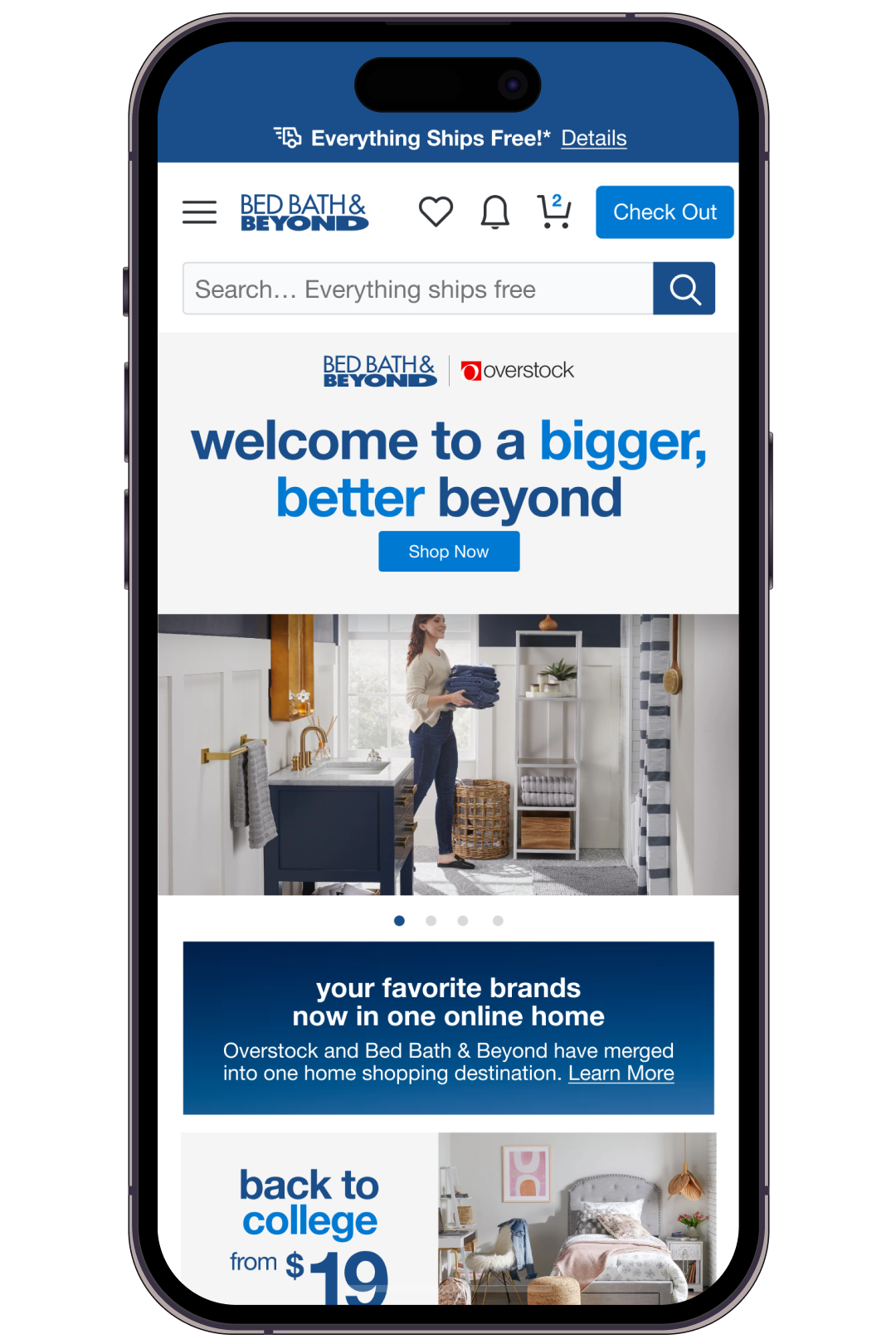

Overstock.com has officially rebranded as BedBathandBeyond.com. CEO Jonathan Johnson discussed what it will mean for consumers and product vendors.

George Anderson: You once told me you would be at 22 or 23 percent margins come hell or high water because of your dropshipping fulfillment model. Will that hold with your new categories in Bed Bath and Beyond?

Jonathan Johnson, CEO, Overstock: We’ve added over 600,000 new SKUs, all on the dropship model. Suppliers that haven’t been able to dropship have been willing to put their product, that they own, in our warehouse and let us pick, pack and ship for them.

You mentioned our 22 to 23% gross margin. We think we can continue to maintain that. However, during this initial rebranding period, we’ve told the street that we will stray a little bit from our financial recipe card for a few quarters as we try to significantly increase the number of active customers shopping on the new Bed Bath and Beyond.

Anderson: Bed Bath and Beyond disappointed a lot of customers.

Johnson: Bad management kills companies, but it doesn’t kill brands. We did customer surveys and found that among home products shoppers, Bed Bath and Beyond was a top-five brand that people loved, trusted and wanted to shop at. So we think they’ll have a great customer experience on this newly launched site. During this initial period, there’ll be great promotions, including reinstating some of the Welcome Rewards points the bankruptcy court took away. So we have marketing efforts in place to one, keep loyal Bed Bath and Beyond customers, and two, bring back some customers who left.

Anderson: What’s your relationships with Bed Bath & Beyond’s suppliers?

Johnson: That’s been one of the quick-to-materialize benefits of this purchase. There has been some overlap in our suppliers. When there’s been overlap, usually the supplier would not open their full catalog to us as Overstock. Now that we’re Bed Bath and Beyond, they’re opening their full catalog and, even better, suppliers we’ve been trying to onboard for years are knocking on the door and asking to be onboarded. So, the Overstock name wasn’t only a hurdle for customers. It was a hurdle for suppliers. That’s been removed.

Anderson: Bed Bath and Beyond had gotten heavily into the private brand space. What are your intentions?

Johnson: Don’t look to us to lean into private label. Look for us to lean into name brands that customers want and expect.

Anderson: You unsuccessfully tried rebranding Overstock. Do you bring any lessons from that to rebranding under the Bed Bath and Beyond banner?

Johnson: Rebranding away from the dictionary meaning of a term is hard. With Overstock, the dictionary meaning is liquidation. With Bed Bath and Beyond, the dictionary meaning is about home products, so I think it will be easier. Our branding dollars will go further and create more loyalty than at Overstock, where even when we got someone, we didn’t necessarily convert them into a loyal customer. We need to make people make first purchases, second purchases and beyond.

Anderson: Are the Overstock and Bed Bath and Beyond customer the same person?

Johnson: They’re similar. They’re not the same. Overstock has always been a promotional company including coupons. Bed Bath has been the same. So those customers are trying to make their dream home come true at smart value prices, getting a deal. So while there’s not 100% overlap, as we shift our marketing slightly to the larger Bed Bath and Beyond customer database, the Overstock customer won’t feel like we’re abandoning them.

The big blue coupon was beloved by Bed Bath and Beyond customers. For those that love that coupon, what they’ll really love is downloading our mobile app, where special and unique promotions will be pushed to them, including during this launch period, a 25% coupon for the initial downloading of the app.

Anderson: What role will personalization play in your merchandising and marketing?

Johnson: What we found in Canada, where we launched a little over a month ago, is that personalization through our SEM (search engine marketing) efforts had a better return on ad spend than when we were Overstock. It’s because the Bed Bath and Beyond name is more recognizable. We got a treasure trove of data that we can use to personalize for people in the Bed, Bath and Beyond customer database. So yes, we’ll continue to focus on personalization and push to people what they want rather than just a shotgun approach to marketing.

Anderson: Moving into new product categories, you’ll also go against new competitors. How are you going to differentiate?

Johnson: You can break that roster into two groups. There are general merchandisers, think Amazon

AMZN

Anderson: Do you see store-within-a-store, pop-up or other brick-and-mortar opportunities?

Johnson: Never say never, but I think it’s never for now. The one place I could see us experimenting, sooner than later, maybe next year’s back-to-school, back-to-dorm efforts. We could look at that because that’s an area where Bed Bath has done pretty well. We think we can improve on it.

Anderson: Are you considering partnerships with complementary retailers?

Johnson: We explored some of that under Overstock and never found the right partner. I think that’s another place where a headwind has been removed. Potential partners, like an Amazon and Kohl’s relationship, may be more palatable now that we have a well-known name.

The conversation has been edited and condensed for clarity.

Read the full article here