Investment thesis

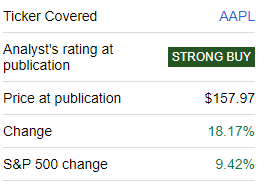

My first article about Apple (NASDAQ:AAPL), which I shared a quarter ago, worked out well. The stock price appreciation significantly outpaced the broad market with about an 18% rally since the call went live.

Seeking Alpha

The company still experiences severe headwinds due to the harsh macro environment. Q1 revenue declined YoY, but profitability metrics are still robust. Apple will continue demonstrating stellar execution even while navigating a challenging environment. But, according to my valuation analysis, the stock looks slightly overvalued at current price levels. Therefore, I downgrade my opinion of AAPL to “Hold”.

Recent developments

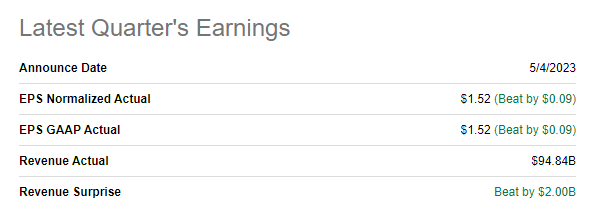

Apple reported its Q2 earnings on May 4, beating consensus estimates on the top and bottom lines. On the other hand, revenue decreased by 2.5% on a YoY basis.

Seeking Alpha

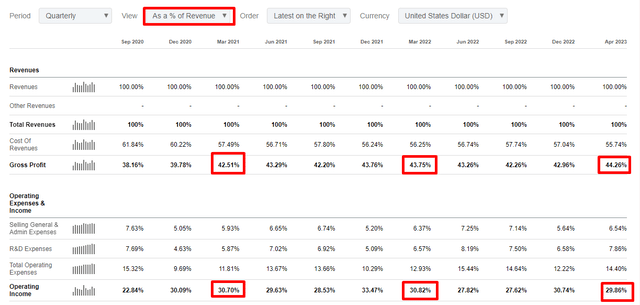

The upcoming quarter’s earnings are expected to be lower YoY again. But the extent of the decrease is lower and is projected to be at -1.5%. The EPS is expected to shrink by 1 cent, which is solid given the challenging environment. The company is experiencing severe headwinds due to softening demand for electronics due to high inflation and high-interest rates. Despite the weakening demand, its sales drop was not dramatic. I also like that the company’s operating margin almost did not suffer even compared to March 2021 quarter. And the gross margin even expanded, meaning the company has strong pricing power and customer loyalty.

Seeking Alpha

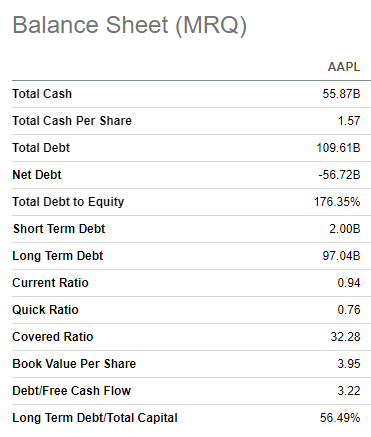

The balance sheet is still powerful with over $55 billion in cash. AAPL’s leverage ratio might look high, but I don’t think it is a big problem given a comfortable covered ratio.

Seeking Alpha

On June 5, the company hosted its annual worldwide developers’ conference, where software updates and new hardware offerings were unveiled. The main emphasis of the event, usually centered around software, was overshadowed by the company’s introduction of Apple Vision Pro. This eagerly awaited mixed-reality headset marks Apple’s first venture into a significant new product category since the Apple Watch. The launch of the Vision Pro sales is scheduled for 2024. I don’t think that it will replace the iPhone, which represents the vast portion of the company’s sales, and that is the main reason I think that replacing iPhone with Vision Pro will be very risky. Instead, I believe that the new headset will replace laptops and computers. But Vision Pro will be priced at $3,499, more expensive than the laptops usually used in the offices. Also, it is imperative to mention that the headset comes with massive power-draining hardware and runs for just two hours on a charge. That said, from the mobility perspective, it will be tough for Vision Pro to compete with laptops.

At this point, I think Vision Pro will be a niche product, and its sales over the long run will be comparable to the sales of the Mac segment. In FY 2022, the MAC segment represented about 7% of the total revenue. Therefore, I think that fluctuations in demand for the iPhone will still be the primary driver for the stock price in the nearest future.

Valuation update

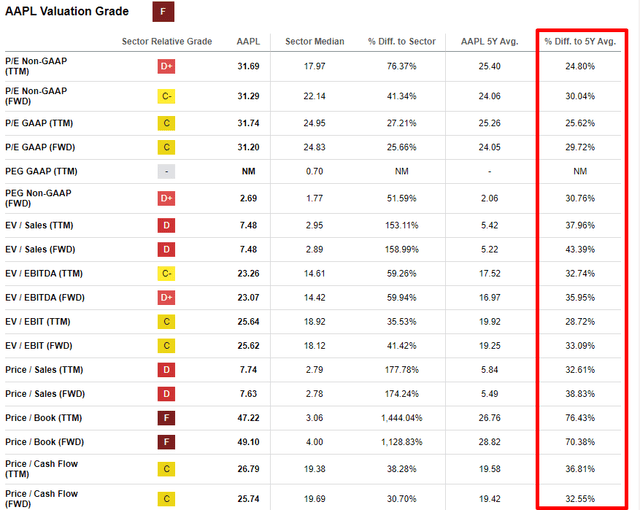

The stock delivered about a 50% rally year-to-date, significantly outperforming the broad market. Seeking Alpha Quant’s valuation grade of AAPL is still low at “F”. This is due to multiples much higher than the sector median and the company’s 5-year averages. While the comparison to peers’ valuation ratios might not be suitable due to Apple’s uniquely dominating position, the comparison with AAPL’s historical multiples is a good indicator. As you can see, all multiples across the board are more than 20% higher than the 5-year averages. For me, it is an indication of the overvaluation.

Seeking Alpha

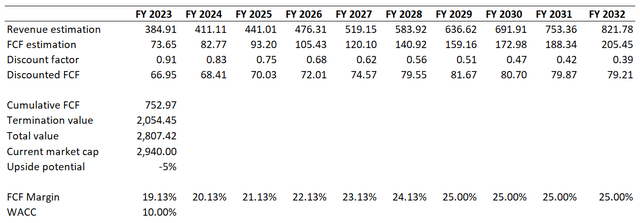

Let me simulate the discounted cash flow [DCF] model to get more evidence. The WACC is the same at about 10%, which I consider fair. Revenue consensus estimates were slightly downgraded, and I would like to incorporate a new growth profile into my DCF. I also use a softer FCF margin for the base year FY 2023 due to the company’s headwinds. The FCF margin is expected to expand by 100 basis points yearly until it peaks at 25%.

Author’s calculations

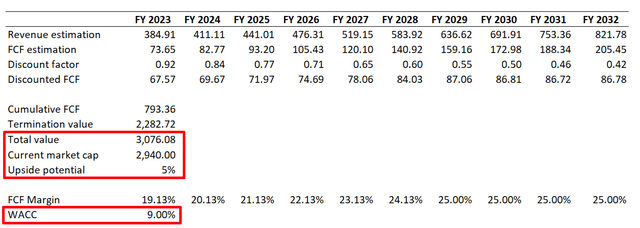

Under these assumptions, the company’s fair value is estimated by my DCF at $2.8 billion, which is slightly lower than the current market cap. This also suggests overvaluation, as the multiples analysis does. Optimists might argue that a 10% WACC is too high for a superstar like Apple, especially given the high probability that the Federal Funds rate will start decreasing in the nearest quarters. Therefore, let me simulate the second scenario with a softer 9% discount rate.

Author’s calculations

With a lower WACC, the stock now looks about 5% undervalued. The upside potential is not worth the risk, especially in the harsh environment. Also, I think the probability of the Fed’s pivot in its monetary policy is not close. Therefore, I cannot conclude that the stock is currently attractively valued.

Risks update

We are now in a very challenging environment, and Apple’s offerings are primarily discretionary for customers. One of the wealthiest markets for Apple, the Eurozone, is already in a recession. The U.S. is not in a recession yet, but I do not see reasons for the optimism in the nearest term. Last week, Jerome Powell said that more rate hikes are likely this year to combat levered inflation. Therefore, I think that Apple will continue to face softening demand over multiple quarters, and the company’s pricing power is not infinite.

Consensus estimates forecast a 9% revenue CAGR over the next decade, which is very ambitious. This level of growth is considered challenging, primarily due to the company’s existing scale and size. When a company reaches a certain level of maturity and market saturation, sustaining high growth rates becomes more and more difficult. If AAPL fails to deliver a 9% revenue CAGR, it will lead to disappointment from investors, who are likely to start selling off the stock.

Being the world’s largest company also means competing across all your segments with tough opponents. Apple has an unmatched ecosystem, and it is a competitive advantage. But the company’s offerings are priced at a premium compared to competitors, so consumers’ expectations for Apple’s new features are very high. If the company fails to continue delivering valuable innovation to its products, Apple will likely lose its vast pricing power, and customer loyalty might deteriorate.

Bottom line

Overall, AAPL stock is a “Hold” for the nearest future. Don’t get me wrong, I am a big fan of the company’s products and a long-term fan of the stock. But, I think the company will continue to face multiple headwinds in the near term, which are highly likely to pressure the stock. Near-term challenges are substantial, and the valuation does not look attractive.

Read the full article here