Over the last week, CrowdStrike Holdings (CRWD) has slumped following a software update that caused a massive outage for Microsoft (MSFT) customers. Palo Alto Networks, Inc. (NASDAQ:PANW) hasn’t rallied on the glitch of a top competitor because the “platformization” concept likely took a major hit. My investment thesis remains Bearish on the stock due to the rich valuation and execution problems at the cybersecurity company.

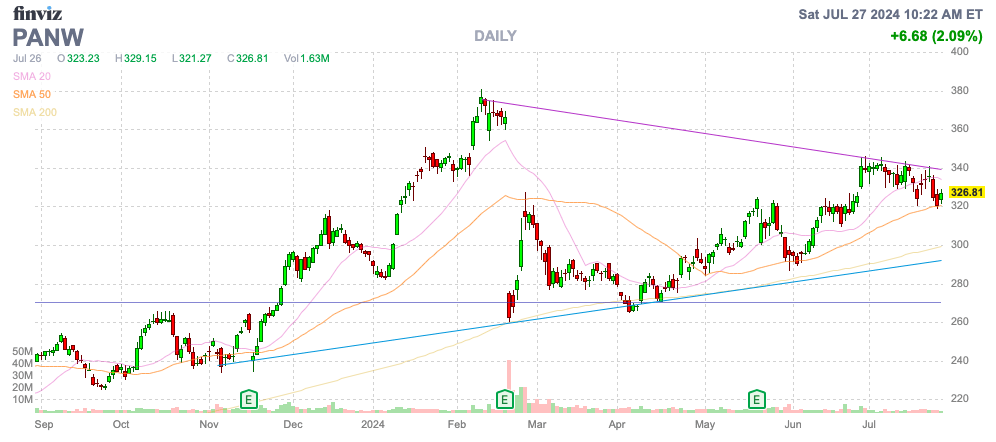

Source: Finviz

Cybersecurity Platform Problems

Both CrowdStrike and Palo Alto Networks have pushed the concept of cybersecurity platforms. Instead of enterprises working with multiple vendors, a company can work directly with one provider for all of their cybersecurity needs.

The problem here is that most companies aren’t experts in every area of cybersecurity. Palo Alto Networks started out in firewall products, while CrowdStrike was an endpoint security specialist. Both companies have moved into other categories like Zero Trust Access in order to offer a complete solution.

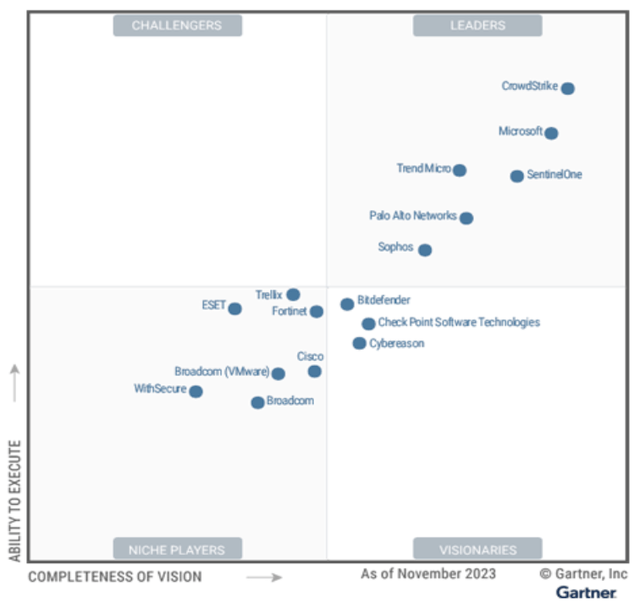

Gartner highlights the prime problem with the platformization goal of Palo Alto Networks. Some smaller enterprises might just sign up for one security provider to handle all of their cybersecurity needs, but Palo Alto Network is a distant leader in Endpoint security behind CrowdStrike, Microsoft, and SentinelOne (S).

Source: Gartner

In the telecommunications sector, the biggest mistake made by companies in the 2000s was to assume customers wanted to consolidate wireless, landline, and internet access onto one bill. Customers wanted the best wireless and internet products available at their homes, not random products with a simple consolidated bill.

The cybersecurity space will likely fall into this issue. Any security breach will make executives question why a company didn’t have the best-of-breed protection.

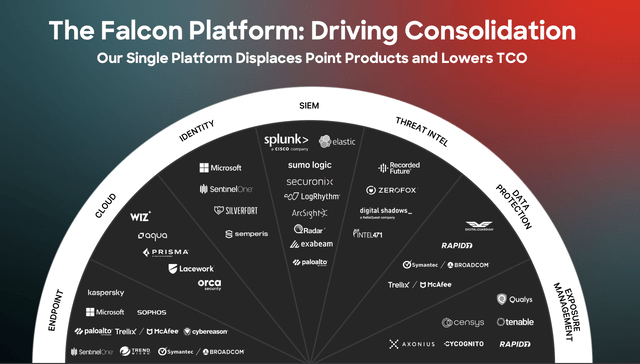

The CrowdStrike outage causing at least 8.5 million Microsoft systems to crash will likely bring up the problems of being reliant on one provider for cybersecurity. CrowdStrike highlighted the leaders in all of the different cybersecurity platforms, and one has to wonder if some enterprises are looking to move back away from a single platform in favor of the leading point products.

Source: CrowdStrike FQ1’25 presentation

A few quarters back, Palo Alto Networks pushed forward the platformization concept on the FQ2’24 earnings call as follows:

Five years ago when we began our strategy, the industry believed building leadership across multiple categories wasn’t possible. No one was talking about the security platform. Instead, the word was best-of-breed. Our success over the last five years has been driven by the shift to platformization. We’re committed to investing in innovation to extend our industry leadership position and platform.

The irony here is Palo Alto Networks acknowledging the market shift away from best-of-breed products. The CrowdStrike outage could nudge the market back towards the best solution, not a platform offering the simplest solution.

The recent Google (GOOG) attempt to acquire Wiz highlighted how the company was quickly becoming a leader in cloud security. Palo Alto Networks is currently the leader in annual ARR, but Wiz is the fastest grower in the sector according to CNBC, and has now reached $350 million in ARR.

Wiz is pushing forward as an independent company with the goal of quickly reaching $1 billion in annual ARR. The CrowdStrike outrage no doubt invigorated the company to pursue the opportunity alone, knowing a best-of-breed cloud security option will have more potential to compete with the big platforms now.

The big issue for Palo Alto Networks is that platform customers are the golden goose. The company suggests multi-platform customers’ average customer lifetime value is more than 5x that of single platforms. The customers on all 3 platforms are 40x larger.

In essence, customers had become married at the hip to cybersecurity platform providers, and the CrowdStrike outage might alter this willingness to trust the big platforms.

Not Priced For The Risk

Palo Alto Networks will report FQ4 earnings towards the end of August. The company guided to revenues of $2.16 billion for only ~10% growth as the cybersecurity company provides discounts and free service to customers switching to their platform.

The company forecasts FQ4 earnings will actually dip slightly due to the lower sales growth while investing for the future. The EPS target of the key FQ4 is only $1.41 per share for a stock trading at $327.

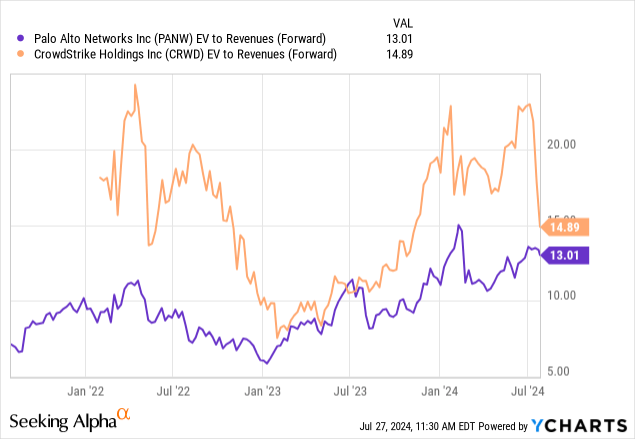

The problem here is that the stock is priced for perfection already, and the CrowdStrike issue likely disrupts the business plans. Palo Alto Network already trades at 11.5x FY25 sales targets of $9.1 billion on rather limited growth.

CrowdStrike has slumped following the outage, but both stocks now trade at 13x to 15x forward EV/S targets. Palo Alto Networks still has a market cap topping $105 billion.

Remember, as well, Palo Alto Networks was aggressively providing customers with discounts and free service for an extended period until existing contracts with legacy vendors expired. The CrowdStrike outage likely alters this desire for enterprises to shift towards a platform for platform cybersecurity solutions, and not necessarily best-of-breed.

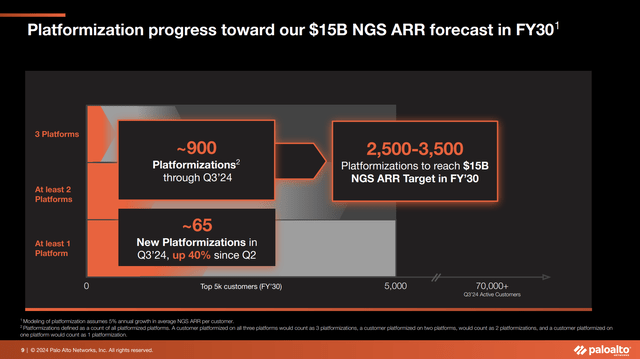

A key focus of the FQ4 results, and in the progress towards reaching the $15 billion NGS ARR forecast in FY30, is the progress towards platformization. Palo Alto Networks lists 900 platformizations with 65 accomplished since FQ2 when reporting FQ3 results.

Source: Palo Alto Network FQ3’24 presentation

With the CrowdStrike outage happening with about 2 weeks left in the fiscal year-end, investors will clearly want to see whether customers paused the shift to cybersecurity platforms.

Takeaway

The key investor takeaway is that Palo Alto Networks was already priced for perfection, and the CrowdStrike outage likely doesn’t help. The cybersecurity company was already reporting weak results due to providing customers a discount to shift to platforms, and now this move is likely to take a pause.

Investors should sell Palo Alto Networks at this expensive valuation and re-evaluate the stock at a lower valuation after the market shakes out.

Read the full article here