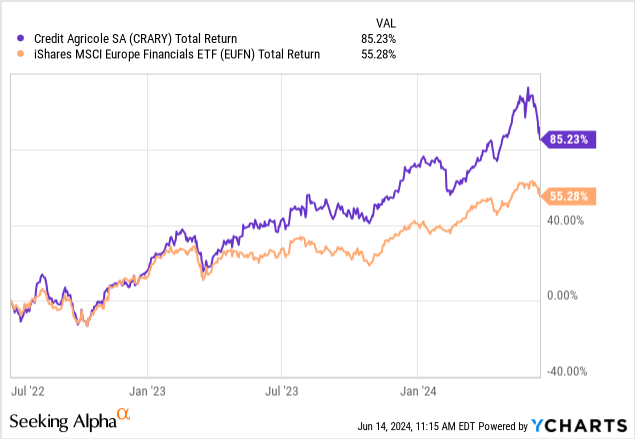

Political developments in France may have sent French bank stocks tumbling this week, but Crédit Agricole S.A. (OTCPK:CRARF)(OTCPK:CRARY) has nonetheless been a solid performer in recent years, outperforming wider European financials (EUFN) by around 30ppt since the European Central Bank (“ECB”) began hiking interest rates back in the second quarter of 2022.

Although it has outperformed its peers in this time, Crédit Agricole is actually one of the least sensitive banks in Europe to interest rate movements, and this characteristic of its business should provide support to profitability now that the ECB has begun cutting rates. With the stock trading at a discount to tangible book value, resilient earnings imply a roughly mid-teens earnings yield and high single-digit dividend yield, which should help lift the shares over time. I open on the bank with a “Buy” rating.

Limited Sensitivity To Interest Rates

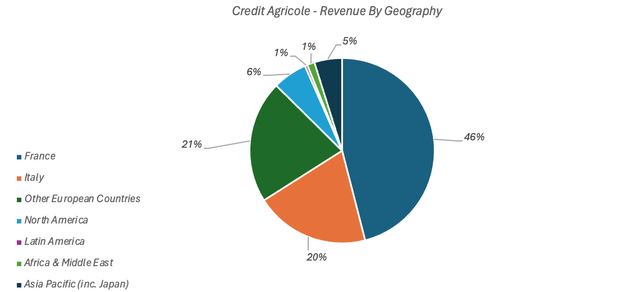

Crédit Agricole is a French universal bank with €2.2 trillion in assets. Around 46% of its revenue is generated in France, with a further 41% generated in other European countries. Its footprint outside of Europe is relatively light, with other geographies accounting for less than 15% of revenue and around 21% of net income last year.

Data Source: Credit Agricole 2023 Annual Report

Crédit Agricole is one of the least sensitive banks in Europe to interest rate changes. This is a function of its diverse revenue mix, country-specific features of the French retail banking market, plus the composition of its domestic loan book.

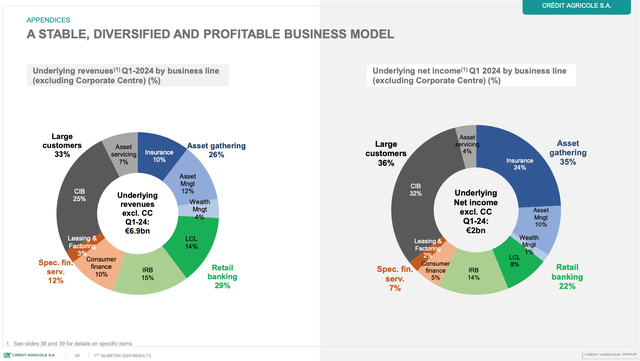

Crédit Agricole’s revenue mix includes significant contributions from non-interest-based business lines, including asset management, insurance, asset servicing, and investment banking. Below is a breakdown of total revenue and net income by business line (as of Q1 2024):

Source: Credit Agricole Q1 2024 Results Presentation

Crédit Agricole also has significant interest-based businesses, including retail banking, which was just under 30% of revenue last quarter. This is split roughly equally between French Retail Banking (“LCL”, ~14% of 1Q24 revenue) and International Retail Banking (~15% of 1Q24 revenue).

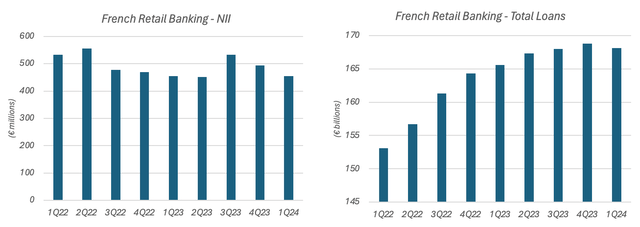

Country-specific features of the French retail banking market, plus the composition of LCL’s loan book, have further limited Crédit Agricole’s interest rate sensitivity. These country-specific features include government-regulated yields on certain customer deposits, while LCL’s loan book is dominated by long-term fixed-rate residential mortgages, which are naturally slow to reprice to higher interest rates. These accounted for around €104 billion, or 62%, of LCL’s loan book at the end of 1Q24.

As a result, French Retail Banking net interest income (“NII”) has actually been falling even as Eurozone interest rates have been rising. This has occurred despite a growing loan book, implying a contraction in the net interest margin.

Data Source: Credit Agricole Q1 2024 Results Release

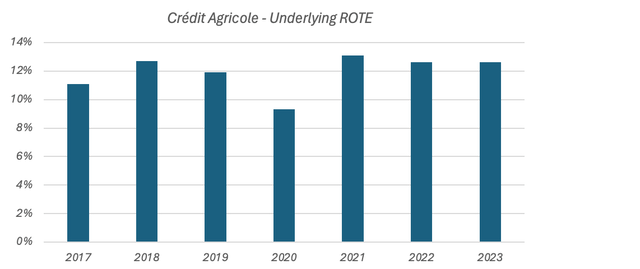

Limited sensitivity to interest rates means that Crédit Agricole has not enjoyed the tailwind to profitability that certain Eurozone peers have in this hiking cycle. While underlying net income has grown by around 8% since 2021 (the year before interest rates began increasing in the Eurozone), this has occurred on a growing capital base. Profitability has actually been fairly stable, with annual underlying ROTE landing at 13.1% (2021), 12.6% (2022), and 12.6% (2023) in that time.

Data Source: Crédit Agricole Annual Reports

While Crédit Agricole’s lack of interest rate sensitivity has not led to an expansion in underlying profitability, it also means that profitability is typically stable in different interest rate environments. This has been the case in recent years, with the bank averaging a circa 11.6% underlying ROTE between 2017 and 2021 (when the ECB deposit facility rate was negative), and a 12.6% ROTE between 2022 and 2023 (when the deposit facility rate increased by 450bps). As such, I expect relatively stable profitability now that the ECB has begun cutting interest rates.

Valuation

At €12.80 in Paris trading (~$6.80 per ADS), Crédit Agricole shares are at 0.79x tangible book value per share (“TBVPS”), which was €16.19 at the end of 1Q24 (~€15.14 per share excluding the 2023 dividend, which was paid in Q2). This implies a P/E of approximately 6.7x, or an earnings yield of 15%, based on a through-the-cycle ROTE of 12%, which Crédit Agricole has achieved historically.

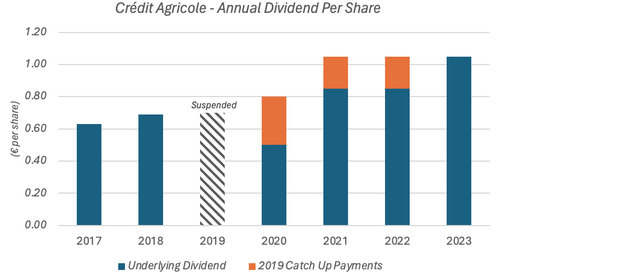

Management’s stated dividend policy is to pay out 50% of net income each year. On a ~6.7x P/E (~15% earnings yield), this implies a dividend yield of approximately 7.5%.

Based on the actual 2023 dividend of €1.05 per share ($0.57 per ADS), the dividend yield is 8.2%. This is higher than the implied yield as Crédit Agricole earned a slightly higher ROTE last year (12.6%), while the payout ratio was also somewhat above management’s target (~54% in 2023).

Allowing for modest ROTE contraction is prudent, as Crédit Agricole is still benefitting from stronger than expected asset quality. Cost of risk, for example, which is bad debt provisioning expenses relative to total loans, was 33bps last year and 29bps in 1Q24, below management’s through-the-cycle target of 40bps. Normalizing this figure would put downward pressure on ROTE, albeit it would remain around 12%.

With 50% of net income retained for growth, Crédit Agricole should theoretically be able to achieve around 6% annual earnings growth assuming a 12% though-the-cycle ROTE, which all else equal would result in a similar level of annual dividend growth.

Note that, while the per-share dividend has been flat over the past three years, the headline figures are somewhat misleading, as the 2021 and 2022 payouts also contained “catch up” payments stemming from the 2019-allocated dividend (which was suspended in 2020 due to COVID). The 2023 per-share dividend was actually around 24% higher than the 2021 payout on an underlying basis, while Crédit Agricole has increased its dividend per share at a circa 8.9% annualized rate over the past five years.

Data Source: Crédit Agricole Annual Reports

A 50% payout ratio appears low given the limited growth prospects of its core European footprint, though Crédit Agricole also has a history of making acquisitions, most recently in buying the European asset servicing business of Royal Bank of Canada (RY) and Belgian bank Degroof Petercam. M&A funded out of retained earnings can also help grow net income over time.

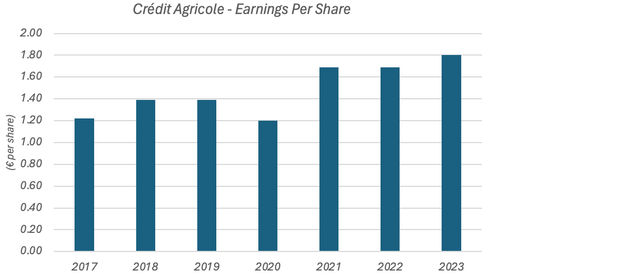

Data Source: Crédit Agricole Annual Reports

Note that Crédit Agricole has grown EPS at an approximately 6.6% annualized rate since 2017, roughly in line with the 6% annualized rate implied by a 12% ROTE and 50% earnings retention.

Conclusion

On a high single-digit dividend yield and ~6% annualized growth, Crédit Agricole shares can deliver low-teens pre-tax annualized returns for investors even on a flat valuation multiple. ROTE is comfortably above 10% and is typically resilient regardless of the wider interest rate environment, which could lift shares upwards to 1x TBVPS while still leaving them on a double-digit earnings yield. Although this would offer investors an additional source of upside, it’s not necessary to achieve acceptable returns, with the current dividend yield and implied growth enough to generate attractive double-digit annualized returns on their own. As such, I open on Crédit Agricole with a “Buy” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here