When Marathon Petroleum (NYSE:MPC) reported the 1st quarter earnings, management described the markets, tight. Crack spreads, the difference between crude oil costs and product sales, have been volatile, ranging at least in the Gulf Coast, between $60 last June to $30 this June, but markets still remain tight. For Marathon, with its rather unique business structure having two sources of cash, operations driven by crack spreads and distributions from MPLX (MPLX), continues to mint money. With regard to the last source, management stated,

“This quarter, it generated adjusted EBITDA of $1.5 billion, which is up 9% year-over-year. MPLX distributions to MPC was roughly $500 million this quarter and an annualized rate of over $2 billion, which fully covers MPC’s dividend as well as half of our planned 2023 capital program.”

In our past MPLX article, we noted strong signs of increased distributions perhaps 10%, an increase which would pay for most of the total capital plus dividend equaling $775 million last quarter. From the seasonally higher crack spreads, the company generates enormous amounts of cash, which it has used primarily to repurchase stock. Investors ought to be asking questions. Will tight markets continue supporting strong cash flow? What will management decide to do with all the cash? Let’s measure the size of the doghouse vs. the size of the dog. (If the dog just doesn’t fit, there has to be spillover.)

1st Quarter Results

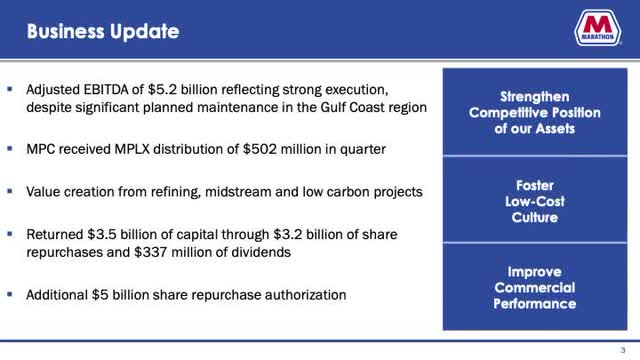

A slide from the company’s 1st quarter presentation summaries the results.

Marathon 1st Quarter

Of the $775 million spent by Marathon for capital and dividends, MPLX sourced $500 million leaving approximately $5 billion in EBITDA and most of the free cash flow $4.2 billion free for spending elsewhere. The company used $3.2 billion to repurchase shares equaling approximately 25 million leaving 425 million issued. It has $9 billion left on its repurchase authorization. Quarterly earnings totaled $6 per share.

Working capital’s $100 million headwind slightly lowered cash, but a bigger headwind, heavy 1st quarter Gulf Coast planned maintenance plus Winter Storm Elliott impacted utilization negatively by 5% dropping from 94% to 89%.

Another expense, tax rates, averaged just above 20% forcing the company to set aside a provision of $800 million. Corporate expense remain reigned in with last year’s $100 million reduction.

Management noted strong gasoline demand during what is normally a weaker time of the year,

“So at least in our view, we think it’s a very constructive time for gasoline at this time of the year as we’re heading into which is more of the higher demand time as we head into the summer.”

Guidance for the 2nd quarter follows:

- 2.6 million barrels per day throughput up 2% quarter over quarter driven by lower levels of planned maintenance.

- Lowering operating costs to $5.20 with higher throughput and lower energy costs. Future operating cost might trend lower for the year settling out at $5.

Management also offered this important general statement.

“At the same time, supply remains tight, supported by nearly 4 million barrels per day of global refining capacity that has come offline in the last couple of years. Global demand continues to grow as the need for affordable, reliable energy increases throughout the world. IEA is projecting 2 million barrels a day increase in 2023. . . . As we continue through the year, much will depend on the ongoing recovery in China and the extent, if any, of recessionary impacts.”

In summary, 1st quarter was the strongest in company history and markets are still tight.

Investing in the Future

Marathon’s Star Texas City project with its 40,000 barrels per day is in startup. Another project, Martinez, CA (renewables), the biggest change, is also approaching startup. Investors should follow its impact, but from our experience, this type of operation unless prudently located, of which we know of only one, hasn’t been terribly successful.

Competition & Tightness

Because of the unusually strong crack spreads, management bantered with analysts over competitive issues. This part of the call was probably the most interesting and important. With respect to Asian imports into the West Coast, Marathon pointed out that it had several advantages:

- Tanker rates for transportation are up 2x to $8 per barrel, resulting in a $0.20 per gallon advantage.

- Lack of tanker availability.

- Logistic constraints in terms of docks and tankage.

- California specification issues.

With respect to Asia and Europe, management noted,

“Singapore and Asia and Europe, we’re hearing rumors of run cuts there, which we see as bullish for us, especially on the West Coast, as you know, the incremental barrel at times comes from Asia. And if it doesn’t come to the West Coast, we see that as positive for margins and cracks.”

On structural issues, management considers Europe “as the marginal player” with cost feedstock complexity, workforce and reliability advantages.

Growth into strengthening markets bodes extremely well for strong pricing. We noted early in the article that crack spreads for the Gulf Coast 2-1-1 have been volatile ranging in the $60’s to the $30s during the last year.

Gulf of Mexico Sized Cash Flow

The size of the cash flow that Marathon has been generating in the last few quarters can’t be overlooked. At the current rate, Marathon would repurchase 20% or more of its stock per year. It also seems clear that plans to repurchase significant levels of stock remain with still $9 billion authorized enough to approximately purchase another 75 million shares. At some point, lower levels force management into alternative uses, i.e. significant increases in dividend could be one of those.

The balance sheet holds almost $12 billion cash, approximately $30 per share. Last quarter’s earnings equates to $25 per share per year or 20%. At this point it is important to remember most of the capital and all of the dividend are paid from MPLX. Free cash from Marathon drops uninhibited to the balance sheet or to shareholders. With respect to the dividend, Maryann Mannen, company CFO, added:

“So as it relates to the dividend, we continue to be committed to the secure competitive and as we’ve said, potentially growing dividend. We’ve committed to evaluate that dividend at least annually, and we intend to do so in a very similar schedule as we did in 2022.”

The Multiple Billion-Dollar Question

Can the spreads continue at this level? The obvious history answer is, no. This is considered mid-cycle results. But, in our view, the cycle is different driven from political investment destruction, virus shutdowns and other issues. An estimate provided by the EIA adds strength to our position.

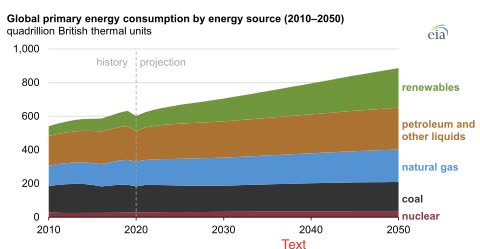

EIA ((EIA))

The continued lack of investment in crude production and U.S. refining doesn’t bode well for reductions in petroleum product pricing as shown above in the EIA slide with fossil fuel usage continuing to increase. The idea that massive reductions in consumer costs seems remote long-term.

Risk & Reward

In our view, the major risk lies in a sudden and catastrophic collapse in demand from an event such as the virus a few years ago. But even that is most likely a short-term event.

What we believe is that the next two quarters are likely to expose the lower range on crack spreads. In particular, the June quarter report will reveal a lot of what might be the lower end for Marathon financial results. From our own data, the Gulf Coast crack spreads for the March quarter, a good measure, averaged $36. In the June quarter-to-date, the average equals $30 or 20% lower. Management noted an increase of 2% in operating utilization and a cost drop of $0.50 per barrel. It appears to us that the June quarter free cash flow might drop into the low $3 billion range from the $4 billion produced in March. This is still an enormous number with a run rate at $12 billion per year, a result ten times greater than the current dividend payout. We expect the June results, in particular, to capture a picture for the future. We rate this stock a hold until the June results, but if our estimate is close at $3.2 billion in free cash flow, this becomes a buy.

The valuation of the stock under consideration borders on ridiculous. The company profits fall in the realm of 25% of the valuation using last quarter’s results and a possible 20% under June’s estimate. In two years, at least at these numbers, earnings per share could jump another 40% due to repurchases. This kind of possibly force investors to ponder possibilities of 5-10 times valuation. The yield at $110/share equals 3% in-line with other refineries. What happens to evaluation if Marathon should increase the dividend five times? Does the stock price increase five times? What will they do with all the cash with share count under 300 million two years out at the current pace? Again, a quarter or two more is required to access risk, but it seems clear that long-term systemic structural changes will drive higher dividends and stock pricing. The dog is way too big for the dog house and at some-point that fact will spillover into the hands of patient shareholders. We are holding for the results of the June quarter.

Read the full article here