Investment thesis

Dynatrace Inc (NYSE:DT) is an IT operations software company that offers software intelligence through application performance monitoring [APM], infrastructure monitoring, logging and AI ops. My rationale for suggesting an investment in DT was that the company stands to gain from the structural shift brought about by the development of technology and digital solutions in the way businesses function. Given the success of this thesis so far (the share price is above my price target), I am maintaining my buy recommendation. Strong performance can be seen across the board since my initiation, total revenues grew 25% to $314 million and ARR growth was very healthy as well. Despite the fact that there were a few letdowns, like lower NER and fewer net adds, I would advise against drawing any firm conclusions based on this one quarter’s data because the poor macro situation may be to blame. Looking at average ARR per customer, things are still looking up, with a new logo landing on more than $130k, which is up from the $120k averaged in 3Q23. Similar increases in multi-product adoption can be seen in the ARR of over $500k reported by customers who have purchased three or more modules, an increase of 50% year over year. As a result, I anticipate that DT will maintain strong performance in the upcoming quarters and years due to sustained growth in ARR. This growth will be fueled by increased adoption of DPS, and positive momentum from new product launches. As more applications, workloads, and computing requirements emerge, the demand for observability solutions should rise, further benefiting DT.

Competitive product and strong market position

My hypothesis that the DT solution is gaining a lot of traction in the market, particularly among existing customers as they adopt more modules, has been borne out by the solution’s impressive performance thus far. As a result, I anticipate that DT’s strategic position will continue to strengthen, allowing the company to more deeply integrate itself into the IT workflow processes of its customers. This provides DT with additional resources for research and development as well as product diversification and monetization. DT’s success, I believe, can be attributed to the company’s proprietary AI technology, which is difficult to imitate because its rivals lack both the data that DT has amassed and the years of experience building the product (in the cloud).

Continued growth momentum

As long as fundamental metrics are strong, I believe DT’s recent growth trend will continue. Take Dynatrace Platform Subscription (DPS), which was just released and is already being used by 130 customers. From a financial point of view, the value proposition to customers is very good. Customers will be able to test out and deploy the more comprehensive platform for a set price. Because of this, I anticipate a substantial increase in adoption, which will result in brisk ARR growth (management has mentioned that DPS has higher ARR accretion). In addition, I advocate that management strategy to increase the size of the internal sales team and the use of partners to refine the go-to-market strategy in order to boost sales when momentum is high. Growth in 1CQ24 is likely to accelerate as these sales reps reach full productivity, but I anticipate some margin weakness in 2CH23 due to the anticipated increase in sales capacity due to hiring that is heavily weighted toward that quarter. Assuming demand flow remains constant, which I highly believe it will give the current upward trend and momentum, growth would be fueled by both an increase in the number of sales representatives and the total number of customers. Given that 65% (50% last year) of newly acquired customers begin with adopting 3+ modules, I believe the success of DT’s multi-product strategy approach would further accelerate ARR. In comparison, there is typically little additional cost associated with increasing adoption of modules. As such, I see higher structural margins as this approach continues to see success.

Valuation

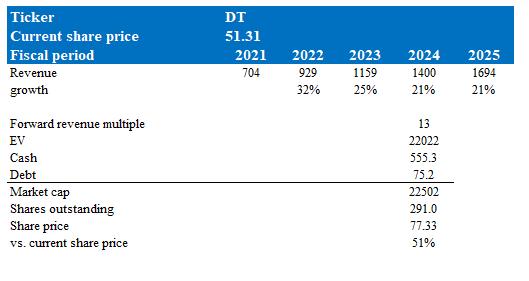

My model suggests DT is worth $77, if it trades at 13x forward revenue multiple in FY24, which is DT historical average.

Model walkthrough:

- Revenue to follow management full year guidance in FY24. Afterwards, I expect revenue to continue growing at a similar pace as strong growth momentum continues.

- Similar to my previous view, I believe DT valuation can go higher from here as I expect the market to increasingly appreciate DT growth profile and market position (note that valuation has rerated from 7.8x to 9.8x since I wrote about the stock). Steady path towards margin expansion as the business scales would also attract more market intention, in my opinion. Given that investors are now expecting software companies to turn profitable and generate FCF, I think this could be a catalyst for valuation re-rating.

Own calculations

Risks

I do not think there are any constants in the software industry. The same holds true in the modern DT marketplace. Even though DT is making sales and beating out established competitors (AppDynamics), this does not guarantee that it will maintain its current level of market dominance indefinitely. If Dynatrace is unable to keep up its current rate of new customer additions and product innovation, it poses a serious risk to DT’s performance forecasts and share price, in my opinion.

Conclusion

DT has demonstrated strong performance and growth, driven by increased adoption of its software intelligence solutions. I believe DT strategic position and competitive product have allowed it to gain traction in the market and integrate itself into customers’ IT workflows. I expect the continued momentum and success of DT’s multi-product strategy, along with the expansion of its sales team, to fuel further growth in the coming quarters. Based on my valuation model, I believe DT has the potential for further upside in its share price, and I maintain my buy recommendation.

Read the full article here