Amid ongoing social unrest at home and abroad, there’s a growing total addressable market for expanded law enforcement tools and technologies. Estimated at more than $650 million among U.S. agencies, VirTra (NASDAQ:VTSI) has plenty of room for growth should budgets allow for increased spending. I have a buy rating on VTSI for its decent valuation, robust growth outlook, but somewhat concerning near-term chart.

VirTra: Room To Grow

VirTra

According to Seeking Alpha, “VTSI provides force and firearms training and driving simulators for law enforcement, military, educational, and commercial markets worldwide. The company’s patented technologies, software, and scenarios provide intense training for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations.” The firm boasts that its “simulations are intense, immersive, and realistic training solutions that will give officers the skills they need to always be prepared and ready for the unexpected.”

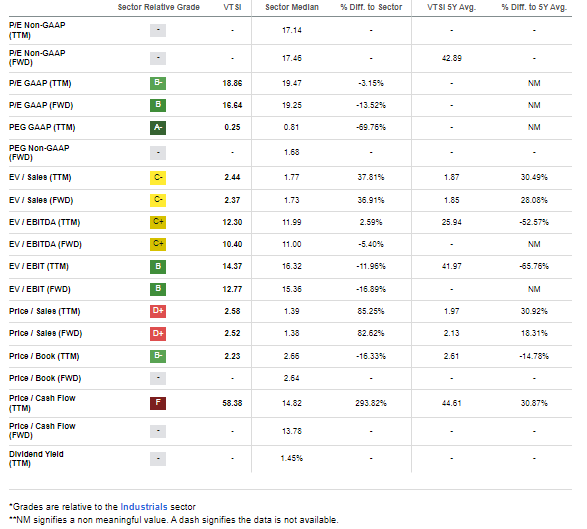

The Arizona-based $81 million market cap Aerospace and Defense industry company within the Industrials sector trades at a near-market 18.9 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to Seeking Alpha. The stock has a high 63% implied volatility reading.

Back in May, VirTra reported a strong GAAP earnings beat – per-share profits verified at $0.27, topping estimates of just $0.24. Sales totaled $10 million, a strong 47% increase from $3.15 million earned in the same period a year earlier. The stock responded very favorably, jumping from $5.40 at the close of the previous trading week to just above $7 in the days after the Monday afternoon earnings date. Big volume was seen on the chart, too (detailed later in The Technical Take).

The upside surprise comes after the firm appointed a new CEO last December, and the company stands to benefit from the ongoing trend toward equipping law enforcement and the military.

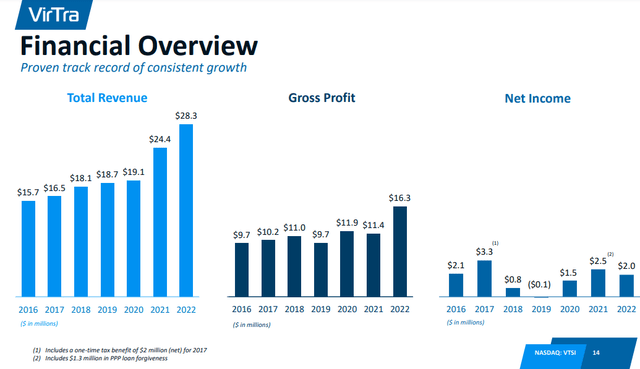

VirTra’s Sales Trends Are Positive, Earnings Accretion Likely To Come

VirTra

Risks

Key risks include municipal budgets being pressured and the chance of reducing military funding at the Federal level. It’s also possible that the new CEO may struggle to execute on near-term and long-term growth initiatives. Something else to monitor in the upcoming Q2 report is the margin situation. There may be a higher bar for margins today compared to a few quarters ago, given the trend improvement mentioned earlier. Another variable is the company’s order backlog, which has been robust, but a shrinking backlog as a result of fewer orders would likely send the stock lower. I am also somewhat concerned about growing operating expenses, so more strategic investments rather than rising costs with related to expansion would be good to see in my view.

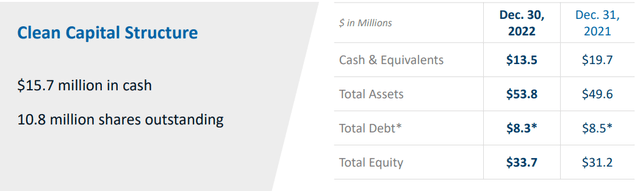

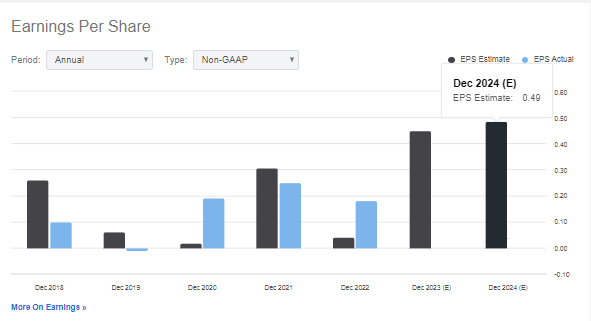

On valuation, earnings per share are expected to rise sharply over the coming quarters. Also encouraging is the firm’s sales trajectory, which shows steadily climbing revenue trends. 2023’s net sales are expected to rise above $32 million from just $28.3 million last year. Operating margins are steady in the high single digits, while its profit margin over the last 12 months is at the best level in more than 5 years. The company is not highly dependent on debt financing – the capital structure is less than $10 million debt compared to its market cap of $82 million, though it is free cash flow negative.

VirTra: Robust Balance Sheet

VirTra

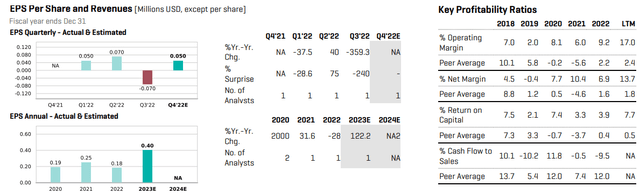

VTSI: Big 2023 EPS Growth Expected

CFRA Research

If we assume $0.47 of EPS over the coming 4 quarters (the expectation based on the chart below) and apply a 17 earnings multiple (between its current multiple and the sector median), then the stock should be near $8. I assert a modest P/E is warranted given that the stock already trades above the sector median price-to-sale ratio.

EPS Estimates

Seeking Alpha

The bulls could argue that the firm’s historical non-GAAP forward P/E of 43 suggests a loftier valuation, but there’s high risk with this small company. Lastly, if we simply give VTSI a market EV/EBITDA multiple, then the stock should be about 10% higher from the current $7.50 level.

So, I have a soft buy on valuation based on likely upcoming EPS growth and will outline a way to buy the stock on sale later in this report.

Weaker margins and higher operating expenses, along with a reduced order backlog, are items that would lead to turn less optimistic on the company, and would likely result in a downgrade my buy rating. We should find out more in the August Q2 report.

VTSI: Generally Favorable Valuation Metrics Considering The Expected Growth Trajectory

Seeking Alpha

Looking ahead, the next earnings report is scheduled for August 11.

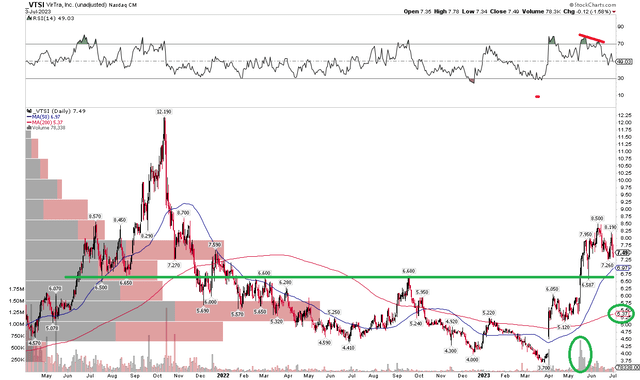

The Technical Take

VirTra’s momentum is strong right now, but I spot some risks. Notice in the chart below that the stock broke above key resistance at the $6.9 mark. There was a big volume spike in May following its strong Q1 earnings report that resulted in an upward share price move. VTSI went on to retest previous resistance (now support) later that month, and it just recently made fresh highs dating back to late 2021.

Lately, though, momentum has actually slowed – and that is evidenced by a bearish RSI momentum divergence as seen at the top of the chart. RSI failed to make a new high as the stock price hit $8.50. With VTSI now $1 under that high, I see the chance of another visit to that $6.50 to $7 range – that’s also where the rising 50-day moving average comes into play. The good news for the bulls is that the long-term 200-day moving average is upward-sloped, which is a bullish trend indicator.

Overall, the chart is solid, but I have concerns that a correction is taking place, so buying the dip into the high $6s appears as a favorable risk/reward play.

VTSI: Eyeing Key Support Near $6.90, Rising 200DMA, Bearish Near-Term RSI

Seeking Alpha

The Bottom Line

I like the growth story with VirTra, and a ‘buy the dip’ strategy I assert works best in this instance.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here