I warned of growing risks to the dividend for Oaktree Specialty Lending Corporation (NASDAQ:OCSL) in May as the business development company sparked a spike in impaired loans, suffering a serious deterioration in its credit profile.

Though Oaktree Specialty Lending’s non-accrual ratio decreased in 3Q24 (the BDC’s last quarter), the business development company barely covered its dividend with net investment income.

Oaktree Specialty Lending also paid a price in terms of its net asset value, thanks to a higher amount of unrealized losses on certain debt and equity investments.

I am still evaluating Oaktree Specialty Lending as a ‘Hold,’ but think that the risk/reward relationship has overall softened.

If Oaktree Specialty Lending under-earns its dividend with net investment income in the next quarter, a dividend cut might be in the cards for passive income investors.

My Rating History

I modified my stock classification for Oaktree’s Specialty Lending from ‘Strong Buy’ to Hold as the business development company suffered a substantial decline in credit quality.

In the quarter ending June 30, 2024, Oaktree Specialty Lending’s non-accrual ratio decreased again, but the company suffered a decline in its net investment income regardless.

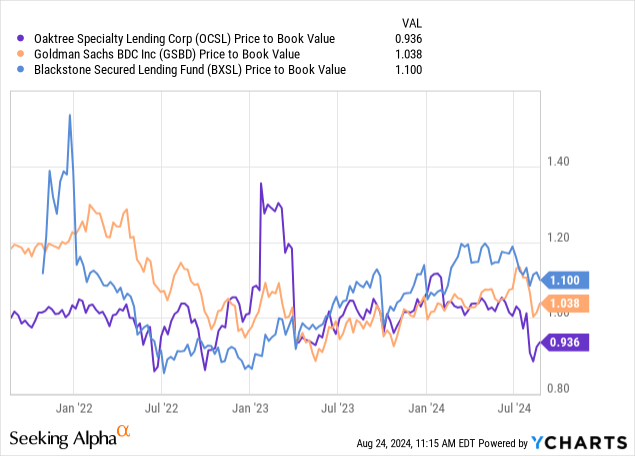

The BDC’s stock is now selling for a NAV discount as well, sustaining my ‘Hold’ stock classification.

Portfolio Review

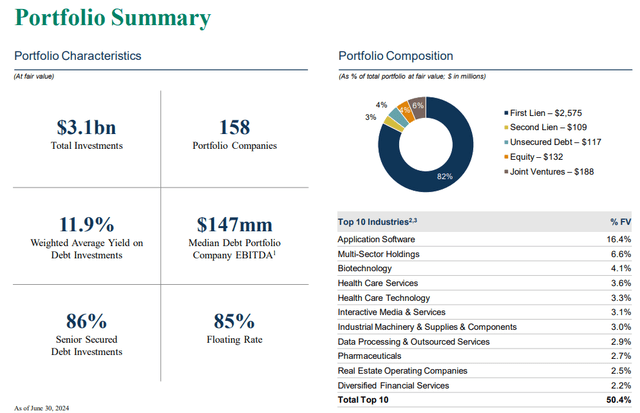

Oaktree Specialty Lending had $3.1 billion in investments spread out over 158 portfolio companies in the last quarter. The biggest investments were First Liens which represented 82% of the company’s investment portfolio as of June 30, 2024.

Oaktree Specialty Lending is not as aggressively floating-rate positioned as other business development companies, such as Goldman Sachs BDC (GSBD) or Blackstone Secured Lending fund (BXSL). Oaktree Specialty Lending had 85% of its investments allocated to floating-rate loans compared to close to 100% for the other two BDCs.

Portfolio Summary (Oaktree Specialty Lending Corporation)

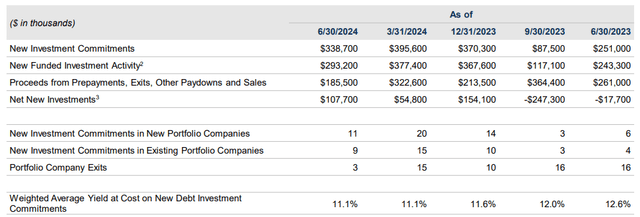

In terms of investment activity, Oaktree Specialty Lending had its third highest new funded investment activity in the last quarter. In total, the business development company had $293.2 million in new funded investments compared to $377.4 million in 2Q24.

Oaktree Specialty Lending could profit from a boost to loan originations in its business if the central bank slashes short-term interest rates next month, the odds of which have considerably increased as of late.

New Funded Investments (Oaktree Specialty Lending Corporation)

A key weakness for Oaktree Specialty Lending is its high non-accrual ratio, which has triggered declines in investment income, particularly interest income. Oaktree Specialty Lending’s non-accrual ratio as of June 30, 2024 was 3.7%, up 0.6 percentage points YoY. Higher non-accruals obviously mean a lower amount of performing loans and, as a result, lower interest income.

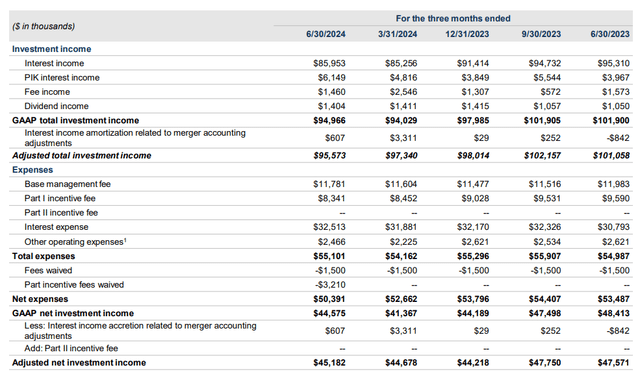

In 3Q24, Oaktree Specialty Lending’s interest income decreased a whopping 10% YoY to $86.0 million. Total investment income was $95.0 million in 3Q24, down 7% YoY due to the offsetting effect of higher payment-in-kind interest income. All things considered, the decline in net investment income is a cause for concern, particularly as far as the margin of safety is affected.

Adjusted Net Investment Income (Oaktree Specialty Lending Corporation)

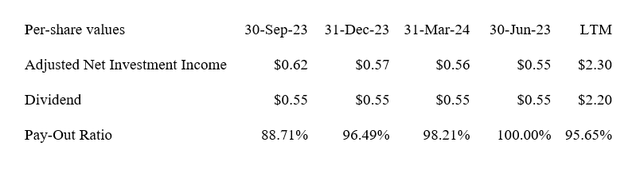

Dividend Pay-Out Ratio

It was not a good quarter for Oaktree Specialty Lending in terms of pay-out ratio as the business development company suffered its third straight QoQ decline in its adjusted net investment income and thus the third consecutive deterioration in its pay-out ratio.

Oaktree Specialty Lending earned only $0.55 per share in net investment income in the last quarter which compares to a dividend pay-out of $0.55 per share per quarter. The dividend pay-out ratio was 100% in 3Q24 and thus the worst in a year.

Dividend (Author Created Table Using BDC Information)

6% Discount To NAV

Oaktree Specialty Lending’s net asset value decreased 2.9% in the last quarter due to net realized and unrealized losses in the investment portfolio that affected the business development company’s net asset value to the tune of $0.54 per share.

As a consequence, Oaktree Specialty Lending’s net asset value, as of June 30, 2024, was $18.19, and thus dipped $0.53 per share QoQ. With a stock price of $17.02 per share at the time of writing, Oaktree Specialty Lending is selling at a 6% NAV discount.

Goldman Sachs BDC also disclosed credit profile issues in the last quarter, but the business development company’s stock is now, after a short-lived sell-off, selling for a 4% NAV premium again.

Blackstone Secured Lending, which I mentioned above, is selling for a 6% NAV premium, but I consider BXSL to be in a league of its own when taking into account its low dividend pay-out ratio of 87% and very strong credit profile (0.3% non-accrual ratio based on fair value). Thus, Blackstone Secured Lending is a top quality pick for me.

Why The Investment Thesis May Be Faulty

Obviously, the risks to the dividend increased after the business development company just barely covered its dividend with adjusted net investment income in the last quarter.

The central bank also is poised to lower short-term interest rates shortly, which could pose an additional headwind to Oaktree Specialty Lending’s dividend pay-out ratio.

However, since Oaktree Specialty Lending is less invested in floating-rate loans than other business development companies, I expect OCSL to be a less vulnerable to future interest rate cuts.

My Conclusion

Oaktree Specialty Lending’s net asset value slumped QoQ in the last quarter due to a higher amount of unrealized losses on debt and equity investments.

As a consequence, the business development company also reported a decline in its net investment income, which was just about sufficient to cover its present $0.55 per share per quarter dividend pay-out.

Oaktree Specialty Lending must improve its underlying credit quality fast or risk being forced to lower its dividend, which would probably do substantial damage to the trust that passive income investors have placed on management.

The stock is selling for a 6% NAV discount, which seems about appropriate given the present circumstances in the portfolio. Hold.

Read the full article here