspect we may well see Getty’s investment program slow, but this program increases aggregate growth much more than per share growth given the narrow investment spreads. Moreover, its lease quality is very high, and c-store exposure is a positive, given its economic resilience. I would continue to accumulate shares and enjoy secure dividends with 3-5% growth over time. Assuming 10-year treasury yields do not rise substantially, I believe shares can rally towards $31, providing a 12-13% total return as investors realize GTY can generate about 4% organic growth, meaning a dividend yield of about 6% is appropriate to achieve a 10% long-term return.

My view of $31 being the fair value for Getty is not much different than several months ago. That is because I have never assigned too much value to its investment pipeline as nearly 90% of the incremental cash flow is lost to share count dilution. As such, less dealmaking and less share count growth have a modest impact on my go-forward FFO expectations. As the next few months show Getty reporting modest but steady growth, I believe investors will be comfortable placing a higher value on Getty’s business. This $31 target would still leave shares at a 5-8% discount to the sector, which I view as reasonable given its smaller size and long-term gas station risk. At its current valuation, these risks are more than fully priced, making shares attractive.

Read the full article here