The most recent notable development around U.S. cryptocurrency ETFs is a WSJ article reporting that the SEC dismissed applications by BlackRock (BLK) and Fidelity to get vehicles approved as not good enough. The companies have since refiled applications, though.

An ETF directly investing in Bitcoin would be a pivotal event for the crypto industry, expanding access to the cryptocurrency and simplifying its purchase and sale.

So far, the SEC has consistently denied these funds market access since 2017. The key problem the agency identifies is susceptibility to “fraud” and potential market manipulation. Despite this, several ETFs owning Bitcoin futures, with prices correlating very closely to Bitcoin spot prices, have been allowed to enter the market.

According to the WSJ article, many insiders predicted that BlackRock’s filing, which this time proposed a “surveillance-sharing agreement” with Nasdaq (where the ETF would be listed), would ease the SEC’s concerns.

It didn’t, and the SEC denied it reportedly again based on the surveillance agreements around spot Bitcoin. This isn’t that surprising because it has been their go-to line. With the decision in the Grayscale vs. SEC court case coming up somewhere in the next few months, I don’t expect that to change until the court comes up with a ruling there.

The arguments raised in the Grayscale vs. SEC lawsuit by both sides explain this most recent rejection. I’ve written about the case more extensively here but here are the key quotes of how I’ve laid it out there:

Futures derive their prices from spot and are approved by the SEC.

Because the SEC has accepted the situation of the futures ETF where; futures and off-exchange manipulation will be spotted by CME (Futures exchange) a Bitcoin spot ETF (while fraud monitoring futures) should be allowed as well.

In contrast, The SEC’s position seems to be that the manipulation of the off-exchange Bitcoin spot would be spotted in Futures because the price action would also show up there.

However, the SEC is also arguing that the manipulation of off-exchange Bitcoin spot to defraud investors in a potential spot ETF wouldn’t necessarily show up in the futures and wouldn’t necessarily be spotted.

The positions taken in court seem to be in line with the position taken in court. The SEC is simply still not enthusiastic about surveillance-sharing agreements that aren’t set up to monitor spot manipulation directly.

Grayscale argued the spot ETF could rely on the same fraud monitoring system the futures ETF use (which makes quite a bit of sense to me). However, the court has not decided whether Grayscale’s or the SEC’s view should prevail in this matter.

Given this context, the latest rejection is unsurprising. I think the companies just want to be ready and far along the process once a ruling does come down.

Consequently, how the court will rule in the SEC vs. Grayscale case matters. What’s interesting about this latest round of filings is that even if Grayscale is unsuccessful in 1) getting to convert its closed-end fund; The Grayscale Bitcoin Trust (OTC:GBTC) to an ETF or 2) capture the top spot as nr.1 ETF with GBTC, the launches of Bitcoin ETFs by Fidelity and BlackRock could be enough to trigger substantial inflows as transacting and custody of Bitcoin become so much easier and more accessible. Aside from GBTC specifically, for the Bitcoin price itself, it could be more favorable if BlackRock or Fidelity ends up with the nr.1 ETF.

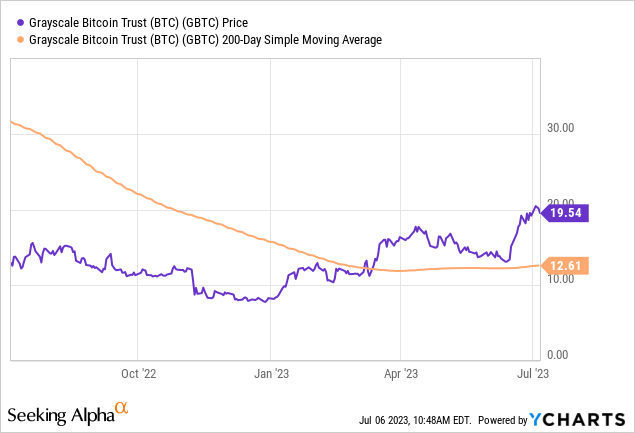

Going back to October 2022, I’ve been tactically invested in Bitcoin, specifically through Grayscale’s Bitcoin Trust with the intent to hold until it transitions into an ETF. Or at least until this intent is communicated clearly, and the discount narrows significantly. Back then, GBTC traded at a 40.4% discount to the spot Bitcoin it holds. This has since “narrowed” to 28%, but I think it can narrow to ~0% if ETF status is obtained.

Part of my justification for a GBTC long is that I believe (based on the most recent hearing transcript) that Grayscale’s legal case against the SEC is progressing well, Grayscale has a strong case and a decision is anticipated before year’s end. There is clearly a risk that the court does not rule in favor of Grayscale. A negative ruling would almost surely immediately lead to the discount widening back out. There is also a small chance that the court rules in favor of Grayscale, but the SEC decides to shut down the futures ETF instead of allowing spot ETFs. An unlikely path forward, but it’s worth being aware of.

There are also reasons to like Bitcoin more generally that are obviously relevant to any unhedged investment in GBTC.

First, the banking tremors of 2023 with even large banks like First Republic and Credit Suisse suddenly getting taken over for small sums has helped accelerate a renewed interest in crypto. The tremors have subsided as the Fed has provided a lot of liquidity to the banking system. However, I can easily see interest rates being increased a bit further. Inflation is down but not out and the official target of 2% still appears to be quite distant.

Second, the next upcoming Bitcoin halving, expected within 285 days, generally leads to Bitcoin prices rising. This event makes it harder for Bitcoin “miners” to deliver supply to the market because it decreases the rewards these players receive for their work. The miners are a consistent source of supply in the market and this inevitably decreases that supply. It’s not a guarantee to overshadow other forces of supply-and-demand, but historically it has been a good time to be long Bitcoin.

Finally, the discount on GBTC, coupled with Bitcoin’s potential price action, makes it an attractive proposition. If Grayscale converts the fund into an ETF, this would lead to a 38% uplift. If a 28% discount goes to 0% this corresponds to ~38% price appreciation.

It is not exactly my strong suit, but you could also argue technical indicators support GBTC and Bitcoin, providing additional encouragement for investors.

I’ll be the first to agree that regulatory decisions as well as market movements are not easy to predict even within wide bands. However, to sum up my views on GBTC; an upcoming Bitcoin halving and GBTC’s potential to appreciate by ~38% if converted into an ETF are hard to resist. My optimism is lightly reinforced by technical indicators supporting Bitcoin and GBTC. Keep in mind that a negative ruling out of the courts would immediately set GBTC back. Even in a best-case scenario, this would lead to a conversion getting delayed.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here