J&J Snack Foods (NASDAQ:JJSF) has grown tremendously over the past few years. The company is making sound investments in new food processing lines and distribution centers to increase its scale while reducing distribution costs. But, the company’s growth rate can quickly decelerate due to a slowdown in the movie business or consumer spending. The dividend yield is too low, and the payout ratio is too high. Investors will pummel this stock at the first signs of any deceleration in growth rates. Most likely, all the gains have been had in this stock, and investors may be better off not chasing it.

Strong revenue growth over multiple quarters

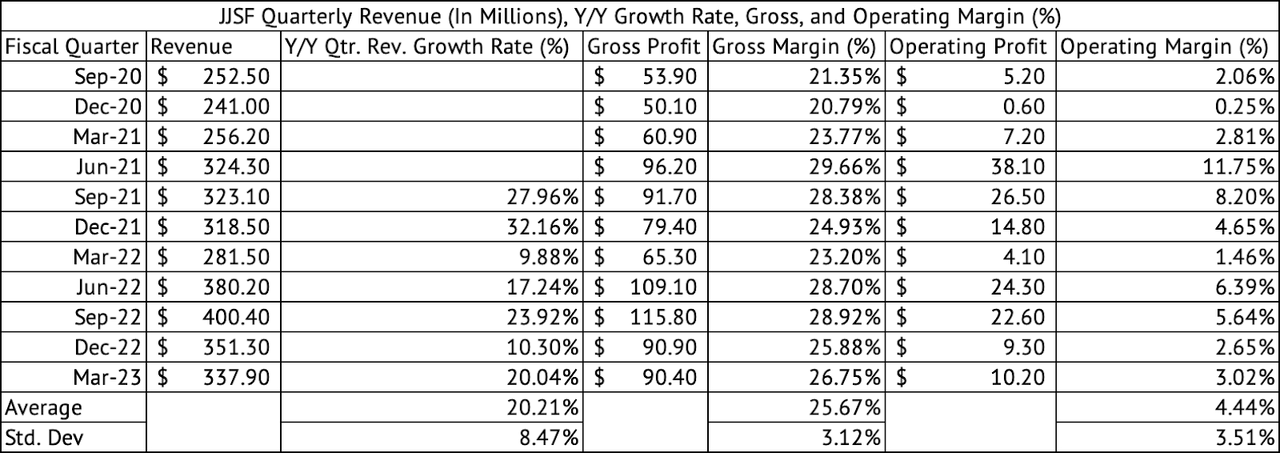

In Q2 2023, higher volumes, coupled with the positive impact of the price increases enacted in 2022, helped increase sales by over 20% to $337.9 million (Exhibit 1). Gross margin also showed over 300 basis points improvement, to 26.7%, in the Q2 2023 quarter compared to 23.2% in the same quarter in 2022. But, the company’s quarterly operating profit margin has dropped precipitously from 9.8% in the pre-pandemic year of 2019 to 3% in the March 2023 quarter.

Exhibit 1:

J&J Snack Foods Quarterly Revenue, Gross, Operating Profits, and Margins (Seeking Alpha, Author Compilation)

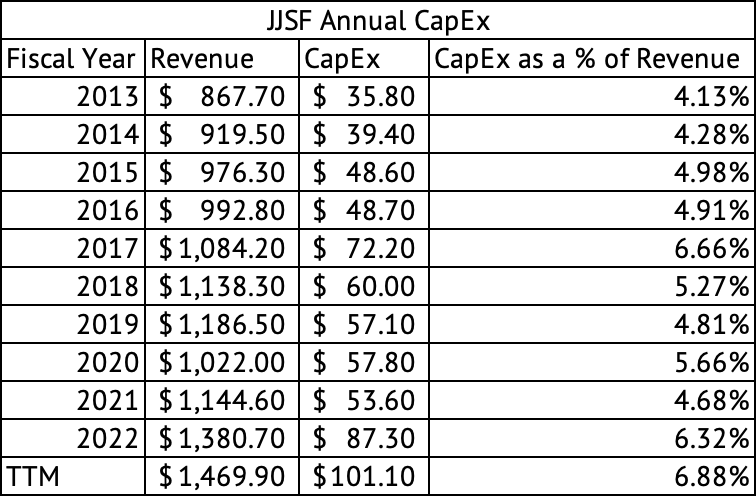

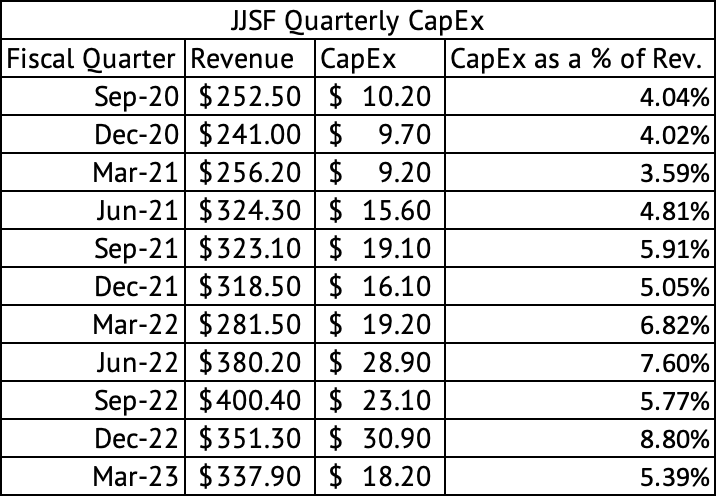

Besides inflation affecting its input costs and the Dippin Dots ice cream acquisition increasing operating costs, another reason for its profit drop could be its significant increase in capital expenditures as the company creates a new manufacturing line and regional distribution centers to have end-to-end control over its product distribution. The company’s CapEx has increased from 4.1% in 2013 to 6.3% in 2022 (Exhibit 2). On a quarterly basis, the CapEx has increased from 4% in September 2020 to 5.3% in March 2023. The company spent 8% of its revenue on CapEx in the December quarter (Exhibit 3).

Exhibit 2:

J&J Snack Foods Annual Revenue & CapEx (Seeking Alpha, Author Compilation)

Exhibit 3:

J&J Snack Foods Quarterly Revenue and CapEx (Seeking Alpha, Author Compilation)

J&J Snack Foods trades at a massive valuation

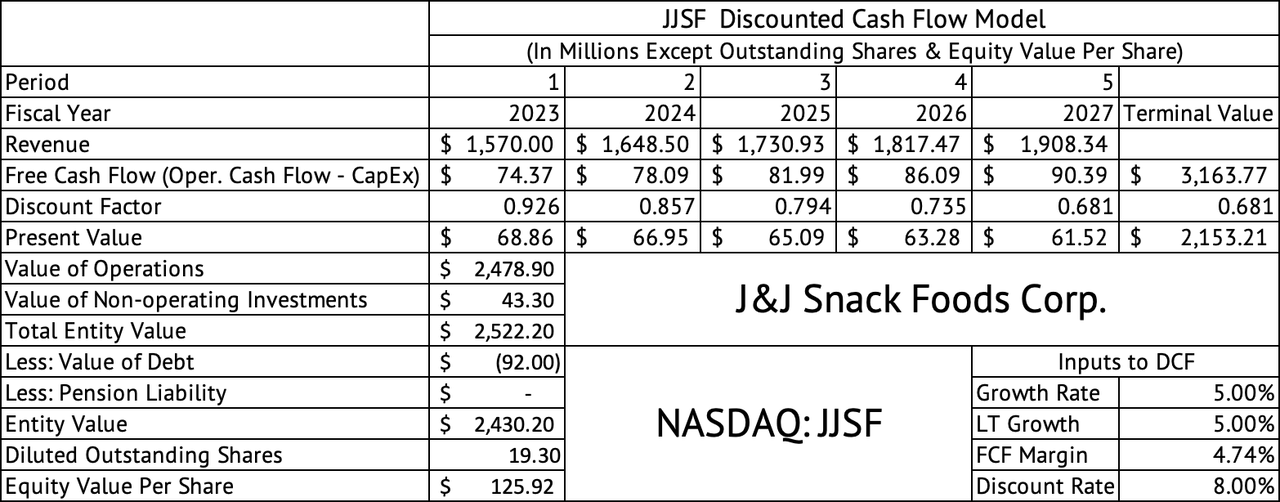

The stock is trading at a stratospheric forward GAAP PE of 41x. The Vanguard Consumer Staples ETF (VDC) companies are trading at a weighted average PE of 24x, a high valuation for mostly low-single-digit revenue growth and margin uncertainty across the sector. Based on an earnings estimate of $3.91 per share in 2023, a 24x multiple would put the stock at $93. A discounted cash flow model estimates the per-share equity value at $125 (Exhibit 4). This model assumes a revenue growth rate of 5%, a free cash flow margin of 4.7%, its long-term average, and a discount rate of 8%.

Exhibit 4:

J&J Snack Foods Discounted Cash Flow Model (Seeking Alpha, Author Calculations)

This valuation premium placed on the company may be due to its strong double-digit growth over the past couple of years, which is expected to continue in the short term. Theaters, a significant customer for J&J Snack Foods, is amidst one of the best years in a long time. The movie studios have released blockbusters like The Super Mario Bros. and Spider-Man: Across the Spider-verse. The hits are expected to continue in 2023 with the release of Mission: Impossible and Barbie. These movies should draw record crowds to the theatres and drive the sales of J&J Snack Foods.

The company pointed out that it is pursuing multiple expansion opportunities with theater chains and quick-serve restaurants. In the next few years, the company’s growth will be driven by the successful expansion of its ICEE, Dippin Dots ice cream, and other products into new retail settings. This should keep the revenue growing quickly, assuming the economy does not enter a recession. But, a positive growth story could quickly turn, and the high valuation may no longer be justified. I am weary of buying a stock trading at a premium based on its growth story since the growth, and its sky-high valuation may quickly return down to earth.

Performance of the Consumer Staples Sector

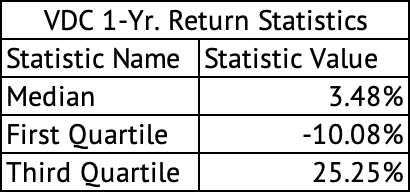

The Vanguard Consumer Staples ETF is made up of 105 companies. Out of these, about 44 companies have dropped over the past year. The median return for the companies in this ETF is 3.4%. About 25% of the companies (first quartile) lost over 10% of their value over the past year, a dismal performance, with the worst performance coming from companies such as Veru (VERU) and Tattooed Chef (TTCF), both losing over 90% of their value.

Exhibit 5:

Vanguard Consumer Staples ETF 1-Year Return Statistics (Barchart.com, Data Provided by IEX Cloud, Author Compilation)

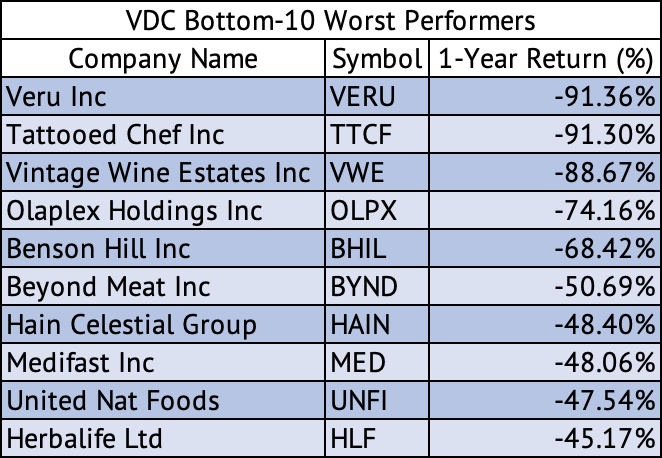

Exhibit 6:

Vanguard Consumer Staples ETF Bottom-10 Worst Performers (Barchart.com, Data Provided by IEX Cloud, Author Compilation)

I had never heard of Veru. When I read the analysis, I learned that it is a pharmaceutical company looking to bring a treatment to market for moderate to severe COVID-19 infection. What is a drug company doing in a Consumer Staples ETF? I had to double-check my data-gathering tools and the Vanguard Consumer Staples ETF website to ensure I had not made a mistake in including it in the Consumer Staples index. Veru may have had consumer products earlier in its incarnation but now considers itself a biopharmaceutical company. Veru does not belong in this ETF. Since the Vanguard ETF is based on the MSCI US IMI Consumer Staples index, the ETF will not change its composition until MSCI changes its index.

Tattooed Chef is a plant-based frozen food company probably on the verge of bankruptcy. Once a significant stock market darling, Beyond Meat (BYND), a maker of plant-based meat substitutes, has lost over 50% of its value over the past year. The stock has dropped from its high of $150 in 2019 to $12 today.

Tattooed Chef and Beyond Meat offer a cautionary tale for investors chasing the next fad. Investors need to take a patient, long-term view when investing in stocks. They must look for companies with reliable cash flows that have been around a few challenging business cycles and have proven products. Products made by Beyond Meat may find a niche but would find it difficult to convince a broad swathe of the population to consider their products. Introducing consumer products is not for the faint of heart. It takes deep pockets for marketing, and the consumers need to like the product to gain and keep customers over the long term. A massive marketing budget alone can create a fad but not a long-term successful product.

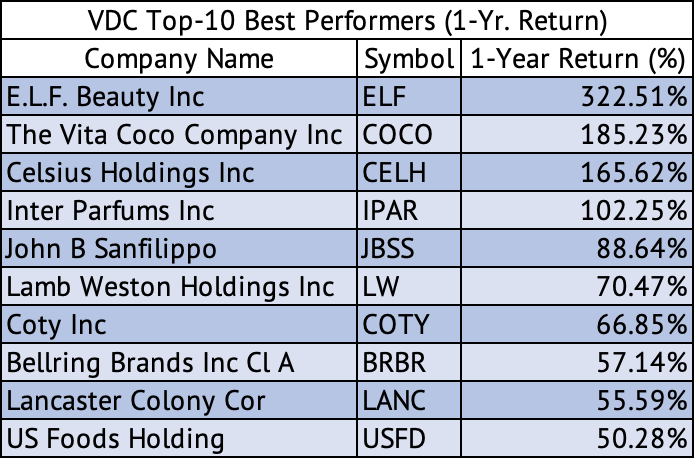

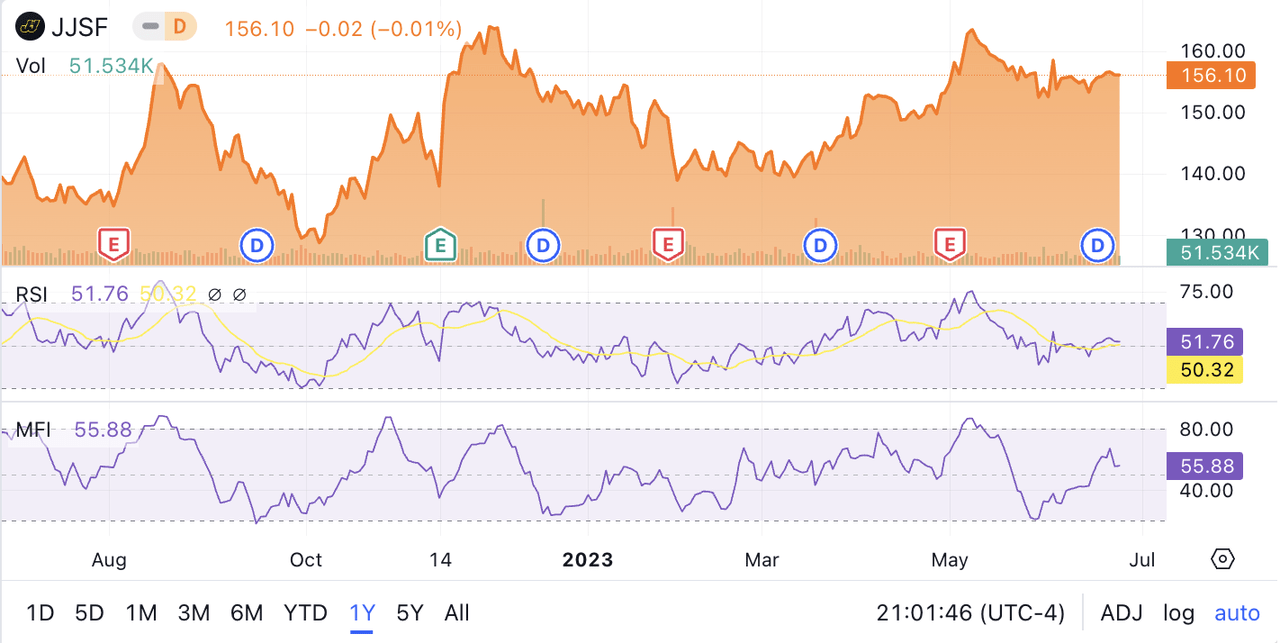

e.l.f. Beauty (ELF), the maker of affordable cosmetics, is a big winner over the past year with a return exceeding 300% (Exhibit 7). Vita Coco (COCO), which packages and sells coconut water, was also a big winner with 185% return over the past year. J&J Snack Foods gained a respectable 14.9%, compared to the S&P 500 Index (SP500) gain of 14.5% over the past year. The stock lost momentum after peaking above $163 in May. The RSI and MFI technical indicators confirm the lack of momentum with a steady decline to the mid-fifties (Exhibit 8).

Exhibit 7:

Vanguard Consumer Staples ETF Top-10 Best Performers (Barchart.com, Data Provided by IEX Cloud, Author Compilation)

Exhibit 8:

J&J Snack Foods 1-Year Stock Chart and RSI and MFI Technical Indicators (Seeking Alpha)

Low dividend yield

The stock offers a low dividend yield of 1.7%. The company’s dividend is under pressure since it does not generate enough cash to cover its dividend comfortably. The dividend payout ratio stands at 96%. Inflation-related cost increases have pressured margins, and the company’s investments in its automated food production lines and distribution centers have pressured its operating cash flows. The company is confident it can increase its gross margins to 30% annually. However, on a quarterly basis, margins may come under pressure due to the seasonality of its products. For example, Dippin Dots ice cream sell well during the summer months, which is the Q3 and Q4 for the company.

Although J&J Snack Foods has shown tremendous growth over the past two years, this double-digit growth may not continue much longer. The company is dependent on the movie studios continuing to release blockbusters. There is also the prospect of a further decrease in consumer spending, impacting the stock’s valuation. Investors who bought the stock at a much lower valuation may consider taking some profits after a nice run. New investors should avoid the stock.

Read the full article here