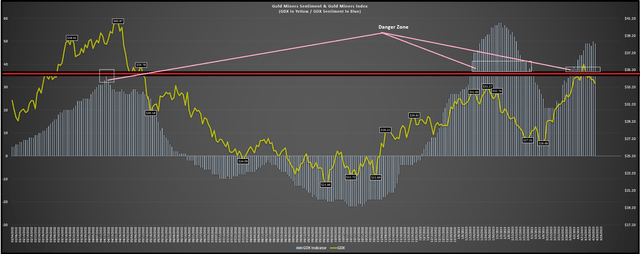

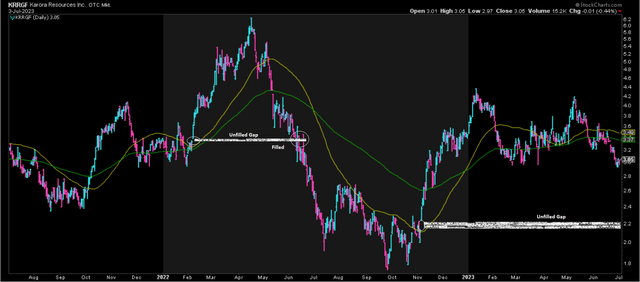

Just over a month ago, I wrote on Karora Resources (OTCQX:KRRGF), noting that while the company had just delivered an exceptional Q1 report, it was difficult to justify paying up for the stock above US$3.40. This is because the overall sector was vulnerable to a deeper correction that could bring Karora down with it because of the elevated optimism (shown below) we saw for gold miners in early May, which more often than not has portended a 15% plus correction in the Gold Miners Index (GDX). Since the late May update, the GDX has given up further ground, which isn’t surprising, and Karora has underperformed its peer group by 9% with a [-] 10% return. The good news is that this has improved the stock’s valuation, and Karora remains one of the better names sector-wide, with it being one of the few producers to report meaningful reserve growth per share.

In this update, we’ll look dig into its FY2022 Reserve/Resource statement for Beta Hunt and whether the stock has finally dropped into a low-risk buy zone:

Gold Miners Sentiment vs. GDX (March 2022 to April 2023) (Author’s Data & Chart)

All figures are in United States Dollars unless otherwise noted.

2022 Reserves & Resources

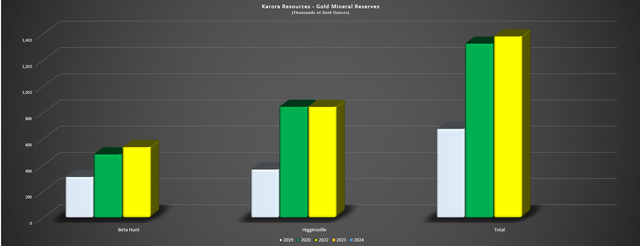

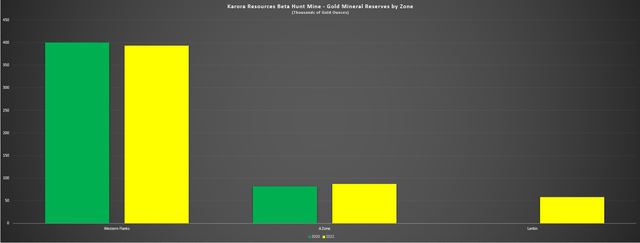

Karora released its most recent reserve update for its flagship Beta Hunt Mine earlier this year, reporting a 20% increase in measured & indicated [M&I] ounces to ~1.33 million ounces of gold, a 34% increase in inferred ounces to ~1.05 million ounces of gold, and a proven & probable reserve base of 538,000 ounces. The latter represented a 12% increase from the most recent reserve update and a 4% increase in reserves assuming a similar reserve base at Higginsville vs. its previous Q3 2020 reserve estimate. The material increase in Beta Hunt’s reserves from the most recent Q3 2020 update (~538,000 ounces vs. ~482,000 ounces) was attributed to a slight increase in tonnes at its two existing zones (Western Flanks and A Zone) partially offset by lower grades at Western Flanks (2.5 grams per tonne of gold vs. 2.7 grams per tonne of gold), and maiden reserves at the newly delineated Larkin Zone, which lies south of the Alpha Island Fault.

Karora – Gold Mineral Reserves by Mine & Total (Company Filings, Author’s Chart)

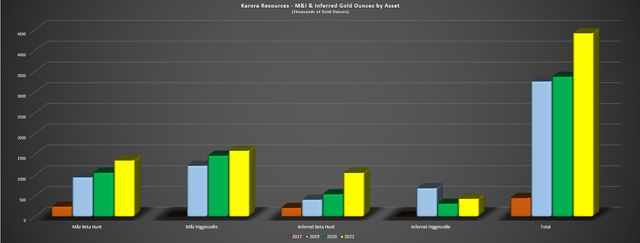

Digging into the reserve base a little closer, we can see that the bulk of Karora’s reserves lie at the lower-grade Higginsville asset (~800,000 ounces at ~1.5 grams per tonne of gold), but Beta Hunt is growing substantially, with its reserves up over 70% from 2019 levels (~310,000 ounces —> ~538,000 ounces). This material reserve growth has given the company much more breathing room with a ~6.8 million tonne reserve base (~3.4 year mine life based solely on reserves at new throughput rate) as it works to increase mining rates to 2.0 million tonnes per annum with its second decline. And while this might seem like a relatively small reserve base, it’s important to note that the resource base at Beta Hunt has more than quadrupled since 2017, with significant resources added at Western Flanks. In fact, its M&I and inferred combined gold resources now sits at ~2.4 million ounces, up from ~445,000 ounces just five years ago.

Karora – Gold Mineral Resources by Asset (Company Filings, Author’s Chart)

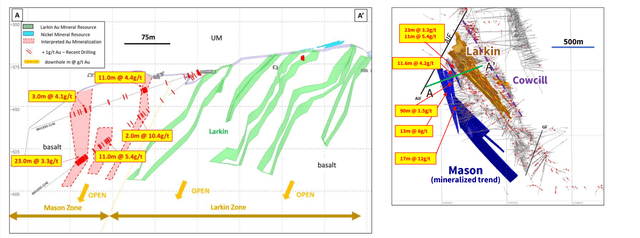

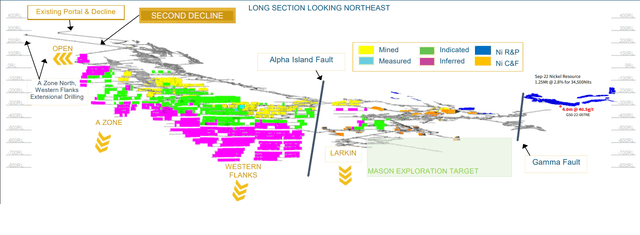

Karora noted earlier this year that it will be focusing on upgrading inferred mineral resources to M&I as well as continued expansion of its reserve base, and with what’s now a ~4.4 million ounce consolidated reserve base (with over half of these ounces at Beta Hunt), the company has certainly justified its recent mill purchase and the addition of a second decline. And it’s worth noting that these resource ounces do not include the Fletcher Shear Zone, where the company hit an impressive 7.0 meters at 46.5 grams per tonne of gold. In addition, these resources do not include Mason and Cowcill, which have also yielded impressive results over solid widths, with a highlight intercept of 17 meters at 12 grams per tonne of gold. To summarize, Karora continues to have some of the most exploration success sector-wide, and this has extended to its nickel resources where it also added meaningful tonnes this year, benefiting the company from a by-product standpoint.

Mason and Cowcill + Larkin Resources (Company Website)

So, was there any negative news?

While the resource and reserve growth at Beta Hunt was positive, we did see a slight decline in resource ounces at the newly defined Larkin Zone, with the January 2022 resource of ~280,000 ounces reduced to ~205,000 ounces, and just ~58,000 ounces making it into reserves, well below the 100,000+ ounces I expected to be added to reserves. Karora noted that it saw a 54% decline in the inferred resource (88,000 ounces) vs. the prior update, with the dip in ounces primarily related to a geological re-interpretation of the northern end of the resource that led to a downgrade in size and grade based on the additional drilling data. And while this is disappointing, the exploration success at Mason and Cowcill should easily make up for this, with the potential for a 150,000 plus ounce reserve base between the three zones (Larkin, Cowcill, Mason), with Cowcill and Mason interpreted to be parallel shear zones to Larkin.

Beta Hunt Mine – Gold Reserves by Zone (Company Filings, Author’s Chart)

Finally, while we haven’t seen a resource update yet from Higginsville, the land package certainly look promising, with an 1,800 square kilometers of tenements south of the famous KCGM Super Pit that’s home to over 12 million ounces of gold reserves. And while Beta Hunt has been the focus which certainly makes sense given that Karora continues to hit impressive intercepts at above average grades wherever it drills at this underground mine, the company’s growth to the 190,000+ ounce production mark should allow for a more aggressive exploration budget with significantly more free cash flow generation per year. Plus, when it comes to Beta Hunt, the significant underground development and relatively low mining costs (~$39/tonne) certainly result in a low hurdle to adding reserves to the mine plan, meaning that while 10+ gram per tonne grades would be a sweetener to head grades, 3.0 gram per tonne material will suffice as well.

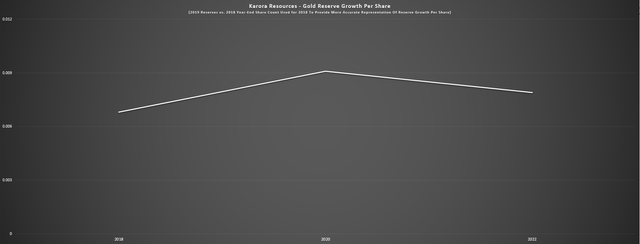

Reserves Per Share

As discussed in past updates, reserve growth is important, but far more important is reserve growth per share. This is because reserve growth that comes at the expense of significant share dilution means that investors are getting exposure to fewer ounces of gold per share held and the result is one is actually seeing their exposure to precious metals diluted by owning a given precious metals producer. The result is that an investor is not getting their desired leverage to the silver and or gold price if reserves and or production per share are declining. Obviously, this isn’t ideal, since it makes little sense to own a more volatile and riskier producer of a commodity (vs. the metal itself) if it is not offering the leverage that one should get for taking on this added risk. Some examples of companies that have consistently failed to deliver reserve growth per share are Coeur Mining (CDE), Americas Gold and Silver (USAS), and McEwen Mining (MUX), and I continue to see these names as un-investable.

Karora Resources – Reserve Growth Per Share (Company Filings, Author’s Chart)

Fortunately, Karora has successfully grown reserves per share, with the company adding considerable reserves and a mill with its Higginsville acquisition, with only moderate share dilution. Notably, this deal allowed the company to be more self-sustaining, with it no longer having to pay a toll to truck its material to other mills and instead sending its material to its own plant. Since then, the company added another 1.0 million tonne per annum mill in Lakewood, which is 20 kilometers to Beta Hunt and nearly doubles the company’s total processing capacity. So, while the reserve per share trend shown above is positive from 2019 to current with reserves doubling, which has outpaced the increase in the company’s share count, the trend is even more impressive given the growth in infrastructure as well. And even if we use the year-end 2018 share count vs. year-end 2019 to reflect the timing of the Higginsville acquisition (a more accurate representation of reserve growth per share) reserves per share has still increased by over 15% (2018-2022).

Beta Hunt Long Section & Resources (Company Website)

While Karora has done a solid job of growing reserves per share since Paul Huet took over as CEO in 2019, it’s important to note that the above chart doesn’t do the company justice. This is because there are multiple opportunities to add to the reserve base that didn’t make it into the most recent reserve update (538,000 ounces of gold reserves at Beta Hunt). These include the Fletcher Shear Zone (1.4 kilometer potential mineralized strike that is a structural analog to Western Flanks), Mason and Cowcill, Spargos Underground (currently being investigated), and other targets that include the Sorrenson Shear Zone, A Zone North, and Western Flanks North. Based on these targets, of which many have yielded significant gold results, I would argue that we could see the Karora’s mineral reserve base grow to 800,000+ ounces by year-end 2025, and assuming ~180 million shares, this would translate to material growth in reserves per share, which is exactly what investors want to see, which is per share growth in production and reserves, and not simply absolute production/reserve growth.

Let’s look at Karora’s valuation and see whether the stock is in a low-risk buy zone:

Valuation

Based on ~181 million fully diluted shares and a share price of US$3.05, Karora trades at a market cap of ~$552 million, a very reasonable valuation for a ~150,000-ounce producer that’s working to grow into a ~190,000-ounce producer. This is especially true given that Karora benefits from operating costs well below the industry average ($1,150/oz vs. ~$1,300/oz) and continues to make new discoveries at its flagship Beta Hunt Mine that could ultimately propel the company’s total resource base (measured, indicated, and inferred) above the 5.0 million ounce mark (~4.4 million ounces currently). That said, I am looking for a significant margin of safety when it comes to starting new positions in small-cap gold producers, with a preferred 40% discount to fair value at a bare minimum. And while this was certainly the case when I bought the stock below US$2.10 last year, I don’t see that margin of safety present currently.

Using what I believe to be fair multiples of 1.0x P/NAV and 7.0x FY2023 operating cash flow estimates and deriving Karora’s estimated fair value from a 70/30 weighting to price to net asset value (70%) and price to cash flow (30%), I see a fair value for Karora of US$4.31 per share. And while this fair value estimate points to a 41% upside from current levels, the ideal buy zone to bake in a minimum 40% discount to fair value comes in at US$2.59 or lower. Obviously, there’s no guarantee that the stock drops another 12% to move into this low-risk buy zone, but I prefer to pay the right price or pass entirely, especially for volatile small-cap names like Karora, and with open gaps below in the stock that could be filled at some point (as we saw with the Q1 2022 unfilled gap) and a few other small cap names trading at far greater discounts to fair value, with some trading at barely 4.0x FY2025 free cash flow estimates, I see more compelling setups elsewhere.

KRRGF Unfilled Gap – Daily Chart (StockCharts.com)

Summary

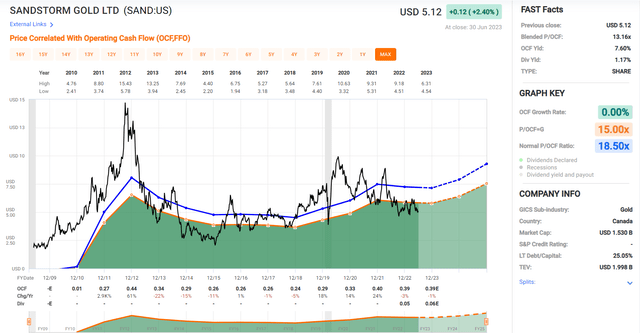

Karora was one of the few producers that meaningfully increased reserves per share in 2022 and it accomplished this while maintaining a relatively conservative gold price assumption of $1,450/oz, in line with the small-cap and mid-cap average. So, with continued exploration success and the stock over 30% off its year-to-date highs, it’s certainly possible that the stock could bottom out here. However, given the stock’s outperformance over the past year, there are several more attractive options from a valuation standpoint sector-wide, one of which is Sandstorm Gold Royalties (SAND) which trades at only a slighter higher P/NAV multiple (0.90x vs. 0.70x) as a royalty/streaming company with nearly double the margins ($1,500/oz vs. ~$800/oz) and greater diversification (~40 producing assets vs. two producing assets).

Sandstorm Gold – Current Valuation vs. Historic Cash Flow Multiple (FASTGraphs.com)

Obviously, Karora could outperform Sandstorm if the gold price trades up to new highs, but I would argue that the bar is set much lower for Sandstorm to beat due to two years of underperformance. Plus, with Sandstorm being one of the most hated stocks sector-wide and Karora having more neutral sentiment, I would argue that there’s much less downside for Sandstorm, allowing for larger-sized bets. Finally, I see far greater upside for Sandstorm, with SAND’s fair value coming in at US$8.95 (72% upside) even if it just trades in line with its closest peers, pointing to a far more attractive reward/risk setup. So, while Karora has a solid year of growth ahead and while I would strongly consider buying the stock were to pullback below US$2.60, I think there are several more attractive places to direct one’s capital currently. Two names that stand out are Telus International (TIXT) at ~13x EV to FY2024 FCF, and Sandstorm at ~12x EV to FY2025 FCF, with both arguably being lower-risk bets.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here