Thesis

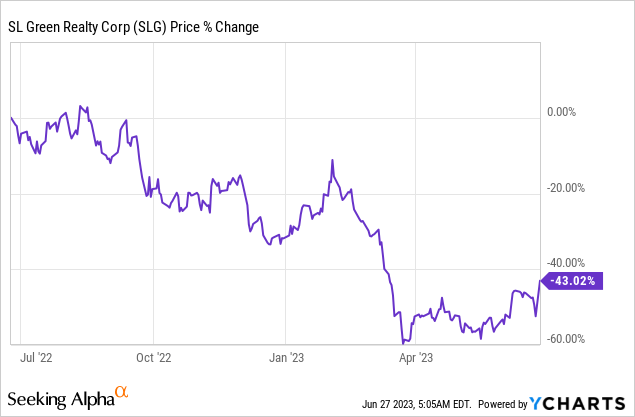

SL Green Realty (SLG) is a NY office REIT. Office REITs have been in the eye of the storm in the past year, and SLG has been no exception:

The common shares are now down -43% in the past year, having been down as much as -60% earlier in the year. SLG owns and operates Class A office properties in New York City. Unlike other large metropolises, NYC is a unique place. When you read about global companies, you usually see them state they have offices in ‘London, New York and Singapore’. You do not see them having offices in ‘Liverpool, San Francisco and Jakarta’. This is not meant to disrespect Liverpool, SF or Jakarta, but it is just the way the world works when it comes to premier cities that are perceived as global magnets for capital (both economic and intellectual).

With the CRE crisis upon us, there are daily news reels that convey an ongoing cataclysmic wave:

SF Office Vacancy (SF Chronicle)

To the uninitiated in the CRE space, an office REIT or investor in a large property will never buy a building outright. They will generally tap a bank to give them a loan and then add the remaining equity. So in the theoretical instance where the building is valued at $1 billion, the sponsor will get a bank loan for anywhere from $700 million to $850 million, and then use their own cash for the remainder. When the loan comes due, if the property is worth less than the loan, a sponsor will usually just hand back the keys to the bank. Why? Because most of the financing in the space is non-recourse (i.e. you cannot go after the other assets the sponsor has). This structural set-up then leaves banks owning office buildings. Does a bank have expertise in managing and upkeeping a commercial property? Usually no. So what banks end up doing is try to remove said property from their balance sheet and take any related losses. Usually somebody loses their job in the credit risk department around the loose practices that saw the bank lend in the space, but generally speaking banks do not like to have the headaches around owning a number of CRE assets and running them. So you will see more headlines like this one:

Chicago Building (Chicago Chronicle)

Why NYC is not San Francisco

It might be a bit repetitive to say, but NYC is not San Francisco. NYC has been and will remain a premier global city, where companies wish to have an office for their global branding purposes. Furthermore, NYC is a hedge-fund Mecca, where even the likes of Citadel who fled Chicago, is now considering additional office space:

JUN 21, 2023

Griffin’s hedge fund Citadel is in talks to take 400,000 square feet at 280 Park Avenue, Crain’s reported, citing two unnamed sources. Such a move would be a boon to the city’s two largest commercial landlords, SL Green and Vornado Realty Trust, which co-own the 1.2 million-square-foot tower.

In fact, Park Avenue where SLG has a couple of properties, is considered ‘Hedge Fund Avenue’. I used to work for one of said hedge-funds, and it was located (you guessed it) Park Ave. A respectable fund needs an image of exclusivity, and I can assure you will never find one with a Brooklyn address for example.

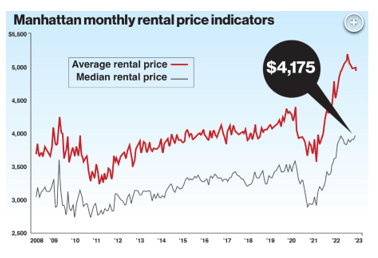

I laugh when I read generic articles about how work from home is here to stay and NYC is dead and the apocalypse is here now. Could not be further from the truth. As San Francisco descends into chaos on the back of what I consider extremely poor state government practices, NYC is firmly moving in the opposite direction. I remember when I moved to Manhattan around twenty years ago – there actually used to be dodgy neighborhoods where you did not want to go at night. There were places which were cheaper because they were shoddier. And more importantly you had no high-rises in the Lower East Side. Everything has changed now, with NYC a bit of a Tik-Tok Disneyland. The city (even the Bronx) has gentrified to an unbelievable extent, and people come to live here for a few years in order to live like they see in the movies. What they end up doing is spend all their money in the city for a few years and then leave:

NYC Rents (NY Post)

Manhattan just hit their highest rental price EVER. Just think about that for a second. The explanation is fairly simple – NYC is an island. There is nowhere to go. The space is finite. For years now we have had low-rises being torn down to make way for high-rises, yet there is not enough space for the demand present. While San Francisco is descending into chaos, the opposite is happening in NYC, with residents of the Bronx complaining they are being pushed out by high earners.

NYC Office market and SLG

While SLG is not in the apartment building business, the values in the city and the demand is worth keeping an eye on, especially in light of office conversions.

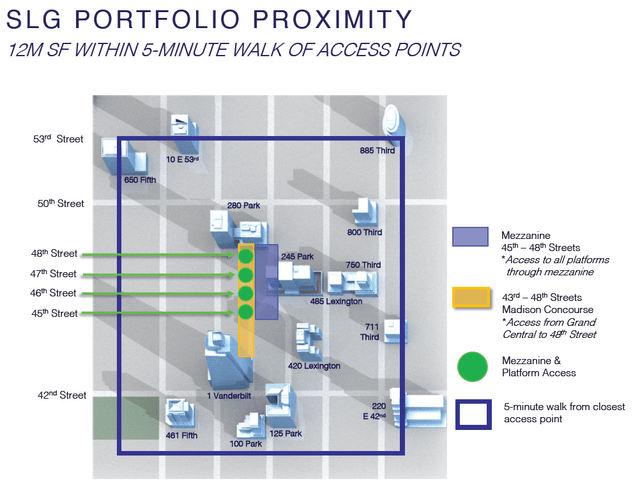

SLG has its foothold in midtown Manhattan, especially around the commuter stronghold of Grand Central:

SLG Portfolio (SLG)

The hybrid work environment will make buildings around commuter centers more appealing, due to the speed of the commute and avoidance of the subway system.

SLG Valuations

The best way to gauge valuations is through sales. And we just had a fairly significant one:

SL Green Realty (SLG), New York City’s largest office landlord, said on Monday it sold a 49.9% stake in 245 Park Avenue to a U.S. affiliate of Mori Trust Co. Ltd. at a gross asset valuation of $2.0B.

SL Green’s (SLG) stock soared 20% in Monday regular-hours trading as the sale of the stake in 245 Park Avenue is the largest part of the company’s financial plan for 2023, following its $500M refinancing of 919 Third Avenue in April. That marks the stock’s biggest gain since November 2020.

The property had been purchased in September 2022, but SLG had invested via a small preferred stake in 2018. The sale does not bring $1 billion in cash to SLG since the property has a loan of around $1.8 billion on it, but what it does is establish a transparent, observable price point and book value. The issue with many office REITs is that the market does not believe their book value. That means market participants think the value of the underlying properties (if sold today) would be much lower than what the respective companies are saying.

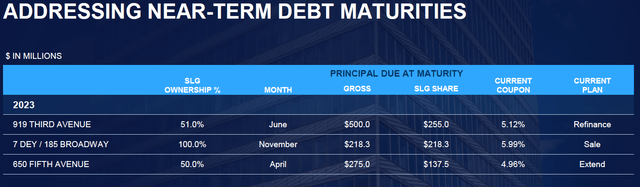

SLG has also been fairly good about executing on its debt maturities for 2023:

2023 Debt Maturity Schedule (SLG)

919 Third Avenue was refinanced in April, landing the $500 million SLG was looking for. 650 Fifth Avenue however was not refinanced, and the company is now in discussions with the lenders regarding the property. Expect the SLG financials to reflect the proper book value for the equity here (if any).

Is everything good in CRE land? No. Are there encouraging signs for certain landlords? Yes. Should investors paint with the same brush NYC Office REITs as opposed to San Francisco Office REITs? Absolutely not.

Where do the opportunities lie with SLG?

We are of the firm belief that the CRE trepidations will take years to work out, and in the meantime common shares will be very volatile places to be. We saw a massive short equity squeeze in SLG yesterday June 26, on the back of the 245 Park Ave news. We are going to get more of that given that more than 25% of SLG’s float is sold short right now.

We are of the firm belief the 245 Park Avenue transaction sets some firmness around book values for SLG, and clearly shows the company will make it through the storm with its set-up. It just really crystalizes its viability long term. We hold and like the preferred shares for SLG (NYSE:SLG.PI) because they offer a 9% yield and represent a play on the survival of the company. We believe yesterday’s transaction just cements the attractiveness of this slice of the capital structure.

Conclusion

SLG is a NYC office REIT. Just like its peers, the company has been pummeled in the past year on the back of lower valuations for its underlying asset class, namely offices. The REIT business is a very leveraged one, and small changes in property values can wipe out completely equity stakes. As the likes of San Francisco descend into chaos with empty office buildings and closing malls, the opposite is happening on the island of Manhattan. Low-rises continue to come down, office properties continue to be converted to apartments and rental rates are at historic highs. The Tik-Tok lifestyle is in full swing in NYC, and the appeal of this magnet city is still present. With the likes of Citadel fleeing Chicago but looking for office space in NYC the message is clear – NYC is not San Francisco and the current turmoil will eventually pass. SLG has been able to successfully execute on some of its re-financings and balance sheet optimizations, with the best example being the partial sale of the 245 Park Ave property. We think the common shares here will continue to be extremely volatile, but we are of the firm belief SLG has proven itself to be a survivor in the current CRE crisis. We are holders of SLG.PI which currently yields 9% and believe this play on the SLG solvency is the best spot to be in the capital structure presently. We continue to Hold clipping the dividend.

Read the full article here