Investment action

I recommended a buy rating for Guidewire Software (NYSE:GWRE) when I wrote about it the last time as I believed GWRE has a strong market position, which has allowed it to drive forward the migration from on-premise software integration to cloud-based solutions, making it a top choice for insurance carriers.

Based on my current outlook and analysis on GWRE, I reiterate my buy rating. I expect GWRE to at least grow 10% over the near-term, and valuation gaps vs peers should close, driving attractive upside.

Business

GWRE provides software systems to the Property and Casualty [P&C] insurance market, with a focus on an underserved area that is ripe for growth.

Industry & Peers

According to Allied Market Research, the global P&C insurance software market size was $11.6 billion in 2021 and is expected to reach $28.5 billion by 2031, expanding at a CAGR of 9.6 percent from 2022 to 2031.

The rise in internet and mobile device penetration around the world, as well as the trend toward digital transformation within industries, are driving the expansion of the global P&C insurance software market. The expansion of the P&C Insurance Software Market is also helped by the rising demand for insurance funds among businesses and individuals.

Companies like PCMS Software, Pegasystems, Duck Creek Technologies, Quick Silver Systems, etc. are GWRE’s main rivals in the market.

Qualitative review

During the quarter, GWRE closed more deals with steeper ramps, leading to lower ARR in the first year but faster ARR growth in subsequent years. Given the rising cost of capital (rising rates), I anticipate this pressure will persist in the near future, as carriers are likely to remain cost conscious. This has a direct result in a greater proportion of deals with higher ramp pricing. While this trend is negative for ARR in the short term, I think it has net positive impact if carriers keep pledging to invest in large-scale modernizations. While investors may be concerned about the lower ARR in the first year under the new sales arrangements, I do not think the market fully appreciates this dynamic. The market, in my opinion, is ignoring the long-term commentary that suggests robust sales activity by maintaining an attractive fully ramped ARR in these same arrangements.

Quantitative review

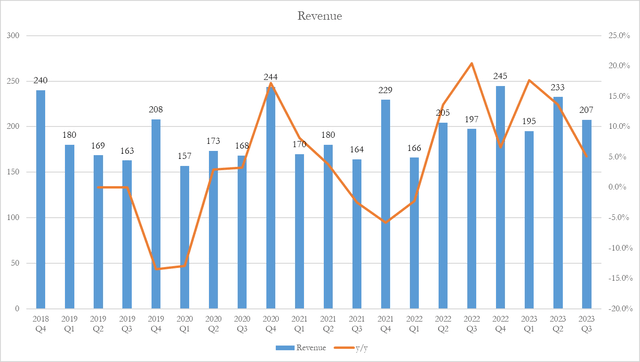

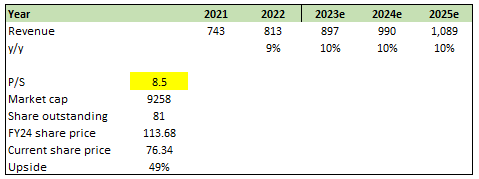

Author’s work

GWRE should continue to benefit from the secular tailwinds of digital infrastructure modernization in the P&C insurance market. I expect GWRE to grow at least at the industry rate of 10% in the near future, with the potential for much more as it continues to roll out innovative products that are difficult to underwrite today, especially given the environment. Even if the product is excellent, underlying customers may delay adoption by avoiding unnecessary expenditures.

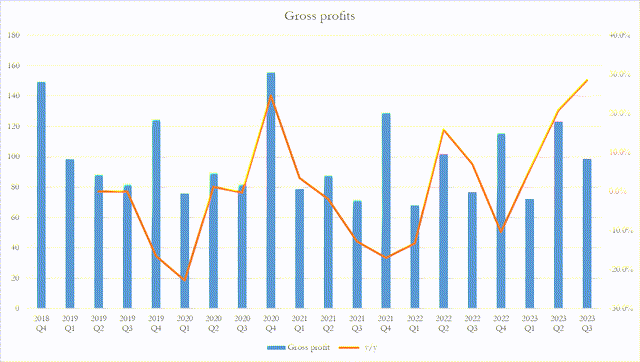

Author’s work

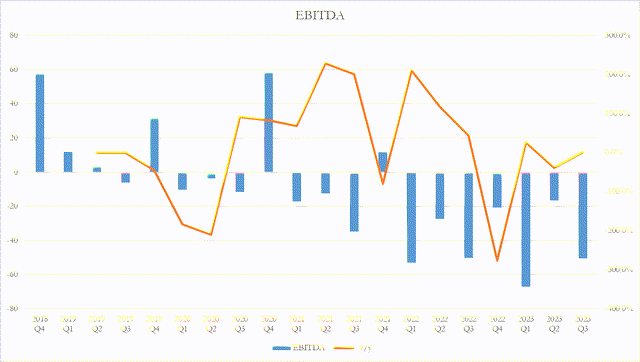

Author’s work

I expect GWRE to be profitable again by FY23/24 as the company gradually completes its cloud transition. Importantly, the current set of deals has lower margins in the first year; as a result, I believe the current financials are masking the business’s long-term margin profile.

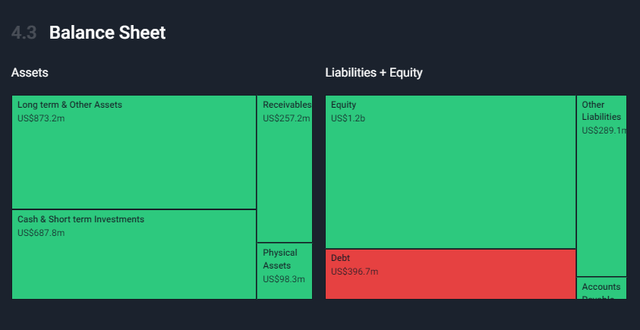

Simply Wall St

GWRE’s balance sheet is healthy, with more cash than debt, indicating a net cash position. This reduces the risk of potential dilution from a capital raise because GWRE has enough cash to stay afloat even if current losses continue for the next four years.

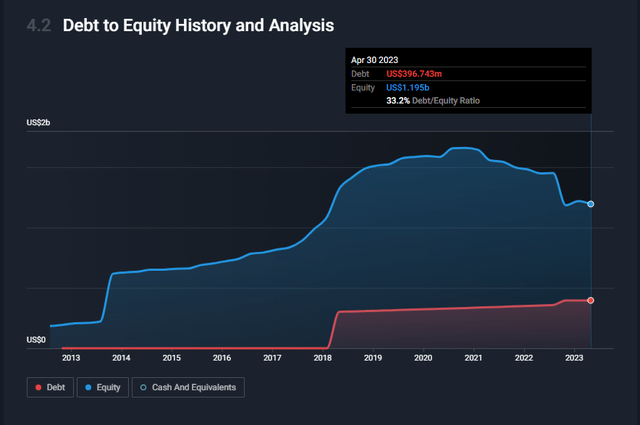

Simply Wall St

GWRE has a debt to equity ratio of 33.2%, which I think is not in dangerous levels, especially with the cash balance in the balance sheet. That said, the ratio has increased over the past 5 years, so it is something to monitor.

Valuation

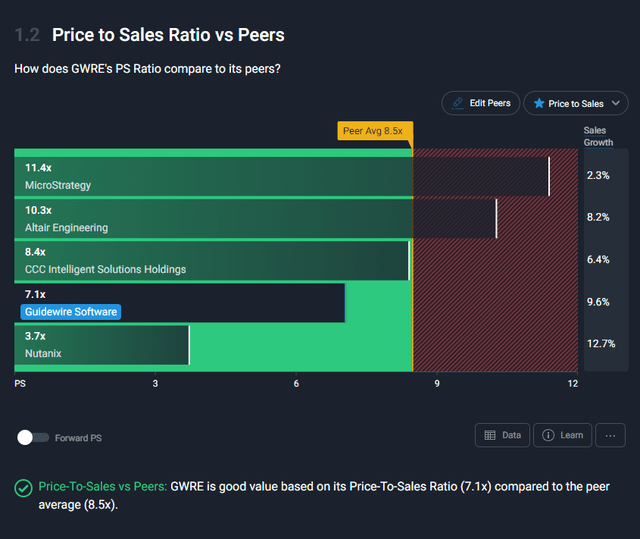

Because GWRE is unprofitable, I value the company and stock based on its price to sales ratio. Despite growing faster, the GWRE PS ratio is trading at a discount to the peer average of 8.5x. I believe GWRE should trade at least in a comparable range or at a premium, rather than at a discount. Given the lack of publicly listed comps that GWRE has (Duck Creek was acquired), I used a peer set of companies that provide similar types of services in other industries.

Simply Wall St

In the short term, I believe GWRE’s revenue can grow at least 10% per year, which is in line with the industry rate, as the industry moves toward digital infrastructure modernization. Given GWRE’s strong market position, the company should have no trouble maintaining its market share. If GWRE grows 10% from its 8.5x revenue base in FY22, the company should generate around $1.1 billion in revenue in FY25. Using the average multiple of peers, a price target of $113 or 49% upside is suggested.

Author’s work

Risk

Customers in the P&C insurance industry may be hesitant to immediately adopt GWRE’s cloud platform due to concerns about the scalability and security of the technology. The top-line mix could be negatively impacted if the expected number of cloud deal signings is not achieved.

Conclusion

I reiterate my buy rating for GWRE stock based on its positive long-term ARR growth potential. GWRE holds a strong market position, driving the migration to cloud-based solutions in the insurance industry. The global P&C insurance software market is expected to expand at a CAGR of 9.6%, providing growth opportunities for GWRE. Despite lower ARR in the first year, the company’s deals with steeper ramps indicate faster ARR growth in subsequent years, which I believe is overlooked by the market. The company’s healthy balance sheet, net cash position, and favorable valuation compared to peers further support the buy rating. However, potential risks include customer adoption concerns and the achievement of expected cloud deal signings.

Read the full article here