Powell & Co.: Take It Easy

“Take it easy Take it easy

Don’t let the sound of your own wheels drive you crazy Lighten up while you still can

Don’t even try to understand Just find a place to make your stand

And take it easy” – The Eagles, 1972

“Best” Economist of All-Time: Two-Year U.S. Treasury Note

|

3Q |

YTD |

1-Year |

3-Year |

|

|

Wedgewood Composite Net |

5.8 |

22.4 |

36.4 |

9 |

|

Standard & Poor’s 500 Index |

5.9 |

22.1 |

36.4 |

11.9 |

|

Russell 1000 Growth Index |

3.2 |

24.6 |

42.2 |

12 |

|

Russell 1000 Value Index |

9.4 |

16.7 |

27.8 |

9 |

|

10-Year |

15-Year |

20-Year |

25-Year |

|

|

Wedgewood Composite Net |

12.5 |

13.7 |

11.1 |

9.5 |

|

Standard & Poor’s 500 Index |

13.4 |

14.2 |

10.7 |

8.2 |

|

Russell 1000 Growth Index |

16.5 |

16.5 |

12.7 |

8.5 |

|

Russell 1000 Value Index |

9.2 |

11.2 |

8.5 |

7.7 |

Top performance contributors for the third quarter include PayPal (PYPL), Meta Platforms (META), UnitedHealth (UNH), Motorola Solutions (MSI) and Apple (AAPL). Top performance detractors for third quarter include Edwards Lifesciences (EW), Alphabet (GOOG,GOOGL), Microsoft (MSFT), Copart (CPRT) and CDW.

During the quarter we trimmed Motorola Solutions and added to Edwards Lifesciences.

|

Q3 Top Contributors |

Avg. Wgt. |

Contribution to Return |

|

PayPal |

6.45 |

2.06 |

|

Meta Platforms |

8.50 |

1.21 |

|

UnitedHealth |

6.46 |

0.88 |

|

Motorola Solutions |

5.22 |

0.86 |

|

Apple |

7.05 |

0.76 |

|

Q3 Bottom Contributors |

Avg. Wgt. |

Contribution to Return |

|

Edwards Lifesciences |

4.58 |

-1.32 |

|

Alphabet |

7.85 |

-0.77 |

|

Microsoft |

5.65 |

-0.23 |

|

Copart |

5.48 |

-0.21 |

|

CDW |

4.45 |

-0.011 |

|

1 Portfolio contribution calculated gross of fees. Contribution to return calculations are preliminary. The holdings identified do not represent all of the securities purchased, sold, or recommended. Returns are presented net of fees and include the reinvestment of all income. “Net (actual)” returns are calculated using actual management fees and are reduced by all fees and transaction costs incurred. Past performance does not guarantee future results. Additional calculation information is available upon request. |

PayPal Holdings was a top contributor to portfolio performance during the quarter. Revenues grew +9% (FX neutral) while adjusted operating income grew +24%, driven by higher transaction margin dollars and continued excellent expense discipline. The Company’s core branded payments and Venmo transactions grew at a healthy mid-single digit clip. PayPal has several investment initiatives that will contribute to accelerating growth over the next few years to help take advantage of their leading market share in e- commerce payments. The Company serves over 35 million online merchants. PayPal’s large, online merchant acceptance base is a rare and crucial component to profitably monetizing payment volumes that many competitors lack. While the Company’s earnings multiple has expanded recently, it continues to trade at levels we think are quite cheap given their strong positioning in the long-term secular expansion of global e-commerce.

Meta Platforms was a leading contributor to performance during the quarter. Revenue growth came in at a strong +23% (foreign exchange-neutral) while adjusted expenses grew slower, with operating margins in the Company’s core Family of Apps business hitting nearly a sterling 50%. The Company has been a consistent beneficiary of artificial intelligence over the past several years, investing aggressively behind deep learning recommendation systems that help power products that reach nearly half the population of the planet. Meta’s AI investments, combined with its massive scale, allow the Company to quickly spin up new products across its digital advertising real estate to reinforce its competitive positioning. Meta’s core Family of Apps products are backed by extremely large and complex (i.e. difficult to copy) AI recommendation systems that have to sort through billions of datapoints in real time and come up with the probability of a user engaged to click. Meta is one of the few companies that has been able to consistently and profitably monetize AI technologies for shareholders and we continue to hold it as a top position in portfolios.

UnitedHealth Group shares rebounded during the quarter and the holding was a top contributor to portfolio performance. The Company reported double-digit growth in earnings per share during the quarter. It has been able to adjust pricing in its Healthcare segment to keep up with medical cost inflation while working with its Optum units to deliver more value-based care, replacing the traditional fee-for-service health-care model. The Optum segment grew operating income over +15% on strong expense management and continued uptake of value-based care offerings. Value-based care is a sensible, long-term growth opportunity for the Company to pursue and also differentiates them from the vast majority of healthcare providers, particularly as it relates to Medicare patients. For example, the Company’s value-based care programs provide more preventative care opportunities and homebased care visits for patients which helps save the U.S. health-care system billions in unnecessary spending, while also providing patients with better outcomes because diseases and behaviors are caught or corrected at earlier stages. Furthermore, the Company has invested in several core assets over the years in order to execute this value-based strategy. It may well become the standard of care as the proportion of people in the U.S. with healthcare insurance coverage continues to reach new highs.

Motorola Solutions was another top contributor to performance as the Company continued its steady execution with +9% year-over-year sales growth and +22% adjusted earnings per share growth. While Motorola’s backlog for products declined, much of it was due to accelerated revenue recognition on strong deliveries for its Land Mobile Radio” (LMR) business – a critical long-term solution for emergency services around the globe. The technology behind LMR is quite simple; however, it is an extremely robust implementation that needs to withstand regular and even mega catastrophes (e.g., hurricanes) in order to guarantee uptime for the emergency services that depend on it for communications. The Company has superlative, unmatched competitive positioning in this core business and should be able to continue to expand value-added service offerings to LMR and drive attractive long-term growth.

Apple also contributed to performance as investors continued to favorably discount the recent unveiling of its AI strategy. As we have noted in the past, the Company has been at the forefront of proprietary semiconductor computer processor development for well over a decade. Given the compute-intensive nature of AI applications, Apple is well situated to develop a suite of compelling, consumer-friendly AI services that are also cost-effective. Apple’s AI value proposition should compel consumers to continue growing their engagement in the Apple ecosystem over the next several years.

Edwards Lifesciences detracted from performance as growth in the Company’s flagship transcatheter aortic valve replacement (TAVR) franchise slowed. Recent growth rates in Edwards’ TAVR segment have not been as steady as compared to the Company’s past growth rates, particularly when TAVR was first emerging. Although the TAVR market is maturing, it is still far from saturated, with upcoming clinical trial results serving as important drivers towards accelerating this core franchise into the larger populations of asymptomatic structural heart disease. We are comfortable owning businesses that report growth that is not perfectly linear in the short-term, as long as the business maintains its competitive advantage and has good prospects for future double-digit earnings growth. We added to positions after the recent sell-off in shares as Edwards’ forward earnings multiples fell to historical and relatively low levels because we think it is too pessimistic given its solid competitive positioning and pure-play focus on minimally invasive structural heart conditions.

Alphabet also detracted from performance despite reporting strong +15% revenue growth (foreign exchange-neutral) in its core search business during the Company’s second quarter. The Company continues to integrate generative AI (gen AI) applications into its largest products that reach billions of users every day. The advertisements that appear above and below this gen AI content, particularly on search results, represents a valuable opportunity for businesses. In addition, the Google subsidiary of Alphabet has been deploying gen AI features that help advertisers easily create ad content and then quickly scale that content across all of Google’s properties and formats. As we have pointed out in the past, Google’s new AI-driven advertising tools and products represent returns on the Company’s early and aggressive investments in AI hardware and application software over the past decade and should lead to significant, sustainable competitive advantages. During the quarter, the District of Columbia ruled that Google violated antitrust law by maintaining a monopoly in the U.S. across its search services and text advertising, specifically through exclusive distribution agreements. Alphabet’s deep competitive advantages go far beyond its distribution agreements, and we believe the Company should be able to maintain its superior return structure, despite the recent legal headwinds.

Microsoft detracted from portfolio performance during the quarter. The Company posted continued healthy organic revenue growth of +13% and growth in operating income of +16%, helped by healthy seat growth in Office365, plus gains from pricing and premium mix shift. The market has revalued Microsoft’s earnings multiple higher over the past several quarters the hopes that the Company can create new revenue streams from its AI “Copilot” products. We are not yet convinced that Copilot will be the revenue growth driver that the market expects; however, we think Microsoft has plenty of mission-critical SMB and enterprise products, along with potential profitability upside from Azure, to keep earnings growing at an attractive, double-digit clip.

Copart also detracted from portfolio performance as the Company reported earnings that were weak relative to last year, mostly driven by one-time events and the cost of ramping up service levels to handle volumes after three named hurricanes that hit the U.S. during its fourth fiscal quarter of 2024. The good news for U.S. drivers is that the long-term trend of fewer accidents per miles driven continues apace; however, the bad news is that for the accidents that do happen, there is a higher likelihood that their vehicle will be totaled given how expensive it has become to repair the high-tech features of newer vehicles. Copart tows, conditions, stores and auctions the growing proportion of vehicles that are totaled after accidents, and this key trend should continue for the foreseeable future as it has in years past. The Company has a dominant profit share in the salvage auction industry, having spent decades building out its geographical footprint to over 200 salvage yards across the globe. We continue to hold Copart as a core position in portfolios.

Company Commentaries

Motorola Solutions

Wedgewood Partners now has owned Motorola Solutions for over five years (funded by the partial sale of our 20-year holding then of Berkshire Hathaway). We’d like to provide an update on the Company, which has been a significant gainer in the portfolio. As a reminder, Motorola Solutions is the dominant market leader in its core Land Mobile Radio (LMR) business: providing infrastructure, handsets, and related software and services for customized, highly resilient, secure networks for global police and emergency services, a variety of government and military applications, and other commercial and public safety applications where security and reliability are of the utmost importance. The Company continues to find success in using its entrenched position in these mission-critical networks to layer in faster-growing and higher-margin software, service, and video products. Although Motorola has some credible competition in these ancillary products, in contrast to its dominance in the LMR business, the Company is the only player capable of fully integrating an entire service offering, given their structural competitive advantage of its LMR network backbone.

In Wall Street terminology, this is basically an example of the beloved razor and blades model, except there is little credible competition for the razor; both the razor and blades are consumable/subscription-type products, and the whole model is on steroids, with actual growth for the entire industry. As we have previously needed to clarify more often than we do now, please remember that Motorola Solutions has nothing to do with the once iconic Motorola-branded consumer mobile products. The Company separated from the consumer mobile business nearly 15 years ago.

To review, there were two key components to our initial purchase, which ought to sound pretty familiar to our investors: 1) We believed we were buying a high-quality, highly profitable, steadily growing, defensible, competively advantaged business model; 2) We believed then the stock was attractively valued. The somewhat unusual angle to our initial thesis was that we believed the valuation component afforded us considerable upside because Motorola Solutions seemed to be a large-cap growth stock that somehow was under the market’s radar. In fact, as we like to tell clients, at the time we purchased the stock – and even for most of the five subsequent years – our investment data provider continued to flag Motorola Solutions with any news about Motorola mobile phones, and it rarely carried any news at all about the Company itself, aside from company press releases and filings.

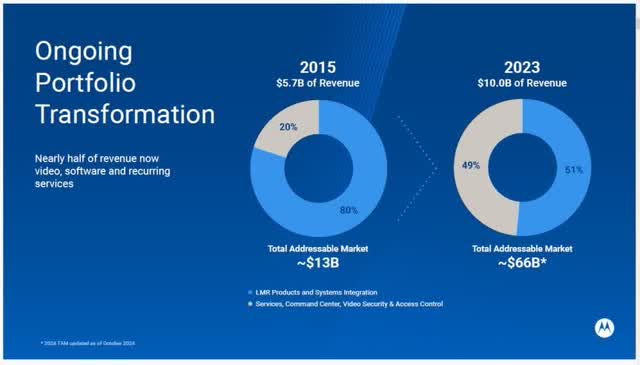

When we first invested in the stock, it was owned by nary a one of our focused large-cap competitors; and, as far as we’ve been able to determine, this has remained true during our entire holding period. The returns in the stock, however, show that many other types of investors have discovered the Company, so a key component in our original thesis has worked out as expected. Motorola Solutions has executed well on the same straightforward strategy that we liked when we first bought our position: using the Company’s dominant position in mission-critical communication networks and devices to layer in faster-growing and higher-margin services, software, and video and continuing to develop these additional capabilities internally and through acquisition. When we shared the graph below in the third quarter of 2021, faster-growing and higher-margin software, services, and video represented 46% of annual revenues in 2020; that total reached 49% in 2023. If not for the continuing solid growth of the core LMR business, we’d be seeing these other components of the business taking share even more rapidly.

Source: Motorola Solutions, Inc. October 2024 Investor Presentation

The continuing transformation of the business model has led to steadily improving profitability trends. Reported operating margins (or EBIT, earnings before interest and tax) have improved by approximately +500 basis points during the past 10 years, while a more comprehensive measure of profitability, our internal calculation of cash-flow-based returns on invested capital, has improved more substantially, by over +900 basis points, reflecting improving operating margins as well as improving asset turns in the company’s business model. While there will always be lumpy blips from quarter to quarter and year to year; based upon the timing of large acquisitions, pandemics, etc., we will keep our eyes on longer- term trends. At a minimum, we like to invest in companies that are able to drive growth in revenues, earnings and cash flows, while preserving high absolute levels of profitability; of course, it’s even better when we can find a company able to grow while continuing to improve profitability over time, as Motorola Solutions has done.

Motorola Solutions Inc.(MSI): Profitability measures

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024(ytd) |

|

|

EBIT(1) |

18.9% |

20.6% |

20.9% |

19.1% |

20.9% |

19.4% |

21.1% |

19.6% |

23.9% |

23.2 |

|

CF ROIC(2) |

11.9% |

16.5% |

6.7% |

22.2% |

19.1% |

18.0% |

19.5% |

20.9% |

21.1% |

n/a |

|

1Earnings before Interest and Taxes 2Cash Flow-based Return on Invest Capital- internal WWP measure sources: company filings and earnings reports |

While little has changed in the company’s strategy, several major external events have helped to prove the competitive advantages of its business model. We learned through the brief (and quickly reversed) “defund the police” movement that 1) most municipalities quickly worked out that defunding the police wasn’t a great idea, but 2) even if you do defund the police, you can’t turn off your emergency services’ control centers’ communication and operational systems. So, if anything, this episode demonstrated the resilience of spending on the Company’s product portfolio despite budgetary pressures on police funding in some places, while also demonstrating that police funding should remain resilient.

We also had help in demonstrating the indispensability of the business from the severe recession accompanying the pandemic, which impacted municipal sales tax receipts both abruptly and quite significantly. While many investors pitched this as a negative catalyst for the Company, we again saw that municipalities were not able or willing to turn off their emergency services’ control centers. In fact, we made an argument that there would be additional benefits to the business as a result of the pandemic, making us admire the business even more. As we wrote in our client letter for the third quarter of 2021:

“This highlights an additional problem with these outdated call centers, which unfortunately was brought into sharp focus by the pandemic: with their lack of capabilities in mobile data or video, and a lack of software or cloud connectivity built into the call centers, public safety customers realized their shortcomings in being able to coordinate their responses between the call center, police officers, emergency medical personnel, schools, or hospitals. Imagine, for example, trying to coordinate a dinner reservation for six people without your mobile phone, without the ability to send group texts, without access to Google, and without the ability to make a reservation online. Now consider that 80% of America’s emergency response call centers were trying to handle something as critical and complex as a response to a pandemic without the most basic of modern technology resources.

We note that not only in these NG911 upgrade initiatives, but in use cases beyond the traditional call center business, including areas such as school or airport security, Motorola’s newer capabilities in areas such as video and software have worked hand-in-hand with integration into their highly-reliant, highly-secure LMR networks to create opportunities for the company, allowing Motorola to present a full solution to a customer looking to solve many of these issues that were highlighted by COVID.”

The federal government had also noticed many of these shortcomings and allocated significant stimulus funding (in the hundreds of billions of dollars) to state and local governments, as well as other Motorola customers such as FEMA, school districts, and airport and transit operators. This funding has been slowly appearing in Motorola’s results over the past three-plus years, contributing modestly to the company’s steady, pre-pandemic-era growth.

The market finally did catch on as business accelerated out of the pandemic lockdowns, with the stock starting to earn the sort of valuation multiples we always had thought were justified–at least when you consider valuation multiples in relation to market consensus estimates. We make this distinction because the stock also has benefited from chronically low consensus earnings estimates. Therefore, through most of our holding period, the stock has been driven not only by multiple expansion, but also by continual estimate expansion (see below). With the exception of a modest slowdown in the middle of the pandemic lockdowns, when the normal sales processes for the company (and everyone else in the world) were briefly disrupted, consensus has tended to underestimate the company’s earnings power fairly significantly.

Motorola Solutions Inc.(MSI): Fiscal year EPS

|

2019 |

2020 |

2021 |

2022 |

2023 |

|

|

Est 2 years prior |

$7.12 |

$8.44 |

$9.63 |

$9.56 |

$11.04 |

|

Est 1 year prior |

$7.67 |

$8.75 |

$8.62 |

$9.87 |

$11.20 |

|

Actual report |

$7.96 |

$7.70 |

$9.15 |

$10.36 |

$11.95 |

|

source: FactSet, showing consensus estimates 1 and 2 years prior to actual results |

Still, whereas we used to be able to buy much of our position in multiple transactions for just 15-18X consensus estimates (which have proved to be too low at the time), the stock now trades over 30X estimates. As a result, you’ve seen us reducing our positions in Motorola Solutions at various points since 2021. Still, we hold a significant position in the stock, and we continue to believe in the Company’s business model as we look forward over the next several years.

Powell & Co.: Take it Easy

The stock market (as of the writing) is up a sharp +23% year-to-date and near all-time highs, as well as up a strong bull market surge of +61% since the correction lows just back in October 2022. Corporate profits are resiliently strong, matching quite tight corporate credit spreads. GDP growth remains better than expected. Even the price of gold glitters at all-time highs.

Yet, on September 18, the Federal Open Market Committee, shifting it’s focus from prices (inflation) to jobs, announced a most anticipated change in monetary policy. The new policy of monetary easing was kicked off with a bang with a 50-basis point reduction in the Federal Funds Rate down to 4.75% to 5.00%.

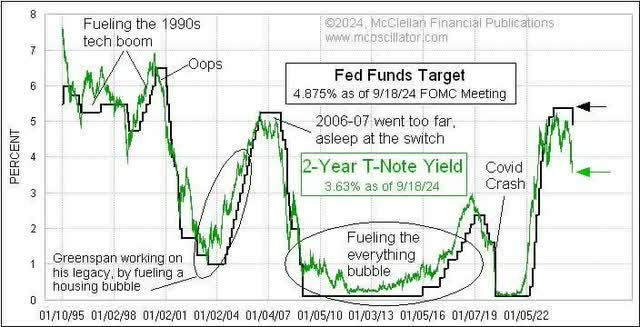

Per usual, the best economist on the planet – the U.S. two-year treasury note yield – “predicted” how far and how long the Fed was “behind the curve.” (See graphic on the first page.)

Since most consumers and corporations encounter borrowing rates with little resemblance to or correlation with the seemingly wild swings in Fed pendulum-like swings in the Federal Funds Rate, the implicit and explicit “messaging” in Fed monetary policy is real in the swings in financial markets. The phrase“Don’t Fight the Fed” is well understood by market veterans (presidential administrations too), particularly at market valuation extremes. At other times, it’s merely symbolic.

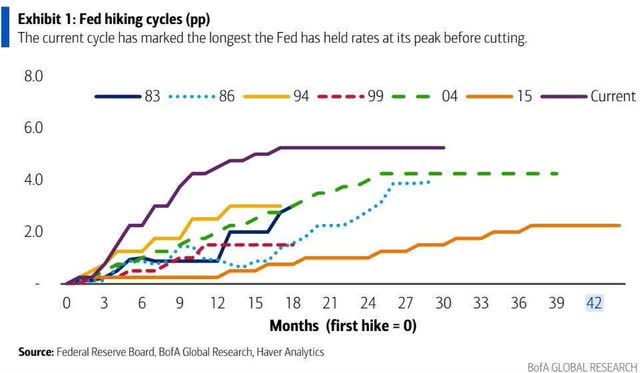

Powell & Co., exhibiting their best Paul Volcker-like inflation fighting bona fides, kept the Fed’s Fund Rate “higher, for longer” in their justification ending monetary policy of restriction. Per usual too, the Federal Reserve’s monetary policy decision making algorithms – armed with a small army of Mensa-like PhDs – have never over the many decades cracked the monetary code of being “ahead of the curve.” I suppose better late than never. Without fail, the Fed reactively follows the two-year. The U.S. two-year Treasury Note remains the undefeated GOAT.

The mixed metaphor of the title of this Letter speaks to the never-ending fiscal stimulus – revolving administrations will likely see to that – plus the current ballooned size of the Federal Reserve’s balance sheet, and it speaks to the reality that both financial markets and the U.S. economy enjoys plenty of stimulus even before a change in monetary policy. As Powell & Co. embark on a new policy of ease, we hope they take it easy.

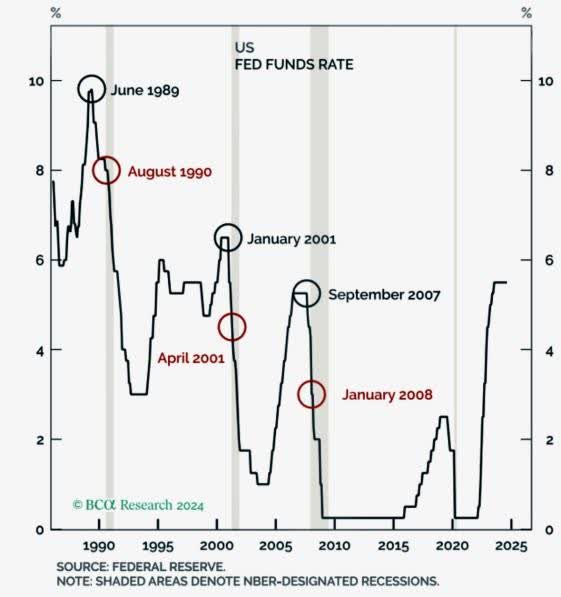

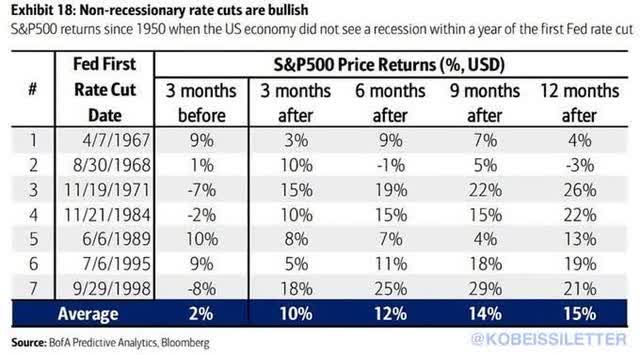

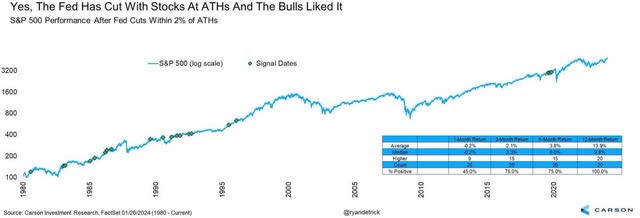

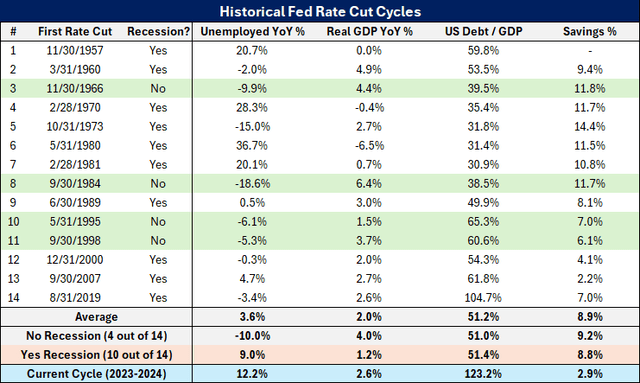

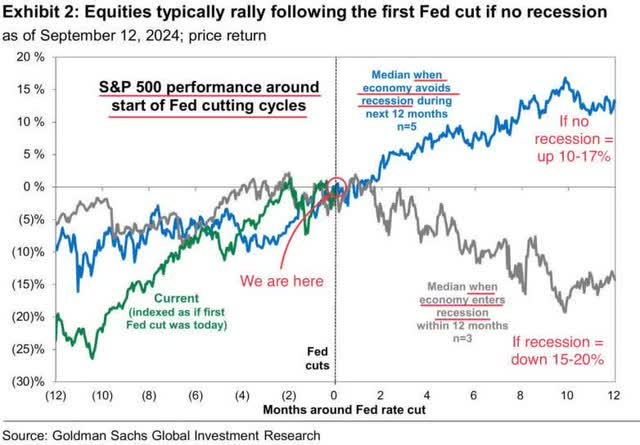

Wall Street investment strategists and pundits quickly rolled out a myriad of tables and graphics depicting the historical record of stocks price movements when the Fed begins easing monetary policy. A couple of these are depicted below:

Please note the bullish tone of the two above. Consider too the more balanced two below, which incorporate the economy and stock prices when recessions are present.

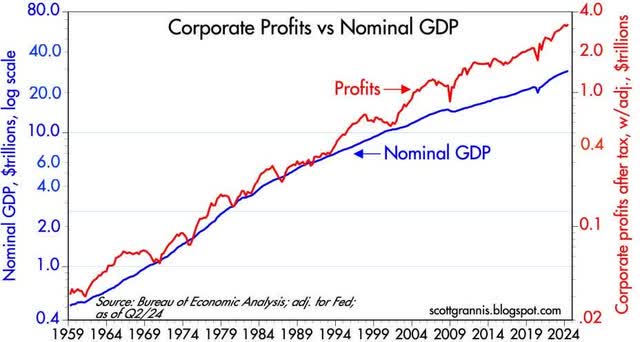

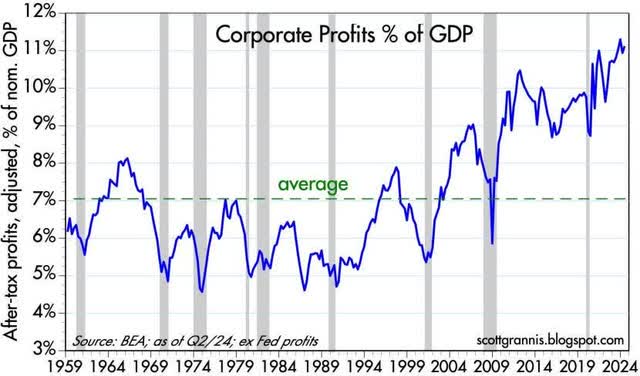

Corporate profit growth (or the lack thereof) are the mother’s milk of stock price gains or declines. Over the shorter periods of time, say, even a year or two, the correlation is weaker than most investors assume. That said, over longer periods of time the relationship is undeniable. Corporate profits are both at all-time highs on a nominal basis an as a percentage of GDP.

Scott Grannis (Calafia Beach Pundit) reports that after the 2018 reduction in the tax rate on corporate profits from 28% to 21%, since the end of 2018, corporate profits have climbed a sharp +58%, while nominal GDP rose +39%. In addition, he reports that despite large cuts in tax rates, corporate tax payments to the U.S. Treasury rose from a low of $189 billion in the 12 months ending January 2019, to $516 billion in the 12 months ending just this past August – a huge increase of+173%. And, last and none too surprisingly, the S&P 500 Index is up +130% since 2018.

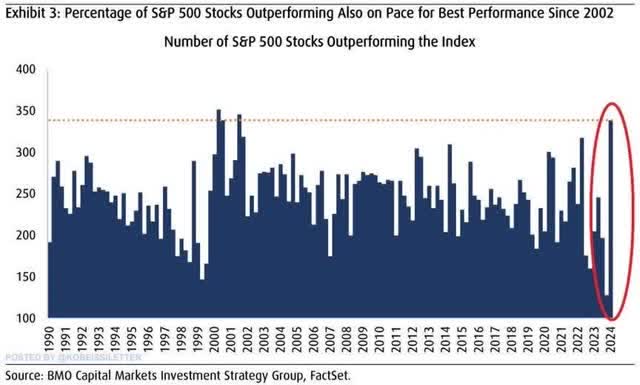

The growth in corporate profits continues to be broad-based. This has manifested itself in the broad-based performance of the majority of stocks in the S&P 500 Index from the much narrower outperformance of technology stocks earlier in the year.

We are pleased to report a broadening of better performance of the non-tech stocks in your portfolio.

Thank you for your continued confidence in Wedgewood Partners.

David A. Rolfe, CFA, Chief Investment Officer

Michael X. Quigley, CFA, Senior Portfolio Manager

Christopher T. Jersan, CFA, Portfolio Manager

|

The information and statistical data contained herein have been obtained from sources, which we believe to be reliable, but in no way are warranted by us to accuracy or completeness. We do not undertake to advise you as to any change in figures or our views. This is not a solicitation of any order to buy or sell. We, our affiliates and any officer, director or stockholder or any member of their families, may have a position in and may from time to time purchase or sell any of the above mentioned or related securities. Past results are no guarantee of future results. This report includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. These comments may also include the expression of opinions that are speculative in nature and should not be relied on as statements of fact. Wedgewood Partners is committed to communicating with our investment partners as candidly as possible because we believe our investors benefit from understanding our investment philosophy, investment process, stock selection methodology and investor temperament. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term. Forward-looking statements can be identified by words like “believe,” “think,” “expect,” “anticipate,” or similar expressions. You should not place undue reliance on forward-looking statements, which are current as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate. The information provided in this material should not be considered a recommendation to buy, sell or hold any particular security. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here