H.B. Fuller (NYSE:FUL) manufactures adhesives, coatings, encapsulants, and other chemical products. They work in three segments: Engineering Adhesives [EA]; Construction Adhesives [CA]; and Hygiene, Health, and Consumable Adhesives [HHC]. In the EA segment, they produce high-performance industrial adhesives like light cure and silicone. In the CA segment, they offer products for tile setting, heating, and insulation applications. In the HHC segment, they produce specialty industrial adhesives, like thermoset and thermoplastic.

FUL recently announced its Q2 FY23 results. In this report, I will analyze its Q2 FY23 results. I think they are overvalued, and there are headwinds that might hamper their growth throughout FY23. Hence I assign a hold rating on FUL.

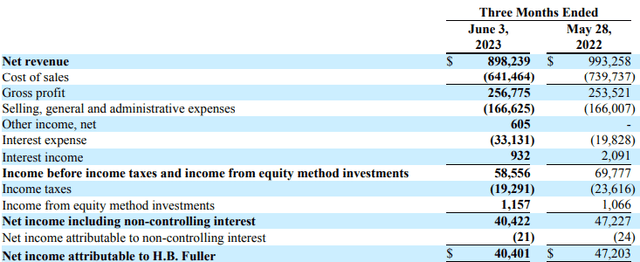

Financial Analysis

FUL recently posted its Q2 FY23 results. The net revenue for Q2 FY23 was $898.2 million, a decline of 9.5% compared to Q2 FY22. I think underperformance in all its segments was the main reason behind the revenue decline. The organic revenue of the Hygiene Health and Consumable Adhesives [HHC], Engineering Adhesives [EA], and Construction Adhesives [CA] segments were down by 5.5%, 9%, and 14.2% in Q2 FY23 compared to Q2 FY22. I believe the HHC and CA segments were mainly impacted due to the high customer destocking, and the EA segment was impacted by lower volume in the durable goods and construction market. The gross margin for Q2 FY23 was 28.5% which was 25.5% in Q2 FY22. I believe raw material cost actions and a favorable pricing policy improved the gross margin.

Seeking Alpha

The net income for Q2 FY23 was $40.4 million, a decline of 14.4% compared to Q2 FY22. I believe the improvement in the gross margins and EBITDA margins was quite impressive. Despite a 9.5% decline in revenues, their EBITDA grew by 3% in Q2 FY23 compared to Q2 FY22, which improved their EBITDA margins. Despite the decline in revenues delivering margins like this is quite impressive. I stated before that raw material cost actions, pricing, and operational efficiencies led to the improvement. But still, we cannot ignore the decline in revenues. Now talking about the second-half expectations, they first started to experience the destocking issue in Q4 FY22, so I think the destocking issue has started to decrease, and it might not affect them as much as it did in Q2 FY23. So I think we might see an improvement in the revenue in the second half of FY23. But I think it would still be less than the second half of FY22 as the destocking issue is still present.

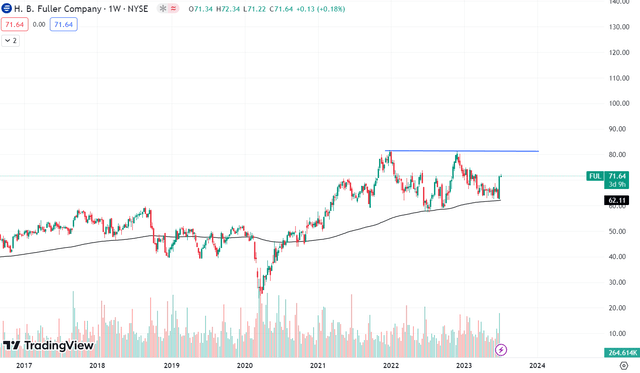

Technical Analysis

Trading View

FUL is trading at the $71.6 level. After consolidating in a small range of $63-$68 for three months, the stock has broken out of it and is headed towards its all-time high of $81. The 200 ema, which is at $62, is also providing strong support to the stock. Talking about the buying opportunity, I think buying opportunity will only arise once it crosses its all-time high of $81 because the stock has failed to cross the $81 level two times in the past, and both times after touching the $81 level, the stock has corrected about 25%. Hence I would advise waiting for the level to break, as I think once the $81 level is broken, we might see fresh momentum in the stock.

Should One Invest In FUL?

First, talking about FUL’s valuation. FUL has a P/E [FWD] ratio of 18.39x compared to the sector ratio of 13.73x. This shows that it is overvalued according to industry standards, and in addition, its five-year average P/E ratio is 16.5x, so it is currently trading above its historical average. So in both scenarios, it seems that it is currently overvalued. FUL has an EV / EBITDA [FWD] ratio of 9.75x compared to the sector ratio of 7.72x. So both ratios indicate that FUL is currently overvalued.

The management is expecting its FY23 revenue to be down by 3%-5% compared to FY22 revenue, and I think with the slower industrial production and current destocking actions, they might struggle with the revenue growth. So I think they don’t deserve to trade at higher multiples as I think their growth rate doesn’t justify their high valuation. But still, as I mentioned earlier, I expect the second half to be better than the first half of FY23 in terms of financials.

After analyzing all the factors, I think it is best to wait for the headwinds to pass, and I think the headwinds might last till Q4 FY23. Hence I think one should wait for FY23 to end to make any investment decisions in the stock. Hence I assign a hold rating on FUL.

Risk

The value of their pension trust assets, their future expected pension liabilities, and other postretirement benefit plans might all suffer from poor equity market conditions and credit market volatility. They might also need to contribute more money to the pension plans. Because of this, their financial outcomes can suffer. Restricted access to financing markets may impact their capacity to finance acquisitions and other strategic growth activities. Additionally, the decreased credit availability can make it harder for their clients to fund business investments, refinance debt that is about to mature or cover continuous working capital requirements. The demand for our products may fall if these clients lack access to the financial markets.

Bottom Line

FUL is facing destocking and slower industrial production issues which I think might last till the end of FY23. The destocking affected their revenue growth in Q2 FY23, which might continue to affect them in the second half. Hence looking at all the factors, I think it is best to avoid trading in the stock till the end of FY23. So I assign a hold rating on FUL.

Read the full article here