Dear readers/followers,

Elkem ASA (OTC:ELKEF) isn’t your run-of-the-mill basic materials company, and it’s not a company to simply “invest in”. Due to its relatively small size and somewhat unconventional risk profile, investments in the company should be made only after really considering the risks and potential downside. While I remain in a positive position for the company in the long-term, I’d be hard-pressed to ignore some of the things that end up making this Norwegian chemicals player into a volatile business.

As you know, when I pick a company I tend to focus on those that perform better than average but trade at a discount. This goes hand in hand with what many “gurus” like Warren Buffet go for – quality at a below-average price, and you’re not unlikely to outperform the broader market. Elkem offered us this last I wrote about it. A 40% drop does not change that fact, let me state that straight away.

I draw your attention to what I said in my last article:

So, the reason I’m not moving firmly and deeply into Elkem as an investment is that the company, all things considered, isn’t massively undervalued.

(Source: Elkem Article)

Therefore, the main question that I have here is whether the company has now dropped enough to where I might consider it an interesting investment, risk profile or no.

Let’s take a look.

Elkem – Updating the company after a 40% drop

So, remember Elkem? The company is essentially a fully integrated silicon-based material provider with approx. NOK 45.9 billion of sales (2022) with a diversified product portfolio and balanced geographical, market-leading positions.

It doesn’t sound bad, it certainly sounds like the sort of company I would be interested in investing deeply in. The company sells its silicon-based material to a wide variety of different end markets and users, and some of the primary ones that can be considered interesting and future-proof are renewables, EV’s, healthcare and the infrastructure industry.

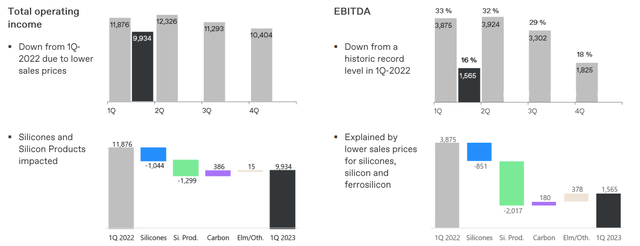

We have the 1Q23 results since I presented you with my last article on the company. Elkem delivered 1.5B NOK in EBITDA at a margin of 16% on the EBITDA level, with strong results in products and solutions due to good cost basis and market position.

However, the silicone position took a hit from weak results due to very challenging markets, requiring the company to take cost-cutting and efficiency measures. The situation is bad enough for the company to curtail production at both the Thamshavn and Rana plants, with Elkem actually pushing forward already-planned maintenance to try and really make the best of the situation.

The company’s presentation illustrates some of the challenges. Rather than focus on results, the company focuses on the potential of its technologies and potential green deals in Europe, and what this could bring.

Elkem IR (Elkem IR)

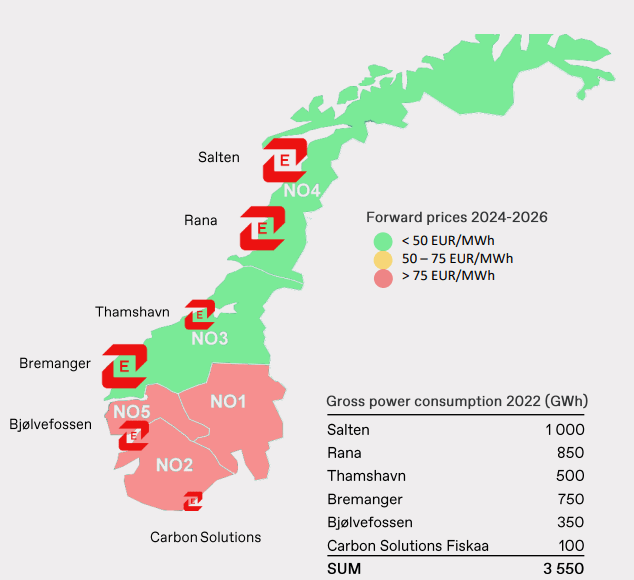

While none of these things are in any way unimportant or uninteresting, the simple fact is that the reason they do not present further impressive 1Q23 results is that there are few to present at this time. The best the company can offer investors is that the company managed to sign a new slew of long-term power contracts, that will likely allow for good forecasting of production ability and cost going forward. The company consumes 3.5 GWh on a gross, annual basis, with most (1,000 Gwh) found in the northern Salten facility, where prices are cheap.

Elkem IR (Elkem IR)

The company is currently investing in capacity expansion which should lead and drive top-line growth from 2024 and forward, but this is likely around a year away, with capacity expansions opening up in China, France, and Brazil, that will increase company production capacity by as much as 50% with the Xinghuo facility.

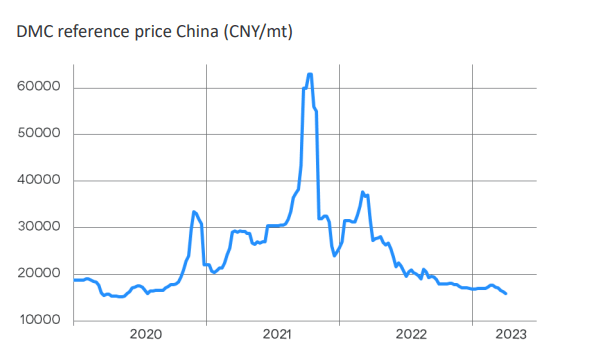

The negative silicone market is a result of Chinese overcapacity on the production side coupled with overall weak markets and very slow demand. GDP growth rates for both the EU and NA are being revised down, and infrastructure and other commoditized markets for silicones have been significantly impaired. Price recovery seems far off at this time, even though we’re starting to see a gradual recovery in demand – this is due to the sheer capacity glut.

Elkem IR (Elkem IR)

Other markets and products are still doing better and showing somewhat stronger results, but in the end, things are still lower than they were on a YoY basis in both total income and on a sector/segment basis.

Elkem IR (Elkem IR)

This does not make Elkem a bad company. the fundamental appeal of the business is still very much intact because that is based on very high, average margins in both gross, operating, and net margins. The company is a very efficient business that manages to squeeze upwards of 12-20% net margin from a gross profit of just south of 50% of revenues, where 51.2% are COGS and around 25.7% in terms of OpEx. The company also remains in a positive position in terms of cash, being very profitable overall and increasing its overall revenues. This downturn is cyclical, meaning temporary, but it will take some time for the company to work through.

But once it is worked through and the company comes out the other side, that’s where we’ll see more upside.

The thing is, very little in the current downturn is something the company can really influence all that much. The company does not control macro – and when the company is stating things like the one below, they’re just stating the obvious, which analysts such as myself already know given that we’re heavy in the industry.

The situation for the Silicones division, however, has been more demanding. The weak result in the fourth quarter last year has continued into the first quarter this year with a weak market sentiment in the EU and in Americas. And this is combined with a slower recovery and overcapacity in the Chinese market. Due to the weak market conditions for Silicones, we’re taking actions to optimize cost and production. We’re also looking into investment levels and we’ll put on hold projects that do not deliver immediate cost improvements.

For Silicon Products, the demand is also weak. We have taken the opportunity to move forward the already planned maintenance work. And this applies to 2 plants in Norway, Thamshavn and Rana and include maintenance that has been scheduled within the next 12 to 18 months. So with this work completed, we will be in a very good position when markets will improve again.

(Source: Elkem 1Q23 earnings call)

It’s these two segments that you, as an investor, want to keep your eye on. When things here start turning around not just in price but in demand as well, then we’ll be able to see an uptick for Elkem, gain as well. The presentation that Elkem delivered for 1Q23 was in fact so comprehensive, that I (and I was present on the phone), did not have any questions for the company’s management – nor did anyone else, which is the first time I’ve seen that in a billion-dollar Scandinavian company (Source: 1Q23 earnings call).

Market sentiment and demand, as well as macro, dear readers/investors. That’s what you want to look at with Elkem. With that out of the way, let’s look at the company’s current valuation.

Elkem – The valuation is attractive, but risks remain

In the end, nothing about the company is fundamentally impacted at this juncture. The company still has decent operational cash flow, and though it expects 2Q to come in weaker due to low market sentiment, the company’s strong financials and profitability as well as market position will ensure good cash flows in 2Q as well. That’s why I view that 40% drop as a godsend.

Elkem isn’t really a “forecastable” company as such. What do I mean by this?

I mean that analysts, for several years, have never been able to pinpoint this company’s earnings. Not with a 10% or a 20% margin of error. The company has always either beat or underscored expectations, mostly beaten them over time. So any forecasts here should be viewed with an appropriate amount of conservative consideration.

That being said, due to the macro and the situation we’re going into, my professional opinion as an analyst at this time is that the company’s free cash flow, or EBITDA, or earnings, aren’t really going to go anywhere for the next couple of years. It’s not going up from a 2021-2022 average of around 5.5-6B NOK, but it’s not going down either. And that’ from above 12B NOK in EBITDA during 2022, if you’ll recall.

Most analysts seem to call this expectation more or less correct. The current forecast up until 2026-2027E is for earnings to remain flattish, with EBITDA at around 6B NOK at the highest point (Source: S&P Global). EPS levels are likely to come in at around the 4-5 NOK level, which would put the dividend, based on previous payouts and the company’s policy, at around 1.9-2.3 NOK per share, compared to the massive dividend in 2022 at 6 NOK. This gives us a forward yield of at most 8-9.2%, which is still very significant, especially for the sector.

This is why I like a decline in the company.

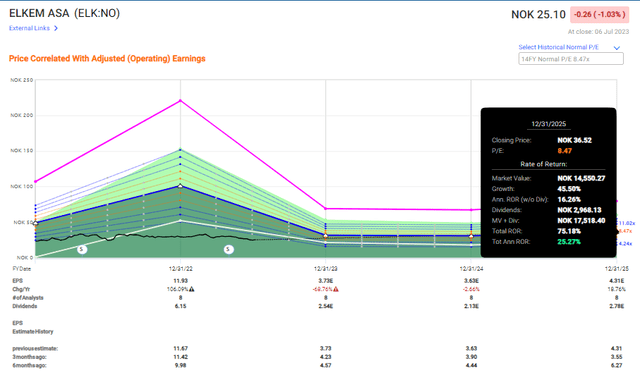

Even on the basis of only a 6-8.5x forward P/E, the company still has a very real upside of 25% per year or 75% in less than 3 years.

Elkem Upside (F.A.S.T graphs)

Perhaps the main risk to consider is Chinese ownership. And when I say ownership, I do mean ownership. The company has several assets as well as customer relationships when it comes to China. As of the current circumstances, Elkem is majority-owned by the China National Bluestar-controlled Bluestar Elkem Co. LTD, with 52.91% of the voting power. This is very rare for a Norwegian company, which typically likes national control – but in Elkem the government only has around 5%. This is also the one characteristic that, until now, prevented me to go “into” the company. If I go into Chinese companies, which Elkem can be argued to be due to that ownership, I want my “China discount”. After a 40% drop, that China discount is something I’m getting.

I’ll never be 100% comfortable investing in something with a Chinese majority, but in the end, it’s acceptable to me because it’s a company with Norwegian history and over 50% of its assets and exposures in Europe. After that, it’s mostly mathematics – and there it doesn’t matter where the influence comes from. I also expect, despite that ownership, for the Norwegian government to exercise influence based simply on the production assets found in Norway. It also goes to the fact that it has over 100 years of native Norwegian history under its belt.

So, as long as the company is cheap enough, that’s fine with me. My latest PT for Elkem was 41 NOK/share. I’m not changing that PT due to the crash – the company is absolutely able to reach this – but the fact that we’re now at 25 NOK means we can also call Elkem “cheap”.

Based on this, here is my thesis for Elkem as it stands.

Thesis

- I consider Elkem to be a very interesting chemical play, perhaps somewhat impaired by its majority of owners from China. The upside is a very diversified production base, with favorable exposure to low-cost environments, and also being a market leader.

- The downside is the company’s size, cyclicality, and limited lifespan with its current operations, making forecasting or giving the company a fair value tricky.

- Still, at this time, I give the company the equivalent of a long-term 10x P/E as a PT, which comes to 41 NOK/share. That means that there’s an upside and a “BUY”. I can now, as of July 2023, also call this company “cheap”.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I now call Elkem cheap, and consider the company a significant “BUY” with a good upside here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here