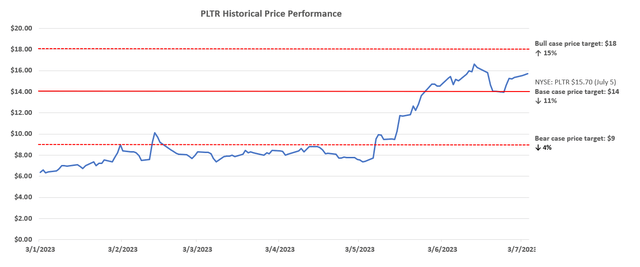

Palantir Technologies Inc. (NYSE:PLTR) stock has doubled in value from a steep rally over the six-week period after the introduction of its AI Platform (“AIP”), bolstered by management’s reaffirmation on the full year guidance for GAAP profitability, in early May. As discussed in our previous coverage, we had noted how the combination of positive cash flows, GAAP profitability, and additive prospects of AIP has improved investors’ confidence and bolstered the stock’s appeal amid a flight-to-safety trade ahead of lingering macroeconomic uncertainties.

And the shares have continued to find resilience in the mid-teens despite a slight setback last week, dragged down by the broader market’s pullback and a ratings downgrade by Raymond James. While it currently trades at a whopping 68x estimates earnings, outperforming AI leader Nvidia Corporation’s (NVDA) 47x, the metric is still a far cry from the 284x observed for rival Snowflake (SNOW). Admittedly, P/E may not be the best metric for gauging market’s optimism over the Palantir stock’s valuation prospects, given its currently nominal profit margins and expectations for more constructive expansion ahead.

From a sales perspective, the stock now trades at about 14x its estimated top-line, below Nvidia’s 21x and Snowflake’s 20x, which is much more comparable on a relative basis considering their respective growth prospects. Yet, there is also a discord when compared against AI software peer C3.ai (AI), which trades in line with Palantir at 14x estimated sales, though the underlying business remains unprofitable and cash negative, alongside weakened growth prospects based on management’s commentary during the latest earnings release.

The mixed picture on the market’s enthusiasm for AI based on the performance of some of the most blessed stocks by the burst of interest in the nascent tech trend is brewing curiosity over how much of the related valuation gains is hype and how much is real – especially amid persistent macroeconomic uncertainties that yield to little visibility on the future of corporate earnings, exacerbated by surging borrowing costs that will further dull the luster of future cash flows at growth names like Palantir. In the following analysis, we share our updated financial forecast and valuation for the stock to gauge its near-term prospects.

While the AI momentum – which Palantir aspires to dominate in but has yet to disclose a monetization plan for – is overtaking the company’s fundamental spotlight that is currently anchored in profitability after its 30% annualized growth target through 2025 has been derailed by unexpected macroeconomic headwinds over the past 12 months, we expect the two factors to reinforce both the underlying business and stock’s prospects. AI will drive growth despite Palantir’s uncertain monetization roadmap for the technology, given ensuing cross-industry total addressable market (“TAM”) expansion. Meanwhile, the adoption of AI will also improve productivity and help ongoing margin expansion efforts taken on across the broader tech industry amid the uncertain macroeconomic climate. Looking ahead, the sustainability of the newly priced premium into the Palantir stock observed in recent months will depend on whether its GAAP profitability can demonstrate improved durability and management can provide clarity on AIP’s forward monetization plan.

Can AIP Bring Back 30% Growth?

Recall that the market’s optimism for Palantir was previously rooted in management’s commitment to driving 30% annualized growth through 2025. But said growth aspirations were quickly derailed by a combination of lumpy government contract revenue recognition timelines, exacerbated by a wind-down in pandemic-driven demand, alongside an economic slowdown that followed and weighed on the expansion of Palantir’s commercial prospects.

The company has faced continued deceleration over the past 12 months, with its near-term pace of annualized growth likely to settle in the teens, or at best, the 20% range given the uncertain IT spending environment and lumpy nature of government revenues. The 30% annualized growth target would have set 2025’s revenue target at about $4.5 billion – a figure that now appears out of reach, despite burgeoning interest in AIP, given management has yet to provide a constructive monetization roadmap for the recently introduced solution.

The issue of how do you have security, a data model or knowledge and wisdom that’s proprietary, interact with an external large language model or with generative AI is not new to Palantir, and that’s why we were able to launch our platform AIP so quickly, the demand for — of which is nothing I’ve ever seen in 20 years of being involved in Palantir…our strategy on AI is just to take the whole market. We have no pricing strategy.

Source: Palantir 1Q23 Earnings Call Transcript.

The setback in Palantir’s growth narrative has pushed the company to redivert its focus onto profitability. The combination of stock-based compensation (“SBC”) reductions and job cuts, helped by better-than-expected below-the-line gains, have bolstered prospects for sustained GAAP profitability through 2023 and beyond. But the recent introduction of AIP – and broader AI momentum across the enterprise end market – has helped salvage some of Palantir’s growth story from being completely left on the back burner, keeping the company on the map as a viable name to benefit further from secular trends ahead.

IT budgets are expected to prioritize AI investments in the coming years, with related spending intentions to account for as much as 10% of total digitization expenditures next year, underscoring significant growth headroom and a robust demand environment for AIP. The advent of mainstream generative AI adoption is also expected to expand the TAM for cloud-based data solutions and software. Anticipated demand for both infrastructure used in the development and deployment of generative AI technologies, and relevant software is expected to drive combined opportunities valued at more than $330 billion by 2032, bolstering growth prospects for Palantir’s wide-ranging portfolio of cloud-based data platforms and solutions, such as Foundry, Gotham, Apollo, and now AIP, over the longer-term.

Specifically, the emerging demand for AI-facilitating software is expected to complement Palantir’s existing modularization strategy, underpinned by its development of industry-specific platforms to improve end user scalability. For instance, AIP can address rising enterprise urgency in AI adoption by allowing its customers to train large language models used in the development of generative AI solutions using their own data, while also leveraging the “security, control and auditability” functions built into its various industry-based Foundry solutions to optimize scalability.

However, the company is likely to experience lingering challenges from its ailing Strategic Investment Program. Recall from management’s warnings earlier this year that related revenues are expected to “drop-off” significantly in the second half of 2023 due to market uncertainties. This is further corroborated by Palantir’s most recent 10Q disclosures, which outlined a decrease of $102.4 million in the value of related contracts as of March 31, 2023 compared to the period ended December 31, 2022:

The total value of such Strategic Commercial Contracts as of March 31, 2023 was $390.3 million, inclusive of $43.7 million of contractual options. When determining the total value of these Strategic Commercial Contracts, we assess customers’ financial condition, including the consideration of their ability and intention to pay, and whether all or some portion of the value of the contracts continue to meet the criteria for revenue recognition, among other factors. As a result of these assessments, the above $390.3 million of total value of Strategic Commercial Contracts excludes an aggregate of $102.4 million of the value of certain contracts when compared to the amounts as of December 31, 2022…some of our early-stage Investee customers recently filed for bankruptcy, and the remaining value of the commercial contracts with such customers that is not expected to be recognized as revenue has been excluded from the total value of Strategic Commercial Contracts above.

Source: Palantir 1Q23 10Q Filing.

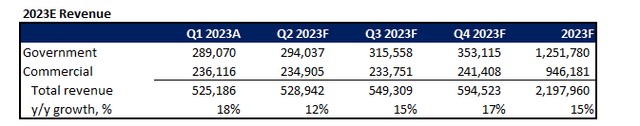

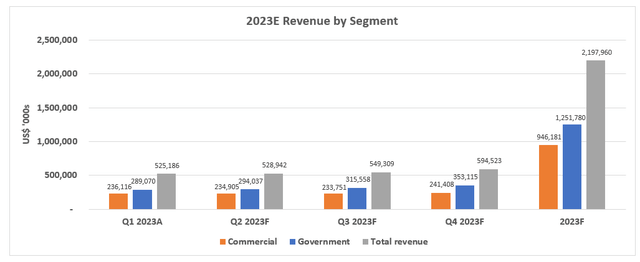

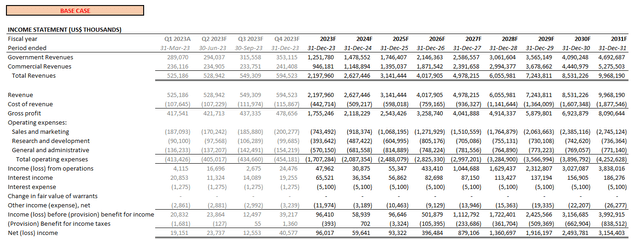

Considering the emerging AI tailwinds, offset by low visibility on Palantir’s near-term growth outlook considering lingering challenges from the uncertain IT spending environment amid deteriorating macroeconomic conditions, alongside an undetermined pricing strategy for AIP, we expect the pace of revenue growth to stay in the mid-teens for full year 2023. This is in line with management’s guidance for revenue in the current period to range between $528 million (+11.6% y/y) and $532 million (+12.5% y/y), and for full year 2023 to range between $2.18 billion (+14% y/y) to $2.23 billion (+17% y/y).

Author Author

The base case revenue growth assumption also considers recent industry sentiment checks, which show that while IT spending intentions for software are stabilizing, they have yet to recover. Specifically, software providers continue to face deterioration in new customer acquisitions during June due to persistent macroeconomic uncertainties. Yet, some have been able to leverage their existing customer base to benefit from consistent contract expansions to offset impacts from the tepid demand environment.

We expect Palantir to have benefited from the same trend in the last three months, leveraging its “land-and-expand” business strategy that continues to demonstrate effectiveness as an insurance, to some extent, against rising competition and macro-driven uncertainties to its demand environment. This is corroborated by the recent expansion of its partnership with Jacobs Solutions (J). As previously discussed, Palantir has been partnering with the consulting and project delivery expert since last year to develop industry-tailored versions of its Foundry platform for commercial users – particularly in the water management sector. The expanded tie-up will add commercialization of industry-specific AI solutions for application across “critical infrastructure, advanced facilities, supply chain management, and more” by incorporating AIP.

Through the adoption of Foundry and now AIP, Jacobs is delivering end-to-end, AI-powered solutions with real-time computing power, actionable data and control…Our previous success in helping Jacobs’ clients achieve efficiency improvements in energy utilization and chemical usage is only the beginning.

Source: Jacobs and Palantir Expand Partnership.

The latest development underscores the effectiveness of Palantir’s land-and-expand business strategy in driving growth through both upselling and cross-selling across adjacent offerings. The go-to-market strategy is also expected to contribute favorably towards Palantir’s ongoing margin expansion efforts by lowering customer acquisition costs over time as land-and-expand continues to drive scale. The latest expanded tie-up with Jacobs also underscores favorable prospects for continued improvements to Palantir’s cross-industry AI penetration, which will broaden its access to opportunities in the emerging growth frontier.

Author Author

Meanwhile, on the government front, Palantir has also been consistently landing and expanding contracts across various public agencies beyond defense, and beyond the U.S. This includes the new contract valued at $463 million awarded by the U.S. Special Operations Command (“USSOCOM”), which will require Palantir to help drive insights on data acquired by the agency and enable informed decision-making. The partnership is likely to also leverage Palantir’s recent advancements in AI to “reduce cognitive load on war fighters and commanders,” bridging the gap in military capabilities on the field. At least five other government contracts with non-defense U.S. public agencies, such as the Department of Health and Human Services and Department of Agriculture, valued at about $25 million have also started during the second quarter. In Europe, Palantir is also seeking to better leverage its talent in the region to drive incremental advancements in innovation, such as AI, to better facilitate government agency demands in the region, spanning health and defense.

We have had a large presence for over a decade in the U.K., a thousand engineers based here, and we do much of the core research and development for other software here…We have been in Ukraine for 18 months and that has opened the eyes of [not only] Europe but the wider world to whether there might be gaps in military capability. Clearly that has opened opportunity for us around the world.

Source: Bloomberg News Interview with Louis Mosley, Executive VP for U.K. and Europe Palantir.

We expect Palantir’s industry-leading compliance accreditations as an advantage to bolster its ability in capitalizing on AI opportunities in the public sector, especially considering growing calls to better “regulate emerging tools and address the potential downsides of the technology.” Recall that Palantir is only one of three companies alongside Microsoft (MSFT) and Amazon’s AWS (AMZN) that have been accredited IL6 clearance from the Defense Information Systems Agency. The company is also FedRAMP and IL5 accredited which gives it additional national security clearance to provide cloud offerings for classified public agencies across the U.S. federal government, including the Department of Defense and Intelligence Community, enabling deeper penetration across AI opportunities in government verticals.

Author Author

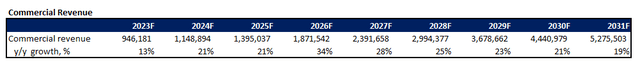

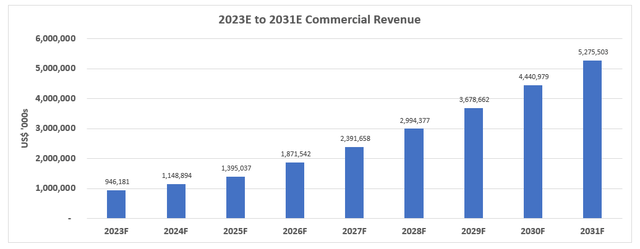

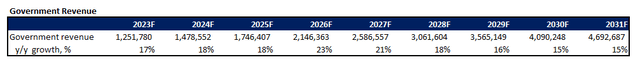

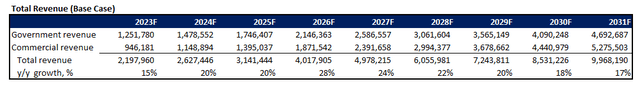

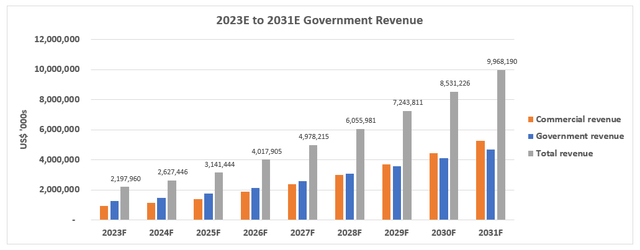

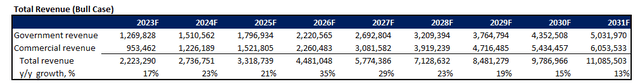

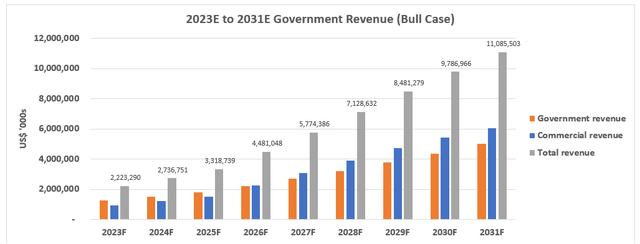

Taken together, we expect total revenue to expand at an 18% CAGR through 2021, driven by a 21% CAGR in commercial revenue and 16% CAGR in government revenue over the same period.

Author Author

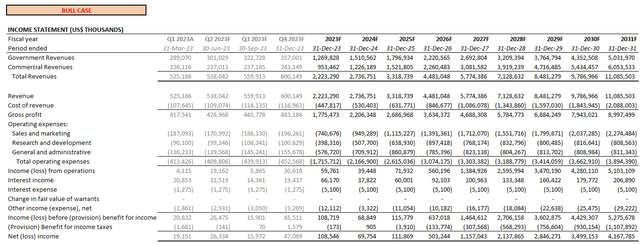

In the upside forecast, we expect commercial revenues to grow at a faster-than-expected pace amid surging demand for AI solutions. However, related upsides are not expected to be material in the near-term given industry is still in the early innings of adopting nascent AI technologies. But over the longer-term, there is potential for Palantir to further accelerate commercial revenue growth, considering the proven benefit of its modularization strategy in deploying industry-based, enterprise-grade cloud-based solutions as corroborated by the expansion of its partnership with Jacobs into the AI foray.

Author Author

Stepping Up on Profitability

As discussed in our previous coverage in the stock, Palantir’s positive operating margins (+1%) for the first quarter is an impressive improvement from wide operating losses (-4%) in the fourth quarter, bolstering durability to its GAAP profitability aspirations through the remainder of 2023. The question is whether the bottom-line can expand at a sustainable pace, considering the additional benefit of below-the-line increases – such as elevated interest income and non-recurring transaction gains – observed in recent quarters fade. While reduction in forces implemented earlier this year are expected to translate into a more evident impact on SBC reductions through the remainder of the year, more constructive efficiencies in operating expenses remain to be seen as the cost structure ex-SBC observed during the first quarter remain largely unchanged from those exiting 2022, with the exception of general and administrative spending.

In our base case forecast, we estimate gross margins (ex-SBC) in the 80% range in the current year and through the longer-term, in line with historical levels as well as the cost structures of comparable SaaS peers. Operating margins (ex-SBC) are expected to stay modest in the low single-digit percentage range this year considering expectations for elevated sales and marketing and R&D spending to drive growth, with improvements in the latter half of the decade as the land-and-expand strategy continues to scale. We expect much of the opex improvements (ex-SBC) to come out of non-sales generating general and administrative functions, in line with improvements observed during the first quarter. On the SBC front, we expect 2023 levels to remain largely in line with the payout structure exiting the fourth quarter, which would represent an eight-percentage-point step-down from full year 2022, with greater reductions in the latter half of the decade to reflect scale.

Author

In the upside scenario, we expect Palantir’s cost structure to benefit from more constructive improvements in addition to SBC reductions, in line with our bull case expectation for revenues to grow more than expected and drive greater scale for the business. Opex efficiencies are expected to be most prominent in the general and administrative, and sales and marketing functions, while R&D spend is expected to stay in line with base case levels given the importance of investing in innovation to drive sustained growth.

Meanwhile, general and administrative spend relates to cost functions in which the company could potentially exercise greater discipline in, while sales and marketing spend could benefit from further reductions via a differentiated go-to-market strategy and faster-than-expected ramp-up of Palantir’s land-and-expand strategy to lower longer-term customer acquisition costs. This is in line with Palantir’s recent go-to-market partnership with AWS, leveraging the public cloud-computing vendor’s leading market share to improve the deployment of Foundry and AIP for businesses to commercial end users, without material incremental sales costs.

Author

Valuation Analysis

Author

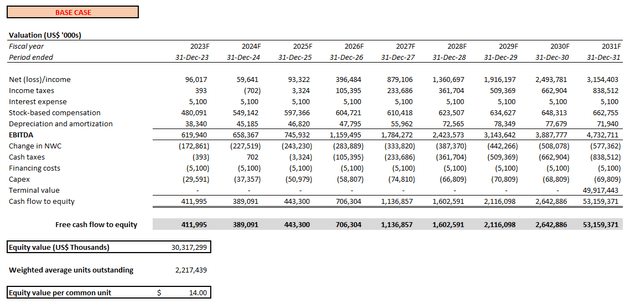

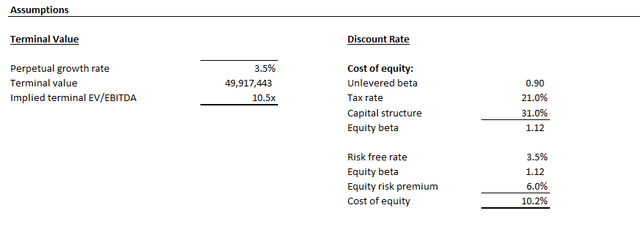

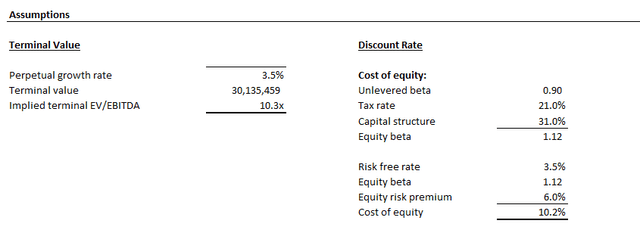

We have arrived at a $14 price target using the discounted cash flow (“DCF”) approach applied on projected cash flows taken in conjunction with our base case fundamental forecast for Palantir, with the application of a 10% WACC in line with the company’s capital structure and risk profile, alongside an estimated perpetual growth rate of 3.5% in alignment with the anticipated pace of economic growth across its core operating regions. This is largely in line with levels in which the stock has been finding support since demonstrating improved sustainability to GAAP net income and an expanded growth frontier via burgeoning market interest in AI.

Author Author

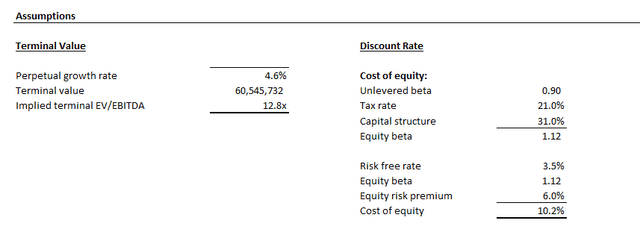

Currently trading at about $16 apiece (July 5 close), Palantir stock implies a perpetual growth rate of 4.6% while holding underlying cash flow projections and the 10% WACC assumption unchanged. The divergence in the implied perpetual growth rate likely represents the premium in which market has allocated to Palantir for potentially better-than-expected prospects stemming from both its ongoing implementation of “disciplined spend management” and deployment of AIP. And the further the number deviates from the base case perpetual growth rate estimated grounded in fundamentals, the greater the catalysts needed to maintain durability in the rally.

Author Author

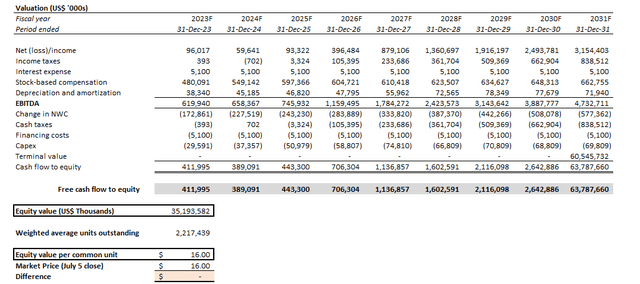

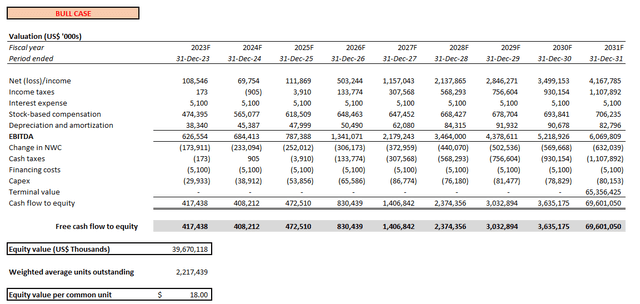

However, a discounted cash flow (“DCF”) analysis on projected cash flows in conjunction with our bull case fundamental forecast, while keeping the base case WACC and estimated perpetual growth rate unchanged, yields an estimated intrinsic value of the stock at up to $18 apiece. However, we remain cautious on the potential for better-than-expected top- and bottom-line performance in the near-term, given persistent uncertainties in the IT spending environment and Palantir’s AIP monetization roadmap. This is also in line with our earlier discussion that incremental sales growth driven by AI momentum are not expected to be material over the immediate- to near-term due to the ongoing ramp up of AIP deployment and continued adjustments to the solution’s pricing strategy. But consistent SBC reductions and recent contract expansions driven by AIP adoption remain supportive of the upside scenario.

Author Author

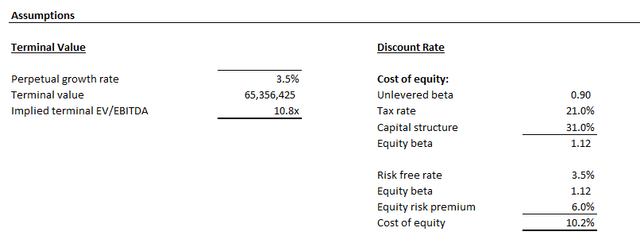

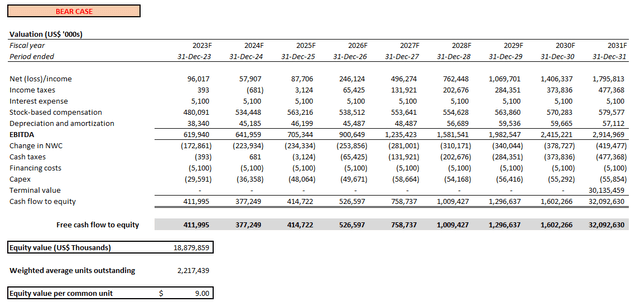

The downside scenario assumes weaker-than-expected fundamentals resulting primarily from a softer demand environment, taking into consideration the lack of visibility on forward IT spending intentions, blighted by surging interest rates and persistent inflationary pressures. Our downside valuation has been upped from the previous $5 to $9, nonetheless, to better reflect lowered execution risks on Palantir’s near-term financial targets, as corroborated by a consistent land-and-expand strategy to alleviate customer acquisition costs, SBC reduction, and innovations to drive improved top- and bottom-line expansion over the longer-term.

Author Author

The Bottom Line

Considering the base case forecast, which expects potential exposure to continued deceleration in the near-term in line with ongoing uncertainties regarding end-market spending intentions, offset by optimism over structural bottom-line gains, Palantir Technologies Inc. stock is likely to stay rangebound in the low-to-mid teens. Investors are likely now shifting to a wait-and-see approach to determine if Palantir can show consistent progress in improving its fundamental performance and grow into the valuation premium currently allocated to its AI potential.

In the meantime, we do not expect the stock to fall below the sub-$10 level prior to the second quarter earnings release, despite potential for further monetary policy tightening that could dampen sentiment for growth stocks. Specifically, the advent of generative AI technologies and the burst of mainstream interest in the nascent trend is expected to alter the growth potential and productivity across industries, and contribute to a “7% increase in global GDP” over the next decade. This is expected to buoy valuation multiples across names that embrace generative AI, like Palantir, given their exposures to AI-driven cross-industry TAM expansion. Unless the company backtracks on AIP (or the industry retracts interest in AI altogether), we see limited incremental downside risks to what has likely already been considered by investors pertaining to macro-driven IT spending uncertainties in the near-term.

Read the full article here