Investment action

I recommended a sell rating for Campbell Soup Company (NASDAQ:CPB) when I wrote about it in October last year, as I expected the tough macro conditions to heavily weigh on demand and CPG’s sales. I acknowledge that I have underestimated CPB ability to navigate the macro environment, and hence, I am shifting away from a sell rating. However, I don’t see any room for upside in the near term, as I am not convinced that CPB is able to achieve its long-term targets. As such, I recommend a neutral rating.

Review

CPB reported 2Q24 earnings two weeks back, which saw $2.29 billion in sales, missing consensus estimates of $2.3 billion; a gross profit of $719 million, which also missed consensus estimates of $731 million; and an and an EBIT of $329 million, which also missed consensus estimates of $331 million. However, lower interest expenses and a better tax rate led to net income of $189 million, beating consensus estimates of $185 million.

CPB

Faster forward two weeks from the earnings, CPB had its FY25 investor day that had a whole bunch of information. I would not go into the details since readers can look through the deck themselves. My focus for this post is to discuss why I believe the growth algorithm that management laid out during the investor day is unlikely to happen.

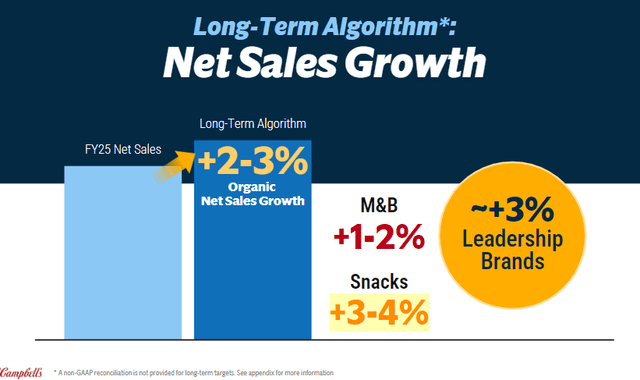

As per the deck, management long-term growth algo of 2 to 3% is bridged by 1 to 2% growth in meals & beverages (M&B) and 3 to 4% growth in Snacks. For a start, this ~2.5% long-term growth is a massive step up from CPB historical organic growth. I remind readers that pre-covid (FY14 to FY19) CPB average organic growth is -0.5%, and the last time it touched that level of growth was post-subprime in FY12/13. Importantly, volume/mix growth contribution has never gone past 1%; in fact, it has been negative (-1%) for the preceding three years before FY19.

Taking a deeper look, my biggest problem with the growth assumption is the 3 to 4% growth in Snacks. There are multiple reasons why I think management is overly optimistic about it. Firstly, organic growth has never reached the midpoint of that growth guide pre-covid (highest was 3%, but this was 8 years ago in FY16). Secondly, competition is intensifying in the industry, with multiple large players like General Mills (GIS), Utz Brands (UTZ), and Mondelez (MDLZ) aiming for a piece of this industry. This ramp-up in competition makes it hard to believe that CPB can accelerate its growth.

And I look at our Snacks business. We’re going to have double the price pack architecture coming into the marketplace that we did last year. And that’s small opening price points, smaller pack sizes, and then the larger ones that bring more value.

We’re seeing our lift on our merchandising ahead of our categories. We’re going to bring back in-store events that we haven’t been able to do through the pandemic across our Snacks and Cereals. That will be effective for us. General Mills – Barclays Annual Global Consumer Staples Conference

We did have some competitors who obviously had continued to price into the year. What we saw in July, although we anticipated some of it, was a much more promotional environment than I think even we had expected in terms of breadth of competition, the depth of the pricing that they went into.

And sort of the channels, C-store, which is an area where we continue to need to do work on our own, as well as mass became significantly more promotional. You can see that in the data over, call it, that 6-week period Utz Brands – Barclays Annual Global Consumer Staples Conference

I didn’t mention as a category, we are looking at snack bars at this point in time, between what we acquired through Clif and what we have with other brands like, Grenade and Perfect Snacks. Mondelez International – Barclays Annual Global Consumer Staples Conference

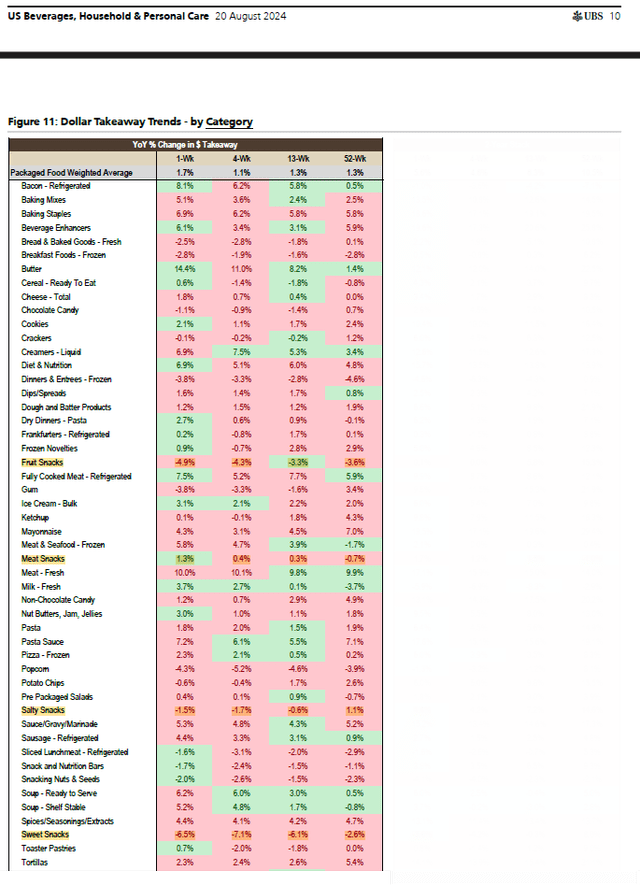

UBS

Lastly, as per UBS data (based on Nielsen), the recent sales trend for the Snacks industry remained poor and seems to have deteriorated. This makes it even more concerning that competition will step up as peers ramp up promotional activities to capture demand. This also makes the 3 to 4% growth expectation hard to believe, as it means CPB will be capturing 400 to 500 bps of market share.

Therefore, with Snacks representing close to 50% of total sales, and I don’t see it achieving that level of growth, it makes it unlikely that CPB can accelerate growth to 2 to 3% over the long term.

CPB

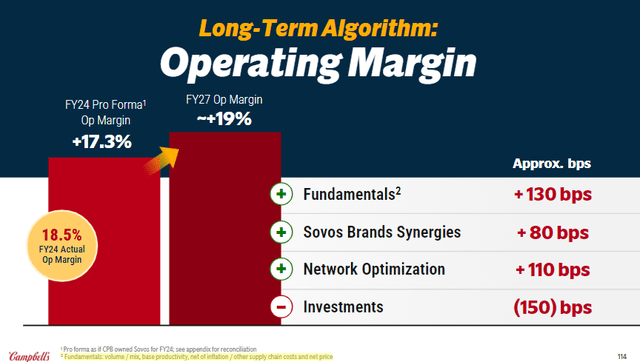

Another area that got me puzzled is slide 114, in which management shared their M&B long-term EBIT margin outlook of achieving >19% by FY27. Of the 4 drivers, that one that I find hard to appreciate is the 130 bps of contribution from fundamentals. If you look closely at the slide, the underlying reasons are volume/mix, productivity, inflation, pricing, and other supply chain costs. Other than this blanket statement, management did not discuss deeply as to how all this would materialize. Historical performance certainly does not provide support, as volume/mix and pricing were all negative in the past three years before COVID (FY16-FY19). As for supply chain cost, I also find it hard to believe that it would be a major driver given that just two quarters ago, management noted supply chain was “in full force.” Given that this 130bps is the largest driver of this margin expansion outlook, I need to see more evidence and comments from management before I will be convinced.

With our supply chain in full force, effective marketing and accelerating innovation and strong but disciplined promotional activity, we look forward to monitoring the pace of consumer recovery closely with in-market results serving as a clear indicator of that progress. 2Q24 call

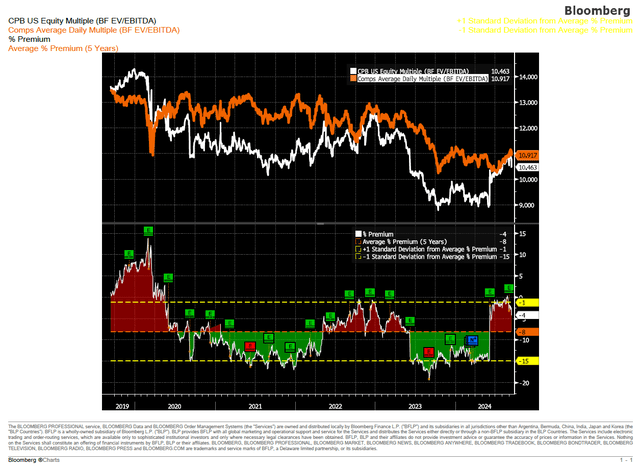

Valuation gap already close relative to peers

CPB valuation is also a lot less attractive than it was in October last year. Back then, there was a steep valuation gap of ~15%, but it has closed now with CPB trading in line with peers at 10.5x forward EBITDA. Given the lack of strong evidence to support management’s growth expectation, I don’t expect the market to attach a higher multiple than peers. Hence, upside to share price needs to come from EPS growth, which I think consensus has already incorporated any upside to their estimates. Current FY26 EPS estimates call for $3.41, which is ~7.5% y/y growth vs. management FY25 midpoint EPS guidance of $3.17. As a comparison, CPB grew its EPS by an average of 3% between FY14 and FY22. Hence, I don’t see any room for EPS estimates to go higher as well.

Bloomberg

List of peers (Author’s work)

Final thoughts

My recommendation is a hold rating for CPB as I remain skeptical about its ability to achieve its long-term growth targets. CPB’s historical performance, coupled with intensifying competition and uncertainties surrounding its growth drivers, suggests that the expected long-term growth target is optimistic. Additionally, CPB’s current valuation, which is in line with its peers, offers limited upside potential.

Read the full article here