Investment thesis: With an arguably fast-approaching global energy crisis on the horizon, mostly due to a lack of global oil & gas supply growth, the world is likely to respond by ramping up all available alternative sources of energy. Nuclear power is arguably seeing a revival, after decades of fear-induced reduction in demand. Wind power is also very popular. Such projects take time, while solar has the advantage of being versatile enough that it can work as large-scale projects, or as small-scale individual home projects that can be deployed faster, with immediate impact. For this reason, I see a significant surge in solar power installation demand, which should in theory translate into a corresponding surge in silver (XAGUSD:CUR) demand. With supply growth prospects limited on the other side of the equation, as well as other potential sources of demand growth probably kicking in, I believe silver prices could see a significant and sustained rise in prices in the coming years.

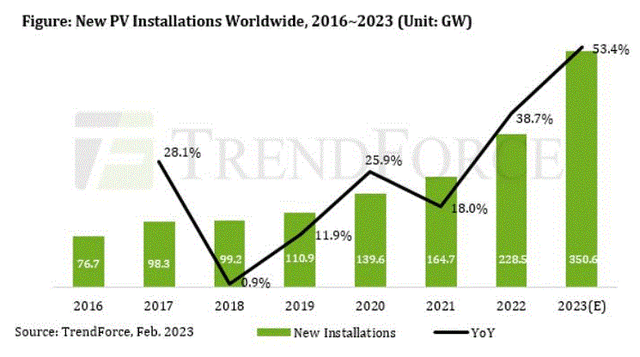

Global solar power installation seems to be surging this year

When a nascent industry starts to take off from a relatively low baseline, those growth rates can seem quite impressive. Solar & wind power generation currently accounts for 12% of the world’s total electricity supply, based on 2022 data, so it is no longer the case that this is just a gimmick. We are increasingly deeply dependent on this power source.

PV Magazine

As we can see, the rate of growth we are potentially seeing this year might be the best in almost a decade, which is all the more impressive, given that the 2022 baseline is no longer so insignificant.

As I pointed out in a recent article, I expect to see an impending sustained energy price spike to start as early as the end of this year, mostly due to oil & gas supply constraints. This outcome should come to pass despite continued weakness in the global economy.

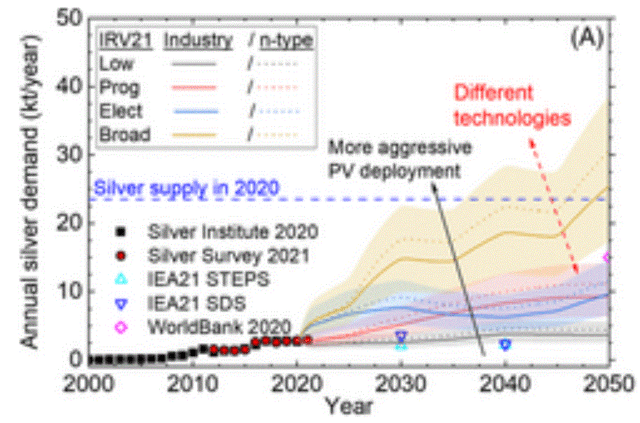

It is estimated that in 2021 113 million ounces of silver were used in solar panels, while in 2022 the amount grew to 127 million ounces. In other words, even though solar power installation grew by just under 40%, silver demand from the global PV industry only increased by about 13%. It seems as though the trend of silver use reduction is still ongoing. It also seems that global solar power demand may continue to expand at a fast pace, which could potentially push us into a situation where most of the global silver supply will go toward the PV industry by 2050, based on certain estimates.

Wiley Online Library

While the PV manufacturing demand for silver from the solar industry is a bit of a wildcard, it seems that at least within the current silver market price environment, there are no prospects of global mined production growth.

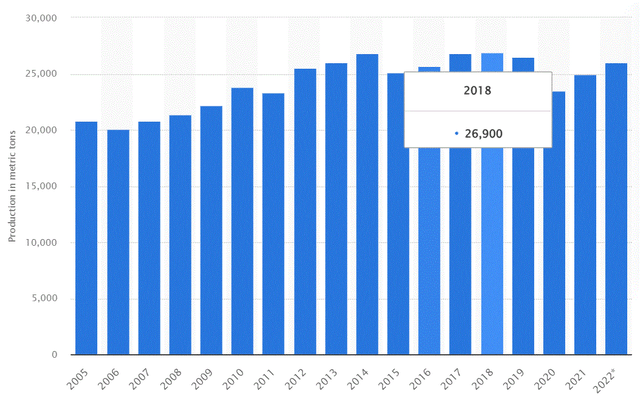

Global mined silver production (Statista)

Global silver mined supply peaked in 2018, and as of 2022, it was down about 3.5%. It looks like, at best, global silver production has peaked, and it is now stagnated. The only thing that would reverse this trend of stagnation and push production higher would be sustained higher prices. The continued exponential expansion of the global PV industry suggests that despite continued improvements in the industry’s efficiency level when it comes to silver use, demand for silver input from the industry continues to expand. At some point, we may see a stagnation in efficiency growth, at which point it is probable that silver demand growth in the PV industry will start to mirror solar power generation growth.

Investment implications:

I have been a long-time, long-term investor in silver, which thus far has not been a very exciting journey. I always saw it as a good long-term investment in a safety asset, aside from gold, with the added storyline related to growing industrial demand. There is the PV story, as well as other industrial uses that silver is ideal for, where it is fully worth paying the current price of silver and potentially a lot more in order to gain higher performance in tech and other applications.

We should keep in mind that previous bullish hypotheses in regard to growing industrial demand were hampered from becoming reality by other factors along the way. There was a collapse in demand for photography applications as digital cameras became dominant. Demand growth from the PV industry was underwhelming in the past decade, despite rising PV demand, as efficiency gains that made for less silver input needed per panel slowed down demand growth. While this has been a drag on silver demand for the past decade or so, my long-term view is that it sets up a potentially strong sustained silver price bull market because the less volume input we have, the less likely it is that the PV industry will respond to higher silver prices by cutting back on its use. It, therefore, removes an obstacle for the market to rally in the longer term.

One final non-industrial use-related point I want to briefly touch on is the likelihood of silver becoming more prominent in the emergence of a new global financial order. Zoltan Pozsar, formerly a Credit Suisse employee, put forward an interesting thesis in regard to this decade being the beginning of a new financial world order that will see a transition from fiat currencies to commodities-based currencies. I personally see this as a viable concept, with state-backed stablecoins, backed by gold, silver, and other assets becoming a potential new trend, within the current global geopolitical context. If this thesis is correct, we might start to see a significant increase in global central bank silver acquisitions.

My current stock exposure to silver miners consists of Wheaton (WPM) and Silvercorp (SVM). I also hold physical silver in the form of coins, which is my largest silver investment holding at the moment. In the event that we will see a significant pullback in these stocks, on the back of a decline in silver prices, I intend to increase my stock position in both, and perhaps add to my physical silver holding as well. There seems to be very little or limited downside to silver prices going forward, given that production seems to have at the least temporarily peaked half a decade ago. On the upside, there are increasingly few limits to how high silver prices can go in fiat currency terms. A combination of potentially growing industrial demand, as well as arguably improved global geopolitical prospects for silver to see a return to its traditional historical role as a store of value and an intermediary in transactions, is arguably very bullish for silver. Then again, there have been episodes in the past as well, where things looked bright for the silver market, but things did not turn out as hoped. I do think however that this time it really is different.

Read the full article here