At the end of last year, I published a neutral outlook on Toyota (NYSE:TM) in “Toyota: Solid State Batteries Will Create A New Electric Vehicle Era.” At that time, I believed the company had a strong long-term outlook mired by short-term cyclical risks. Since then, TM has risen by 12.6% in value but had been up by ~33% before reversing most of those gains.

For the most part, my views regarding Toyota’s long-term potential are unchanged. However, there is growing reason to believe that its near-term outlook could continue to shift toward underperformance. Significant risk factors include Japan’s economy, a potential rebound in US consumer strains, supply chain issues, and its lack of current competition in the EV space. It lost considerable value after being caught allegedly falsifying vehicle tests. Accordingly, its valuation may be stretched in light of these risks.

Safety Testing Scandal Casts Shadow On Trust

My previous outlook for Toyota was neutral. I like its long-term prospects but am uncertain about its profit outlook for 2024 to 2027. Toyota’s focus on developing the technology and supply chain for solid-state batteries may give it an immense competitive edge in the 2030s. According to the company, these batteries should be cheap to mass produce once the supply chain is built and offer over 900 miles on a 10-minute charge.

I think it is sensible for Toyota to focus on this technology instead of delving into the increasingly competitive EV market today, which has hardly built an edge over conventional gas vehicles. In other words, I believe EVs and conventional cars offer pros and cons that make each important for various consumers. However, if batteries could be lighter and have far greater range, EVs would be the no-brainer option for gas vehicles.

That said, I am troubled by the recent scandal involving the company allegedly falsifying safety tests, which led to the halting of the shipment of certain vehicles that were found to have irregularities in safety applications. I subscribe to the view that if one cannot be trusted in small things, one should not be trusted in large ones.

Toyota has made numerous impressive claims regarding its solid-state battery plans. The CEO of a significant Chinese battery company, CATL, which supplies over a third of the EV market, has stated that his company invested in solid-state battery technology for ten years and believes solid-state batteries are “unreliable and unsafe.” Of course, all corporate managers have agendas, but in light of the recent scandal, I feel there may be a need not to assume all of Toyota’s claims will prove correct, at least in the 2027 timeline suggested.

Global Car Sales May Crash By 2025

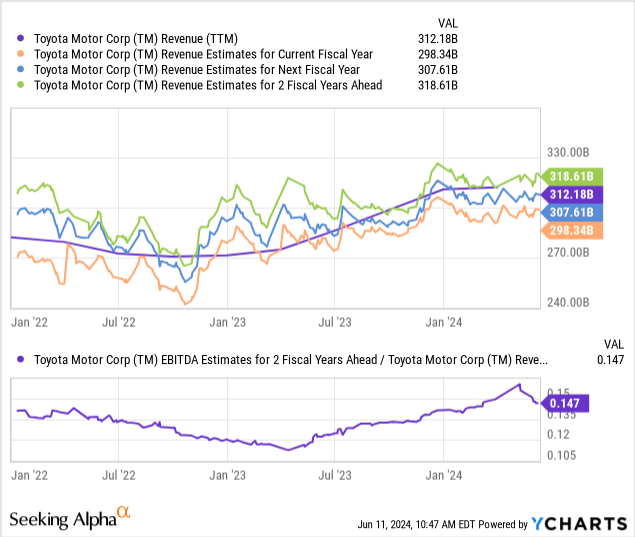

The outlook for most car companies is subpar today. Toyota is not expected to see sales growth over the coming years. Instead, its sales are expected to decline this year and not recover until around 2026. There is also no positive or negative trend in its sales outlook. See below:

Toyota’s two-year-ahead EBITDA margin outlook is also slipping after rebounding since 2023, pointing to a potential negative shift in expectations. I believe the labor and material production costs will likely rise with inflation, meaning income may decline over the coming years. To be fair, all major automotive companies are expected to see stagnation. Tesla (TSLA) is an exception, but its growth outlook is nowhere near its historical levels.

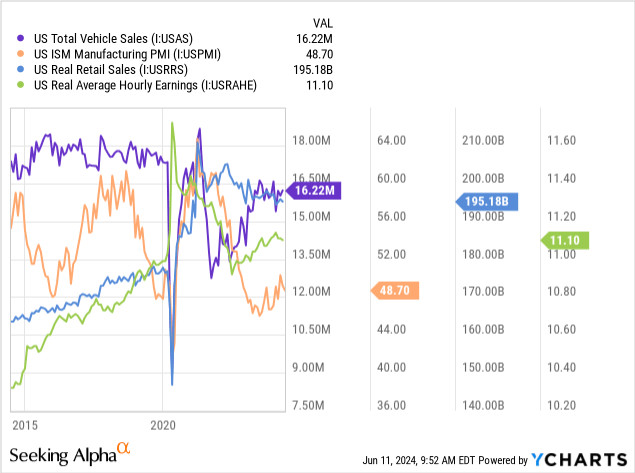

The US durable consumer market outlook is particularly weak. Total vehicle sales have stagnated at a level well below pre-COVID levels. The manufacturing PMI continues to point to a contraction in industrial activity. Real wages and real retail sales are also declining again. See below:

According to Fitch data, US auto loan delinquency rates remain elevated, with subprime delinquencies at around a 30-year high. Prime delinquencies are still low, but often, subprime will lead to prime as economic challenges spread. EMEA region delinquencies are rising significantly for both prime and subprime. Historically, spring and summer see better loan recovery rates and lower delinquencies, so this issue should accelerate over the coming six months.

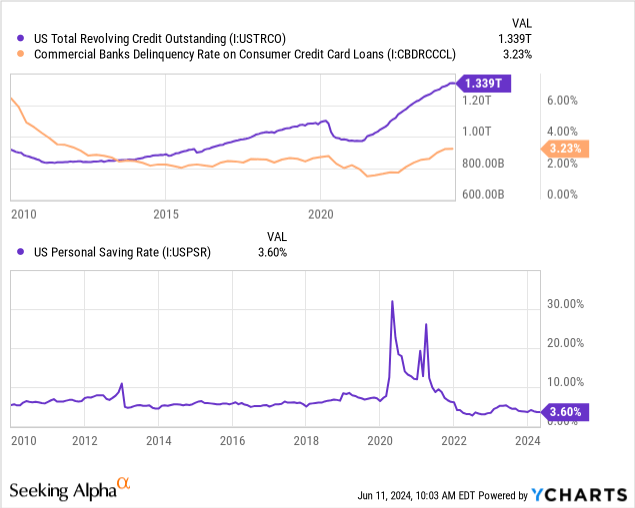

In the US, credit card debt has risen quickly since consumer prices began to rise faster than wages. We’re seeing an acceleration in credit card delinquencies, mixed with very low consumer savings levels. See below:

The US is also seeing falling full-time employment and much lower job openings. These data are relevant for Toyota and car manufacturers because their prospects are closely tied to economic trends. I feel there is some effort to look at headline data to say the economy is stronger than it is, potentially causing some to have a bullish macro outlook on Toyota. While I would certainly not say the North American (and European) economies are in a freefall, I think the deeper-level data is evident in that consumers are in a very tough spot.

Jobs and incomes may be rising since people are taking on extra part-time jobs to try to make ends meet. While this trend may indicate strong job and wage growth, which does benefit the economy, it also points to low discretionary spending capacity. With interest rates on durable goods much higher and excess incomes much lower, I think Toyota and other auto manufacturers may face larger-than-expected sales declines over the next two years.

In my view, workers and consumers in developed-world economies are pushing themselves to keep their finances afloat without significantly reducing spending. However, that trend can only continue for so long before unemployment rises and discretionary spending declines more rapidly, particularly on high-cost items like vehicles, which often have their lifespans extended as people avoid purchasing new cars.

The US outlook appears particularly weak, but most of these issues are mirrored in Europe, Canada, Australia, and others. These are a large portion of Toyota’s revenue, with the US also being a material portion of its production. However, Japan is Toyota’s largest market for sales and production. Japan’s economy may be in a recession following its negative Q1 GDP print. Though its unemployment level remains low and its inflation is below that of the US, its corporate bankruptcies are surging.

The Japanese Yen is also, once again, at a historical low due to its weak economy and the BOJ’s reluctance to raise rates. The country has resorted to FX intervention to try to improve its unstable currency, but this effort is proving ineffective. Since Japan’s overall debt level is so high (far above that of the US), increasing its interest rates may cause an economic crisis. However, continued currency devaluation would as well.

It is often seen that a weak Yen benefits Toyota by lowering relative prices on exports. While true, I’d argue that the extreme currency weakness we’re beginning to see may do the opposite by excessively increasing raw material import costs, potentially creating supply chain issues. At this point, the weak Yen is still likely a net positive for Toyota. However, I expect a more considerable potential currency decline to be bearish by creating knock-on operating issues, assuming excess currency volatility is bad for business.

What Is Toyota Worth Today?

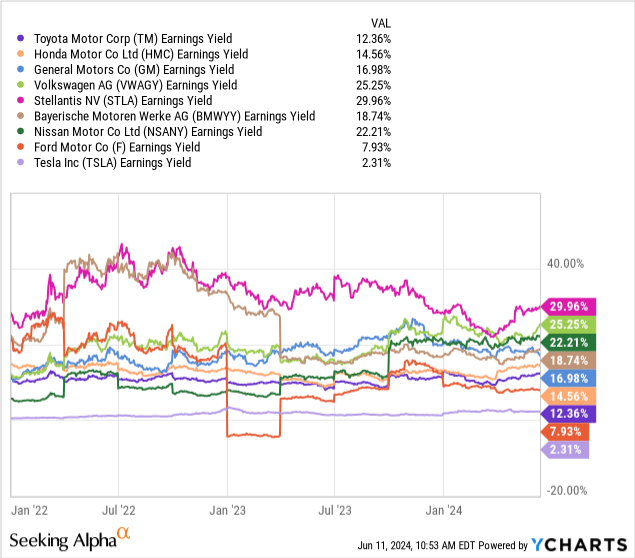

Much of what is discussed is relevant to most of the global auto industry, notably Honda (HMC). However, considering the recent scandal and Toyota’s lack of current EV development, its risks may be higher than most. However, TM trades at a notable valuation premium to most other largest automotive companies by sales. See below:

I use earnings yield rather than price-to-earnings because the inverted metric is too volatile to chart clearly for most of these companies. Further, some, like TSLA, trade an immense premium to others due to their higher growth outlook. That said, I still fail to see how Tesla’s valuation is sensible, given its fundamentals and growing competition. Ford (F) is also at a premium to Toyota because its profit margins are incredibly low, and investors hope they will improve. I believe Ford is at the most significant risk of financial distress, given my negative outlook for US auto sales for the coming years.

Beyond those two, Toyota is the most expensive. Although it has a good track record for margin stability and sales, I believe that may change due to its difficulties with EVs. In my opinion, the scandal negatively impacts its general credibility. The lackluster trade environment in Japan may be an issue if its currency devalues. Again, I am not of the view that immense currency weakness is necessarily good for business.

I estimate TM would be more fairly valued at an earnings yield closer to GM’s, or around 17%. That equates to a “P/E” target of ~5.9X, which is ~26% below its TTM 8X level, giving me a fair value price target of $152. To me, that is a sensible price, given TM traded below that value from the end of 2022 to early 2023. An even lower price may be reasonable if we see a significant decline in global car demand, as I expect. I am bearish on TM, but I do not believe it is overvalued enough to be a short opportunity.

To me, the testing scandal darkens my long-term outlook on the firm. I still hope its solid-state battery technology will prove viable, but I’ll believe it when I see it. Again, though I am bearish, that largely stems from its valuation and my macroeconomic outlook. It may be that consumer buying capacity for durable goods improves sufficiently that Toyota’s prospects recover. Indeed, although its valuation is above its peers, it is not high compared to stocks at large. Thus, a surprise improvement in consumer sentiment would likely be bullish for TM.

Read the full article here