Executive Summary

Dave & Buster’s Entertainment Inc (NASDAQ:PLAY). is a prominent American restaurant and entertainment company that has redefined the dining and gaming experience. Founded in 1982 by David Corriveau and James “Buster” Corley, the company has grown into a leading player in the restaurant and entertainment sector, captivating customers with its unique blend of food, drinks, and interactive attractions. Dave & Buster’s traces its roots back to Little Rock, Arkansas, where David Corriveau, a successful restaurateur, and James Buster Corley, a visionary entrepreneur, joined forces. In 1982, they opened the first Dave & Buster’s location, envisioning a revolutionary concept that combined a high-quality dining experience with an extensive selection of arcade games and attractions. Their innovative approach quickly gained popularity, establishing Dave & Buster’s as a pioneer in the entertainment-dining industry. Dave & Buster’s operates within the vibrant restaurant and entertainment sector, which encompasses businesses that offer both food services and recreational activities. This sector caters to a diverse consumer base seeking engaging experiences, making Dave & Buster’s well-positioned to tap into the growing demand for interactive entertainment options. Dave & Buster’s revenue streams are diversified across multiple channels. The company generates income through its food and beverage sales, offering a menu that ranges from appetizers and entrees to specialty drinks and desserts. Furthermore, game and attraction revenue play a crucial role, as customers engage in a wide array of arcade games, simulators, and virtual reality experiences, paying for game credits and playtime. Additionally, Dave & Buster’s hosts special events and parties, providing tailored packages for corporate gatherings, birthday celebrations, and other occasions.

Investment Thesis

Despite a unique business model, a stellar management team, and a positive quarter, we see some mean reversion occurring as I foresee a H2 consumer melt up. As student loan payments resume at the end of the summer, interest rate lags continue to persist, and the VIX continues to break yearly lows, cyclical growth could see a tumultuous second half. The purpose of my coverage is to convey my reasonings for why Dave & Buster’s is a quality security with an optimal risk/reward profile (albeit depending on timing) while providing an entry point that could potentially generate high absolute returns and mitigate drawdown risk. Please keep in my mind that the investment profile identified here is buy-and-hold investors, generally with a time horizon of 1-2 years. Momentum investors (ultra-short-term) or buy-and-hold for > 2 years may have an entirely different perspective.

Management Overview

The head of the ship is Chief Executive Officer Chris Morris who was appointed to the position in 2022 following the acquisition of Main Event where he also served as CEO. Chris Morris has held various leadership roles at analogous offerings such as Chuck-e-cheese, California’s Pizza Kitchen, and most notably, Main Event which was bought out by Dave & Buster’s for over $800 million in 2022. Morris’s background in the leisure and entertainment industry has likely given him an abundance of practical knowledge scaling similar business models. With his experience managing Main Event, he appears to be the best choice for optimizing the Dave & Buster’s/Main Event synergies. In addition, Kevin Sheehan currently holds the position of board chairman. Kevin has been a member of the D&B board since 2011 and has held numerous director and leadership positions across various cyclical industries. The rest of the senior management are as follows.

Dave & Buster’s

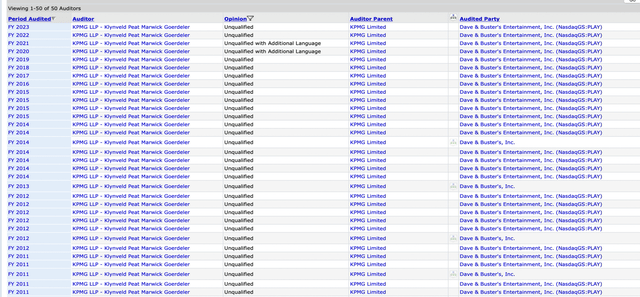

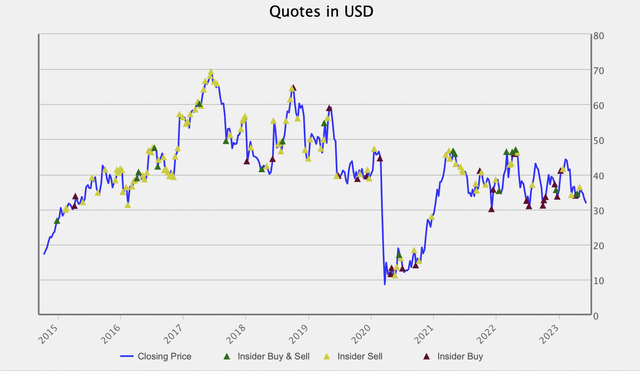

After conducting a background check, none of the preliminary executives have had any issues related to misconduct/fraud and there has been no alarming insider disposition of shares. Further, the company has kept the same auditor for over a decade and has remained an unqualified audit opinion. Lastly, Dave & Buster’s management hasn’t been involved in any related party transactions that should alarm investors. The consensus following my background check exhibits that we should have no reason to believe that the management team is dubious.

Capital IQ

Capital IQ

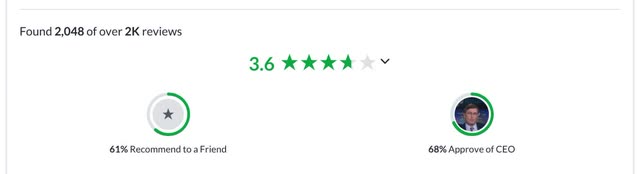

Employee Reviews

In the case of Dave & Buster’s, it’s important to not weigh any previous employment-related measures too heavily considering the management team has seen some changes following the Main Event acquisition. To begin with, let’s look at how management treats its employees. When looking at current and previous staff reviews, employees are generally happy to work at Dave & Buster’s with the only complaints being about the specific job itself and not the underlying workplace culture. The complaints about the job itself should not be alarming given the labor is easily replaceable and high turnover tends to be common in these service-based bottom-level positions.

Glassdoor Glassdoor

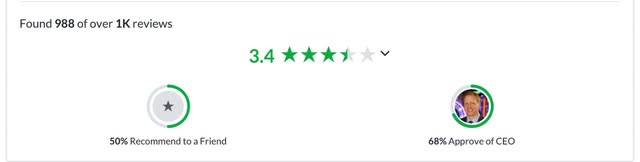

Much like Dave & Buster’s, Main Event appears to have a similar perception from past and current employees. Although, there were some comments from bottom-level workers who had issues with their supervisors and claimed that they were inexperienced.

Glassdoor

Overall, there aren’t any flags warranting further investigation or a lack of management competency. Dave & Buster’s appears to be able to keep its employees satisfied, which is a victory in this industry.

Management’s Track Record

Dave & Buster’s CEO, Chris Morris, has no quantifiable records to display, however, he’s held numerous leadership roles in the leisure and entertainment business; and Morris led Main Event to its $800 million acquisition from Dave & Buster’s. Moreover, Dave & Buster’s chairman, Kevin Sheehan, has evidently created shareholder value in the public markets. When Sheehan became the CEO of Norwegian cruise lines between 2008-2015, the stock more than doubled during his tenure after taking it public.

Capital IQ

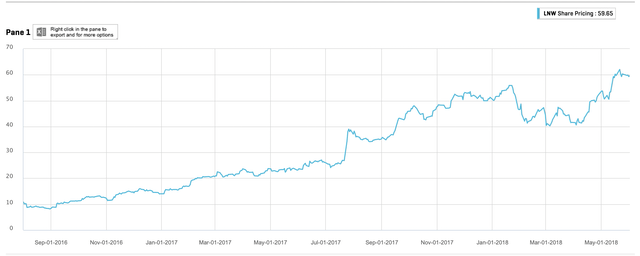

Leaving near the stock’s all-time high, Sheehan then became the CEO of Scientific Games in 2016, where the shares went 6x during his 2-year tenure.

Data

Therefore, it can be expected that Dave & Buster’s management team has the potential to create adequate value for its shareholders.

Competitive Positioning

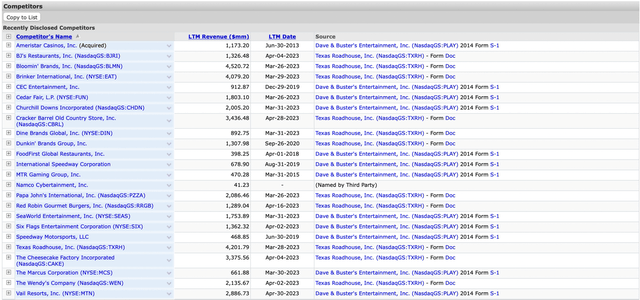

Dave & Buster’s competitive positioning is unique because they’ve managed to obtain a blue-ocean strategy, or at least a very good red-ocean strategy. However, depending on how you view the company, Dave & Buster’s either has a lot of competition or a lot of substitutes. In this analysis, I go under the assumption that amusement parks, restaurants, and other leisure entertainment businesses (i.e., Chuck-e-Cheese) are substitutes because they all target different demographics, have slightly different offerings, but have the same end goal for the consumer (something to do on the weekend). Dave & Buster’s has plenty of substitutes from both public/private companies.

Capital IQ

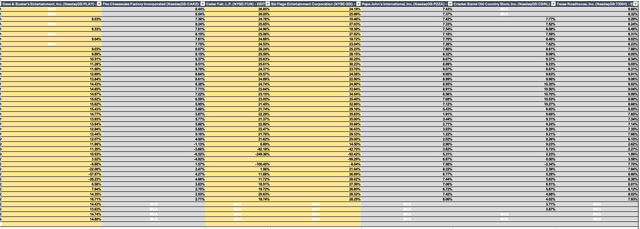

Despite the industry fragmentation, when assessing the EBIT margins of the substitutes, we see that only the restaurants appear to face some pricing competition. Additionally, all of the publicly traded substitutes either have stagnant or decreasing margins over the years.

Excel

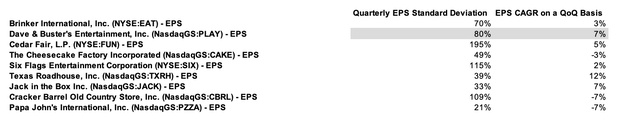

The yellow highlighted columns represent non-restaurant chains while the grey columns represent restaurant chains. We see that the non-restaurant chains have preserved their margins more so than the restaurants, exhibiting less price competition among the non-restaurant names. Notably, Dave & Buster’s has had relatively solid margin preservation. Moving to EPS growth, Dave & Buster’s has performed well relative to its peers on a 5-year QoQ basis.

Excel

Evidently, Dave & Buster’s appears to be faring well against the competition/substitutes. The company’s blue-ocean strategy has enabled them to avoid head-to-head price competition, expand its stores nationwide, and sustain long-term margin expansion and EPS growth.

Recent Strategic Initiatives

During the recent management call, Dave & Buster’s outlined its strategic initiatives to drive revenue growth, improve operational efficiency, and enhance the guest experience. The company emphasized the execution of various opportunities to unlock significant potential in its business. They highlighted efforts to perfect the service model, optimize the role of team members as brand ambassadors, and improve guest satisfaction scores. Additionally, Dave & Buster’s discussed enhancements to their culinary team, focusing on improving the quality of food, simplifying the menu, optimizing operating efficiencies, and upgrading guest-facing technology. The company expressed enthusiasm for the growth potential in their Special Event business, which has shown significant comp store growth and is expected to continue growing meaningfully. Furthermore, Dave & Buster’s emphasized ongoing efforts to implement efficiencies and reduce costs across all areas of the business, including the cost of goods sold, store labor, store operating expenses, and corporate overhead. Management has claimed that they’ve already achieved $25 million in cost reduction following the synergies of Main Event. Finally, the company has begun to further increase its international presence with locations in Puerto Rico, India, and Australia. Through these strategic initiatives, the company aims to drive lower costs, expand margins, and generate improved cash flow. Overall, based on the early innings of their Main Event acquisition appearing to be accretive, the management’s background, and their historical ability to maintain margins and expand EPS, Dave & Buster’s empire is still very well on its way to being fully built.

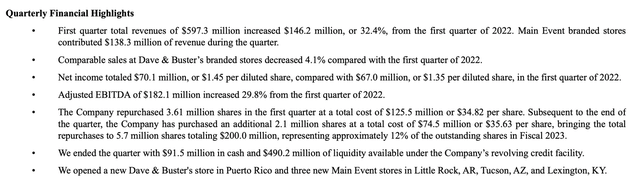

Profitability

In the previous section, I mentioned that Dave & Buster’s has maintained its margins significantly better than its substitutes/competitors. Evidently, this exhibits Dave & Buster’s superior competitive positioning and somewhat light cost structure. This should also make investors optimistic about its future, post the Main Event acquisition, as greater scale and location consolidation can enable growth without losing any margin. Additionally, the company’s ability to ascertain earnings power is also exhibited by its EPS CAGR of 50% since going public. This not only exhibits earnings quality but also the management’s ability to provide shareholder value. One of the immediate risks that I think exists is the decline we saw in same-location sales growth in Q1 of 4.1%. I think that this ultimately is a precursor to lower guidance in the subsequent quarters due to consumers remaining distraught by the economic backdrop. This will be touched on more in a later section.

10-Q

Balance Sheet

Dave & Buster’s balance sheet has deteriorated over the last 5 years with long-term debt (including leases) ballooning at a 60% annual rate since 2019. Debt-to-EBITDA has increased from 1.4x to 4.0x, indicating a decline of creditworthiness. The following is the structure of Dave & Buster’s debt.

Revolving Credit Facility:

- Principal Amount: $500.0 million (existing facility)

- Maturity Date: June 29, 2027

- Interest Rate: Not specified

- Purpose: Refinanced existing revolving facility

- Additional Information: A portion of the revolving facility, not to exceed $35.0 million, is available for the issuance of letters of credit.

Term Loan Facility:

- Principal Amount: $850.0 million (added as part of the Credit Facility)

- Maturity Date: June 29, 2029

- Interest Rate: Not specified

- Purpose: Used to pay the consideration for the Main Event Acquisition

- Additional Information: The term loan had an original issue discount of $42.5 million.

Senior Notes:

- Principal Amount: $550.0 million ($110.0 million has already been redeemed)

- Interest Rate: 7.625%

- Additional Information: If the aggregate outstanding principal amount of the senior notes exceeds $100.0 million 91 days prior to November 1, 2025, the revolving credit facility can expire before the stated maturity date.

Letters of Credit:

- Outstanding Amount (as of April 30, 2023): $9.8 million

- Unused Commitment Balance (under the revolving facility): $490.2 million

- Commitment balance may increase by a greater than $400 million or 70% TTM adjusted EBITDA

Fortunately, Dave & Buster’s has maintained their EBITDA margins and has ample liquidity with a $490 million unused commitment balance. Further, with around 200 total locations, including Main Event, the company has adequate physical assets to support its current debt levels. Therefore, the rise in debt shouldn’t signal a red alarm yet. However, the rise in debt should still be watched vigilantly, simply due to the increase YoY.

The Macroeconomic Environment

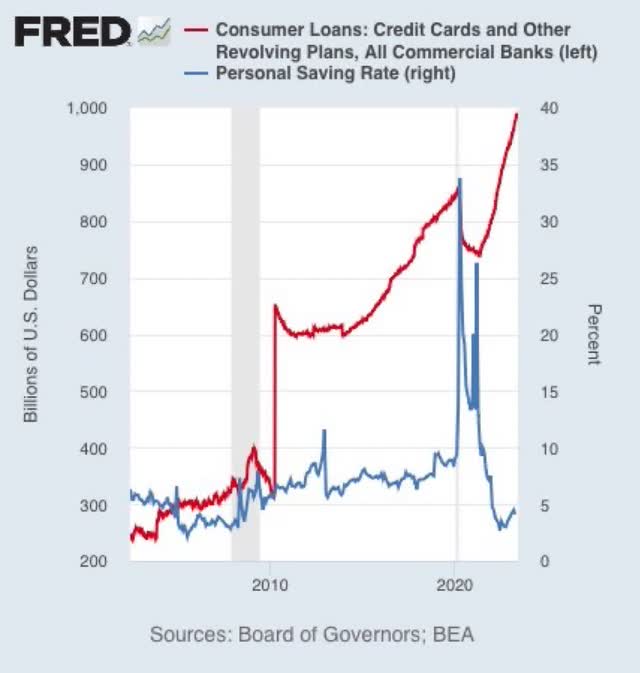

The cool down in same location sales growth mentioned earlier is in my opinion a signal that the U.S. consumer is beginning to tap out to the high interest rates. When looking at where interest rates are relative to the last 5 years and looking at the debt-to-savings ratios of American consumers, I still believe that we haven’t exited the storm just yet.

Federal Reserve

The concern of consumers being stretched financially gives me a reason to believe that a drawdown in Dave & Buster’s share price is highly probable.

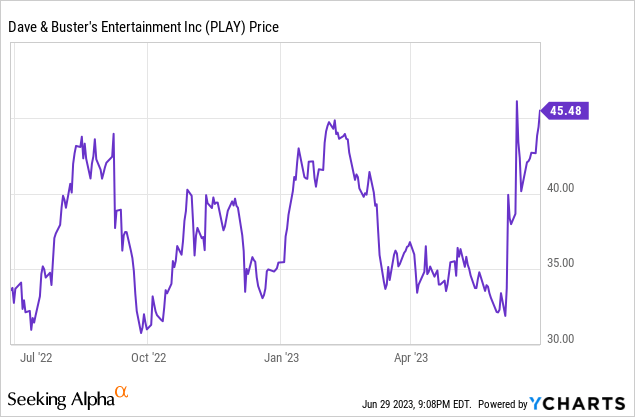

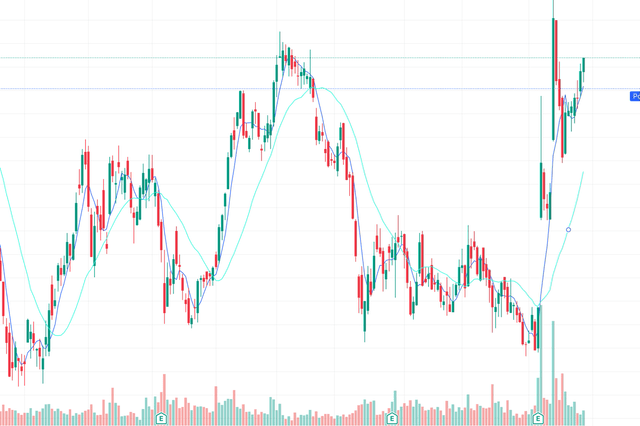

Mean Reversion

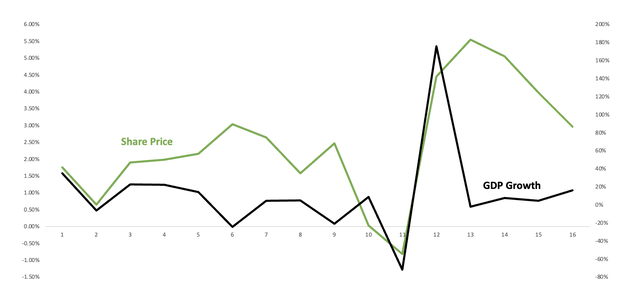

The biggest concern I have for Dave & Buster’s is the mean reversion risk faced after the recent 30% run-up in its stock MoM and potential decline in economic activity. Although Dave & Buster’s does have adequate fundamentals with a good strategy, management team, and modestly robust financial position, the stock has suffered due to the cyclicity of the business. Despite the company growing its EPS by a cumulative amount of 305%, its shares have only risen 145% since going public. The correlation to the growth cycle has appeared to exacerbate since the 2020 pandemic, with a correlation between the stock’s 6-month price changes and 6-month U.S GDP being around 0.5.

Excel

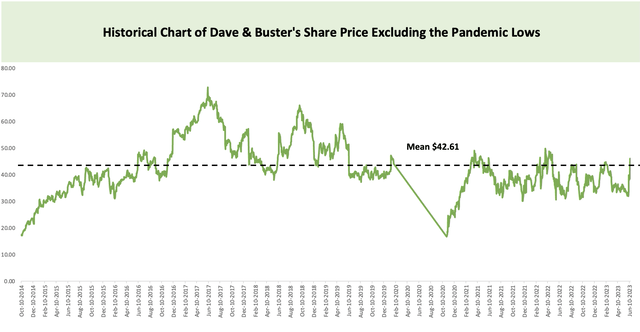

Additionally, the stock is above both its 3-year and 5-year mean of $35 and $42 respectively. In my opinion, this is risky considering the stock’s returns are highly cyclical.

Excel Capital IQ

This leads me to a consensus that Dave & Buster’s share price in the very short term will either provide little or negative returns for investors. The basic assumption of mean reversion is that if the price is above its mean reverting level, the subsequent forecast is likely downward.

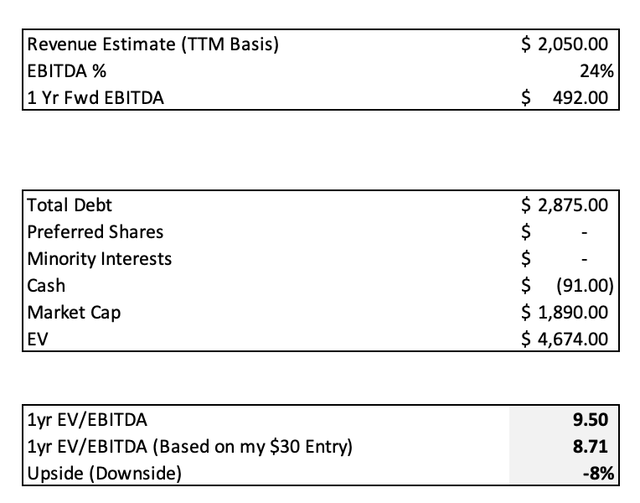

Valuation

For investors to obtain an adequate absolute return on Dave & Buster’s, I think an entry point in the low $ 30s is optimal. Therefore, based on my 1-yr EV/EBITDA of 9.50x, I believe that Dave & Buster’s is slightly overvalued. This was calculated using my modest 1-yr EBITDA estimate as well as two EV/EBITDA multiples, one with the current market cap, and one with a market cap with Dave & Buster’s priced at $35.00 per share.

Excel

I think it’s imperative that investors don’t focus on the relatively low multiple, but rather on how the security trades based on market conditions. That is what’s driving my consensus that the stock is overvalued.

Call to Action

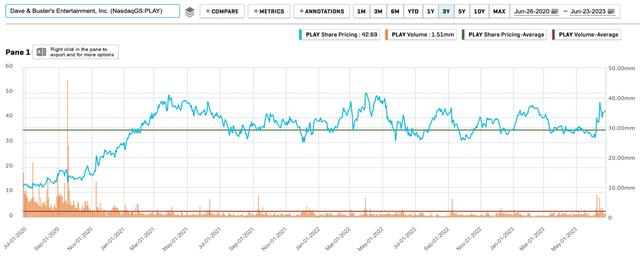

To conclude this write-up on Dave & Buster’s, the company’s stock requires as much analysis of its historical prices as it does the fundamentals. Currently, I foresee some short-term momentum given the company’s recent positive quarter. However, I warn investors that the monthly chart was beginning to see some divergence between the shorter- and longer-term moving averages and reduced volume, coincidently with higher interest rates and a crippling consumer.

Seeking Alpha

This synthesized analysis points me in the direction that a drawdown is probable in H2. For that reason, investors looking to generate alpha with a time horizon of 1-2 years should wait until Dave & Buster’s shares reach low $30.00 levels, which would be below its 3-year average price.

Read the full article here