PIMCO Dynamic Income Fund (NYSE:PDI) is a closed-end mutual fund or CEF that provides investors with a high level of monthly income. The CEF trades very volatile due to the risky debt investments in the fund and the impact on NAV from rate changes by the Fed. My investment thesis is Bullish on PDI due to overstated risks inherent in the massive dividend yield and the likely benefit from upcoming Fed rate cuts.

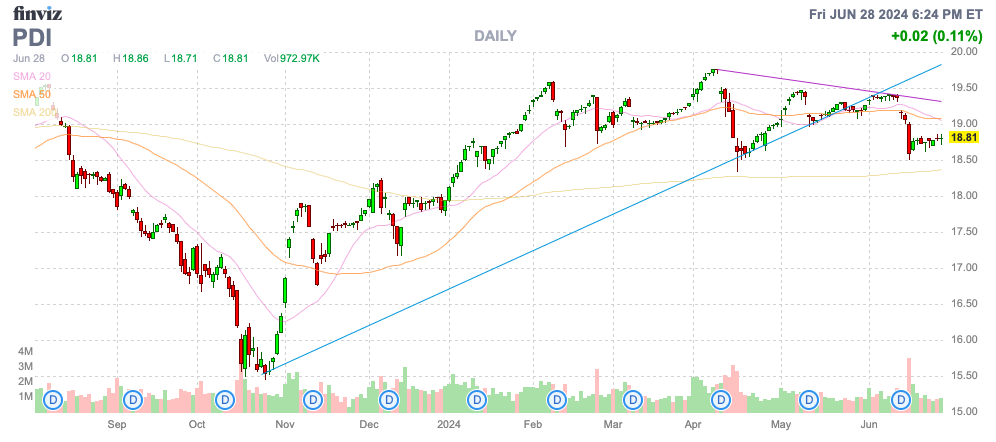

Source: Finviz

Consistent Monthly Distributions

PDI invests in a global portfolio of debt obligations with a universe focused on mortgage-backed securities, investment grade and high-yield corporates, including even emerging market debt. In essence, the CEF uses leverage and diversification to aggressively invest in high-yielding debt.

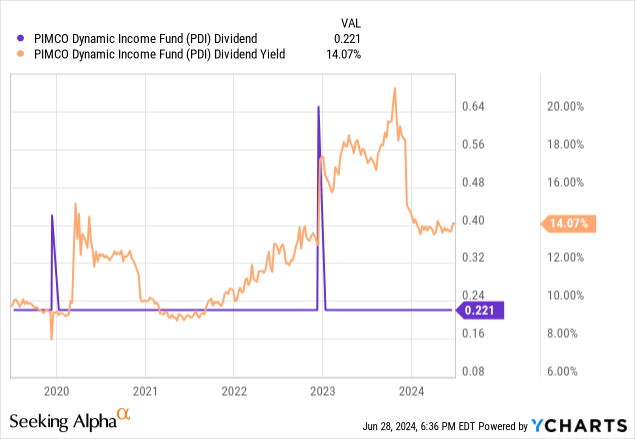

Despite consistent dividend payouts, PDI is a very volatile investment. The fund has paid a monthly dividend of $0.2205 going back to the start of the CEF back in 2012, yet the fund has declined from a pre-Covid price above $30 to below $17 now.

PDI appears ideal for investors looking for strong income and access to investments probably not available to small investors and definitely not easy to diversify to the same degree. An investor only has to sit back and collect the monthly distributions and random special dividends off and on.

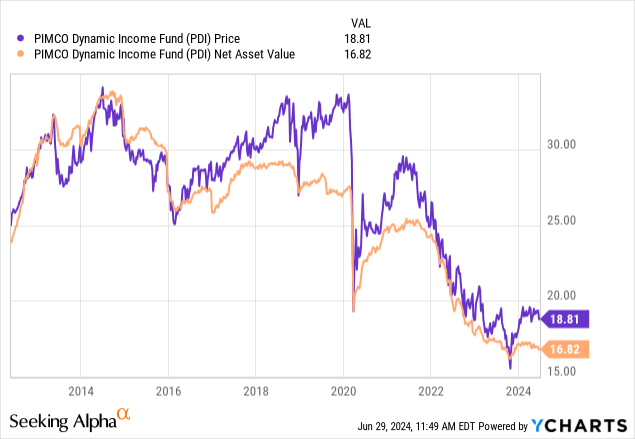

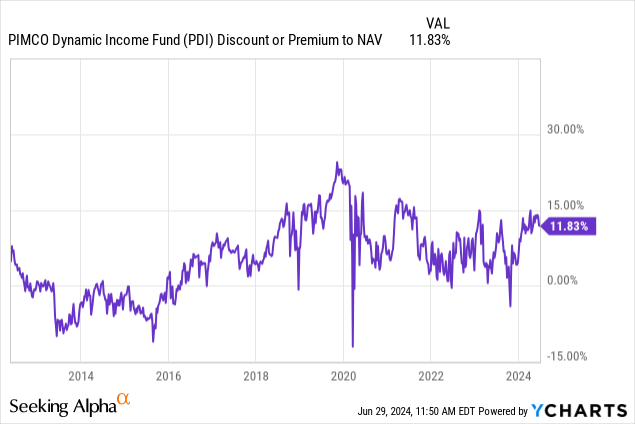

The CEF has a volatile NAV, currently sitting at $16.79. The stock closed June with a market price of $18.81, or about 11% above the NAV, yet the fund still offers a 14% yield.

The market fears lower rates from economic weakness in the U.S. will contribute to issues with high-risk debt. The CEF plunged from over $30 to a low of $18 during the Covid weakness, yet PDI still paid out monthly distributions of $0.2205 each and every month.

The special dividends disappeared after PDI paid a $0.42 payout in December 2019, since the fund has only paid one special dividend since Covid. The CEF paid $0.65 in December 2022 and is unlikely to make a special dividend with a negative UNII.

NAV Hits Likely Over

PDI has had a brutal period over the last few years. The higher inflation period leading to vastly higher interest rates has hammered the NAV. The CEF had a NAV slightly above $25 to below $17 now, for a decline of nearly 32% during a period of just 3 years.

The CEF has seen the 14% annual income distributions nearly completely offset by the capital losses. The fund should do considerably better in a lower rate environment, as debt securities obtain higher values from interest rate reductions that make existing debt with higher rates more attractive.

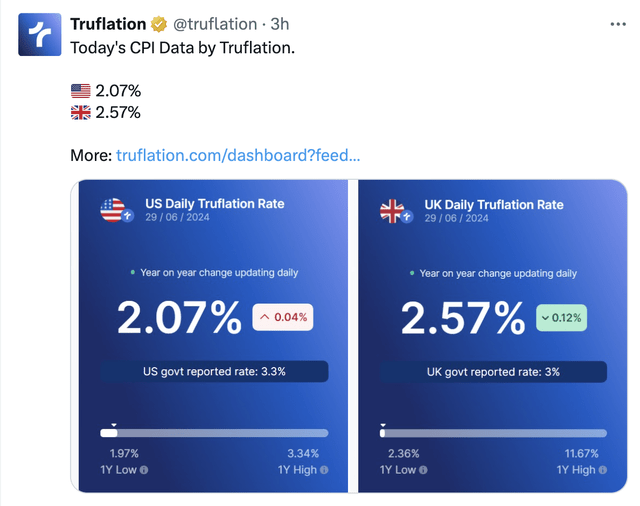

The U.S. CPI is listed at 3.3% with a core CPI of still 2.6% suggesting the Fed could still be far away from cutting interest rates as highlighted by former Kansas City Fed President Tom Hoenig. Truflation has the U.S. CPI inflation rate at only 2.07% due to using more accurate shelter data than the Fed.

Source: Truflation Twitter/X account

PDI had a NAV of $22.54 (already down substantially) when the U.S. Fed initially hiked interest rates a quarter point on March 17, 2022. The NAV collapsed to current levels when the Fed last hiked rates back on July 26, 2023 for a total of 525 basis points in roughly 15 months.

The CEF should perform the opposite in a lower rate environment. Though, the Fed isn’t expected to cut interest rates anywhere close to the 5.25% rate cut, with only a few rate cuts currently on the table through 2025.

PDI is over 75% focused on U.S. debt, so what the Fed does is important to the fund. The average leveraged-adjusted effective duration is slightly over 3 years, with over 35% of the debt securities having maturities exceeding 5 years.

Source: Pimco

The fund regularly trades closer to the NAV. As PDI trades towards a 15% premium to NAV, the fund tends to reverse and trade back closer to NAV, suggesting investors should probably wait for a better deal in the short term.

Takeaway

The key investor takeaway is that PDI is an intriguing fund to own in the current environment. Investors looking for high monthly income should look to buy the fund on weakness when PDI regularly trades back towards NAV.

Read the full article here