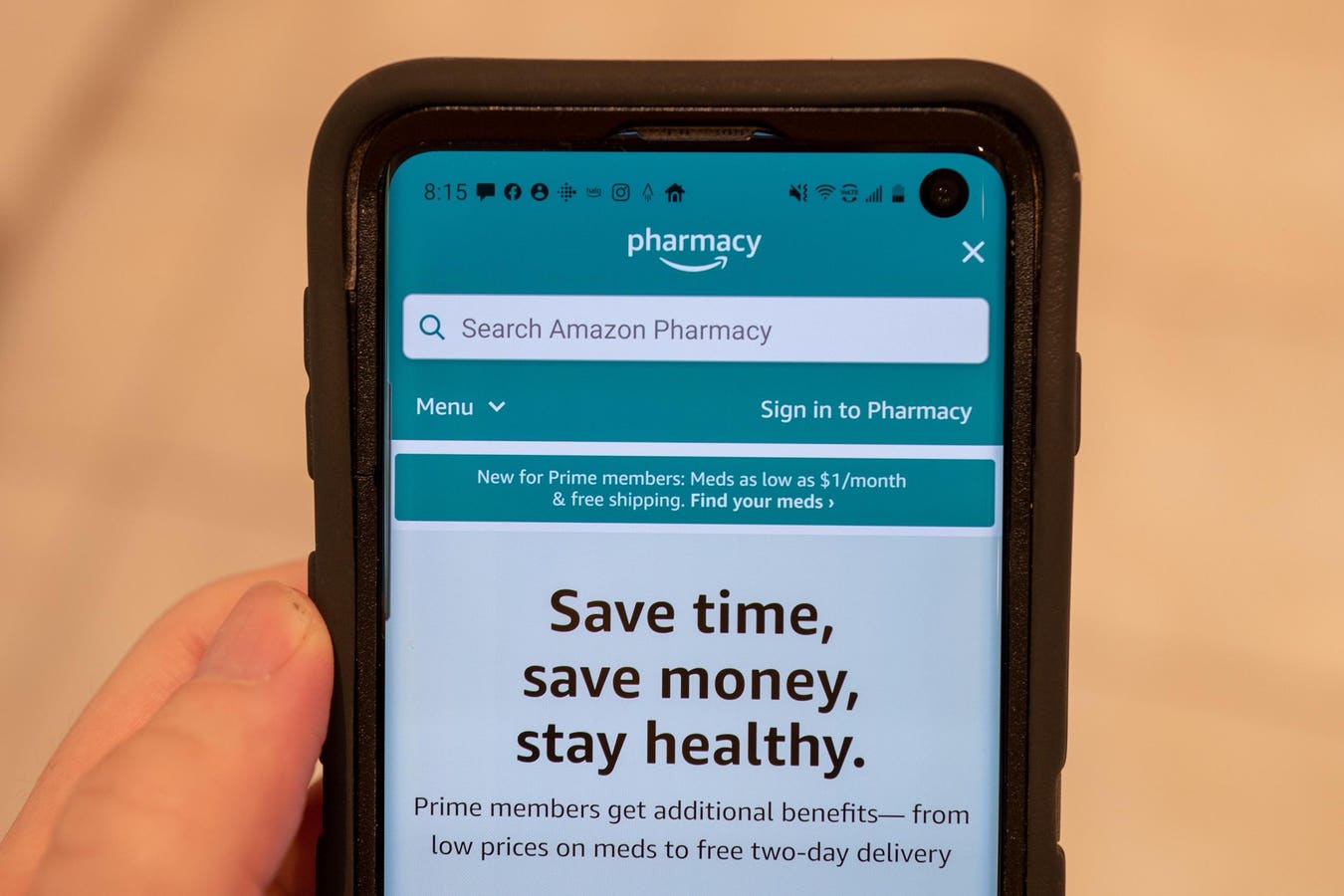

On an earnings call earlier this month, Amazon CEO Andy Jassy remarked about the current, rough state of pharmacy retail and the development’s positive impact on Amazon.

“… Customers love the customer experience of Amazon Pharmacy,” Mr. Jassy said. “And especially, by the way, when you think about the experience and the speed and ease with which you can order versus walking into a pharmacy in a physical store, if you walk into pharmacies in cities today, it’s a pretty tough experience with how much is locked behind cabinets, where you have to press a button to get somebody to come out and open the cabinets for you and a lot of shop lifting going on in the stores. So, the combination of what’s happening in the physical world and how much improved we’ve made our pharmacy experience is driving a lot of customer resonance and buying behavior…”

(Amazon had no further information to add on Mr. Jassy’s earnings call statements in response to an inquiry by Forbes.com.)

While Amazon Pharmacy facilitates the delivery of prescription medicine (products that are always behind the counter in a physical pharmacy) Mr. Jassy’s reference to locked cases addresses the other half of brick-and-mortar pharmacy’s experience; the on-shelf household essentials now as central to the drugstore vertical as medicine. A Fortune article about Mr. Jassy’s statements speaks to that directly, citing customers who would rather shop Amazon online than call an in-store staff member to pull a product from a locked case (Target, too, comes under fire in that article for its locked case-based shoplifting prevention strategy). Along those lines, one anti-theft tech vendor told Axios that there is a potential 15 percent to 25 percent drop in purchases for retailers that lock product up behind cases.

With such sentiment percolating, it’s worth thinking about both the extent to which customers are really being driven to Amazon by a locked-up and otherwise rough urban pharmacy experience, as well as what it means for other retailers and e-tailers that sell household essentials—and how they might want to position what they offer online.

Is an E-Commerce Household Essentials Boom a Reality?

I struggle a bit with the notion that locked-up on-shelf essentials reliably drive customers to e-commerce. First because many of the products that tend to get locked up at the drugstore, (toothpaste, toilet paper, shampoo, etc.) shoppers need immediately. If someone really needed toilet paper and found it inconveniently locked up, they would likely visit another nearby store, say a conventional grocer, before going online (and if the situation is so bad that there is no store in an area where everything is not locked up, that’s a bigger problem I don’t think e-commerce can solve). Going home and placing an order—or even shopping Amazon via mobile from the parking lot—would not get the product to them fast enough without same-day delivery.

Same-day delivery, if its available, introduces another issue: price. For Amazon Prime members, using same-day requires either building a $25 basket to avoid the fee or paying an extra $3.99. For non-Prime members, it means a $9.99 fee. Quite a markup when inflation has people watching their wallets.

Not to mention there are some pharmacies that have kept easily-pilfered SKUs behind cases since long before the recent shoplifting spike, and since long after the advent of e-commerce, indicating that there is some sweet-spot where retailer’s find it a worthwhile shrink-prevention strategy that doesn’t send customers online at scale, even if it may well be inexcusably customer-unfriendly.

That said, let’s assume that in some or many cases, more brick-and-mortar friction from locked up items pushes irritated customers to online shopping for essentials. Or that the overall poor experience Mr. Jassy described is driving people online for new categories. Who, then, can best absorb this traffic, and how?

Physical Pharmacy’s Loss Is Whose Gain?

Amazon generally captures the biggest chunk of online spend, accounting for 37.6 percent of U.S. e-commerce according to JungleScout. But membership-based wholesalers like Costco and Sam’s Club also have gotten their online presences together recently. These retailers are already go-to sources for products like the ones increasingly found behind lock and key, and often it makes financial sense to buy them in bulk in any case, online or off.

Retailers that are locking up merchandise, like Walgreens and Target, also have online presences that they could be utilizing to pick up sales lost in store, though it seems likely a customer frustrated with a retailer’s in-store experience would skip that retailer immediately after a negative interaction, and might find the notion of being nudged online for a better experience insulting. Furthermore, cannibalizing sales lost to a poor store experience is not exactly “winning.”

There’s also a new re-entrant to the market that could be poised to fill a gap for frustrated customers.

Boxed recently announced a relaunch after being bought out of bankruptcy in 2023. Once billed as a Millennial-focused, online-only version of Costco, the subscription service once received and rejected an acquisition offer from Kroger. It fell on hard times in 2021, which a Modern Retail article ascribes to a few factors including difficulty competing with more established, more resourced warehouse players that finally got their minds around e-commerce, and difficulty competing as a newly IPOed company amid a post-pandemic e-grocery downturn.

Now the service could be relaunching into an environment hungrier for the offer, with markets looking for more convenient routes to household essentials than the locked shelf.

It’s worth mentioning, though, that betting on people to move 100 percent online for essentials has not paid off. Amazon’s attempt to wire customers into a purely online essentials replenishment ecosystem, the Amazon Dash

Dash

E-Tail’s Case For Circumventing The Locked Case

Ongoing mass retail theft is a sad development and the rather desperate steps retailers take to staunch the bleeding are equally depressing. It’s not exactly marketing campaign fodder. But you could see a Costco, a Sam’s Club or a Boxed looking for creative, subtle ways to meet this customer need (or prevent Amazon from doing so) for as long as it remains a need, continuing to build up online fulfillment capabilities and promoting around online value offers on household essentials—especially subscription-free options.

Locked-up merchandise is, naturally, a less common phenomenon than locked-down people were throughout 2020. The latter led to an unprecedented trial of e-grocery which some recent sources say has been surprisingly sticky in the post-pandemic world. If shoppers are moving online for essentials, it’s not clear if they’ll stay there at the same rate that pandemic-era e-grocery adopters appear to have stuck with such services, once the incenting social pathology is curbed (which will hopefully be soon).

And if they do stick to online ordering, there’s always porch piracy to worry about—but that’s a conversation for a different day.

Read the full article here