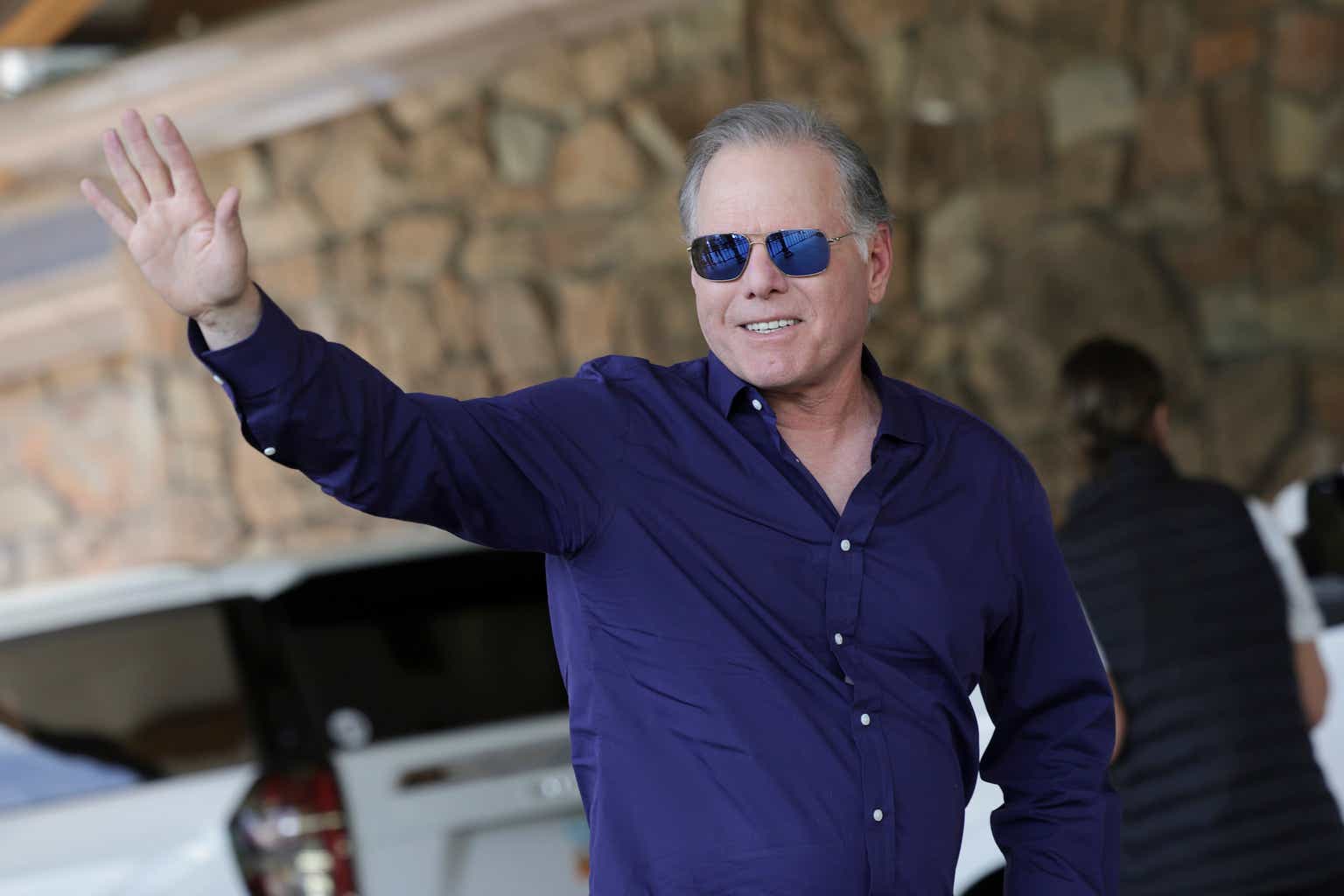

The WBD Investment Thesis Largely Lies On The Highly Competent Management Team

We previously covered Warner Bros. Discovery (NASDAQ:WBD) in April 2023, suggesting that the management might need to deliver near-perfect execution to temper the macroeconomic headwinds and intensified streaming competition.

Combined with the underperforming movie releases post-reopening cadence, we believed that the media company’s prospects might remain mixed in the intermediate term.

True enough, WBD’s Studio segment continues to underperform, with lower adj EBITDA of $0.6B (-21% QoQ/ -25% YoY) and adj EBITDA margin of 18.7% (-1 points QoQ/ -4.1 YoY) by the latest quarter. Its FQ2’23 results may not improve as well, given The Flash’s underwhelming turnout, with Barbie’s performance in FQ3’23 remains to be seen.

Then again, the media company has finally recorded an earlier than expected swing to breakeven for the D2C segment, with adj EBITDA of $0.1B (+ 147.6 QoQ/ +114.2% YoY) and an adj EBITDA margin of 4% (+12.8 points QoQ/ +32 YoY) in the latest quarter.

In addition, WBD’s overall profitability continues to be well-supported by the Network segment’s sustained adj EBITDA of $2.3B (-6.8% QoQ/ -11.5% YoY) and adj EBITDA margin of 41% (-3.8 points QoQ/ inline YoY). This is despite the softer advertising spend market and sustained cord cutting, with the headwinds well-balanced by the management’s effective cost optimization thus far.

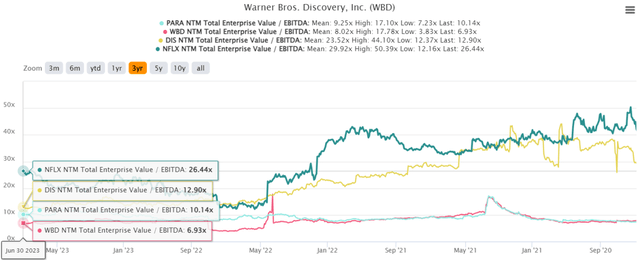

WBD 3Y EV/ EBITDA

S&P Capital IQ

Then again, thanks to uncertain macroeconomic outlook, WBD’s valuation is also impacted to NTM EV/ EBITDA of 6.93x, in comparison to its 1Y mean of 7.28x and its streaming peers, such as Netflix (NFLX) at 26.44x, Disney (DIS) at 12.90x, and Paramount (PARA) at 10.14x.

This is despite the media company’s improved annualized overall adj EBITDA of $10.4B (inline QoQ/ +8.3% YoY) and expanded adj EBITDA margin of 24.2% (+2.5 points QoQ/ +3.2 YoY) by FQ1’23.

These numbers are impressive indeed, in comparison to NFLX’s adj EBITDA margin at 23.3% (+13.1 points QoQ/ -4.2 YoY), DIS at 19.8% (+2.5 points QoQ/ -4.5 YoY), and PARA at 7.5% (-0.1 point QoQ/ -5 YoY) in the latest quarter.

While WBD may still face enormous long-term debts of $45.43B (-6.75 QoQ/ -11.7% from the peak in FQ2’22), naturally expanding its annualized interest expenses to $2.28B (-6.8% QoQ/ +10.2% from FQ2’22 levels), thanks to the elevated interest environment, we are somewhat convinced about the potential balance sheet deleveraging and streaming success moving forward.

The latter is partly attributed to the media company’s growing D2C subscription to 97.6M (+1.6% QoQ/ +5.9% from FQ2’22 levels) by the latest quarter, despite the HBO Max’s increased ad-free subscription fees by +$1 to $15.99 in early 2023.

This cadence suggests WBD’s robust consumer stickiness at a time of tightened discretionary spending, with similar price hikes already increasing competitors’ churn rates, such as DIS’ at 157.8M (-2.4% QoQ/ -2.4% YoY).

The fee hikes have also aided the media company’s improving gross margins at 37.5% (+0.2 points QoQ/ +4.9 from FQ2’22 levels), with the optimized operating expenses of $2.34B (-4.4% QoQ/ -8.2% YoY) naturally contributing to the inline adj EBITDA QoQ, as discussed above, despite the Fed’s rate hikes thus far.

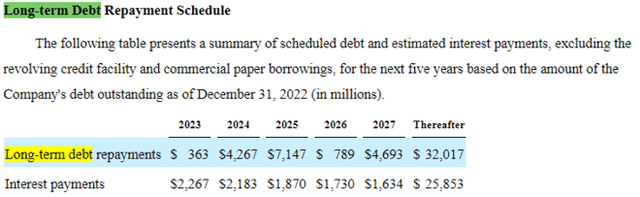

WBD’s Long-Term Debts & Interest Expenses

Seeking Alpha

While the Fed has guided two more rate hikes in 2023, market analysts already expects a pivot by 2024, suggesting the pain may be over soon enough. With WBD’s similarly highlighting that the interest expense payments are already peaking in 2023, we believe the media company may potentially achieve a debt to EBITDA ratio of ~4x by FY2025, if not earlier.

This is based on the assumption that the media company dedicates all of its future FCF generation to deleveraging instead of dividend reinstatement, since most of its debts come with a relatively long-term maturity of over 14 years (from 2022) and a modest average interest rate of approximately 5.1% (based on its latest quarterly filing).

David Zaslav’s laser-focused execution thus far suggests a clear path for WBD to survive the intense streaming war and cord cutting at a time of peak recessionary fears. Kudos indeed.

So, Is WBD Stock A Buy, Sell, or Hold?

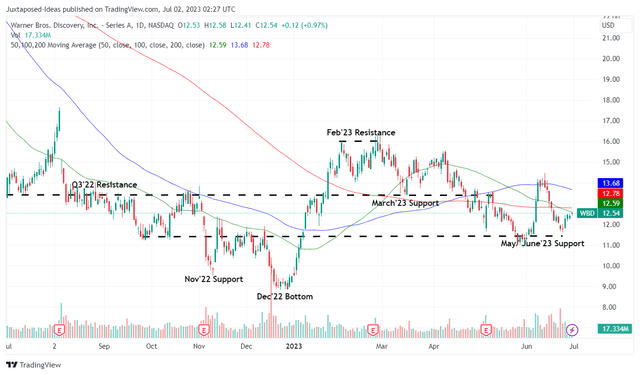

WBD 1Y Stock Price

TradingView

For now, the WBD stock has already rebounded from the previous May and June 2023 bottom of $11s, suggesting the bulls’ immense support at those levels. Assuming that the management is able to sustain the D2C segment’s adj profitability moving forward, we will not be surprised if these support levels hold for the foreseeable future.

As a result of the attractive risk and reward ratio, we are finally rerating the WBD stock as a Buy here.

While our buy rating may have missed the previous December 2022 bottom of $9s, investors may still see a tremendous upside potential from current levels to our price target of $37, based on the market analysts’ FY2025 adj EBITDA projection of $5.34 per share and its NTM EV/ EBITDA of 6.93x. It is not too late to add here, especially due to the promising developments thus far.

Naturally, the portfolio must also be sized appropriately, since the intense streaming competition may be painfully drawn out, with more consolidation likely to occur during the economic downturn, a sentiment similarly observed by Warren Buffett.

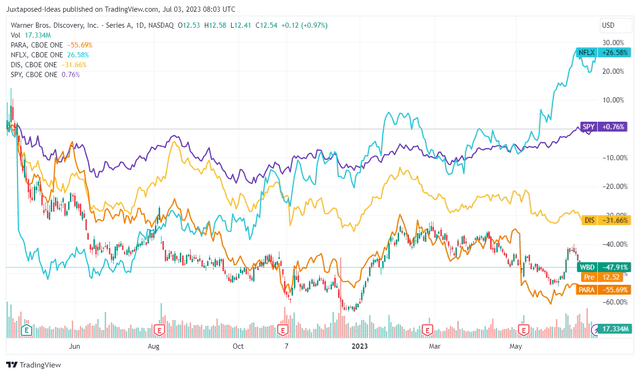

WBD Stock Returns Since Merger Completion

TradingView

While WBD may survive over the next two challenging years, in our opinion, the stock may also be consequently volatile before market sentiments improve, with recovery likely to take more than a few quarters, if not years. Therefore, anyone who add here must be very patient, especially given its underperformance since the merger was completed on April 11, 2022.

Read the full article here