Dear readers/followers,

It’s been over a year since I last wrote on Autoliv (NYSE:ALV). The company has, overall, been a good investment for me. The small position I retain has outperformed most indices, though I haven’t added to it in a long, long time, owing to better market alternatives. What I see here though, is that there is a potential to maybe add more – provided that you’re aware of the risk you’re entering into when buying the company here.

Due to the trends in automotive, including recovery, we’re potentially looking at an upward trajectory for the business – maybe even as high as double digits for several years. In this article, I’m going to show you what you may be able to expect based on a bullish case for the company, but also give you my overall take on what I see as a more “realistic” potential for the business here.

Because those are two different things.

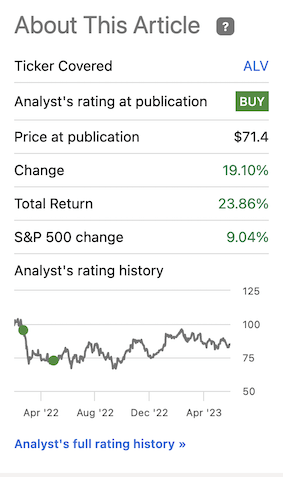

Here is the RoR for the company since my last article.

Seeking Alpha RoR (Seeking ALpha)

Autoliv – What we can expect for 2023-2025

Really, Autoliv has been a more volatile investment than one could expect from a company that essentially deals with safety features in cars. While my current position is in the green, I’ve experienced some significant volatility in what was previously a 3.5% position in my portfolio. I no longer own 3.5%, nor do I intend to do so again, unless we see a substantially better valuation for the company.

The current 2023 story of Autoliv is the same story as with many industrial businesses with automotive correlation. We’re seeing top-line growth in the form of sales increases, and the company is keeping margin declines under control by increasing prices.

The company has a solid and substantial order book, and for the last quarter reported, the 1Q23, it has actually outperformed the Light Vehicle Production trends, or LVP, in all regions by a significant margin. When we’re looking at ALV, by what margin the company outperforms LVP is a typical metric.

At the same time, ALV is experiencing significant pressures on the cost side. A combination of inflation, wage/labor, logistics cost and energy costs is making sure that any price increases the company manages may at best offset the cost increases we’re seeing from other directions. Fundamentally speaking, the company issued new bonds and improved its funding, as well as expanding operations with a new cushion plant in Vietnam.

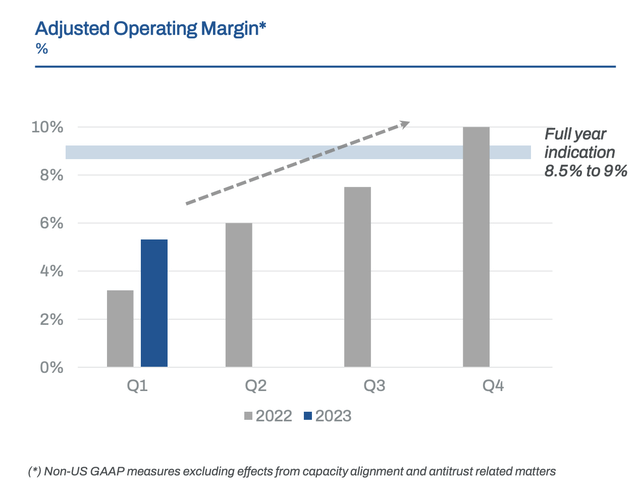

The company fully expects for the 2023E trends to strongly outperform LVP here. The fact that the operating margin on an adjusted basis is improving is really no great feat – because it came from a trough level to begin with.

ALV IR (ALV IR)

Reasons for the improvements include engineering income, better LVP visibility, headcount reduction, sales growth and cost comps, and other recoveries.

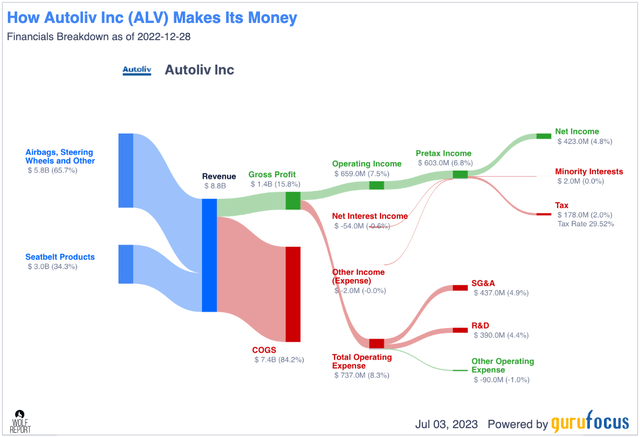

At the same time that the operating income is increasing, cash flow is declining though. The company is so-so from a comparative fundamental perspective, with an interest coverage of less than 10x and a debt/EBITDA of 2.3x. It’s not terrible, but not tremendous either – an average in terms of comps in the vehicles/parts industries, including peers such as Aptiv (APTV), BorgWarner (BWA), Lear (LEA), and others. The company currently manages low-single-digit net margins of below 5%, which is still an improved rate from how things were a few years back.

ALV revenue/net (GuruFocus)

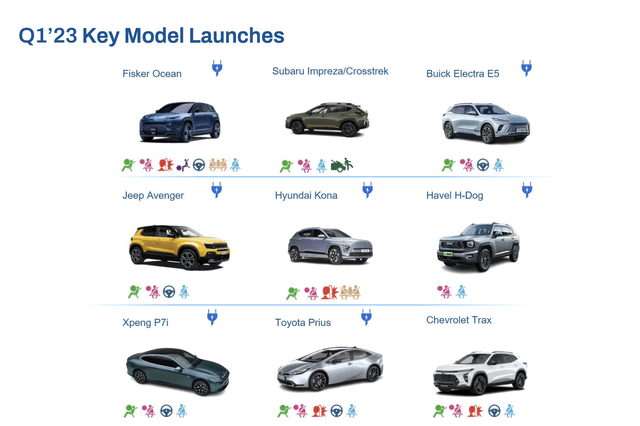

Still, the automotive industry continues to push new models and attractive products to market. This includes, for the time being in 1Q23, the new Prius, the new Fisker, and other models as well.

ALV IR (ALV IR)

Leverage, which really went out of bounds back in 2020 in that it nearly reached 3.0x, has now come down to around 1.6x . This is still above the company’s overall long-term target of 1x, but it’s slowly getting back down. My main reason for leaving this investment behind back several years ago (and only reinvesting cheap) was the company’s departure from a previously rock-solid dividend tradition. When a company breaks this tradition, a reconsideration of the company’s appeal as a mixed income/growth investment is in order. At the time I considered it to no longer be as attractive.

But in the end, the company is a play on LVP development – and the current consensus is for growth in the production of automotive vehicles, even if the seeming likely recession will impact the degree or amount of growth here.

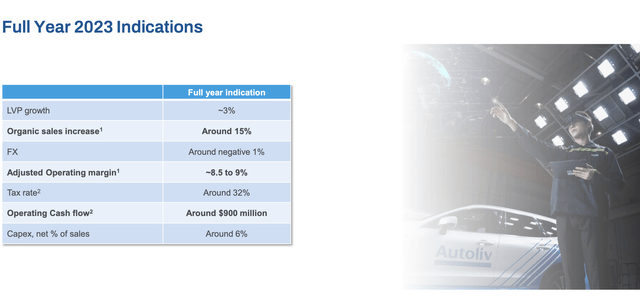

Here are the current full-year indications/expectations for this company.

ALV IR (ALV IR)

Current expectations going forward in the longer term are absolutely superb – we’ll look more at those later. For now, I want to focus on the high-level headwinds and tailwinds.

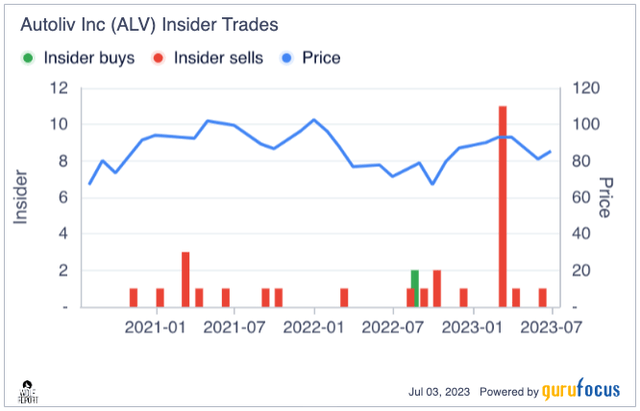

On the negative side, we find cost-influenced declines in both gross and operating margins. We also have insiders selling the share – which might not mean much, but anyone characterizing insider selling as a positive, well I don’t believe that to be the case.

ALV Insiders (GuruFocus)

The positives are the company forecast and fundamentals. Autoliv is one of the world’s most significant manufacturers of all things having to do with crucial automotive safety. This is model/ICE-independent, because regardless of technology, cars need safety features, and Autoliv is one of the leaders in this on a global scale.

From that perspective alone, at an attractive price, this becomes a “BUY” target for me.

However, I also want to keep track of a few things. As you might expect, labor costs and inflation as well as logistics are the main issues I see here at this time. In addition, concerns can also be said to be things like steel prices and other raw material inputs. We’re also seeing significant FX – negative $25M for the quarter alone due to the peso to the USD, but also currencies like the Yen and the Won.

Operating conditions in Europe remain challenged with energy prices at higher levels as well as the overall volume expectations for the company, with plenty of volatility due to inflation and labor.

One thing I want to mention as well, that I noted in the filings, was the significant increase in S&GA as a % of revenue. There’s plenty of inflation here, and the company guides for this increase to be relatively constant – a similar pattern going forward. The reasons also include headcount – which is up 4.5%, but obviously, labor is costing more as well. Headcount evolution and inflation considerations are really the main concerns here, and I don’t see that materially improving anytime soon.

Let’s move on to valuation, and see what we have going for us with Autoliv here.

Autoliv Valuation – Plenty to like, plenty of upside, but also downside/accuracy risks

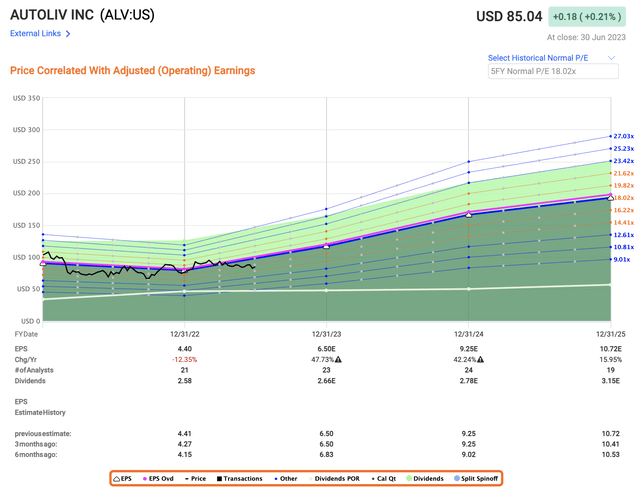

As with any company, Autoliv is a business that you never want to invest in at the more expensive valuation trend here. The current expectations are actually a significant EPS increase on an adjusted basis for the next 2 years of 40%+ in every year.

ALV Upside (F.A.S.T Graphs)

However, I choose to view this as unlikely at this time. The forecast accuracy for this is only 50%, with the analysts following the business being wrong about 50% of the time, with 4 consecutive negative misses for the past 4 years, with 20-60% negative EPS miss from FactSet (Source: FactSet/F.A.S.T graphs).

The company has an S&P Global target range of $84-$127 with an average of $100, with an upside of 17.7% at a current share price of $85/share. However, out of 21 analysts following the company, only 7 have a “BUY” rating for the business, which means that despite these very positive estimates and targets, the conviction on the analyst side leaves something to be desired. As I see it, if the company has missed EPS estimates for 4 years in a row, and by as much as 60% in some cases, it’s not unlikely that it’ll miss estimates again – and this would mean that the relative EPS growth this year could be close to zero.

I wouldn’t go that far. My own forecast is that the direction of the estimates is actually correct, on the basis of sheer volume growth. The question is how exactly inflation, SG&A, input cost increases, logistical costs, and labor influence the bottom line.

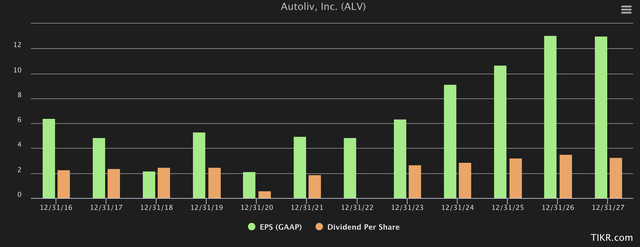

GAAP estimates for the company are equally positive here, to where it’s entirely possible for Autoliv to become a bit of a “dividend monster”, or at least increase that yield to around 3.5%.

Autoliv GAAP/Dividend (S&P Global/TIKR.com)

However, on the flip side it’s incredibly important to remember that this company very recently cut its dividend entirely, lowered it during COVID, and has been an incredibly volatile business. Improvements may be coming, but I don’t consider them as high as the forecasts are calling for here.

Nonetheless, what is expected from the company is good enough that I am increasing my price target for the company here. I’m discounting the EPS growth estimate by 50% to account for historical analyst forecast inaccuracies, which at a conservative 15-18x P/E puts me at a longer-term average of about $92/share. This is a target I consider fair. At current pricing trends, this implies an upside of about 17% per year – and I want to be very clear, that I realize that is a very conservative, borderline bearish estimate when most analysts are going as high as $150/share on a 15x forward P/E based on an annual earnings growth estimate for 2023-2025 of over 35%. That’s the differentiating factor here – I don’t expect more than 10-16% at most.

DCF doesn’t really work here due to the low predictability and high cyclicality of the business model – so working with EPS estimates and perhaps more fundamental multiples, such as revenue or sales, is what we have going for us with Autoliv.

This is my first update on the company in some time, and I’m positive about the business. Given the good estimates, even impaired, I am unwilling to change my “BUY” target, and I’m raising my PT, impacting my Thesis as follows.

Thesis

- Autoliv is one of the more solid automotive safety companies in the world, but unfortunately still has massive ties to light automotive vehicle production.

- The upside is still volatile – but the company has some excellent growth potential from a mix of improving LVP trends, better synergies, operational improvements, and other bullish potentials. Risk remains, but at today’s price, I think the company warrants a second look.

- In my last article, I was positive about selling puts – now I’d be more interested in buying the common shares.

- Still, valuation dictates Autoliv a “BUY” long-term, and I would pay below $92/share for the company.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

Because the company fulfills all but one criteria, I would consider it a “BUY” here.

Read the full article here