China and Australia have largely repaired bruised diplomatic relations but it’s a different story at the corporate level where Chinese mining companies are hitting Australian Government regulatory roadblocks.

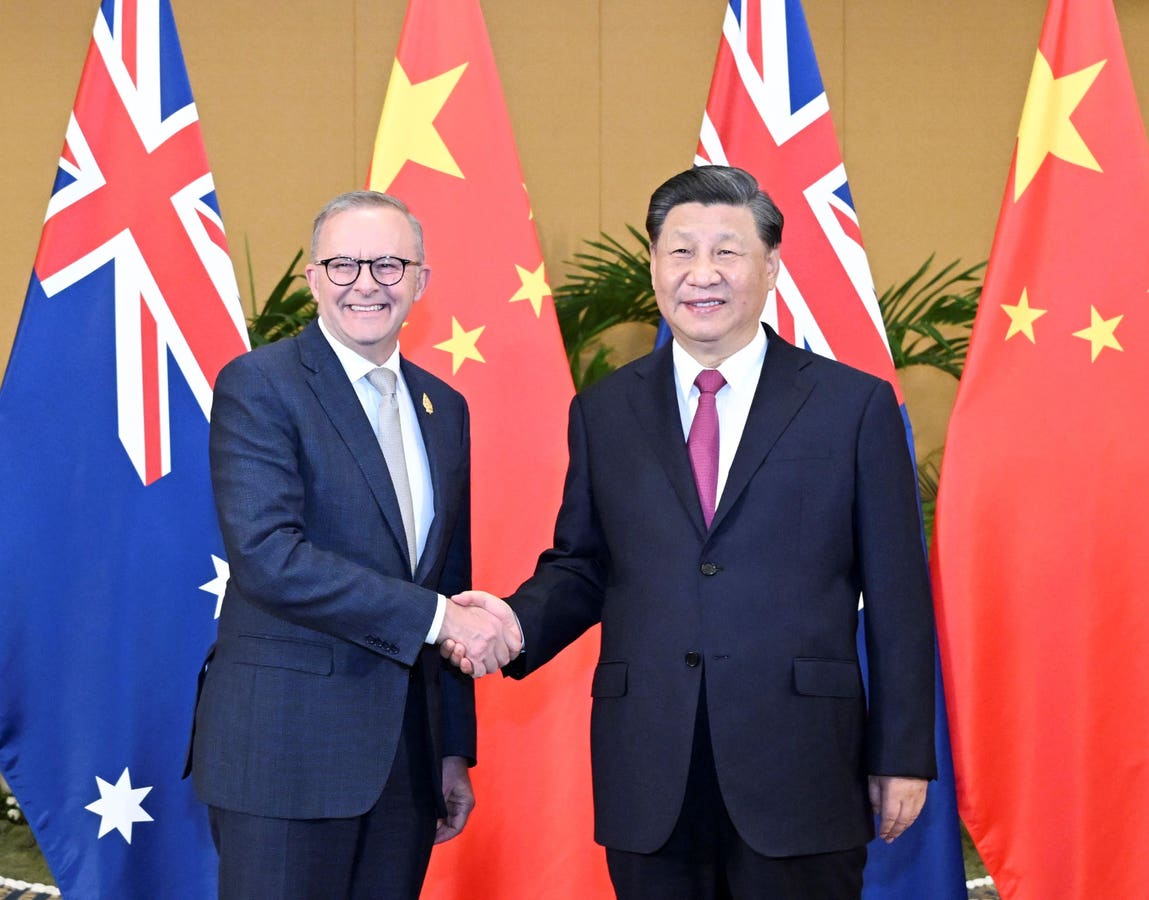

A meeting in Beijing earlier this month between Chinese President Xi Jinping and Australian Prime Minister Anthony Albanese smoothed out most of the outstanding issues created by a Chinese embargo on some Australian exports.

But, as bans on coal, wine, barley and other Australian products have been removed two Chinese companies have seen their mining investment proposals rejected.

The issue which has prompted a negative reaction from the Australian Government agency which controls foreign investment is Chinese interest in critical metals such as lithium and rare earths which have multiple industrial and military uses.

The Foreign Investment Review Board (FIRB) first moved on an attempt by Chinese interests to acquire control of the Bald Hill lithium mine, one of Australia’s first to be developed but later forced into bankruptcy when the lithium price collapsed in 2019.

Chinese interests continued to operate the mine but were accused of selling lithium to associates in China at a steep discount which sparked Australian Government inquiries which led to a ban on Chinese ownership, clearing the way for the Australian company, Mineral Resources, to buy Bald Hill in September.

The latest quarrel with regulators is over a rare earth project developer, Northern Minerals, which plans to mine the world’s largest known deposit of the heavy rare earths dysprosium and terbium at Browns Range in the far north of Western Australia.

Not as prominent in the family of rare earths metals such as neodymium and praseodymium which are used to make the permanent magnets used in electric vehicles and wind turbines dysprosium and terbium improve the durability of magnets.

Northern Minerals has developed a trial pit at Browns Range but has struggled to achieve full production.

A fresh move to fully develop the mine is starting to take shape under new managing director Nicholas Curtis.

It was Curtis who took another Australian rare earth company, Lynas Rare Earths, from obscurity into production before leaving during a rare earth price collapse, being replaced by a new team which has continued his work to the point where Lynas is collaborating with the U.S. Government on a rare earth strategy that includes a facility in Texas to process Australian rare earths.

Like the battle for Bald Hill the fight over Browns Range has sparked Australian Government intervention and a rear-guard fight by Chinese interests which took a fresh turn this week with an attempt to dump Curtis from the Northern Minerals board.

Using Australian corporate law, the Chinese controlled Yuxiao Fund, which has a 9.8% stake in Northern Minerals has requested a meeting of the company’s shareholder to vote on a resolution to remove Curtis.

Yuxiao also wants to see its nominee, Chinese national Wu Tao, elected to the Northern Minerals board despite his being banned earlier this year by FIRB from acquiring more shares in the Australian company.

The FIRB was reported last month by The Australian newspaper to be investigating whether Wu or associated interests had been secretly buying Northern Minerals shares in a bid to seize control.

Northern Minerals said in a statement lodged with the Australian Stock Exchange yesterday that it was considering the request for the meeting along with the standing on Wu under FIRB regulations.

The sensitive nature of the Browns Range rare earth project has been elevated by the involvement of another Australian rare earth developer, the titanium minerals miner Iluka which is building Australia’s first fully integrated a rare earths refinery.

As well as assisting with the development of Browns Range, Iluka plans to use ore from the mine as early-stage feedstock at its refinery.

The complex corporate maneuvers around Northern Minerals are attracting international attention thanks to Chinese dominance of the rare earth industry and its apparent attempt to take control of a potential rival mine in Australia.

Read the full article here