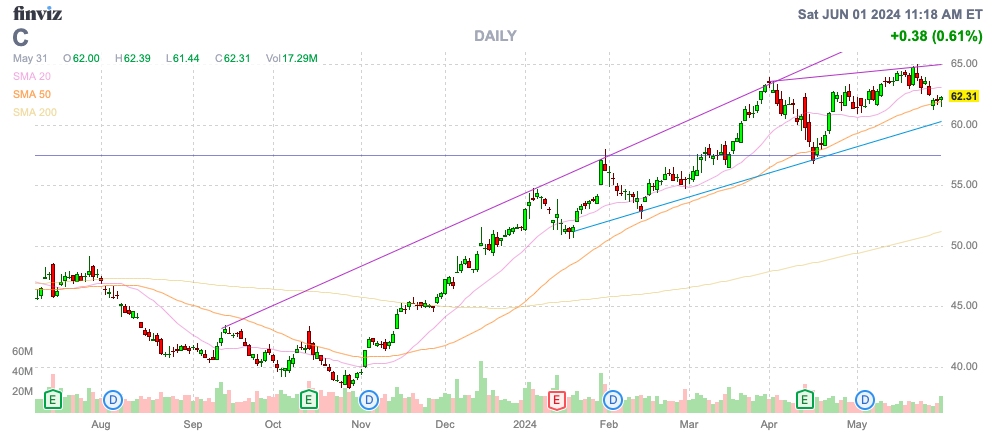

Citigroup (NYSE:C) has long been one of the most undervalued bank stocks, but the company has struggled to generate the growth to reward shareholders. The stock finally participated in the big bank rally off the November lows when Citigroup traded below half of tangible book value. My investment thesis remains ultra Bullish on the turnaround story at the large bank.

Source: Finviz

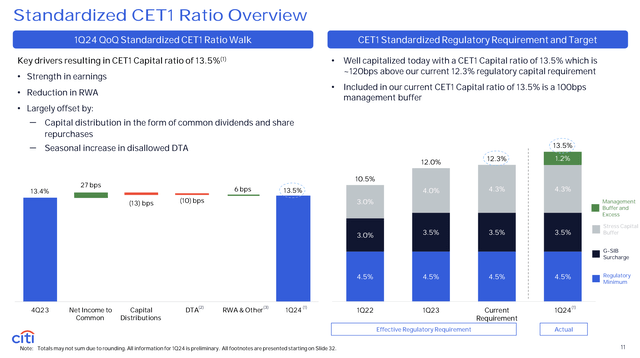

Slashed Capital Requirements

A big part of the negative story for big banks for years now has been the never-ending increases in capital requirements. The more regulations require capital, the less these banks can repurchase cheap shares to reward shareholders.

Citigroup ended Q1 with a 13.5% CET1 capital ratio. The capital ratio has grown 300 basis points in the last 2 years due to increased capital requirements and proposed Basel 3 banking rules with already large increases to the current regulatory capital ratio at 12.3%.

Source: Citigroup Q1’24 presentation

On the Q1’24 earnings call, CFO Mark Mason discussed the current strong capital position:

We ended the quarter with a preliminary 13.5% CET1 capital ratio, approximately 120 basis points, or over $13 billion above our regulatory capital requirement of 12.3%. That said, our current capital requirement does not yet reflect our simplification efforts, the benefits of our transformation, or the full execution of our strategy, all of which we expect to bring down capital requirements over time.

As mentioned, Citigroup ended Q1 with $13 billion in excess capital, but banking regulators were expected to hike capital requirements by another 19% via new capital requirements. These plans are in the process of being substantially reduced with capital requirements already ridiculously high. The largest banks with greater than $750 billion in assets now hold nearly 13% of risk-weighted assets in capital versus only ~7% back prior to the financial crisis.

According to Barclays, the eight largest banks were estimated to need up to $150 billion in additional capital based on the original proposed rules. The banks had already saved up capital for the new rules not set to be implemented until 2025, and only fully phased in by 2028.

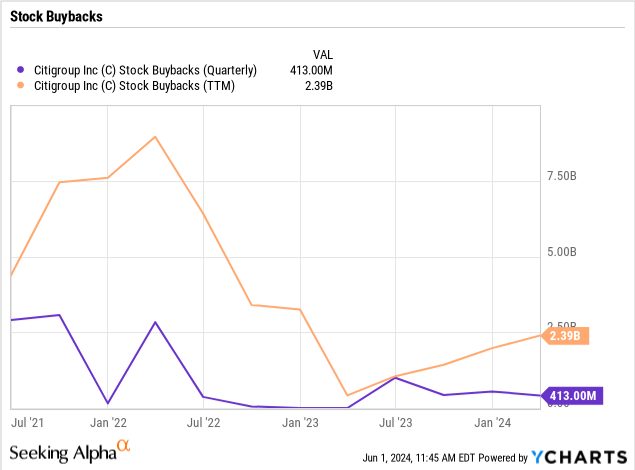

Citigroup has returned to repurchasing shares after a period in 2023 with significant cutbacks. Citigroup bought $413 million worth of shares during Q1 and has spent $2.4 billion on buybacks over the TTM.

The amount is significant considering Citigroup only has a market cap of $120 billion, even after the big rally in the last 6 months. The large bank already pays a 3.4% dividend yield, so buybacks are just gravy to the capital return equation with $1.5 billion returned to shareholders in Q1’24 alone.

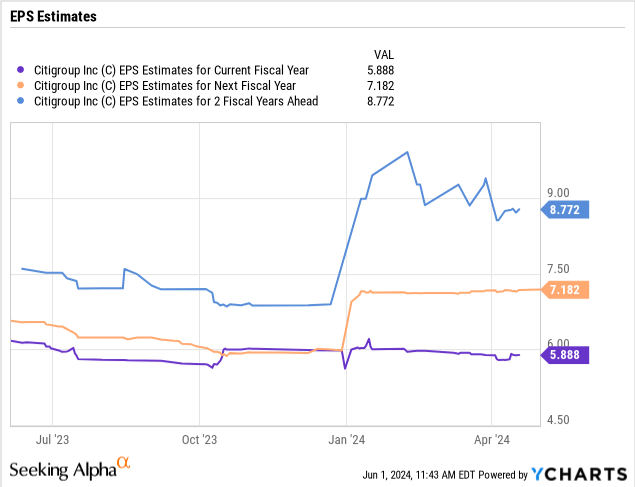

Improving Earnings Picture

Ultimately, the EPS picture is where Citigroup needs consistent growth to justify higher stock prices. The bank is earning at a nearly $6 annual rate and the consensus estimates are forecasting some sizable gains in the next 2 years to reach a 2026 EPS of $8.77.

In Q1, Citigroup produced $3.1 billion of earnings with a 7.6% RoTCE. Investors should see this number as more of a baseline with the ability to produce double-digit RoTCE similar to other large banks.

Management continues to guide towards medium-term RoTCE targets of between 11% and 12%, providing the impetus for the big upside potential in EPS. The 2026 EPS target gets Citigroup closer to the 11% RoTCE target.

The large bank has always been a crazy story of the stock trading far below tangible book value. Citigroup boosted TBV to $86.67 in Q1, up 3% YoY, while the stock ended the week trading at only $62.31.

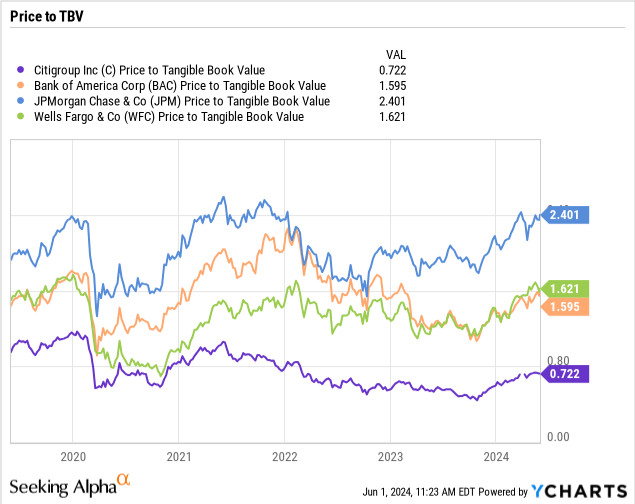

The stock now trades at 0.7x TBV while the other large banks trade at least double the multiple of TBV. JPMorgan Chase (JPM) has seen the stock return to 2.4x TBV while Bank of America (BAC) and even Wells Fargo (WFC), held back by an asset cap, trades at over 1.5x TBV.

On the downside, Citigroup has implemented multiple turnaround plans without success. The stock has consistently traded below TBV due to the past failures to improve the business and consistently grow revenues and profits. The bank stock shouldn’t have ever traded down to $40, but investors could find the stock stuck at $60, if management fails to improve financials yet again.

Takeaway

The key investor takeaway is that Citigroup remains ridiculously cheap. The large bank has a path to strong EPS growth via mostly higher returns while the stock shouldn’t trade below TBV when industry stocks have at least double the multiple.

Investors should continue buying shares with the stock at only $60 and upside potential from growth catalysts. Not to mention, some reductions in expected capital requirements will help boost capital returns.

Read the full article here