Introduction

ABN AMRO (OTCPK:AAVMY) (OTCPK:ABNRY) is one of the largest banks in Europe, and after a few years of poor performance (including the fallout of the COVID pandemic), the Dutch bank appears to be on the right track again and the share price has more than doubled since I rated it a buy in May 2020. I sold my position earlier this year on valuation concerns but as the share price has decreased again since March, I wanted to have another look to see if this is a good moment to get back in.

Yahoo Finance

ABN AMRO’s main listing is on Euronext Amsterdam, where it’s trading with ABN as its ticker symbol. The average daily volume in the Netherlands is approximately 2.9M shares for a total monetary value of in excess of 40M EUR per day. I will use the Euro as base currency throughout this article.

The increasing net interest income in Q1 bodes well

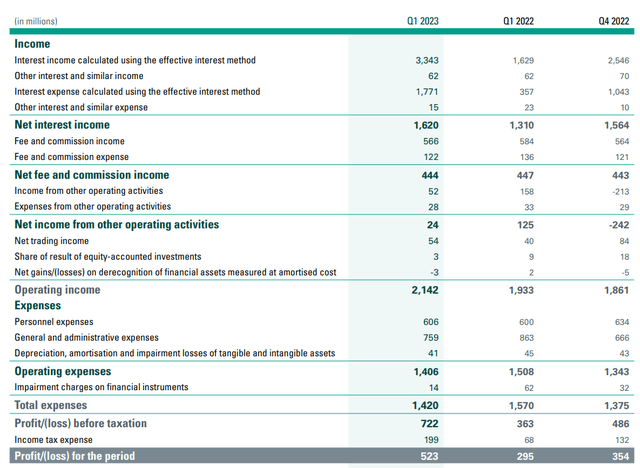

It shouldn’t come as a surprise to see ABN AMRO’s net interest income increased in the first quarter of the year. While the total interest expenses five folded compared to the first quarter of 2022, the total interest income doubled as well and this was still sufficient to report an increase in the net interest income by more than 20% to 1.62B EUR. And although the interest expenses increased by a stunning 70% compared to the final quarter of last year, ABN AMRO was able to increase its interest income by just a little bit more which means that even on a QoQ basis the net interest income increased by just under 4%.

ABN Investor Relations

That’s probably as good as it gets these days and in the next few quarters it will be interesting to keep an eye on the net interest income development. Keep in mind the ECB started to hike interest rates later and at a slower pace so you could argue the European banks still have to deal with the full impact of the rate hike cycle.

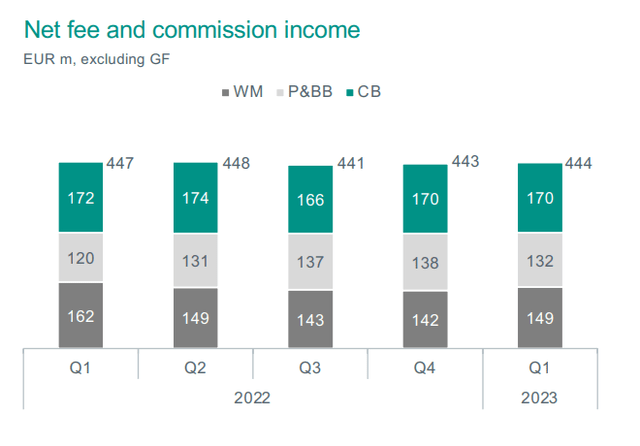

One of ABN’s advantages is its relatively stable fee and commission income result, which traditionally comes in at around 400-500M EUR per quarter. That’s important as it basically covers a substantial part of the personnel expenses. In the first quarter of the current financial year, ABN AMRO reported a total non-interest expense of 1.41B EUR while its total amount of non-interest income was approximately 470M EUR, resulting in a net non-interest expense of 940M EUR.

ABN Investor Relations

The total pre-tax result was 722M EUR on which about 199M EUR in taxes were due. This resulted in a net income of 523M EUR or 60 cents per share based on the current share count of 866M shares.

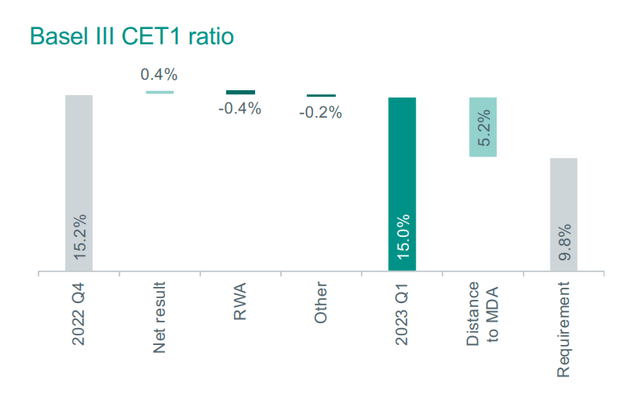

One of the elements I’m keeping an eye on in the European banking sector is the capital ratio of a bank. As of the end of Q1, ABN AMRO’s CET1 ratio came in at 15%, which is approximately 520 bp above the minim requirements for the bank.

ABN Investor Relations

As the total amount of risk-weighted assets on the balance sheet is just under 132B EUR, a 520 bp in “excess” capital represents a capital surplus of approximately 6.85B EUR or 8 EUR per share. This obviously does not mean ABN will distribute that “excess” capital to its shareholders but it does indicate the bank has a solid buffer to deal with economic shocks.

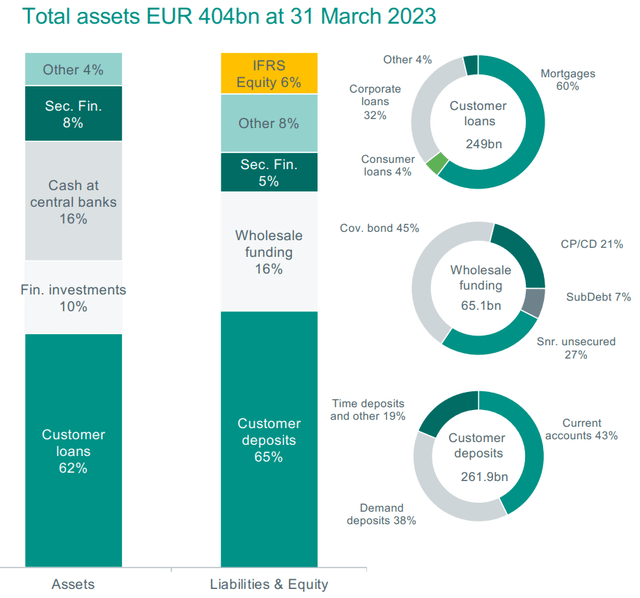

Of the 404B EUR in assets, about 250B EUR consist of loans.

ABN Investor Relations

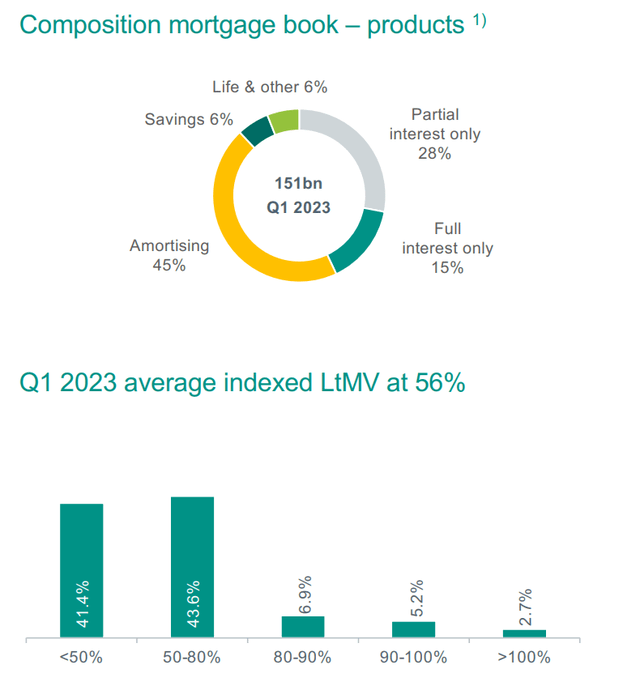

And within that 250B EUR loan book, about 60% consists of mortgages. And as you can see below, in excess of 40% of the total amount of mortgages has an LTV ratio below 50% with the average LTV ratio at 56%. According to the bank, a 20% house price decrease would result in about 12% of the mortgages being under water. And even if they are under water that obviously still doesn’t mean the bank would realize a total loss as the majority of the mortgage could be recouped when an assets gets foreclosed.

ABN Investor Relations

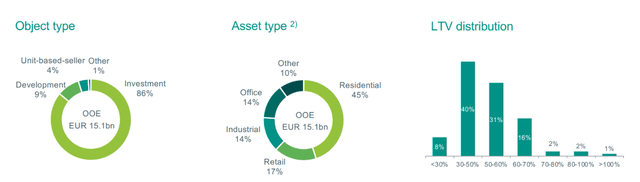

Also important. The total exposure to commercial real estate is just 15B EUR, which is just 6% of the loan book. And the LTV ratios are pretty low here as well as almost 50% of the CRE loans has an LTV ratio of less than 50%. And only a small portion of the CRE loans is related to offices.

ABN Investor Relations

Investment thesis

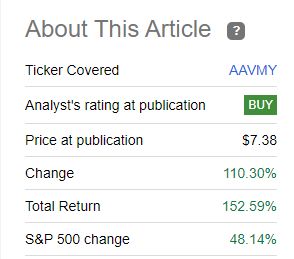

I used to have a long position in ABN AMRO after buying the stock in 2020 when the COVID pandemic was causing volatility in the European banking sector. As the ECB forced the banks under their supervision to suspend the dividend, ABN AMRO was hit pretty hard. In my May 2020 article I thought the stock was too cheap. Since that call, the share price has more than doubled and the total return exceeded 150%.

Seeking Alpha

I sold my position based on the valuation of the bank, and although there still was room for growth, the potential returns were lower than what I’m usually aiming for. However, in the past four months, the share price has lost about 15% and is currently trading at just over 14 EUR per share. The increased volatility also made the option premiums more attractive and I recently started to write out of the money put options again.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here