Introduction

Shares of Kandi Technologies (NASDAQ:KNDI) have risen 67% YTD. Since my last post, the company’s shares are up 53%, while the S&P is up 8.3%. At the moment, I would like to change my view of the company’s shares from Buy to Hold.

Investment thesis

Despite the fact that the company has shown strong financials over the last few quarters, I would like to change my recommendation on the company from Buy to Hold, because: firstly, the shares reached the target price in accordance with my DCF model, which I wrote in my previous article. Secondly, the share of revenue that comes from the United States was ahead of my expectations and already reached 91% in the first quarter of 2023. Thirdly, in my personal opinion, one of the main drivers was the increase in the share of revenue in the off-road-vehicles segment, which has already reached 91% of total revenue in Q1 2023. In addition, the company’s shares are up 67% YTD and already, in my opinion, are not cheap by multiples.

Company overview

The company is engaged in the production and sale of electrical off-road vehicles and lithium-ion batteries. The company operates in the US and China markets, which account for 91% and 9% of revenue, respectively. The main revenue segments are off-road vehicles and lithium-ion cells, which account for about 91% and 8% of revenue in 1Q 2023, respectively.

1Q 2023 Earnings Review and expectations

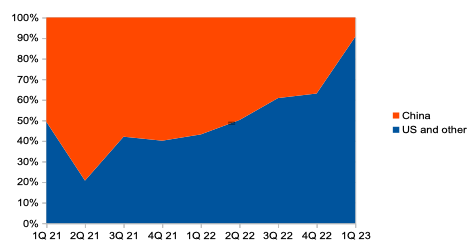

According to the results of the 1st quarter of 2023, the company’s revenue decreased by 8.2% YoY. In terms of revenue geography, the largest contributor was the US and Other segment, where revenue grew by 93% YoY, while in China revenue decreased by 85% YoY. The increase in the share of revenue in the US market relative to China is associated with a strategic change in the company’s priorities. You can see the details in the chart below.

Revenue by geography (Company’s information)

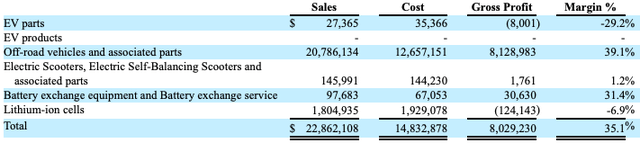

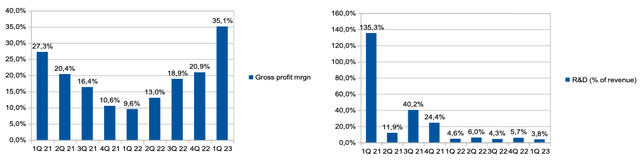

Gross margin increased from 9.6% in Q1 2022 to 35.1% in Q1 2023 due to a favorable change in the product mix (an increase in the share of off-road vehicles, where the gross margin was 39.1%). Details of the gross margin for the business segment for the 1st quarter of 2023 can be seen in the chart below.

Gross margin by segment (Company’s information)

R&D spending (% of revenue) decreased from 4.6% in Q1 2022 to 3.8% in Q1 2023. Thus, operating loss (% of revenue) decreased from 22.9% in Q1 2022 to 9.8% in Q1 2023. You can see the details in the chart below.

Margin trends (Company’s information)

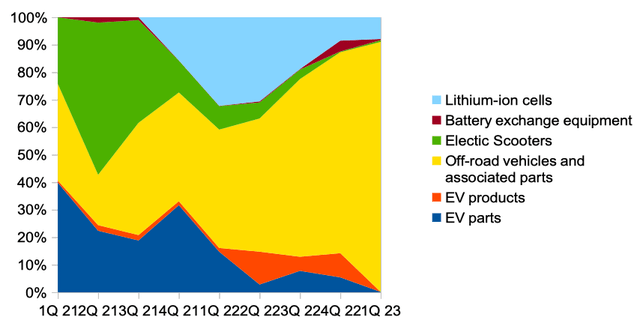

In terms of revenue segments, the main driver of growth was the Off-road vehicles and associated parts segment, where revenue increased by 94% YoY. Thus, the share of the Off-road vehicles and associated parts segment in the company’s total revenue increased from 43% in Q1 2022 to 91% in Q1 2023. You can see the details in the chart below.

Revenue by segment (Company’s information)

In addition, in line with management’s comments during the Earnings Call following the publication of the results, management expects the gross margin for 2023 to be at the level of Q1 2023.

And then the gross margin were roughly around the same level of the Q1 of this year.

In my opinion, the gross margin is one of the main drivers for improving the unit economy, as the share of spending on R&D has dropped significantly and reached 3.8%.

Risks

Competition: increasing competition in the EV segment could lead to a decrease in EV’s share of the current, although fast growing, but highly competitive segment with a number of large players that outperform Kandi Technologies both in terms of economies of scale and view of the depth of vertical integration.

Margin: decreased sales volumes, reduced economies of scale, or increased operating costs can lead to lower operating margins, such that the company may reach the break-even point later than previously planned.

Drivers

Revenue: the company’s product is currently only available at major retailer Lowe’s (LOW), but the company has plans to expand sales channels, especially for the new Cowboy e10k, which could boost revenue in the US market.

New models: the company has already received approval to launch the new K32 model in the US market, so this could support revenue in the second half of 2023 and into 2024.

Valuation

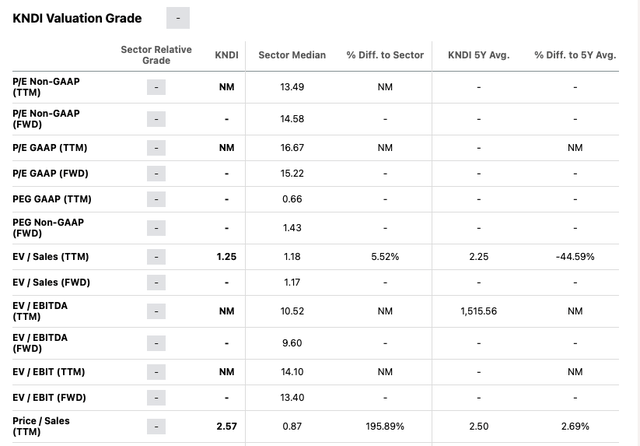

At the moment we cannot use P/E or EV/EBITDA multiples to value the company as the business is still unprofitable, so I suggest looking at P/S (ttm) and EV/S (ttm) multiples. Thus, in accordance with the P/S (ttm) multiple, the company is trading 5.2% more expensive than the sector median check, however, in accordance with the P/S (ttm) multiple, the company is already trading 196% higher than the sector median. In my personal opinion, on the one hand, the company deserves a premium, since the business really demonstrates a steady improvement in the unit economy, however, on the other hand, the current level of valuation seems high to me, since future positive trends are already taken into account in the company’s quotes and I do not see potential for growth.

Multiples (SA)

Conclusion

I think my investment idea, which I talked about in my previous one, has been implemented. The company was able to increase both sales in the US market and demonstrate a significant increase in profitability due to the growth in the share of sales of off-road vehicles. I believe that at the moment the market is already effectively valuing future cash flows in the current share price and I do not see a potential upside. In addition, the company’s shares have reached my target price, which I wrote about earlier. I will continue to closely monitor the company’s operating and financial statements and may change my view if I see new drivers of growth in quotes.

Read the full article here