Reports of employment growth have been recently met with growing skepticism among economy watchers. Huge swings in the monthly reports and substantial revisions make it difficult to gauge conditions in the labor market. In December 2020, the government reported a decline in employment of 264,000. In January, a 494,000 increase. It’s hard to make sense of such swings in such a short period of time. In the most recent report, 48% of the jobs were in federal, state, and local governments and education and health (basically “public sector” jobs). That means there are only about 100,000 jobs in the rest of the economy, that’s not many in the “private” sector, and a very weak performance.

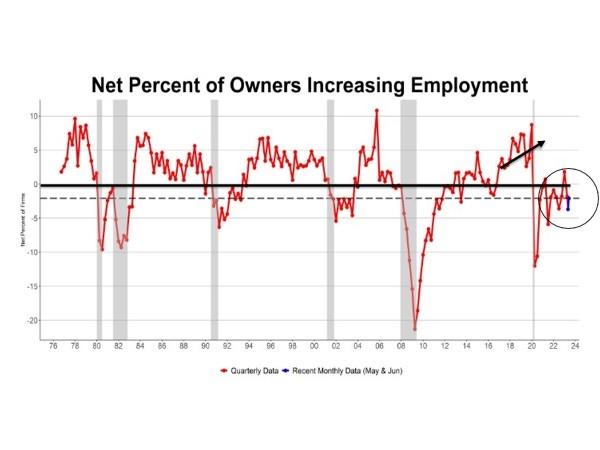

NFIB has monitored job market activity from random samples of its approximately 300,000 member firms since 1973. Chart 1 shows the net percent of owners (increased minus reduced) who increased employment at their firms. The solid line is the “0” level, the dashed line marks the most recent survey reading (June). The recovery of job creation appears to be delayed for many quarters after a major recession (1980 is the exception). Job creation was gaining strength up to the Covid shutdown. Since then, job creation activity on Main Street has been muted, showing little improvement.

The surge in Tech businesses did create a lot of jobs but they are not “small” and are now shedding workers. Small business dominates the retail and non-professional service sectors, and it is still short of the workers needed to operate. The share of new jobs generated by each industry group was approximately equal to their share in the population of firms. Manufacturing firms hired an average of 2.4 workers, the lowest, and firms in agriculture and financial services averaged 2.7 workers, the highest, not much variation.

Overall, it appears that job growth on Main Street is not strong even though record high percentages of owners have job openings. About 90% of owners who are trying to hire report few or no qualified applicants for their open positions, so few get “filled” and the openings linger on. It’s easy to declare an opening, but very hard to fill it. As consumer spending fades, job openings will decline and initial claims for unemployment will rise as private sector firms try to manage labor costs. Reports of higher compensation are now higher than reports of price hikes, unhealthy for profit growth. The need to maintain profits will drive employment decisions as the economy slows.

Read the full article here