The Biden administration has revamped an existing student-loan forgiveness program, and over 800,000 borrowers are slated to have $39 billion of their debt erased.

Texas is home to the largest number of borrowers who will benefit from the reform — and debt cancellation, data from the Education Department released Tuesday morning revealed.

The three states with the largest number of borrowers who will see their student debt erased under the fix to the program, known as Income-Driven Repayment, are Texas, California and Florida, according to data from Education Department.

Nearly 64,000 Texans are expected to see around $3.1 billion in student loans canceled as a result of having paid their outstanding balance through the IDR program over the past two decades.

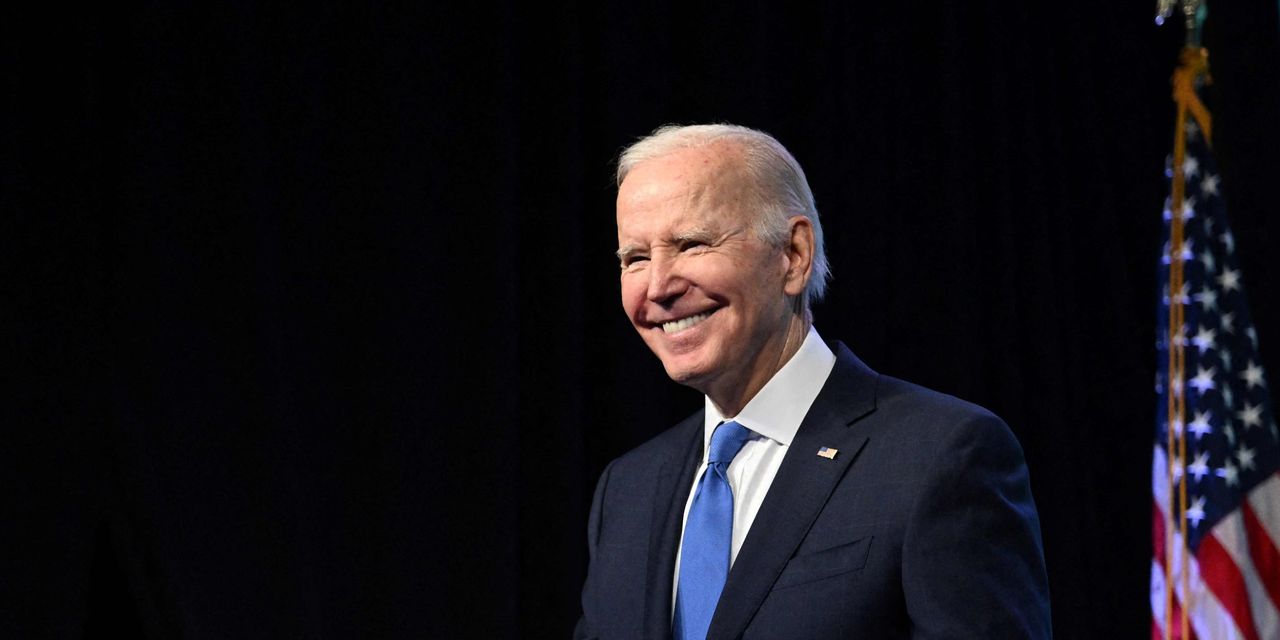

“Republican lawmakers — who had no problem with the government forgiving millions of dollars of their own business loans — have tried everything they can to stop me from providing relief to hardworking Americans,” President Joe Biden said Friday, announcing the plan. “Some are even objecting to the actions we announced today, which follows through on relief borrowers were promised, but never given, even when they had been making payments for decades.”

“The hypocrisy is stunning,” Biden added, “and the disregard for working- and middle-class families is outrageous.”

| State | Borrower Count | Debt Eligible for Discharge (in millions) |

| Texas | 63,730 | $3,091.80 |

| California | 61,890 | $2,958.80 |

| Florida | 56,930 | $3,036.80 |

| New York | 42,070 | $1,924.10 |

| Georgia | 38,590 | $2,130.40 |

At the lower end, loan forgiveness through the IDR fix is least likely to help borrowers in Alaska, Wyoming and Hawaii. In Alaska, only 970 student debtors will see their debt erased through the IDR fix, the federal data revealed.

Last year, the Biden administration and Education Department announced that they would be reviewing borrowers’ accounts to make sure all student-loan borrowers’ monthly payments toward their debt have been accurately counted.

The count is an important part of the Income Driven Repayment program, which allows debtors to pay 20 or 25 years of debt as a percentage of their income and have the remainder forgiven.

Until the fix was announced, few had received loan forgiveness in exchange for paying their debt for 20 to 25 years.

To be clear, the cancellation announced by the administration is not the broad-based loan forgiveness proposal that the Biden administration has been pushing for. The U.S. Supreme Court struck down the president’s plan in June.

The forgiveness comes as a result of a government program that promised loan forgiveness in exchange for debtors paying back their debt over two decades.

Jillian Berman contributed to this report.

Read the full article here