A recent story in the Wall Street Journal chronicles the fact that, for this energy transition to succeed, the United States is going to need massive quantities of cobalt, among other energy minerals. Yet, the Australian owners of what would become the country’s largest cobalt mine, despite having managed to overcome the myriad permitting hurdles that delay and raise costs for opening any U.S. mine, recently were forced to suspend operations and lay off employees recently due to a crash in the commodity price.

As the Journal’s authors note, China currently dominates supply chains for cobalt and most other critical energy minerals, and companies operating in the U.S. face the added obstacles of far higher environmental standards, permitting delays, activist litigation, higher labor costs and difficulty generating interest from Wall Street. The array of subsidies and tax breaks in last year’s Inflation Reduction Act were supposed to help address the financial end of things, but distribution of the funds has been a predictably plodding process within the federal bureaucracies.

The Problem For Rare Earths

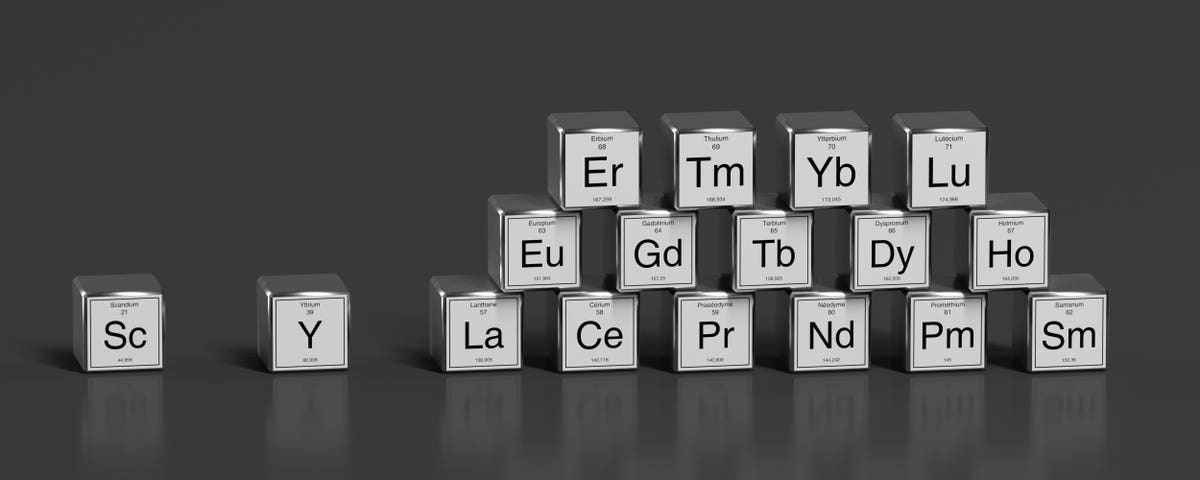

A very similar set of challenges exists in the realm of rare earth elements, where China has also dominated the supply and supply chain landscape for decades. So-called “rare earth” elements are those occupying element numbers from 57 to 71 on the standard periodic table. They come with names like lanthanum (La), cerium (Ce), praseodymium (Pr), and the rarest of all, thulium (Tm).

Rare earth elements have come into increasingly high demand in recent decades due to their use in basically every high tech gadget used by the human race. That demand has expanded in recent years due to the key role rare earths also play in the manufacture of batteries, wind turbine blades and solar panels.

In other words, sourcing and maintaining secure and affordable supplies of these elements is a crucial aspect in making this so-called “energy transition” work. It is a fact that everyone recognizes, one that makes the apparent reluctance of the Biden administration to help jump-start a project to develop the world’s largest known rare earth resource, the Tanbreez project located in a compact area on the southwestern coast of Greenland, almost inexplicable.

A Resource That Could Help Secure The Future

“This mine is one that could basically drive civilization over the next 20, 30, 50 years,” Christopher Messina, CEO of Tanbreez, told me in a recent interview. For the United States and its needs, that is probably no exaggeration given that the resource was recently ranked by Mining.com as #1 on its list of Top 10 rare earth mining projects in the world. The total estimated recoverable resource at Tanbreez of 28.2 Mt. compares to the combined resource in the #4 through #8 mines on the list.

It is an enormous potential resource, on an island nation adjacent to the North American coastline. It can be recovered with current technology with minimal environmental disturbance, and Greenland’s own government is in favor of moving ahead.

Just one problem: Nobody in the private or public sector seems interested in being the first to take on the risk of funding the project. Messina says he had funding secured in early 2020 from a prominent backer of such projects, but “Irony of ironies, he died in April that year of the virus.” With the global shutdown coming to an end, the Tanbreez team restarted fundraising efforts recently. “It’s a situation where everyone cannot wait to be 5th to jump in,” Messina laughs.

At least he has a good sense of humor about it all.

But wait: Didn’t President Joe Biden make a speech in July, 2021 in which he committed to mounting a “whole of government approach” to onshoring supplies and supply chains for critical energy minerals and rare earth elements that are fundamental to the expansion of renewables and EVs? And isn’t the U.S. government sitting on huge pots of funding for projects just like this one that could play a key role in making that whole of government project a successful one?

For those unaware, the answer to both questions is ‘yes.’

But despite repeated meetings with officials at the Department of Defense, Energy Department, the Development Finance Corporation and other federal agencies, Messina has come away frustrated as the government drags its feet. He points to bureaucratic concerns that still reverberate from the Obama-era fiasco with Solyndra as making career officials reluctant to risk having their career impacted by funding another potential failure. This very nature of slow-moving bureaucracy impedes the sort of swift-moving capital deployment that, for example, the Chinese have excelled at in the global minerals race.

But if that is a real dynamic within the Biden bureaucracies, then it will take many years for these funds to be dispersed, causing the transition to fall even further behind the aggressive goals Biden has set.

One alternative to U.S. funding that Messina undoubtedly has available to him would be to reach out to companies affiliated with the Chinese government for the seed money. China would no doubt jump at the chance to control the world’s largest known rare earth deposit as part of its Belt & Road initiative. But he says he considers that to be a last resort.

The Bottom Line

Messina and his team remain optimistic that the needed funding will be secured, despite the lack of immediately catalyzing financial support from the US government. They are in due diligence processes for both equity and offtake financing from a number of sophisticated investors and industrial buyers.

More recently, Messina has been reaching out to current and former independent oil and gas executives, well known risk-takers, as potential sources of funding. “Wouldn’t it be a great story if I could find 20 oil and gas guys who were willing to put in $1 to $10 million each to jump start the most important renewable energy project on earth?” Messina asks.

Yes, it would be, and it’s a story I would definitely enjoy telling here.

Read the full article here