Investment Thesis

Our current investment thesis is:

- BFB is a well-positioned business due to its wide moat. Its global brands, including Jack Daniel’s, as well as its global scale allows the business to generate strong returns.

- Growth is expected to continue on its current trajectory, as acquisitions supplement a healthily growing industry.

- Margin weakness has created some uncertainty due to the weakness over several years.

- Relative to its historical average and peer group, BFB looks average, despite the business trading at a significant premium.

Company Description

Brown-Forman Corporation (NYSE:BF.B) is a leading American spirits and wine company that produces and markets a diverse portfolio of premium alcoholic beverages. The company’s brands include Jack Daniel’s, Woodford Reserve, Finlandia, and Korbel, among others.

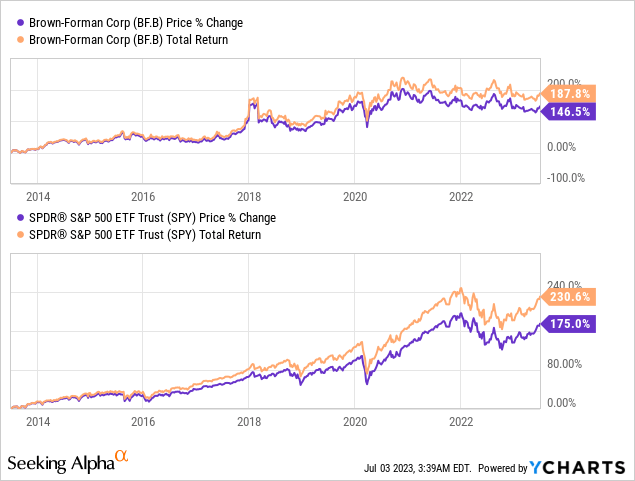

Share Price

BFB’s share price has slightly underperformed the market, although its performance has been respectable during this time. The company has achieved consistent financial improvement and retained its strong market position.

Financial Analysis

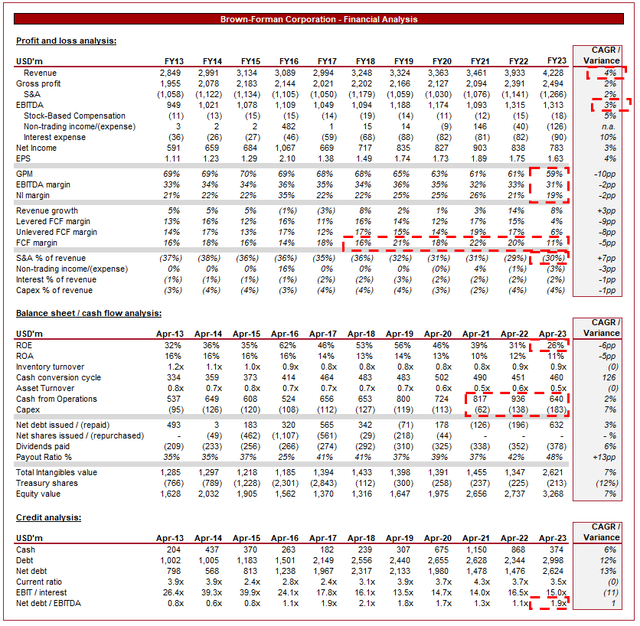

Brown-Forman Financial performance (Capital IQ)

Presented above is BFB’s financial performance for the last decade.

Revenue & Commercial Factors

BFB has grown its revenue at a CAGR of 4% during the last 10 years, although had experienced 2 periods of negative growth. Generally, the company’s trajectory has been positive, capitalizing on its strong market position.

Business Model

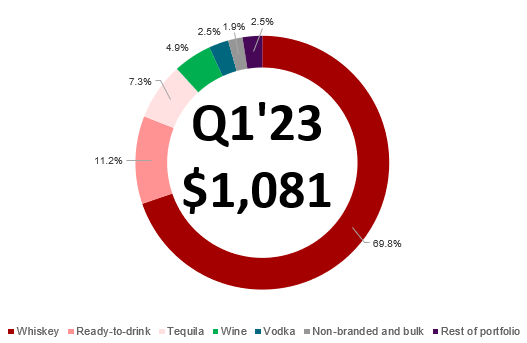

BFB focuses on developing its portfolio of premium spirits and wine brands, catering to a wide range of consumer preferences and occasions, as part of its strategy to capture a large segment of the wider industry. The spirits industry is split into several segments, with BFB operating leading brands across these verticals. Further, the ownership of several brands is highly beneficial due to diversification, as well as the gains from growing alongside each other.

Despite the diversification, BFB generates the majority of its revenue through its Whiskey segment, led by the famed Jack Daniel’s brand.

Revenue split (Brown-Forman)

The company operates an extensive global distribution network, leveraging both direct and indirect channels to reach consumers in various markets. This scale allows the business to compete with its global peers, especially against local brands, benefiting from scale economies and its global identity to win access to customers.

Given the high level of competition in the market, BFB invests heavily in brand-building activities, including marketing campaigns, sponsorships, and experiential events, as a means of enhancing brand awareness. This is a critical activity to maintain brand relevancy and is an area of strength of BFB, as illustrated by the longevity of Jack Daniel’s.

A recent development from the company is the release of the Jack Daniel’s & Coca‑Cola RTD (KO). A “Jack and Coke” (and the various alternative names) is a famed bar order globally and is now available to customers in an RTD offering. There is the potential for a range of RTD beverages based on BFB’s spirits, as well as significant success with this. We believe the marketing effects of this alone will be great for the business.

Competitive Positioning

BFB has three key competitive advantages in our view.

Firstly, and most importantly, the company enjoys market-leading recognition for its premium spirits and wine brands, fostering a loyal customer base and exposure to customers through bars and other establishments.

The company’s size allows it to invest heavily in innovation and marketing, enabling the development of successful new products that cater to evolving consumer tastes and preferences. This is critical to remaining relevant over time.

Finally, BFB’s scale. BFB’s substantial global scale affords the business economies of scale, as well as the ability to utilize unique competencies to enhance its operations across geographies.

Spirits Industry

Competition in the Spirits industry is primarily driven by brands, taste, and marketing, with public perception critical to the success of brands. Major competitors of BFB include Diageo (DEO), Pernod Ricard (OTCPK:PDRDF), Beam Suntory, and Bacardi, among others.

Consumers are increasingly demanding premium and super-premium spirits, presenting growth opportunities for BFB’s brands. We believe the business is positioned well to enjoy the growth of this segment as it expands its footprint. In early 2023, BFB acquired Diplomatico Rum, giving the business access to the super-premium+ rum category. This said, BFB’s focus is on traditional premium. We differentiate between this and “marketing premium”, which is a growing list of brands that are heavily marketed by celebrities as alternative premium offerings. Included within this segment are the likely of Ciroc (Puff Daddy) and Teremana (The Rock). We believe BFB could enhance its growth trajectory through a smart celebrity partnership.

Although the craft beer segment is far more significant, there is a rising popularity of craft and artisanal spirits, influencing consumer choices and encouraging the creation of niche brands. This represents a key risk to BFB’s “traditional” brands, although represents an opportunity to partake in this growth through M&A.

Growing consumer awareness of health and wellness may impact alcoholic beverage consumption patterns. The beer market in particular has been shaken by this, with brands investing heavily in low-calorie alternatives, as well as non-alcohol versions (also capturing a new market). The spirits industry is also experiencing this but to a far lesser extent, supporting the industries growth trajectory despite risks.

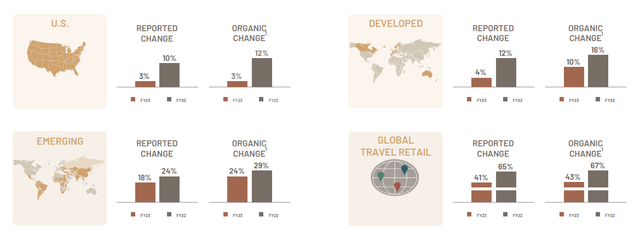

BFB can support its growth trajectory by further expanding its presence in emerging markets, where rising disposable incomes and changing consumer preferences creates demand for Western products. As the following illustrates, BFB is experiencing outsized returns in the regions, implying greater focus and curation could support a continuation of healthy growth.

Sales by geography (Brown Forman)

Margins

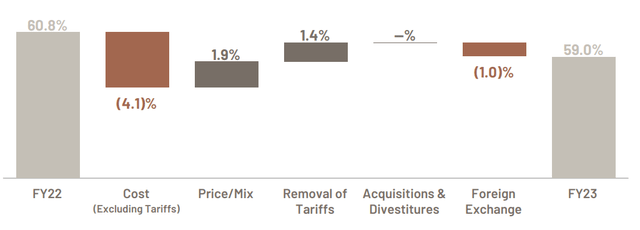

BFB has incredibly attractive margins, with a GPM of 59%, an EBITDA of 31%, and a NIM of 19%. These levels are a financial reflection of the strength of its brands, allowing the business to price at an aggressive premium while still achieving consistent growth.

Margins have declined in the most recent year, year, as the business has been unable to wholly pass on inflationary cost pressures, with only a 1.9% gain in price/mix. This is a disappointing outcome, implying its current elasticity is not competitive. Despite the strength of its brands, this reflects a competitive market environment, making it difficult for the business to increase prices.

Margin bridge (Brown-Forman)

This is part of a wider downward trajectory, as EBITDA-M peaked in FY16 at 36%. This is a key weakness, and the current trajectory implies further dilution is possible.

Balance Sheet & Cash Flows

BFB is moderately financed, with a ND/EBITDA ratio of 1.9x. This level provides the business with sufficient flexibility to conduct M&A if required, as we feel a 3x level is a healthy maximum.

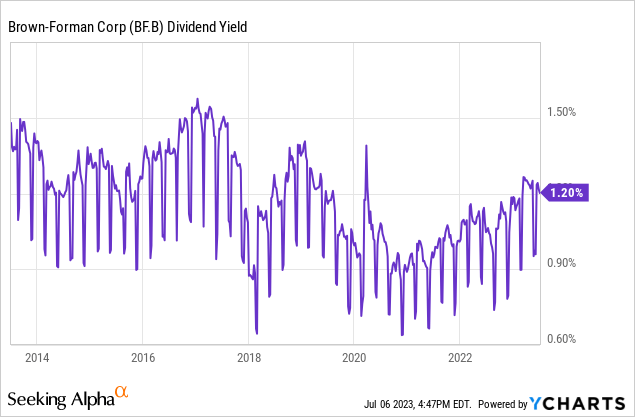

Cash flows have been relatively consistent, although the company experienced a noticeable decline in the most recent period. These cash flows have been used to fund distributions and deleveraging. The absolute yield is fairly mundane.

Outlook

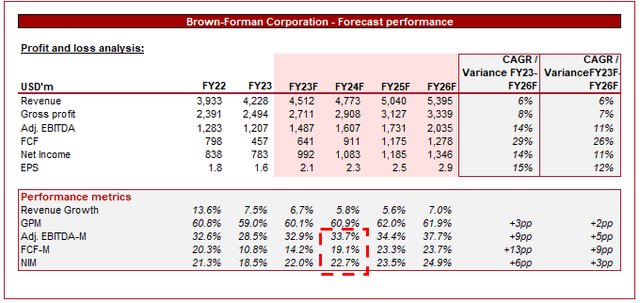

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting a continuation of its near-term growth trajectory, with a CAGR of 6% into FY26. This looks to be a reasonable estimate based on the industry dynamics and the company’s current performance.

Margins are also expected to improve, as analysts likely pricing in inflationary pressures subsiding, as well as a product mix shift toward the super-premium segment. We remain hesitant about this given the lack of improvement indicators identified.

Industry Analysis

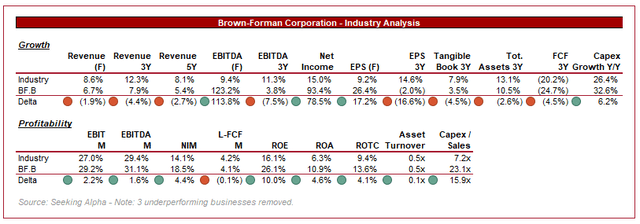

Distillers and Vintners (Seeking Alpha)

Presented above is a comparison of BFB’s growth and profitability to the average of its industry, as defined by Seeking Alpha (6 companies).

Despite the healthy growth achieved thus far, BFB underperforms the market average on every revenue metric. This is not a substantial level but reflects a degree of relative weakness. This underperformance remains in a direct comparison with both Diageo and Pernod.

Although BFB has faced margin pressures, it performs extremely well on a relative basis. The company is noticeably above average and also more efficient. This said, Diageo maintains superior margins and Pernod has comparable margins.

Valuation

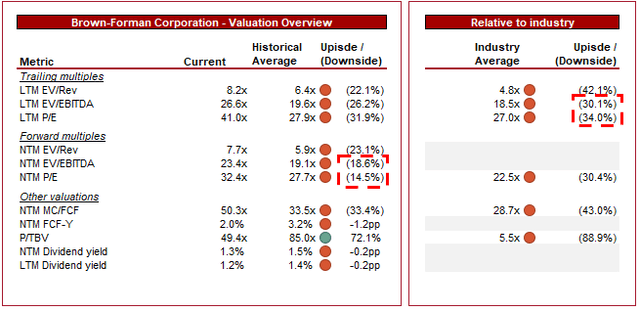

Valuation (Capital IQ)

BFB is currently trading at 26x LTM EBITDA and 23x NTM EBITDA. This is a premium to its historical average.

BFB’s valuation is disjointed from its fundamentals. With margin weakness partially offset against improved scale and industry healthy, we believe a valuation in line with its historical average looks appropriate.

Relative to peers, BFB’s performance is comparable, if not slightly weaker, due to its lower growth trajectory. Despite this, BFB trades at a significant premium to the market average. Diageo and Pernod are currently trading at 17x LTM EBITDA, compounding this overvaluation.

Management

The Brown Family control more than 50% of the economic ownership of BFB. This allows the family to exert strategic control over the business, leaving investors little choice but to buy into their leadership.

Final Thoughts

BFB is a high-quality business due to its strong brands and scale. The business has developed well financially over the last decade, although has faced some weakness with margin erosion. We expect a continuation of the company’s financial performance, as industry strength support growth, although are slightly concerned with margin improvement.

BFB is performing similarly to its peers and historical average. Despite this, the company is trading at a significant premium, suggesting it is overvalued.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here