Plug Power Inc. (NASDAQ:PLUG) hosted an Analyst Day last week, and the company continued a tradition of making big promises about the future with very limited results. Plug Power continues focusing on building green hydrogen systems in the future, but the company struggles to meet targets. My investment thesis remains Bearish on the company, which continues to promote a ton of deals without improving the profits picture from delivered equipment and fuel.

Source: Finviz

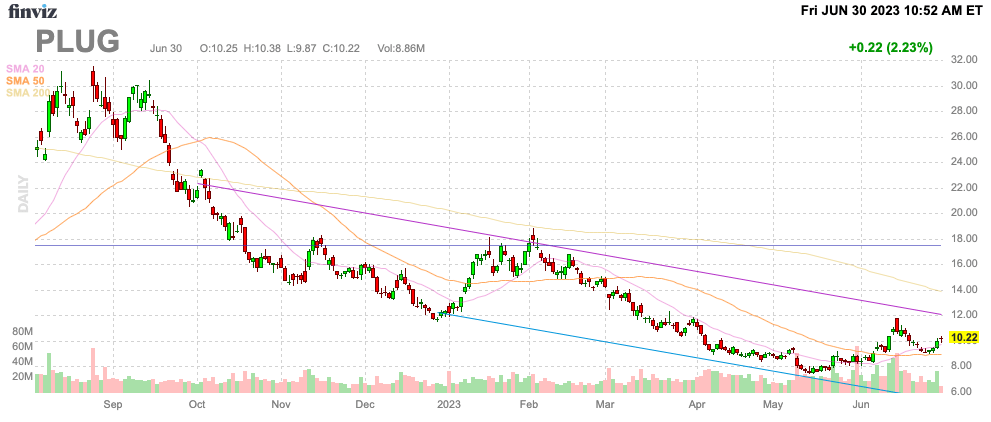

Sales Funnel

A lot of the promises for 2022 and 2023 have been pushed out. Plug Power is very much a 2025 to 2030 story where hydrogen fuel reaches scale and potentially thrives.

The problem with the stock is that management has aggressively pushed financial targets that don’t turn out as forecast and the company ends up eating extra costs from bad planning. The stock trades at multi-year lows despite a Q1’23 report where revenues grew 49% to reach $210 million.

The company reaffirmed the 2023 revenue target of $1.4 billion with very limited gross margins, but the company placed a low-end target of $1.2 billion where gross profits are only $50 million. In a sign of the constant problems, Plug Power originally guided to 2022 revenues of $900 to $925 million and only ended up at $701 million.

A big issue is that Plug Power constantly talks about large proposals and even awards, but a lot of deals end up being canceled. The company only has a total of $540 million in bookings ending Q1 based on 8 GWh in project awards, but the billions of dollars in deals are just promises for the future.

Source: Plug Power ’23 Investor Day presentation

Plug Power might have $2.5 billion in awarded contracts with firm commitments, but these deals don’t progress to booked orders and actual revenues at a very fast clip. The company ended Q1’23 with a bookings backlog of only $1.1 billion, leading to a scenario where hitting $1.4 billion in revenues this year would be very tough, maybe impossible.

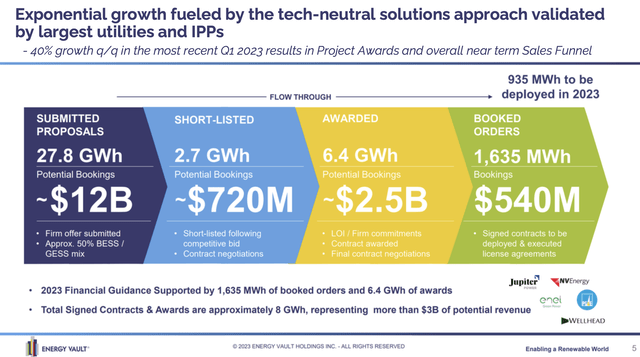

Source: Plug Power Q1’23 10-Q

The problem is that a substantial amount of the current backlog is for 2024 and beyond. The Power Purchase Agreements and Fuel are for periods covering 5+ years and amount to nearly half of the listed backlog.

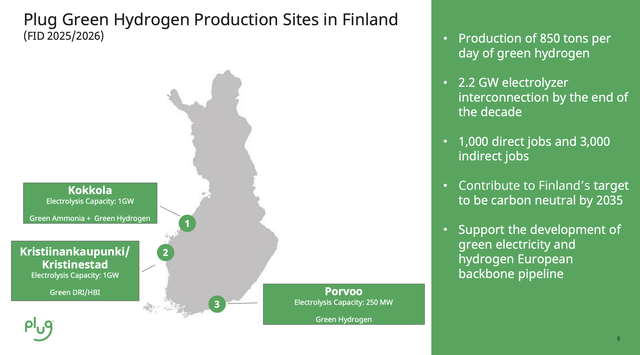

A prime example of the hype and overpromises of the company is the proposed $6 billion green hydrogen production sites in Finland. Plug Power promotes green hydrogen production of 850 tons per day, but the company doesn’t actually expect to make the final investment decision until as late as 2026.

Source: Plug Power ’23 Investor Day presentation

One has to wonder why Plug Power has the CEO spending crucial time on the 2023 Analyst Day presentation on a project that won’t even get an investment decision for over 2 years from now.

Bleeding Edge Cash Burn

A better-managed company could spin these growth rates into a solid business, but Plug Power is built for a substantially larger business that never materializes to the expected level. Back in Q1, the company saw the gross loss double to $69 million and the operating loss reached $210 million, all while share counts are rising.

Plug Power burned $277 million from operating cash flows and used another $169 million in buying equipment. The green hydrogen company definitely needs to greatly reduce the cash burn rates, though the goal is easier said than done when sales never approach targets.

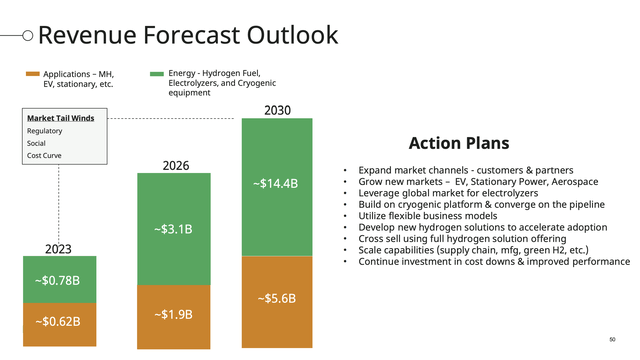

The market is clearly big enough for Plug Power to reach revenue multiples of the current level. Though, the company hitting $5 billion in 2026 and quadrupling to $20 billion by 2030 seems very farfetched.

Source: Plug Power ’23 Investor Day presentation

The crazy part is that Plug Power doesn’t need to hit those revenue targets to reward shareholders. What the company needs to do is assign realistic revenue targets and control costs for a lower revenue base.

Plug Power has a cash balance of $1.7 billion, but the amount is going to burn fast with $446 million burned in Q1 alone. With ~$200 million in debt, the cash position is down to $1.5 billion, and more failures to hit targets will jeopardize the financial stability of Plug Power.

Takeaway

The key investor takeaway is that Plug Power Inc. appears to have bottomed here and could very well bounce short term. Long term, though, the green hydrogen company has to prove operations can grow profitably in order to reward shareholders.

Investors should use a short-term rally here to unload Plug Power due to the bleeding edge cash burn and constant overpromises.

Read the full article here