SINGAPORE, July 24 (Reuters) – Chinese oil refiners and petrochemical companies are investing tens of billions of dollars to produce high-end chemicals for solar panels and lithium-ion batteries to profit from growing demand for energy transition technologies.

The investments illustrate China’s drive to reduce its import dependence and further cement its dominance of renewable energy and electric vehicle supply chains. The move pits the Chinese companies against Dow Chemical, Exxon Mobil (XOM.N) and BASF (BASFn.DE) in making key materials.

Companies including Wanhua Chemical (600309.SS), Zhejiang Petrochemical Corp (ZPC) and Hengli Petrochemical (600346.SS) and state oil giant Sinopec Corp are leading the shift, industry executives and analysts said.

They are moving from making more basic petrochemicals for polyester fabrics and plastic packaging to manufacturing higher value products such as polyolefin elastomers (POE) used to protect the cells on solar panels, ultra-high-molecular-weight polyethylene for lithium-ion battery separators and carbon fibre for wind turbine blades.

“Overcapacity and weak demand for commodity chemicals, and China’s rapidly growing industries like solar, electric vehicles are the key drivers for companies to extend into high-end, high performing materials,” said Kelly Cui, Shanghai-based principal analyst with consultancy Wood Mackenzie.

China’s glutted market in polyethylene and polyesters after years of rapid petrochemical capacity expansion is prompting some of the shift.

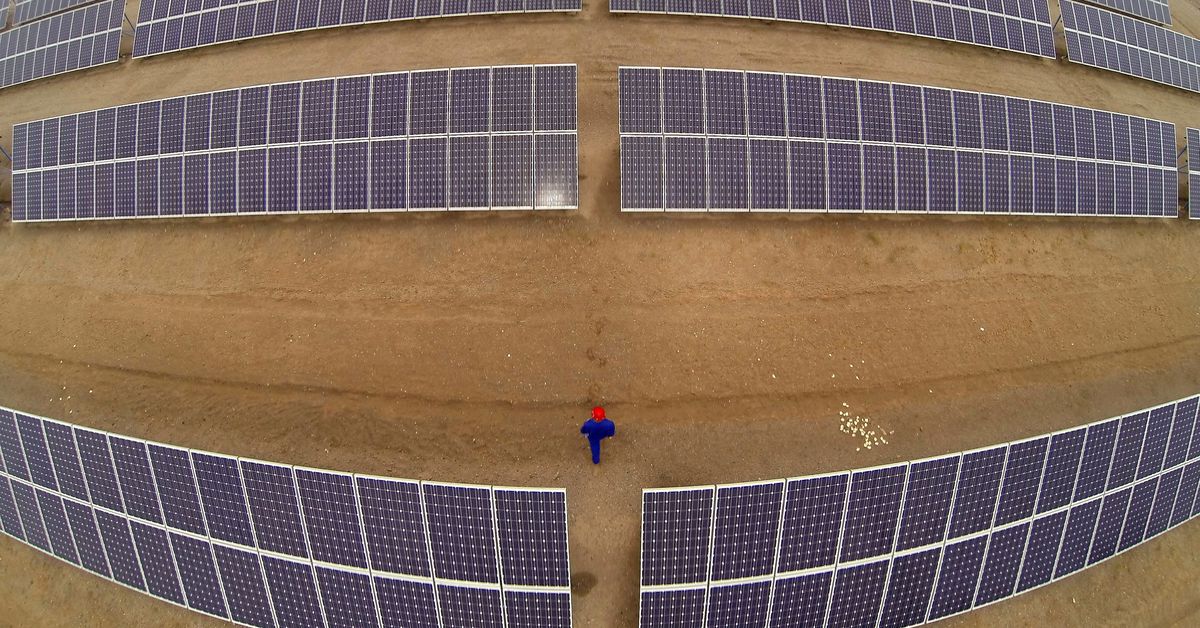

The drive also aligns with Beijing’s push for companies to break through technological bottlenecks for producing key new materials and strengthen domestic supply chains, and builds off China’s status as the world’s biggest manufacturer of electric vehicles, EV batteries and solar panels.

“Companies are moving towards serving the new energy sectors where China is already leading in manufacturing,” said Zhao Tongyang, deputy chief engineer at the China National Petroleum and Chemical Planning Institute (NPCPI).

ZPC, Hengli, and smaller refiner Shandong Chambroad Petrochemical are each building multi-billion-dollar complexes to make the new materials, with production due to come online around 2025, officials at the three companies told Reuters.

Sinopec Corp, the country’s top refiner and basic chemicals producer, is shifting investment to high-end chemicals such as ethylene vinyl acetate (EVA) for solar panels and large-tow carbon fibre used in aircraft and lighter, stronger wind turbine shafts.

“China is no longer short of bulk commodity chemicals and has entered a phase of cost competition,” said a representative at Hengli Petrochemical, which is adding a 20 billion yuan ($2.77 billion) chemical park next to its petrochemical complex in Dalian, in northeastern China.

Engineering plastics, raw materials for bio-degradable plastics and electrolytes for lithium batteries, as well as plastics for the battery separators, are among the new plant’s main planned products, said the Hengli representative, who declined to be identified.

Having set up a specialised battery technology unit in late 2022, Wanhua Chemical said in May it will spend 3.4 billion yuan this year on raw materials for anodes, cathodes, and electrolytes used in lithium batteries, China Chemical News reported in June.

PUSHING POLYOLEFIN ELASTOMERS

Chinese production capacity for POE, a material used for solar panel encapsulation that resists ultraviolet light and is more durable than EVA, will surge to 1 million metric tons per year by 2025 from zero at a cost of about 20 billion yuan, to meet demand that is set to expand at double-digit rates, industry officials estimated.

About a dozen companies, including units of Sinopec and PetroChina , are building or planning POE capacity.

The domestic supply would partly replace China’s POE imports, which have grown by an average of 23% a year over the past five years to a record 690,000 tonnes worth 13.7 billion yuan in 2022, according to Chinese customs.

“China controls 80%-90% of global solar capacity and is home to 90% of photovoltaic encapsulant film manufacturing, but has zero local production of POE pellets,” said NPCPI’s Zhao.

Wanhua and Sinopec are expected to be China’s first commercial POE producers, according to Zhao and Woodmac’s Cui.

In April, Sinopec announced trial output at its Maoming refinery.

ZPC expects to bring online a POE facility that can produce 400,000 metric tonnes per year by 2025/2026, said an official from Zhejiang’s parent Rongsheng Petrochemical.

“Whoever moves faster will win as there could be a surplus, as many are planning (POE plants),” said Woodmac’s Cui.

($1 = 7.1720 Chinese yuan renminbi)

Reporting by Chen Aizhu; additional reporting by Beijing newsroom; Editing by Tony Munroe and Christian Schmollinger

Our Standards: The Thomson Reuters Trust Principles.

Read the full article here