Introduction

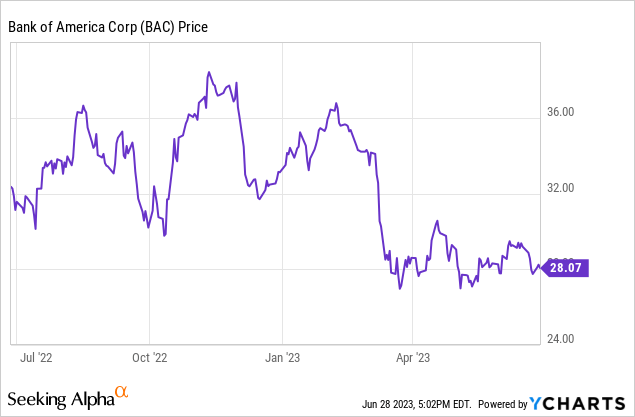

Although I definitely prioritize owning cumulative preferred shares, I have to acknowledge that in some cases I wouldn’t mind adding a non-cumulative preferred share to my portfolio. This paves the way for certain issues from companies active in the financial sector to be considered as most preferred share issues from bank are now non-cumulative in nature. It has been a while since I had a look at the Bank of America (NYSE:BAC) and some of its preferred shares. As interest rates continued to increase, preferred shares (in general) became less attractive and share prices started to slide. And banks had to deal with an additional complication after the collapse of for instance Silicon Valley Bank as suddenly the market started to focus on capital ratios and balance sheet strength. And whereas a call of Bank of America’s preferred shares series GG was almost certain just six months ago, the bank didn’t call the issue and seems to be happy to pay the 6% preferred dividend.

A closer look at the Q1 results and preferred dividend coverage levels

The main concern is obviously to see how well the preferred dividends are covered. And we obviously need the income statement to determine that.

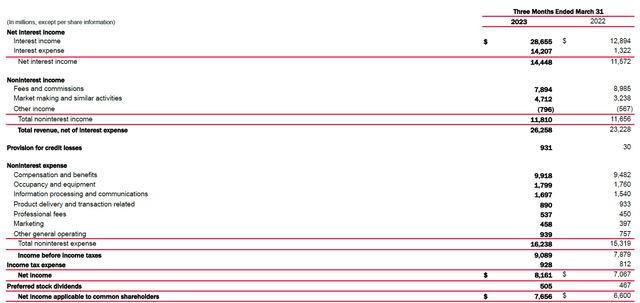

In the first quarter of this year, Bank of America’s net interest income changed dramatically. The higher interest rates on the financial markets resulted in an increase of the interest income by more than 100% but the interest expenses more than ten-folded to just over $14B. The total net interest income in the first quarter came in at $14.5B which is an increase of almost $3B (approximately 25%) compared to the first quarter of last year.

Bank of America Investor Relations

The net interest income boost was very welcome as the bank had to deal with a $0.9B increase in the non-interest expenses, mainly on the back of higher salaries and benefits. In a nutshell, the net non-interest expenses increased from $3.66B to $4.4B while the net provision for loan losses also increased sharply (by $900M).

So while the non-interest expenses and provisions increased by in excess of $1.6B, the $2.9B increase in the net interest income still allowed the bank to report an increased pre-tax income of $9.1B and a net income of $8.2B. The bank still had to pay the approximately $500M in preferred dividend which resulted in a net income of just under $7.7B that was attributable to the common shareholders of the Bank of America. That represented an EPS of $0.95.

The income statement already answered one of the key questions related to investing in preferred shares. The preferred dividend was very well covered in the first quarter of the year as the bank only needed about $0.5B of the almost $8.2B in net income to cover the preferred dividends. This means it needed less than 7% of its net income to cover the preferred dividends and that’s pretty good. It also means that even if the quarterly loan loss provisions would quintuple to $4.5B or even $5B, the preferred dividends would still be covered. But in such a scenario it may not be desirable to actually pay the dividends as an annualized loan loss provision of $20B would indicate something is horribly wrong.

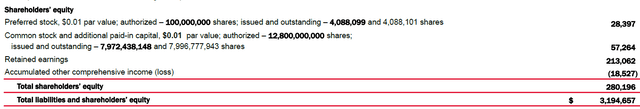

Looking at the balance sheet (see below), we see Bank of America’s total asset base has increased to almost $3.2T of which about $280B consists of equity. And within the total equity component of the balance sheet, about $28.4B is classified as preferred equity which indicates there’s in excess of $250B in equity ranked junior to the preferred shares.

Bank of America Investor Relations

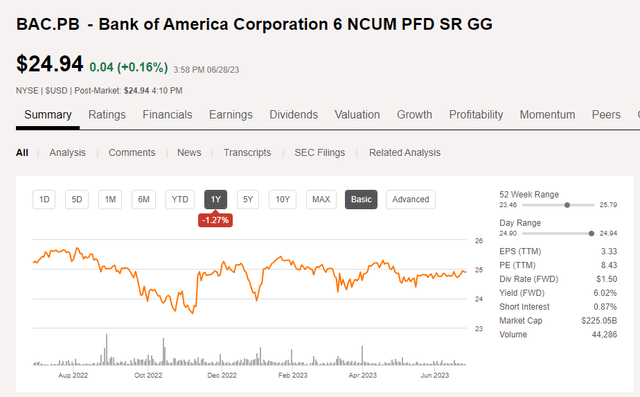

With in excess of $28B in preferred equity there are plenty of series of preferred shares to choose from. I like the Series GG which is trading with (NYSE:BAC.PB) as its ticker symbol mainly because it has a fixed preferred dividend of $1.50 per share, payable in four equal quarterly tranches of $0.375. This security is now callable at any moment.

The stock is trading at just under the $25 call price, resulting in a yield of just over 6%. That makes it relatively attractive for an investor who does not want to bet on fix-to-float preferred shares as the $0.375 quarterly preferred dividend will not change.

Seeking Alpha

Investment thesis

While the situation at a bank can change fast, it looks like the preferred shareholders of Bank of America shouldn’t be too worried with the current circumstances. While I fully acknowledge non-cumulative issues of preferred shares are per definition riskier than cumulative preferred shares because the company does not have to cover missed preferred dividend payments before resuming dividends on common shares, an investment in the preferred shares of Bank of America could make sense in a diversified portfolio.

I currently have no position as my after-tax dividend yield as an European investor doesn’t meet my criteria yet, but investors living in jurisdictions with lower taxes may have a better after-tax yield.

Read the full article here