Introduction

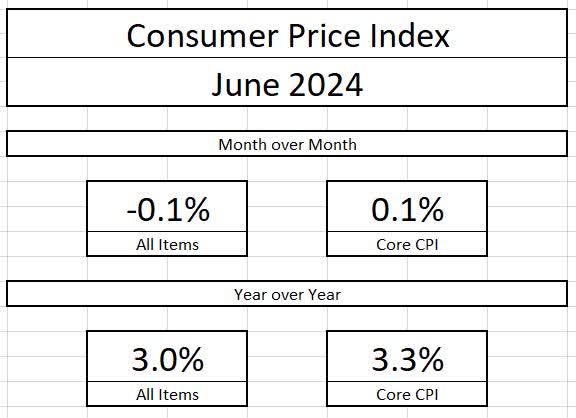

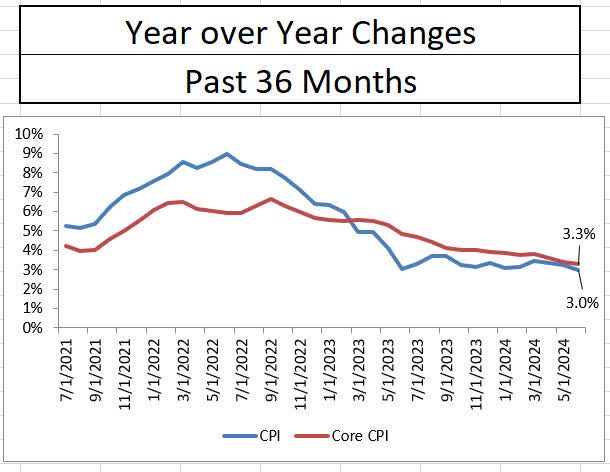

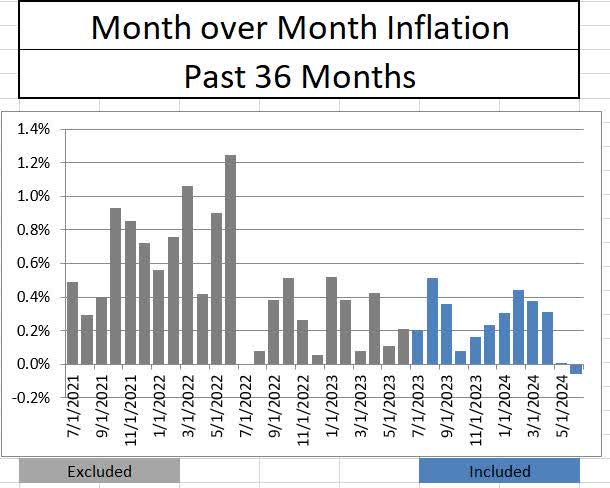

Earlier today, the Bureau of Labor Statistics released the Consumer Price Index for the month of June, which is a popular measure of inflation for the US economy. Overall, inflation declined by 0.1% in the month of June, the first decline since the early days of the COVID-19 pandemic. If you remove food and energy from the equation, core inflation increased by 0.1%. On a year over year basis, overall inflation rose by 3% and core inflation increased by 3.3%. The disinflationary trend continues as year over year inflation has dropped, but I believe the presence of a deflationary month should give a ramp for the Fed to cut rates once this fall.

Bureau of Labor Statistics Bureau of Labor Statistics

The Exacerbation of Goods Deflation

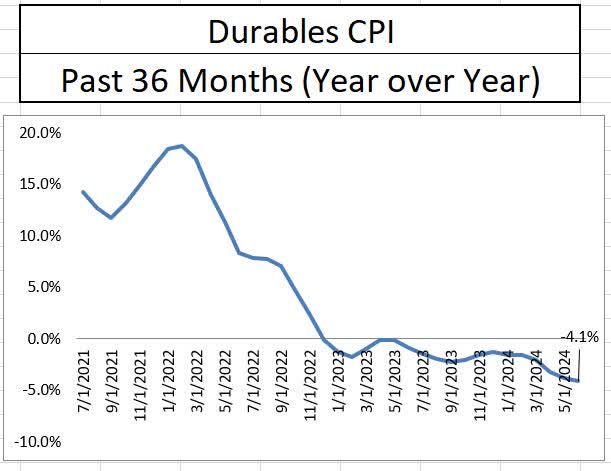

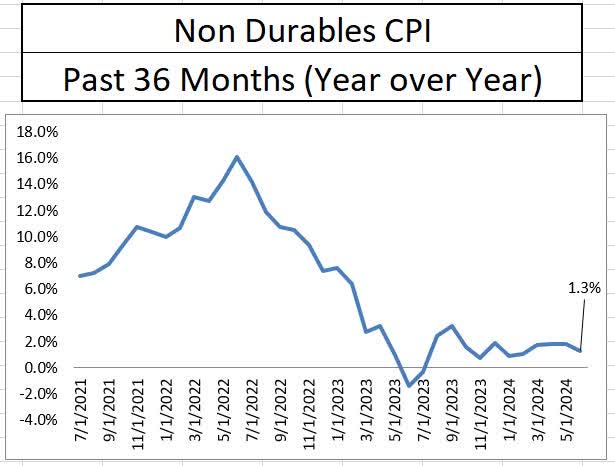

The switch to a deflationary month has been fueled by the massive drop in durable goods pricing, which is now down 4% from a year ago. Durable goods were the first contributors to the original rise in inflation due to the supply strains caused by the pandemic. While not deflationary, nondurable goods prices are only 1.3% higher than a year ago, which is at least contributing to the Federal Reserve’s inflation target. The heavy deflationary influence of the goods sector will still need to continue for the soft-landing narrative to hold.

Bureau of Labor Statistics Bureau of Labor Statistics

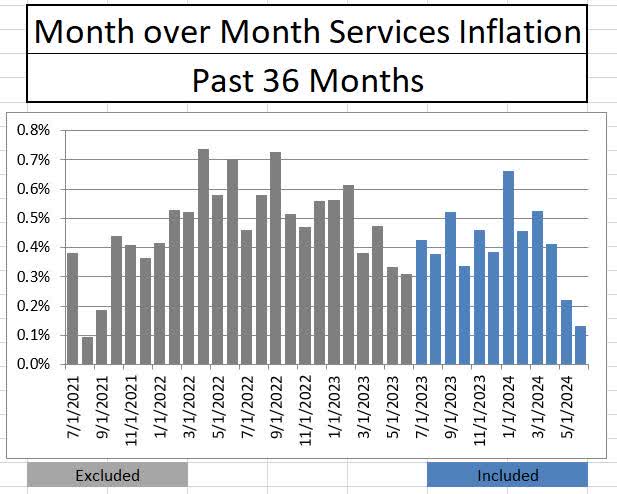

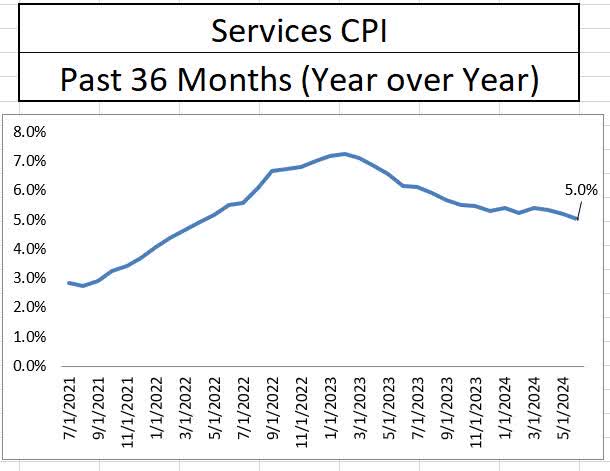

Service Sector Inflation Finally Breaks

Like a stubborn fever that finally breaks, June’s inflation reports also showed substantial progress in bringing service sector inflation back under control. At just over 0.1%, the June reading of services inflation was the second best in three years. While year-over-year services inflation remains at a stubborn 5%, three more months of June’s levels have the potential to shave an entire point off service sector inflation and start an accelerated disinflationary trend.

Bureau of Labor Statistics Bureau of Labor Statistics

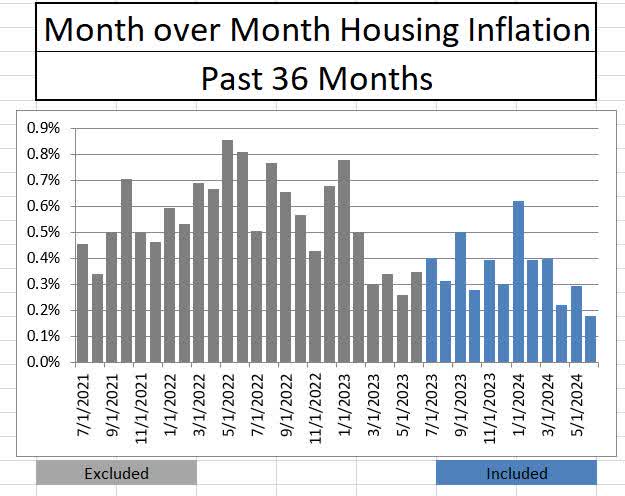

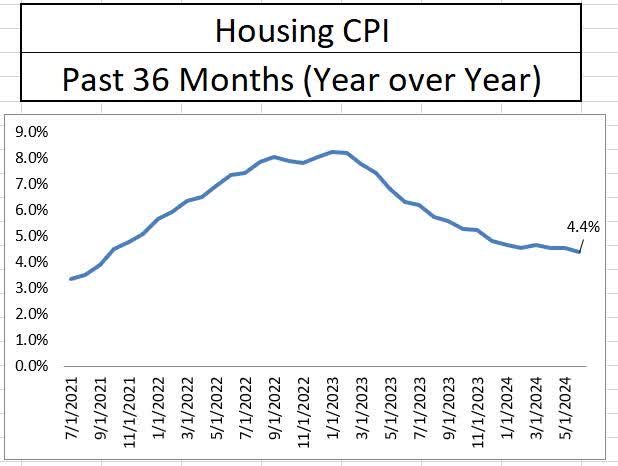

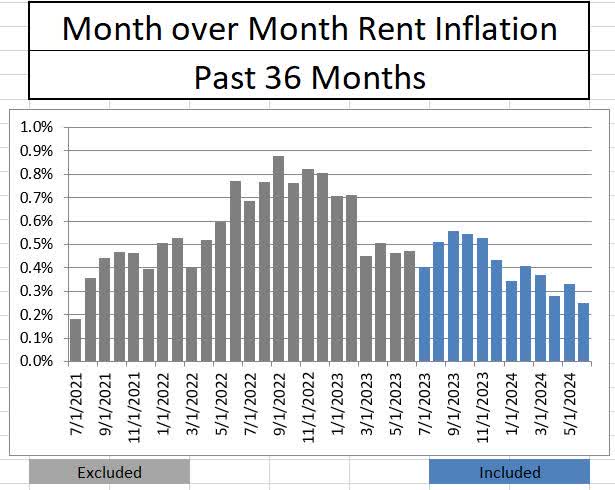

Within service sector inflation, housing and rents showed improvement as well in the month of June. Month over month housing inflation slowed to the lowest level in more than three years and dropped to 4.4% on a year over year basis. With two out of the next three months having large monthly increases dropping off of housing inflation, the chances of meaningful disinflation in housing looks good.

Bureau of Labor Statistics Bureau of Labor Statistics

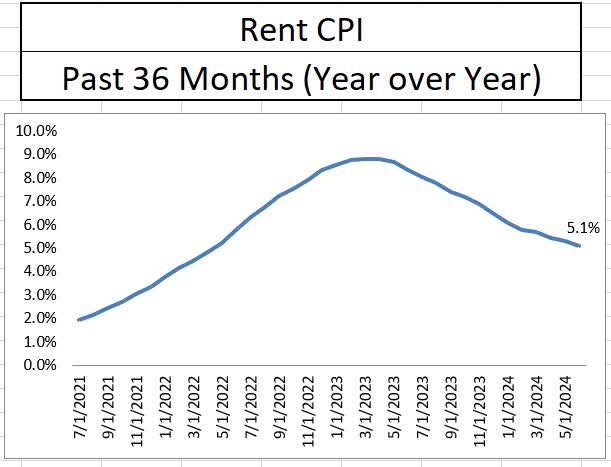

The same notable disinflationary trend is occurring amongst rents as well, with June rental inflation coming in at the lowest in 35 months. Month over month rental inflation has shown a notable trend down over the last nine months, despite still being stubbornly high at 5.1% on a year-over-year basis. The rolling off of some high readings over the next three to four months should provide good disinflation here as well.

Bureau of Labor Statistics Bureau of Labor Statistics

Where Do We Go from Here?

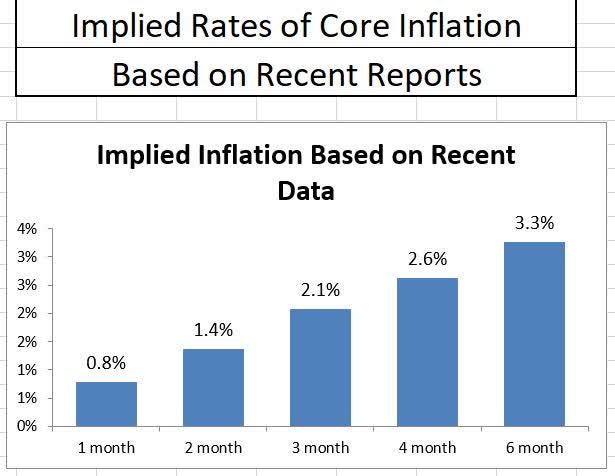

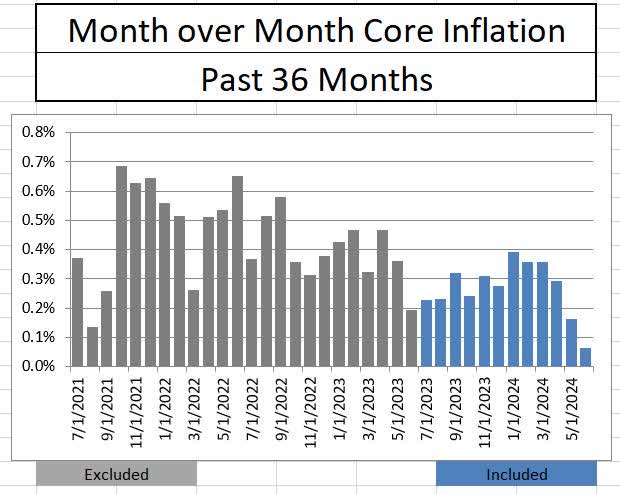

We are clearly in a pronounced disinflationary state based on the last three inflationary reports. If annualized, the April, May, and June core inflation reports come in at 2.1%. The steepening nature of the implied inflation curve demonstrates that recent (versus older) data is bringing inflation down. If the current pace continues, we should see meaningful declines in year over year inflation over the next three months, with core inflation dropping at a slower rate (due to the hot numbers in January, February, and March)

Bureau of Labor Statistics Bureau of Labor Statistics Bureau of Labor Statistics

Conclusion- Here Comes the First Cut

I think the current trajectory of disinflation justifies a September rate cut, but with the forecast beyond that still being uncertain. The Fed is not going to want to reignite inflation, therefore they will want to see continued progress towards 2% after the September cut. Tame energy prices going into the fall could help the Fed be more aggressive (on the cutting side), but we have plenty of runway between now and then. Overall, the June report, combined with the prior two months of data, represents the meaningful drop in inflationary pressures that I believe are required to lower interest rates.

Read the full article here