Prologis

PLD

CFO

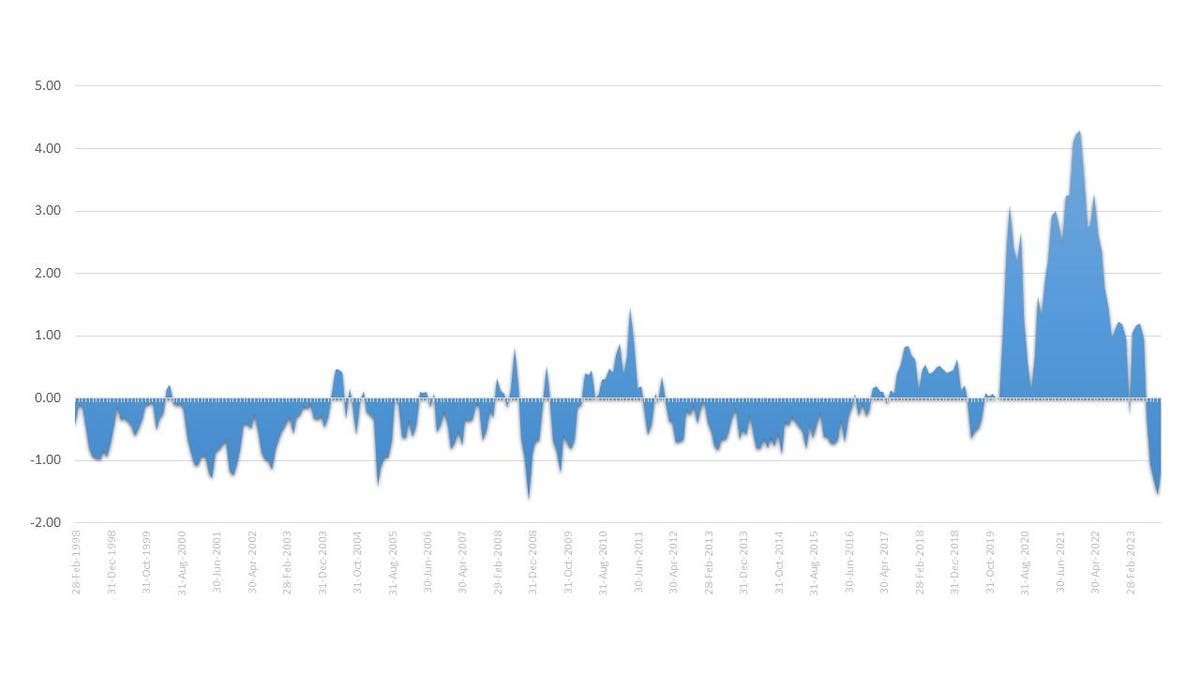

The worldview of logistics/transportation providers is that the decline in supply chain variability signals a return to supply chain normalcy. However, in other areas of the supply chain, challenges persist that are underrepresented by the logistics-centric view of the Global Supply Chain Pressure Index (GSCPI) published each month by the Federal Reserve Bank of New York. This pressure index, while helpful, is transportation/logistics centric and underrepresents other elements of the supply chain.

ADVERTISEMENT

So, is there a return to normalcy? I don’t think so.

Five factors continue to plague manufacturers requiring a rethinking of traditional processes. For each, I share my point of view (POV):

- What Is Demand? Traditional demand planning uses history as a proxy to predict future demand. The past three years represent an abnormal demand pattern. As consumer preferences shift with economic volatility, traditional demand planning processes are not effective. Forecast Value Added (FVA) analysis at manufacturing clients shows continuous degradation. My POV is that demand planning will be redefined in the next two years to be less dependent on order patterns with greater linkage to market data using newer forms of technology (Narrow AI and NoSQL).

- Bullwhip Effect. As we move through this period of volatility, traditional transactional approaches to supply chain planning increase the bullwhip effect resulting in over-buying of the wrong inventory. With the rise in inflation, many companies face not only having the wrong inventory, but also the need to make choices on what to do with expensive inventories. My POV is that companies facing the looming issues of having the wrong, and expensive inventories, will shift the focus only on safety stock management to better manage network inventories, in-transit inventories, and manufacturing cycle stock.

- Supply Shortages Continue. The war in Ukraine continues to put pressure on food, fertilizer, nickel, palladium, and energy. The depletion of armaments increases the demand for scarce parts for weaponry, supplies for ammunitions, and semiconductors. Supply shortages continue. In my opinion, the answer is building strong supplier development organizations to better understand and respond to supplier shortages.

- Transportation Labor Strikes. With unprecedented profits during the pandemic, the unions want their share of profits. They also seek resolution of worker safety issues. UPS negotiations continue against an August 1st deadline. If UPS strikes, Jason Miller, Professor at Michigan State University, estimates that only 20% of the UPS volumes can be picked up by other carriers. The greatest impact looms large for consumer electronic eCommerce, medical device deliveries, and commercial wholesale. The nervousness around transportation labor outages creates the need for increased planning and inventory. Companies need to plan for contingencies.

- Employee Turnover. The pandemic disruption accelerated retirements and employee turnover. Obtaining and retaining skilled planners is a challenge. The shortage of skilled planners can only be solved by companies training and building their own teams.

ADVERTISEMENT

In this period, companies with strong competencies in planning will outperform. Unfortunately, the pandemic increased reactive behavior undermining the principles of supply chain planning. Knee-jerk reactions will not serve companies well in moving through these headwinds. Instead, companies need to constantly assess:

- Do they have a good plan?

- Is the plan feasible?

- Does the plan represent all constraints (source, make, and deliver)?

- Are there sufficient contingencies to meet the pending labor and supply issues?

- Are they a good trading partner with their suppliers to understand and plan for supplier shortages?

Unfortunately, when viewed through this lens, we are not at pre-pandemic levels of disruption.

Read the full article here