Introduction

It’s time to dive into the State Street Corporation (NYSE:STT). Not only did I get a lot of requests to assess this (somewhat) high-yielding asset manager, but I also believe that taking a closer look at this giant tells us a lot about the current state of the industry and potential investment opportunities down the road.

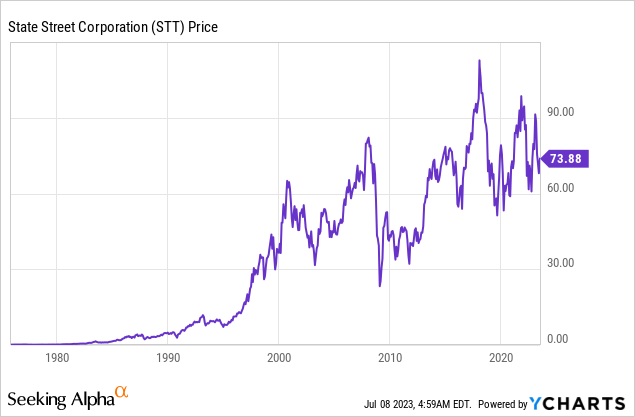

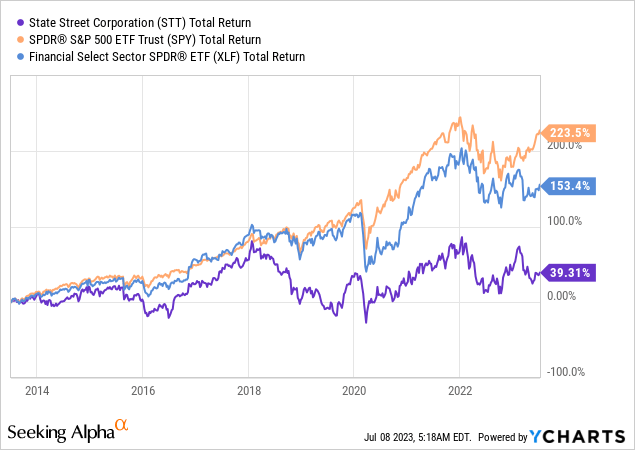

While the stock price performance has been quite disappointing in the past ten years, the stock comes with a 3.4% dividend yield, consistent dividend growth, and what seems to be an attractive valuation.

In this article, we’ll look at the risk/reward through the lens of a dividend (growth) investor.

So, let’s get to it!

What Makes State Street So Special

State Street is a huge corporation. With a market cap of $25 billion, it’s one of the ten largest asset managers in North America.

Headquartered in Boston, Massachusetts, the company is a leading global provider of financial services to institutional investors. With subsidiaries operating in over 100 markets worldwide, State Street offers a wide range of financial products and services to institutional investors, including asset managers and owners, insurance companies, official institutions, and central banks.

To give you some numbers, as of December 31, 2022, the company had $36.74 trillion in assets under custody/administration (“AUC/A”) and $3.48 trillion in assets under management (“AUM”).

State Street Corporation had consolidated total assets of $301.45 billion, total deposits of $235.46 billion, and more than 42,000 employees to manage it all.

The company has two major business segments.

- Investment Servicing: This segment offers solutions that enable clients to efficiently perform services related to the clearing, settlement, and execution of securities transactions and payments. These services include custody, accounting, regulatory reporting, investor services, performance and analytics, foreign exchange, brokerage, and other major services.

- Investment Management: State Street Global Advisors offers investment management strategies and products. This segment also provides services and solutions related to ESG investing, defined benefit and contribution products, and Global Fiduciary Solutions. Additionally, the company is a provider of ETFs through the SPDR ETF brand, which most readers will be familiar with.

Before we dive into the numbers, there are a few things that give State Street an edge – at least according to the company.

In addition to its global presence and broad portfolio of products and services, the company believes that its use of technology and innovation is something that can give the company an edge.

For example, State Street offers integrated platforms like:

- State Street Alpha, which combines portfolio management, trading and execution, analytics, compliance tools, and data aggregation.

- State Street Digital, which focuses on developing services related to digital assets and emerging technologies like blockchain and cryptocurrency.

The company is also a systemically important bank, which comes with extensive regulations and supervision. This is one of the reasons why major corporations trust the company when it comes to pension plans and so many other financial issues.

A Poor Total Return But Steady Dividend Growth

While State Street has often popped up on my radar, I never cared about diving into its financials. The reason was its lackluster performance. I just couldn’t be bothered by spending any time assessing a company with a 10-year total return of less than 40% and a yield below 4%. After all, a low total return isn’t always an issue if a stock turns out to be a great income play.

Speaking of income, STT currently yields 3.4%, which is 20 basis points below the yield of the Schwab U.S. Dividend Equity ETF (SCHD), meaning it’s not very far from high-yield territory.

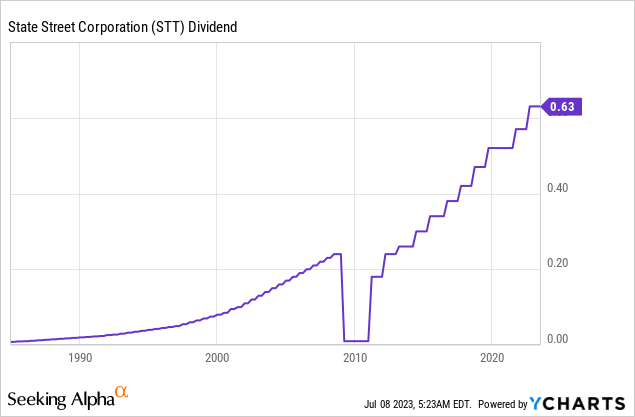

Looking at the chart below, we see that the company has a history of consistent dividend growth – excluding a major cut during the Great Financial Crisis. Both prior to that recession and after, the company consistently hiked its dividend.

- Over the past five years, the average annual dividend growth was 8.5%, which is very decent for a stock with a 3.4% yield.

- The payout ratio is 33%, which is healthy and an indication of strong dividend coverage.

However, we are not dealing with a high yield.

So, to quickly reiterate what we have so far: the company has a consistently rising dividend with a somewhat satisfying yield. However, this yield isn’t juicy enough to satisfy the lackluster total return of the past ten years.

This means we need an attractive valuation. If that is the case, STT suddenly becomes a much more attractive stock.

Finding Growth In A Challenging Environment

During this year’s annual Bernstein Strategic Decisions Conference in May, the company discussed the current environment of uncertainty and pressure on expenses faced by clients.

Hence, the primary focus for servicing clients is on finding growth opportunities and managing expenses.

Traditional asset managers are shifting towards ETFs, while private markets, particularly infrastructure and private credit, continue to experience significant growth.

Clients were also concerned about the increasing costs of distribution, delivering Alpha, and technology and operational infrastructure.

In other words, the concept of future-proofing technology and operations is crucial for asset managers.

The company needs to deal with macroeconomic headwinds, related uncertainty among clients, rising costs, and the rising threat of disruption.

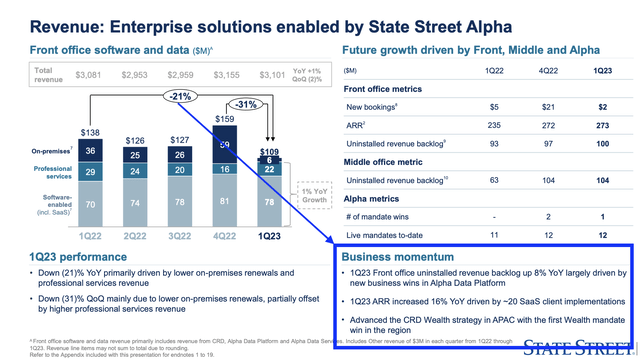

During the aforementioned conference, the company also mentioned that growth has been driven by its Alpha front-to-back offering, which focuses on cost reduction, effective data management, and technology integration.

State Street

Essentially, State Street has been transformed from a back-office service provider to an enterprise outsourcer.

The company believes that while competition is strong, its true front-to-back capabilities give it a competitive advantage.

Geographically, Europe and APAC present attractive opportunities, with the rise of private equity and the potential for deeper market penetration. The private markets segment, particularly in Latin America, still offers room for growth.

Furthermore, State Street’s capital markets business, especially foreign exchange, is a significant area of focus and an opportunity for increasing market share.

Additionally, the company is boosting its pricing strategy. State Street has implemented selective price increases in areas such as alternative servicing and hard-to-process segments to offset the impact of rising costs.

The inelasticity of clients’ responses to these price increases can be attributed to the understanding that these complex services are vital and require accuracy and reliability.

In other words, State Street’s differentiation strategy has led to the introduction of value-adding services with less competition. That’s where the company can gain pricing advantages – especially in times when it matters most.

This brings me to the next part of this article, which builds on these developments.

Current Developments & Valuation

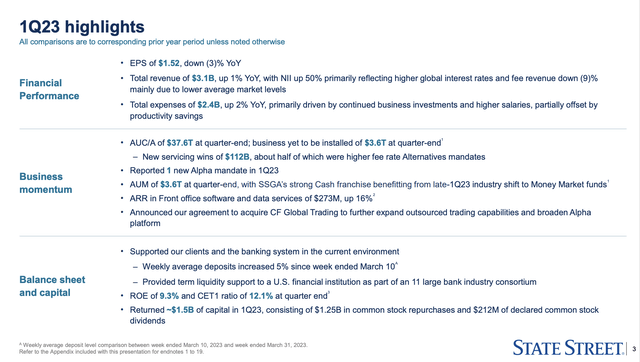

While growth is gone – at least on a short-term basis – the company is holding up quite well. In the first quarter, the company reported earnings per share of $1.52, with a provision impact of $0.06 per share associated with supporting the banking system.

Despite a decline in equity and fixed-income markets, the company experienced strength in net interest income and securities finance business, leading to only a 3% decrease in EPS. The company also managed to control expenses and continued investing in product and client growth initiatives.

State Street

While results were negatively impacted by ongoing macro woes, the company remained focused on what matters most: expanding and focusing on new capabilities.

For example, the acquisition of CF Global Trading announced in March, will expand State Street’s outsourced trading capabilities and liquidity-providing capabilities.

The transaction is expected to be completed by the end of 2023.

State Street recorded $112 billion in asset servicing wins in the first quarter, with approximately half from higher fee rate alternative mandates.

The company also reported additional Alpha mandates, which seems to prove that its technology-focused expansion is going smoothly.

State Street

State Street also maintains a top-tier balance sheet.

The Common Equity Tier 1 (“CET1”) ratio was 12.1% at quarter-end, which is well above the regulatory minimum.

Going forward, the company expects an improvement in financial metrics.

- State Street expects average US equity and global bond markets to increase by about 1% to 2% quarter-on-quarter, with international equity markets remaining flat.

- Overall fee revenue is anticipated to increase by 4% to 5%, with servicing fees up 1% to 2% and management fees approximately flat to up 1%.

- Front-office software and data revenues are expected to increase significantly, and the company plans to adopt new accounting guidance for renewable energy investments.

- Net interest income is expected to decrease by 5% to 10% sequentially, and expenses are projected to remain flat. The company anticipates offsetting NII trends with higher fee revenues and active expense management.

On a longer-term basis, analysts (not the company) expect the company to continue to generate annual net income close to $2.5 billion. After 2024, an upswing is expected.

- 2022: $2.7 billion.

- 2023E: $2.5 billion.

- 2024E: $2.5 billion.

- 2025E: $2.7 billion (8% implied year-on-year growth).

What this means is that while the company is investing in areas that come with decent long-term growth potential, its size makes streamlining the business a very slow endeavor.

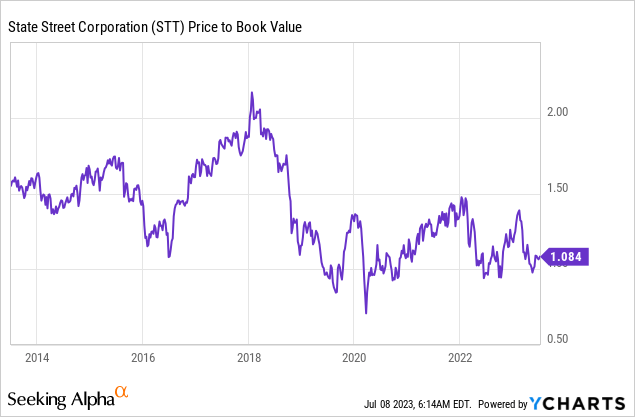

The company’s valuation confirms this. STT is trading at 1.1x its book value. Analysts give the stock a consensus price target of $85, which is 15% above the current price. However, I do not expect the company to leave the prolonged and volatile sideways trend and start a meaningful uptrend anytime soon.

Hence, from a dividend investor’s point of view, I would suggest two things:

- When looking for income, buy a financial stock with a higher yield.

- If yield isn’t important, I would suggest buying financial companies with more growth and a higher likelihood of strong long-term total returns.

As much as I like STT as a business and its ability to deliver top-tier services, it’s just not a great dividend play from my point of view. Needless to say, everyone should feel free to disagree with me in the comment section.

Takeaway

State Street presents a mixed picture for dividend investors. While it offers consistent dividend growth and an attractive valuation, its low total return in the past decade raises concerns.

With a dividend yield of 3.4%, it falls short of higher-yielding options in the market. However, the company’s global presence, broad portfolio, and innovative use of technology provide it with a competitive edge.

It has transformed from a back-office service provider to an enterprise outsourcer, focusing on cost reduction, data management, and technology integration.

State Street’s differentiation strategy and value-adding services offer pricing advantages in a challenging environment.

Despite ongoing macroeconomic woes, the company remains focused on expanding capabilities and investing in growth initiatives.

However, due to its slow streamlining process and prolonged sideways trend, the company may not offer strong long-term total returns for dividend investors, which is why I will pass on the STT ticker – at least for the time being.

Read the full article here