JPMorgan

JPMorgan (NYSE:JPM) is scheduled to release their Q2 ’24 financial results before the opening bell, Friday, July 12th, 2024, with Street consensus expecting $4.18 in earnings per share, on $42.15 billion in revenue for expected y-o-y growth of -4% and -1% respectively.

JPM has a tough compare with Q2 ’23 when revenue and EPS grew 34% and 54%, respectively. JPM also has tougher a compare vs. ’23 in Q3 ’24.

Last quarter, Q1 ’24, JPM grew net revenue and EPS +11% and +13% respectively. Net interest income and trading revenue were the greatest contributors to both. ROTCE (return on tangible common equity) was 22% in the first quarter of ’24.

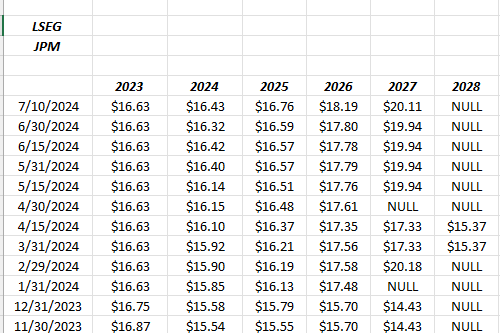

EPS estimates revisions

Data source: LSEG

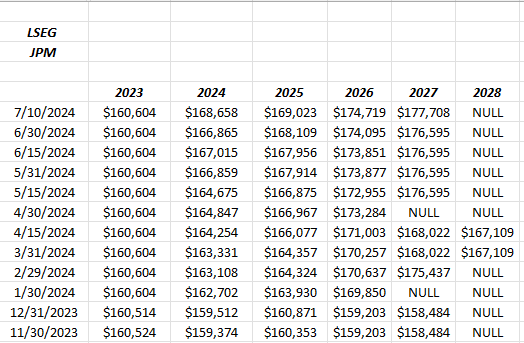

Revenue estimate revisions

Data source: LSEG

Valuation

Using current EPS and revenue estimates, JPM is expected to grow EPS and revenue 4% and 5% for 2024, which is probably understated given the health of the capital markets this year. The Corporate & Investment Banking segment of JPM is roughly 1/3rd of operating revenue and operating profit.

That business is – I believe – expected to be folded into Commercial Banking at some point, but it’s the “delta” segment for the bank in terms of driving EPS upside, and JPM should benefit from the record amount of corporate bond issuance in the first 6 months of 2024.

5 quarters ago, Q2 ’24 was expected to deliver -7% and -2% EPS and revenue growth, respectively. The expected growth rates for 2024 continue to improve.

JPM is trading at 12x expected ’24 and ’25 expected EPS growth of 4% and 6%, but I do suspect estimated EPS growth in ’24 is still “underappreciated” so to speak.

If readers would look at the above EPS and revenue estimate revisions, you’ll see the steady improvement in the numbers the last 6-7 months.

The big news this quarter for JPM were the results of the Fed’s stress test results, which resulted in JPM increasing its dividend 9% to $1.25 and announcing a $30 bl stock buyback.

On June 12th, apparently at a financial services gathering, JPM also pre-announced investment banking revenue to come in at +25-30%, versus their mid-teens estimate, while trading revenue was also slightly better as of that date, versus expectations coming into the quarter.

(My comment: I/B and trading tend to be higher-margin businesses, so better-than-expected, in this case almost double for investment banking, could be a nice upside boost surprise for EPS. The stock was trading around $191 when the investment banking and trading guidance hit the tape.)

With JPM’s book value and tangible book value (TBV) still near or over 2x, JPM is not really a “book value” play for investors. It’s a bank that operationally is as good it gets, and that return on equity (ROE) and the ROTCE reflects that.

JPM Summary

Looking at JPM’s credit card data, the consumer credit picture looks to be in decent shape, while the demand for high-yield credit could lead one to believe that corporate credit is also in reasonably good shape.

We know how the market-related segments have done in the quarter, so the only question is net interest income (NII) and given the trend in revenue estimates, you can see how analysts are modeling that net revenue component.

Over the next few years, the biggest issue will be the timing of Jamie Dimon’s departure. Typically, when an iconic CEO departs a company after an enviable run of both the stock and the business, the successors don’t quite match up.

GE (GE) under Jack Welch, (although his earnings smoothing ultimately cost him his credibility), Jeff Bezos at Amazon (AMZN) (the stock still hasn’t definitively cleared that August and November ’21 all-time-highs), and Sam Palmisano at IBM (IBM), who left in 2012, replaced by Ginny Rometty, with the stock peaking in the spring of 2013, and has yet to see a new all-time high 12 years later, are 3 examples of highly-regarded CEOs whose successors saw issues around subsequent stock price performance. Jamie’s departure will matter for shareholders.

The conditions for the banking sector remain favorable right now, as the stress test results showed, particularly the big banks and all the announcements returning more capital to shareholders.

The scare in 2022 and all the recession forecasts, led the bigger banks to build their reserves for loan losses, and they haven’t been needed yet. From that, we could probably infer that if and when a recession does hit, the initial hit to EPS may be less onerous than if a recession suddenly materialized.

You can make a good case that JPM is fairly valued here in the $200 area, but let’s see what EPS and revenue revisions look like after the call. 2024 could turn out to be another strong year for the stock, which is up 24% YTD, still well ahead of the S&P 500.

(Previous JPM articles: here, here and here).

Citigroup

Citigroup’s (NYSE:C) constant allure over the past 5 years has been its discount to book value and tangible book value that it constantly traded at when the stock was hanging around the high $39s to low $50s, while the sell-side said very little about what a horrible operator the bank was with far-flung consumer operations in various countries, which (supposedly) never really earned their cost of capital.

If there were two opposites in the large cap, money center bank stock universe, it was Citigroup and JPM.

But Citigroup under Jane Fraser is finally generating the kind of results that move the stock, but it also seems like Jane still has her work cut out for her.

Jane is doing what all new or somewhat new CEOs do by focusing on costs, and the fact is headcount probably needs to come down, while not sacrificing net revenue growth, and that’s not easy to do.

On Friday morning, July 12th, ’24, sell-side consensus is expecting $1.39 in earnings per share on $20.074 billion in revenue for expected y-o-y growth of 5% and 3% respectively. Citi announced after the stress test results that the dividend would be increased from $0.53 to $0.56 per share.

Last quarter (Q1 ’24), Citigroup EPS and revenue grew -28% (20% EPS beat) and +3% (2% revenue beat) respectively. Morningstar noted that expense guidance was 3% higher than expected for Citi, which indicates Jane Fraser is not having an easy time getting expenses in line with net revenue. Fee income and investment banking revenue were thought to contribute the most to the Q1 ’24 quarter.

Projected EPS and Revenue growth for Citigroup:

Citi EPS:

- 2026: +26% expected EPS growth

- 2025: +26% expected EPS growth

- 2024: -3% full-year EPS growth

Citi revenue:

- 2026: 3% rev growth expected

- 2025: 3% rev growth expected

- 2024: 3% rev growth expected

I wanted to show readers that 2025 and 2026 are the critical years for the bank, even though the stock price has already started to move higher to incorporate the expense savings and potentially net revenue gains for the bank giant.

That’s what we want to watch after Friday: let’s see how 2025 EPS estimated growth rates change, as well as 2026, when the analysts submit their 2025 and 2026 EPS estimates for Citi. In 2024, the sell-side is expecting just 3% revenue growth and a full-year -3% EPS decline.

Citigroup’s ROE at 7-8%, has always been about half what JPM and Bank of America (BAC) generate, and gives readers an idea of their operational skill. This is expected to change as Citi is now guiding to 11-12% ROTCE in the next few years.

Citigroup summary

What’s interesting about Citi is that the US Personal Banking and the “Wealth” segments represent about 1/3rd of net revenue, but only 15% or so of so-called operating income for the bank giant (as of Q1 ’24). Neither business can leverage their respective net revenue (meaning growing operating income greater than that segment’s net revenue growth) and it’s impacting overall EPS growth for the bank.

The TSS business or Treasury and Securities Services and the Markets group are roughly 48-50% of total net revenue, but these two segments are almost all the bank’s operating income. You’d think the Markets group will perform this quarter at a little better rate, but let’s see what the numbers look like.

Trading at 12x and 9x expected 2024 and 2025 EPS of $5.72 and $7.23, Citi is still cheap on an “earnings growth” basis, in addition to the continued substantial discount to book value and tangible book value of 0.66x last quarter.

If Citi is to trade back to the $80 level where it traded in early ’18, early ’20 and mid ’21, then the expected 25% growth rates in ’25 and ’26 must be deemed realistic. It’s clear discounts to book and tangible book value may not be enough of a catalyst to move the stock price.

Citigroup will have seen EPS growth decline for three years in a row if the 2024 EPS estimate finishes the year where it stands currently.

Citigroup is up 31% YTD as of Tuesday night, July 10th’s close. Fair value is thought to be low to mid-$70s, but if that EPS growth materializes, the stock goes to $100.

Earlier Citigroup articles: here, here and here).

Overall large bank summary

It’s really a great capital market and economy for the big banks after 2008 and then the pandemic, as credit still looks good, the move in Treasury yields to the 4% range helps net interest income, and the capital markets are being supported by S&P 500 earnings growth and credit issuance.

Apollo put out their June credit market missive, and one section caught my eye:

“The resurgence in primary markets was evident throughout most of the first half of 2024. US investment grade issuance set a first-quarter record for new deal activity and volumes through May hit almost $750 billion, up 24% from the same period last year. May was the most active month in the US high yieldprimary market in nearly three years, pushing year-to-date issuance over $150 billion, nearly as much as the total supply for all of 2023. Leveraged loan issuance also hit a monthly record of ~$170 billion in May. We saw similar trends in Europe, with ~$50 billion of high yield issuance so far this year already surpassing last year’s total. US and European CLO issuance also surged during the first five months of the year creating strong demand for broadly syndicated leveraged loans.”

While the big money center banks like JPM and Citi may not be big high-yield issuers, (the brokerage firms like Goldman (GS) and Morgan Stanley (MS) should benefit from that asset class issuance), the bigger banks will be active in high-grade corporate bond issuance, and that issuance has been heavy. Banks are still in good shape from a capital and credit perspective.

None of this is advice or a recommendation, but only an opinion. Past performance is no guarantee of future results. Investing can involve the loss of principal even for short periods of time. All EPS and revenue data is sourced from LSEG.com. All spreadsheet metrics quoted are sourced from quarterly earnings reports and internal valuation models.

Thanks for reading.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here