The process of consolidation in the U.S. shale business took a giant leap Wednesday with ExxonMobil’s

XOM

PXD

A Deal That Checks Off All The Boxes

ExxonMobil CEO Darren Woods said that this long-anticipated merger with Pioneer ticks off a number of key boxes for any company seeking to grow through mergers and acquisitions in the shale space: An outstanding work force, long-term value creation, a high volume of tier-one acreage that is highly contiguous to Exxon’s own acreage base, and opportunities to create value through efficiency gains and economies of scale.

“Pioneer is a clear leader in the Permian with a unique asset base and people with deep industry knowledge. The combined capabilities of our two companies will provide long-term value creation well in excess of what either company is capable of doing on a standalone basis,” said Woods. “Their tier-one acreage is highly contiguous, allowing for greater opportunities to deploy our technologies, delivering operating and capital efficiency as well as significantly increasing production.”

The merger with ExxonMobil will no doubt become seen as the crowning achievement of Pioneer CEO Scott Sheffield, who announced in April that he would retire from the company at the end of this year. Sheffield had retired as CEO once before, in 2016, before returning to the position in 2019 to lead the company through its transition from a company with a wide array of domestic and international assets to a pure-play Permian Basin producer.

In the release, Sheffield emphasized the advantages that would now accrue to employees and shareholders due to the combined company’s size and scale. “The combination of ExxonMobil and Pioneer creates a diversified energy company with the largest footprint of high-return wells in the Permian Basin,” Sheffield said. “As part of a global enterprise, Pioneer, our shareholders and our employees will be better positioned for long-term success through a size and scale that spans the globe and offers diversity through product and exposure to the full energy value chain.”

A New Permian Giant

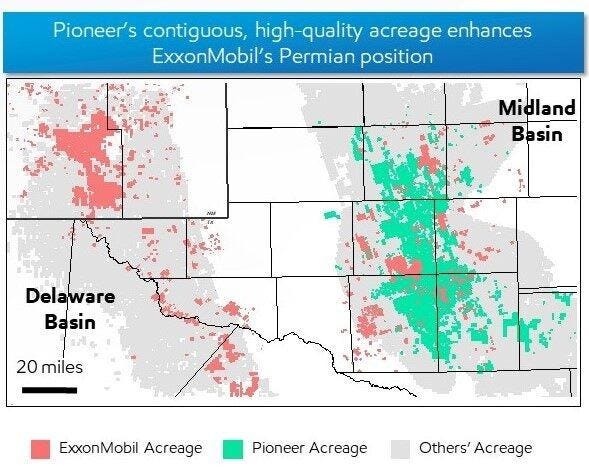

The size and scale of the combined company are truly phenomenal, making it by far the biggest player in the Permian Basin, the world’s most active oil and gas play, and the largest known reserve of oil in North America. By combining Pioneer’s 850,000 net acres of holdings in the Midland Basin with ExxonMobil’s pre-existing 550,000 net acres across both the Midland and Delaware Basins, the combined company will now have 1.4 million acres of drilling and development opportunities at its disposal.

The map shown here clearly illustrates the highly contiguous nature of Exxon’s pre-existing acreage with the newly acquired acreage held by Pioneer in the Midland Basin. As I noted in a story last week, this large amount of contiguous acreage will allow ExxonMobil to optimize water usage, recycling and transport operations, minimize the number of truck trips, and maximize efficiencies related to both drilling and hydraulic fracturing scheduling, among an array of additional efficiencies.

When the deal closes, ExxonMobil’s Permian production will more than double to over 1.3 million barrels of oil per day. The company says it plans to raise that production level to more than 2 million barrels per day by 2027.

Critics Question Capital Deployment

Critics of the deal will no doubt point to the fact that this does not represent “new” current or projected production for the U.S. overall, and that the $60 billion ExxonMobil is deploying to increase its equity production will likely result in less capital available to be deployed to finding and developing new reserves in other parts of the world.

But this analysis tends to ignore the fact that new reserves are constantly being identified and developed within the amazingly prolific Permian region itself. The industry has been able to steadily raise per-well recoveries over the last decade through the advancement of technology and drilling and completion processes. That has been accomplished in the face of predictions by various experts that most or all of the prime drilling locations had already been exploited.

Additional completion horizons continue to be identified within the basin itself. As an example, the Woodford and Barnett shales that have been so productive in other parts of Texas also extend beneath the ground into the Permian region, and companies like Diamondback Energy

FANG

The Bottom Line

In an interview in August 2017, Allen Gilmer, the founder and longtime Chairman and CEO of DrillingInfo (now Enverus) told me he believes the Permian Basin is “a near-infinite resource” for Texas, the United States and the world. He believed then that expert predictions at the time that the Permian was about to fall into decline amounted to nonsense, and that the industry would continue to identify new horizons and raise production from the Basin for years to come.

According to the U.S Energy Information Administration, overall oil production in the Permian since that interview was conducted has increased from around 2.4 million barrels of oil per day to roughly 5.8 million bopd, a stunning rise in such a short period of time.

By entering into this agreement to merge with Pioneer, by far its largest acquisition since the merger between Exxon and Mobil in 1998, ExxonMobil seems to be placing a bet that Gilmer is right about the seemingly inexhaustible nature of the underground resources of West Texas and Southeast New Mexico. Only time will tell who is right.

Read the full article here