The GEO Group (NYSE:GEO) stock has sustained extended losses in recent months, despite management’s tangible efforts to reshape the company’s trajectory.

The GEO Group Stock Price (Koyfin)

I believe that this prolonged decline can be attributed to several factors, including the inherent nature of the company’s business model as a private prison operator, recent increases in interest rates, and the absence of capital returns that could otherwise generate greater investor interest.

Nevertheless, there are indications that GEO may have reached a turning point, supported by the fact that the stock’s valuation has reached multi-decade lows. The company’s management has also been actively working to enhance the balance sheet and improve profitability. Further, the expiration of Title 42 and the company’s electronic monitoring segment, which has been growing, present potential positive catalysts for GEO’s revenues to rebound.

For these reasons, I believe that shares of GEO may have bottomed out, hence my optimistic outlook.

Reducing Debt – The Core Of GEO’s Investment Case

Reducing debt has been the main topic of GEO’s investment case for a long time. By the end of Q2-2021, GEO’s total debt had reached $3.1 billion. By that time (2019), all major banks that had been extending lines of credit and term loans to GEO had already made a firm commitment to sever ties with the private prison and immigrant detention sector, following the fulfillment of all existing obligations.

Therefore, GEO’s management found itself in a dead end. With the prospect of future refinancing being nearly impossible or prohibitively expensive, especially in a climate of rising interest rates and a limited pool of potential creditors due to major banks closing their doors, a swift deleveraging approach became the only viable path forward. In other words, as external financing became increasingly unreachable, GEO’s sole option to fund its future CAPEX was to rely on its own operational cash flows. As a result, alleviating its substantial debt burden naturally became the highest priority.

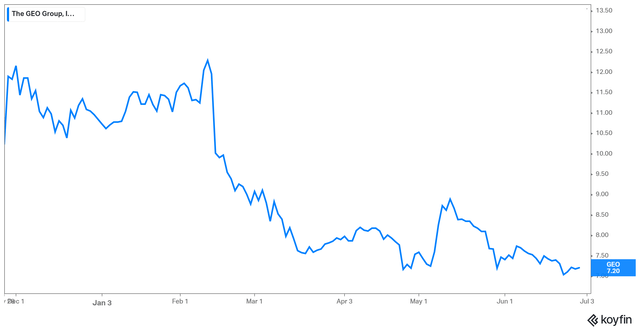

Indeed the company has made great progress in deleveraging since Q2-2021, with its total debt now having declined by more than 1/3 from its past highs.

GEO’s Total Debt (Koyfin)

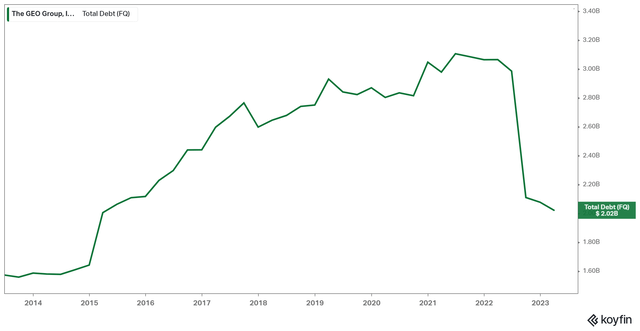

Note that GEO’s interest expenses rose significantly in Q1, reaching $54.3 million from $31.6 million in the prior-year period. The significant $22.7 million increase was due to higher interest rates and GEO’s debt restructuring actions in August of last year. If anything, this increase serves as a testament to the importance of GEO’s deleveraging efforts, underscoring their positive impact on mitigating the potential burden of interest expenses had the company still carried the same debt levels as in 2021.

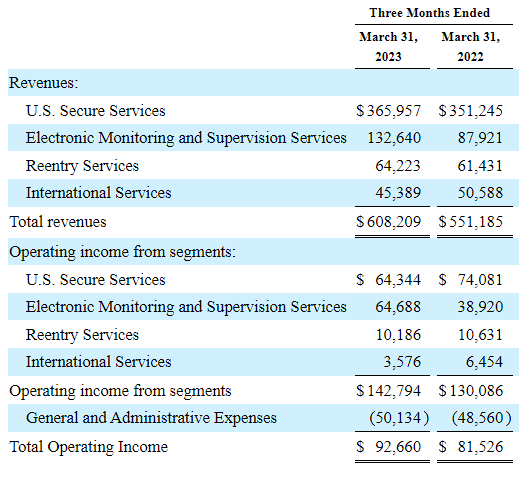

GEO’s Key Operating Metrics (SEC filings)

Source: SEC filings

Management now expects that debt reduction should lead to GEO’s interest expense declining by roughly $25 million every year by 2024. Overall, reducing net debt and leverage remains management’s primary goal over the next two years.

If deleveraging progresses as planned, management expects that net leverage will fall below 3.5X adjusted EBITDA by the end of fiscal 2023 (from 3.5X now) and below 3.0X adjusted EBITDA by the end of fiscal 2024. After these targets are met, management intends to explore options to return capital to shareholders.

Given that GEO’s investment case has been hampered by the lack of capital returns (especially given this was a beloved dividend stock back in the day), this could be the star for a significant bullish catalyst to arise.

Results Improving: Title 42 Expiring and Electronic Monitoring Could Further Boost Revenues, Profits

Excluding the impact of higher interest expense for the reasons mentioned earlier, GEO’s operating results delivered growth during Q1-2023, with the net operating income rising by 5% to $179 million and adjusted EBITDA also rising by 5% to roughly $131 million compared to last year.

Simultaneously, GEO’s results enjoy tailwinds related to Title 42 expiring and growing demand for its electronic monitoring service.

Title 42 Expiration

Most GEO investors have generally expected that the expiration of Title 42 would significantly increase border crossings. In turn, it was expected that the federal government would likely have to process a larger number of individuals confronted by Border Patrol. In fact, an increase in Border Patrol encounters at the Southwest border would be on top of an already unusual seasonal increase in border activity due to the warmer weather in the summer. Higher utilization rates at GEO’s ICE processing centers should certainly benefit the company.

Thus far, it’s hard to say if these expectations are being met. Specifically, within days after the expiration of Title 42, the number of crossings plummeted. During June, border apprehensions remained stable at less than half the level they were before Title 42, with the month likely to feature the second-lowest border encounters of Biden’s presidency.

However, two key factors provide a plausible explanation for this phenomenon. Firstly, a significant influx of individuals rushed to cross the border before the expiration of Title 42. Secondly, those who refrained from attempting to cross the border are currently adopting a cautious “wait and see” approach. Both factors could result in notably higher crossings than what recent data shows, boosting GEO’s results in future quarters.

It is important to note that despite these circumstances, the company has not factored in any positive impact resulting from the expiration of Title 42 in its guidance. Consequently, the potential for upside surprises exists, offering additional growth beyond their projected numbers.

Electronic Monitoring

Another positive catalyst for the company’s results is its electronic monitoring segment, whose results are growing rather rapidly. Revenues grew by nearly 51% to $132.6 million, while the segment’s operating income grew by 66.3% to $64.3 million. This is a high-margin segment that, at the rate it is growing, could meaningfully contribute to GEO’s bottom line.

GEO’s Total Revenues and Operating Income (SEC filings)

Source: SEC filings

Incredibly Cheap Valuation

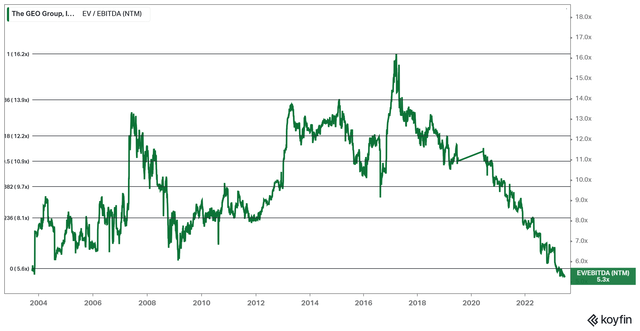

The recent decline in GEO’s stock has significantly compressed its valuation, which now appears to be hovering at incredibly cheap levels from multiple points of view.

The stock’s forward EV/EBITDA of 5.3X is the lowest multiple GEO has ever traded at.

GEO’s Forward EV/EBITDA (Koyfin)

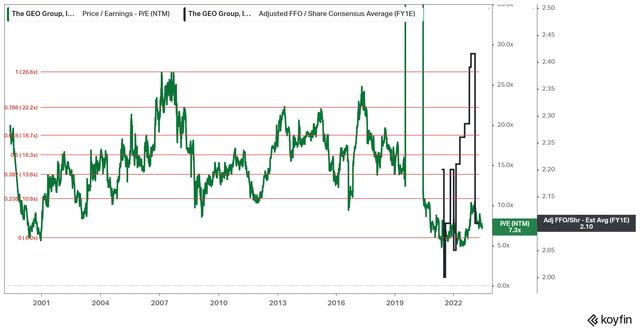

The forward P/E of 7.3X is also at the very low end of GEO’s historical range. More importantly, if we utilize GEO’s projected AFFO/share of $2.10 for fiscal 2023, which is a more useful metric given that GEO records heavy amounts of depreciation and amortization, we arrive at a P/AFFO of 3.4, which is clearly a multiple low enough to “price in” as many risks as anyone would like to list in my opinion.

GEO’s forward P/E and AFFO/share Estimate (Koyfin)

Conclusion

The investment risks associated with GEO are widely recognized among investors who closely monitor the stock. These risks include political uncertainties, ethical concerns, and various obstacles that may (and have) impede(d) the company’s progress.

Nevertheless, GEO’s management has demonstrated tangible advancements in reducing debt and capitalizing on alternative revenue streams beyond their primary U.S. Secured Services offering. This progress is particularly evident in their electronic monitoring segment’s remarkable and highly profitable growth.

In the meantime, shares appear notably undervalued, while management’s guidance does not include any potential benefits that could occur as a result of the expiration of Title 42.

Finally, given that management has a clear deleveraging roadmap and that they intend to consider resuming capital returns to shareholders from fiscal-2024-afterward, there is potential for a significant shift in sentiment towards GEO, paving the way for strong returns ahead.

Accordingly, I have assigned the stock a Buy rating.

Read the full article here