Author’s note: This article was released to CEF/ETF Income Laboratory members on June 28th.

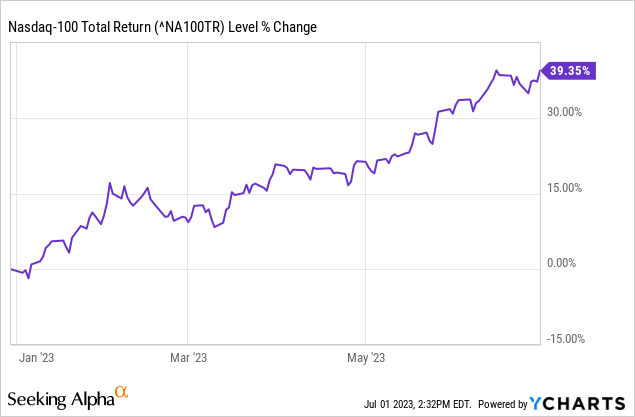

It has been an outstanding year for tech investors, with Nasdaq-100 index up 39.4% YTD.

Considering the above, thought to write article on how tech fundamentals and relevant industry metrics stand after recent gains.

Tech valuations remain high, although lower than in 2022.

Tech earnings are stagnating, due to an industry-wide slowdown, and due to unfavorable comps.

Tech momentum is strong, although somewhat out of line with fundamentals.

In my opinion, and taking into consideration the above, tech does not look like a particularly compelling investment opportunity right now. Conditions are much better than in 2022, however.

I’ll be focusing on the Technology Select Sector SPDR Fund ETF (NYSEARCA:XLK) for this article, instead of the more well-known Invesco QQQ ETF (QQQ), as XLK more accurately tracks the tech industry than QQQ.

Valuation – Tech Remains Expensive

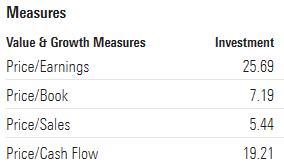

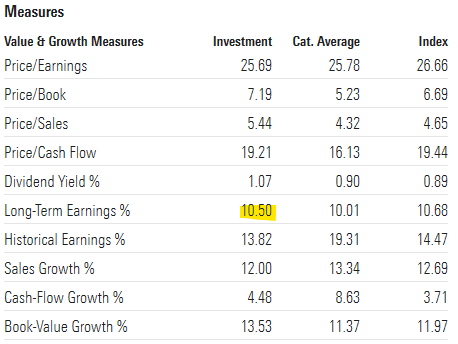

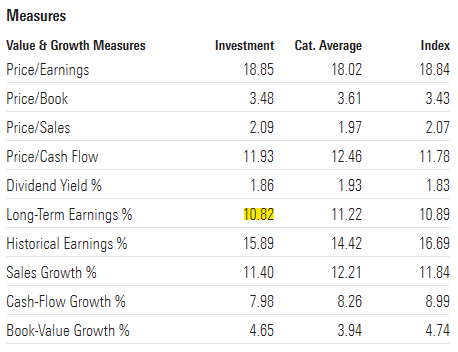

Tech currently trades with a relatively expensive valuation. Compare XLK’s valuation metrics:

Morningstar

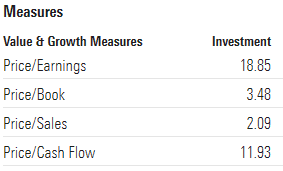

to those of the S&P 500:

Morningstar

As can be seen above, XLK’s valuation metrics are all quite a bit lower than those of the S&P 500. XLK sports a 25.7x PE ratio, for a 36% premium relative to the S&P 500’s 18.9x. It also sports a 7.2x PB ratio, for a whopping 105% premium to the index’s 3.5x, although book values are not particularly informative for tech companies, due to their intangible assets (lots of software and patents are not included as assets in accounting statements).

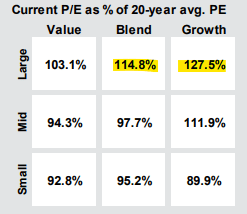

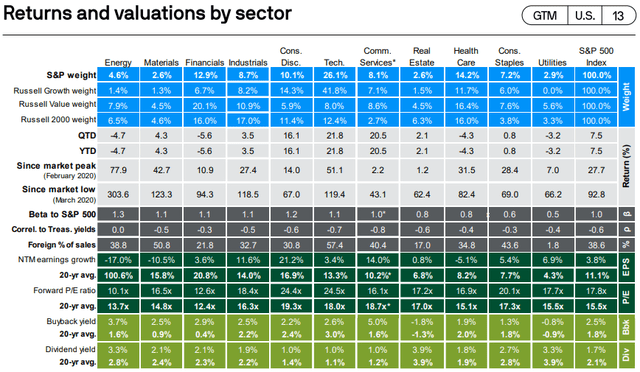

Tech almost always trades with a premium valuation, due to strong realized / expected growth. Premiums do vary, with XLK sometimes trading at a historically cheap (less expensive) valuation, sometimes with a particularly frothy one. Right now, tech is about 27.5% more expensive than its historical average, compared to 14.8% for the S&P 500.

JPMorgan Guide to the Markets

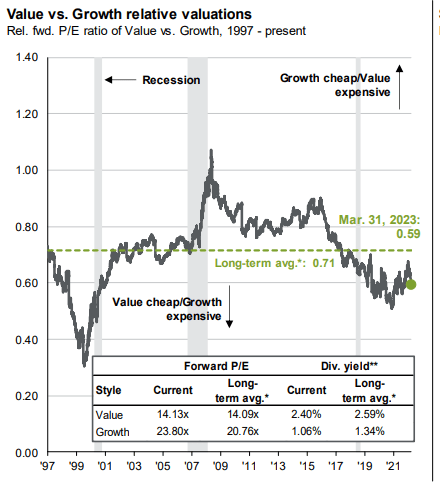

More broadly, the valuation gap between growth and value is moderately wider than average right now, although narrower than last year.

JPMorgan Guide to the Markets

Considering the above, it seems clear that tech currently trades with a premium valuation. That is the case comparing industry valuations to those of the S&P 500, comparing current valuations to their historical averages, and comparing growth versus value valuations. Tech is expensive, across most metrics and points of comparison. Valuations were more expensive in early 2022, see above, although these remain quite elevated.

Growth – Earnings Growth is Declining

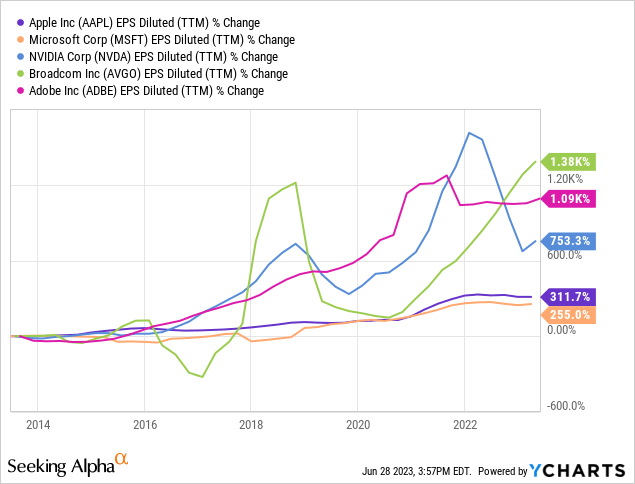

Strong growth underpins premium tech valuations. Investors are (generally) willing to pay premium prices for companies with strong growth prospects, as these are sometimes able to grow into their valuations, and sometimes deliver outsized capital gains and returns. Tech companies have (generally) seen outstanding growth these past few years, including some of XLK’s largest holdings.

Data by YCharts

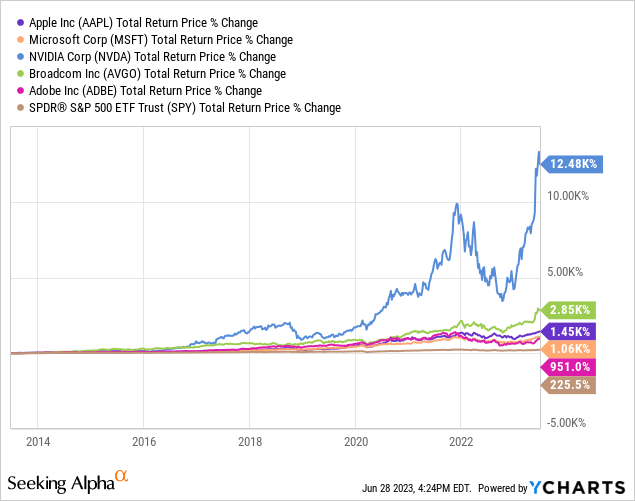

Strong growth led to outstanding, market-beating returns, as expected. As a aside, NVIDIA’s (NVDA) gains do seem a bit excessive.

Data by YCharts

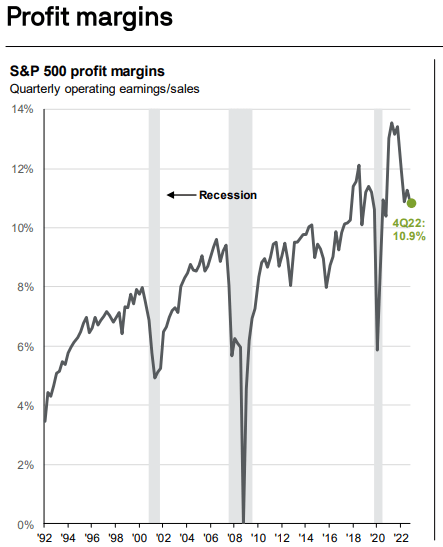

Importantly, earnings growth is slowing down, as margins shrink:

JPMorgan Guide to the Markets

Earnings have also declined due to an industry-wide slowdown, as a reaction to very rapid growth in the years following the pandemic. In short, tech saw several years’ worth of earnings in 2020, as business accelerated IT investments to better operate from home / in the cloud, and as consumers shifted their consumption to online services and offerings, as brick-and-mortar options were locked-down. Once the pandemic subsided growth slowed down, as the necessary investments and shifts had already occurred.

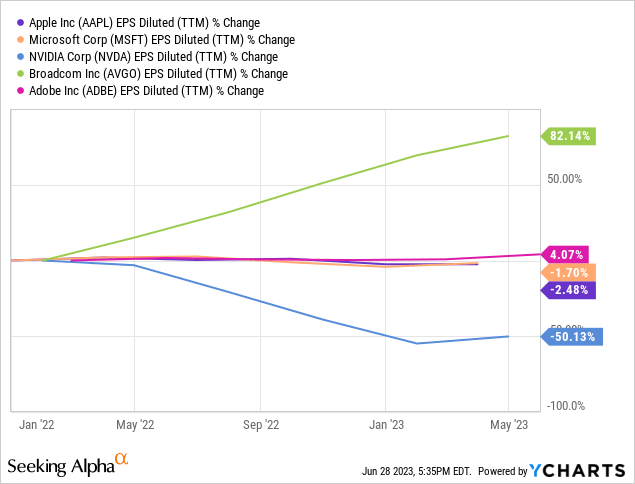

XLK’s largest holdings have mostly seen stagnating earnings growth since early 2022, with lots of volatility, and two glaring exceptions.

Data by YCharts

Analysts are bearish, with most expecting earnings growth of 3.4% for the next twelve months. Growth is much lower than the 15% – 25% experienced in the past, and a bit lower than the expected earnings growth of the S&P 500, at 3.8%.

JPMorgan Guide to the Markets

Expectations of long-term growth are a bit healthier, at 10.5%

Morningstar

but these a bit lower than those of the S&P 500, at 10.8%:

Morningstar

In my opinion, expected tech growth rates do not currently justify industry valuations. Industries with below-average growth should trade with below-average valuations, obviously. Earnings could increase by more than expected, if only due to the inaccuracy of these long-term forecasts. AI could always lead to massive, unprecedented growth, although it might end up disrupting the industry too.

Momentum – Strong Momentum

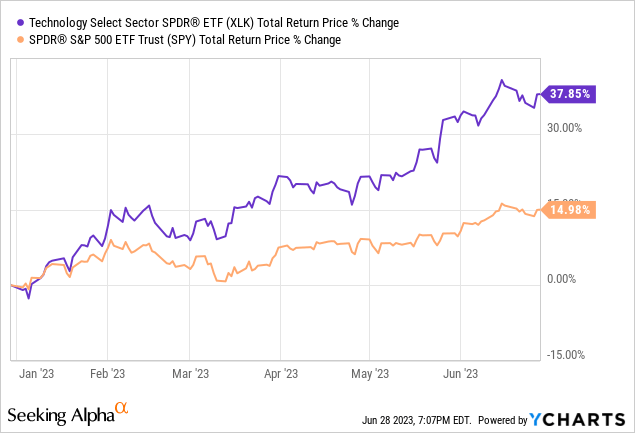

Tech has strong momentum behind its back, with XLK posting returns of 37.9% YTD, more than twice those of the S&P 500.

Data by YCharts

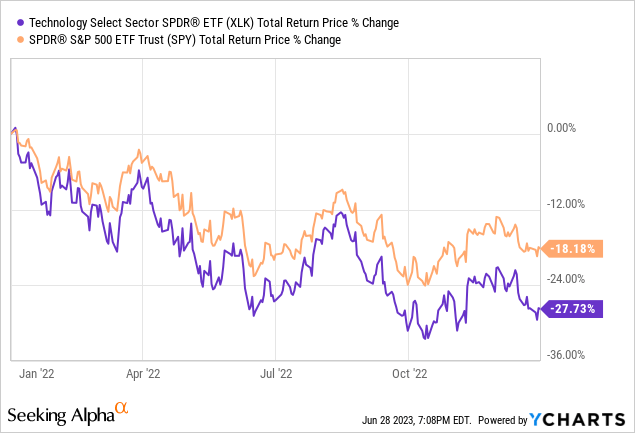

Momentum is explained by improved investor sentiment, and something of a dead cat bounce from prior losses. XLK was down 27.7% in 2022, and some of those losses were very likely going to be reversed, sooner or later.

Data by YCharts

XLK’s returns do not completely align with fundamentals, considering tech valuations are a bit frothy, and earnings are declining. Long-term earnings could always see better-than-expected growth, but I have no real reason to believe that this will be the case.

Conclusion

Tech valuations remain high, although lower than in 2022.

Tech earnings are stagnating, due to an industry-wide slowdown, and due to unfavorable comps.

Tech momentum is strong, although somewhat out of line with fundamentals.

In my opinion, tech does not look like a particularly compelling investment opportunity right now.

Read the full article here