This post follows a previous post which pointed to significant influence that ExxonMobil+Pioneer created in the oil and gas sphere. Now we explore the company’s influence in climate and the energy transition. In this sphere, it’s quite remarkable what the company has accomplished in just the past few years, and it looks like this is just a start.

Influence on climate change in the energy transition.

The energy transition brought on by climate change has not been clearly associated with ExxonMobil

XOM

On a closer look, history has misjudged Exxon before and after its merger with Mobil in 1999. Exxon had a head start over other oil companies in studying global warming. In the 1970s and 1980s they predicted with stunning accuracy the rise in atmospheric CO2 concentration up to 2020 — and the accompanied rise in global temperature.

They got this right. And they agreed that it had a human cause – largely due to burning of fossil fuels. Fossil fuels that today contribute 73% of all global carbon emissions.

But in later years it was alleged that Exxon in public cast doubt on the science of climate change. But This has been challenged by an alternative interpretation:

Predicting climate change is a different animal from predicting global warming. Yes, there are direct indicators such as Arctic ice melting, glaciers retreating, corals bleaching, and sea levels rising. But much more serious are weather extremes such as the killer quad of droughts, wildfires, super-rain floods, and hurricanes. These can wreak havoc in the form of famines, flooding, migration, and government instability. But these severe effects have not worsened over the last 40-50 years, on a global basis, while global warming has increased by 1 C degree.

It appears Exxon has been hesitant about forecasting dramatic climate change scenarios, and about whether urgent action is needed to fix the problem. This may have been wrongly taken as a denial of climate change. In more recent years, other serious thinkers have also been hesitant, as is clear from their own careful documentation2,3,4.

An alternative interpretation of Exxon’s position is that global warming is proven, but the serious weather extremes that have not worsened over the past 40 – 50 years contradicts climate alarmists. This case will undoubtedly be presented by the defense during upcoming lawsuits against Exxon.

What are ExxonMobil doing to address climate change?

Despite the company’s uncertainties about attributing extreme weather events to global warming, ExxonMobil have set on an ambitious course to limit their greenhouse gas carbon emissions. This makes sense because, if emissions from burning their oil and gas by parties who buy their products are included (i.e. Scope 3 emissions), ExxonMobil’s contribution to global emissions will become exorbitant after their merger with Pioneer.

There are three buckets to control carbon emissions: reducing emissions in the field, carbon capture and storage, and hydrogen generation. In the past couple of years, ExxonMobil+Pioneer has come to the forefront in repealing emissions in these three categories. Let’s look closer at this surprising statement.

Reducing emissions in the field.

The Permian basin roadmap includes a goal to reach net-zero emissions by 2030 by (1) electrifying operations using wind, solar, and natural gas, (2) expanding methane leak detection and mitigation technology, (3) eliminating routine flaring, (4) setting up high-quality emissions offsets, which may include nature-based solutions.

The Permian roadmap will be a challenge because 2030 is only 7 years away, and now ExxonMobil’s facilities have roughly doubled if Pioneer’s are included.

But Pioneer has in its own right emphasized emissions reduction over the past few years. Based on the next five years, Pioneer’s emissions (Scope 1 and 2) will be 75% lower than ExxonMobil’s global upstream average1.

ExxonMobil’s wider goals for 2030 are reduction in upstream carbon emissions by 40-50% (based on 2016 levels). For company-wide carbon emissions the reduction is to be 20-30%. For gas flaring of wells, the reduction goal is 60-70%. For methane emissions from equipment leaks the numbers are 70-80%.

Carbon capture and storage (CCS).

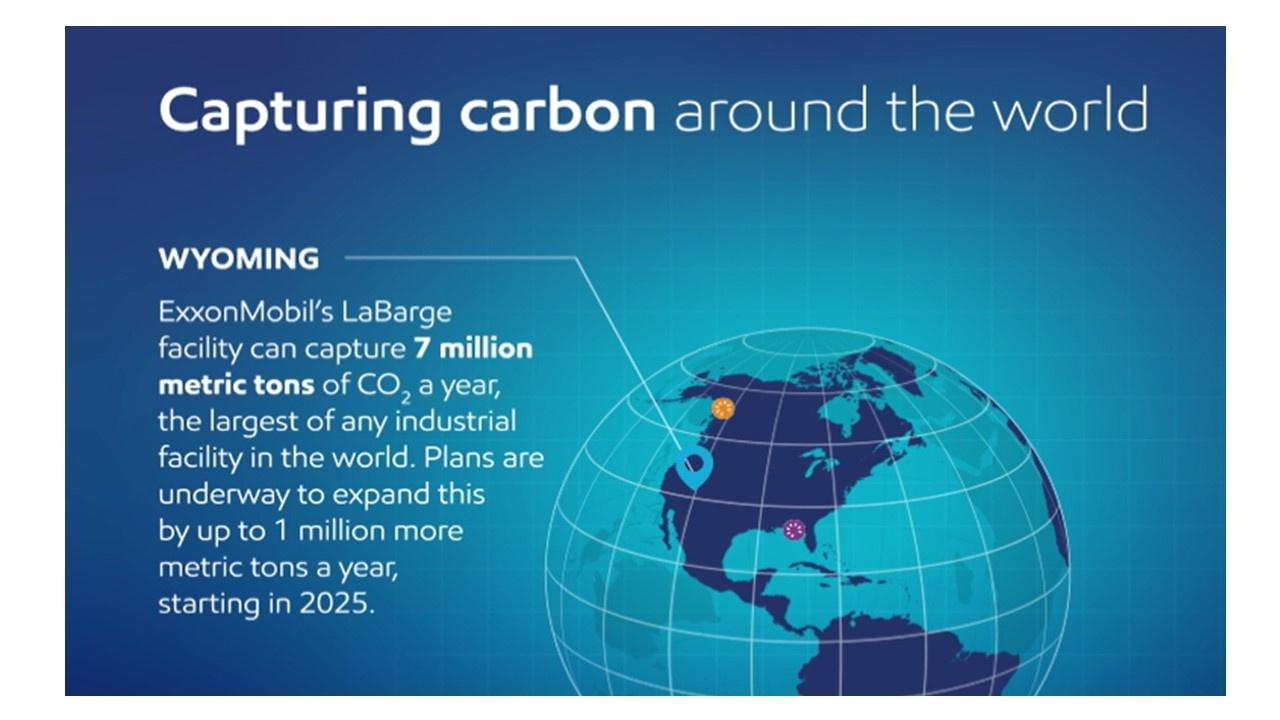

ExxonMobil have the largest number of CO2 injection projects up and running – about a dozen mainly in the US. They are ready to surge out of the blocks in the race to commercialize vast numbers of CCS projects that will be needed to reach net-zero emissions by 2050.

ExxonMobil set up in 2021 a branch company called Low Carbon Solutions to focus on reducing CO2 emissions by scaling up CCS and new fuels such as blue hydrogen. The two are connected: blue hydrogen is formed by decomposition of methane, CH4, while the biproduct of CO2 would be captured and buried (via CCS) beneath the ocean.

Spending will be about $2 billion in 2023, rising to $3 billion by 2025 and $6 billion by 2027.

The Baytown project: ExxonMobil has advanced plans to build a 1 billion cubic feet per day (bcfd) blue hydrogen and ammonia production plant linked with a 7 million tons per year CCS system at its refinery in Baytown, Texas. This 7 million tons is equivalent to emissions from 1.5 million cars. It would almost double ExxonMobil’s current CCS capacity of 9 million tons per year.

The Baytown project would be ExxonMobil’s contribution to a larger joint venture with other partners, to establish a Houston carbon capture hub valued at $100 billion. It would be built around an interdisciplinary collection of CCS and hydrogen projects.

The visionary target would be disposal of 100 million tons of CO2 per year by 2040. About 7 million tons of CO2 per year will come from the Baytown refinery. The rest will come from Houston-area power plants, refineries and petrochemical facilities who will pay to have ExxonMobil+Pioneer sequester their CO2 biproducts. 100 million tons per year is substantial: it would amount to roughly 2% of total current emissions from the U.S.

The vision is a game-changer as it will reduce ExxonMobil’s Baytown emissions, enable customers to reduce their emissions, and will provide low-carbon hydrogen power to other Houston hard-to-abate industries.

At least 11 miscellaneous companies have expressed support for this vision. These are companies that produce electrical power, transportation fuels and oils, and everyday essentials like medicines and plastics.

Tens of thousands of new jobs would be needed, and Houston would become the new energy capital of the world.

This kind of vision puts ExxonMobil+Pioneer on the big influencer stage – their vison preceded the two U.S. Congress financial bills that have since provided seed money to develop CCS – the Infrastructure Act of 2021 and the Inflation Reduction Act of 2022.

ExxonMobil’s financial commitment was announced last December. The corporate plan for the next 5 years is to maintain its capital expenditures at $20-25 billion per year while growing investments up to $17 billion total to reduce carbon emissions. This $17 billion is only a small fraction, 14 – 17%, of total expenditures over 5 years.

But the elevated fed’s tax credit 45Q to decarbonize by using CCS, per the Inflation Reduction Act, may bring other companies running with money to pay ExxonMobil to bury their carbon emissions.

Given the massive projected growth of CCS to meet Paris’ net-zero emissions by 2050, this tax credit worth could balloon up to $100 billion. With their expertise, ExxonMobil+Pioneer are poised to cash in on this dramatic growth. But more than this – they will have the position and power to influence how this kind of energy transition develops.

Hydrogen generation.

The Baytown refinery will produce blue hydrogen plus ammonia, while the biproduct CO2 will be stored in a CCS project under the Gulf of Mexico. The hydrogen would be used for ExxonMobil’s olefins production plant where carbon emissions could be reduced by 30%.

The company is already talking with potential customers to purchase surplus hydrogen and ammonia volumes in a 2027-2028 time frame.

Caution: hydrogen may not be a silver bullet for ExxonMobil+Pioneer because it is blue hydrogen, not green hydrogen.

One of seven hydrogen hub projects was recently awarded hefty funds (about $1 billion) from the U.S. Department of Energy (DOE). Called the HyVelocity Hub, it is centered along the U.S. Gulf Coast, and organized by Chevron

CVX

ExxonMobil will have their hands on critical elements of this hub project. First, the project would be leveraging on a network of 48 hydrogen production centers (the largest in the world). Second, there will be 1,000 miles of dedicated hydrogen pipelines along the Louisiana and Texas coasts. Third, 10,000 permanent jobs would likely result.

Fourth are technical goals. One goal is to solve DOE’s challenge, called the Hydrogen Shot, of making 1 kg of hydrogen while emitting less than 2 kg of carbon dioxide. Another goal is to reduce the cost of hydrogen by 80% — to $1/kg within 10 years.

ExxonMobil+Pioneer will be right in the middle of this HyVelocity Hub, and their influence on R&D, hydrogen production, and miles of hydrogen pipelines will be hugely important. Tax credits offered by the Inflation Reduction Act could enable $100 billion in clean hydrogen production over the years.

References.

1. Wood-McKenzie Press note, ExxonMobil acquisition of Pioneer Natural Resources

PXD

2. Wrightstone, G., Inconvenient Facts, Silver Crown Productions.

3. Koonin, Steven, Unsettled, Benbella, 2021.

4. Pielke, Roger, The Honest Broker.

5. Wood-McKenzie Press Note, 7 Btpa of carbon capture needed to meet net zero by 2050.

Takeaways.

ExxonMobil’s hesitancy about forecasting extreme weather events from global warming, and about whether urgent action is needed to fix the problem, has been misunderstood as a denial of climate change. In more recent years, other serious thinkers have also been hesitant, as is clear from their own careful documentation2,3,4.

ExxonMobil+Pioneer have set on an ambitious course to limit their carbon emissions. There are three buckets to control carbon emissions: reducing carbon emissions in the field, carbon capture and storage, and hydrogen generation. The company is at the forefront to repeal emissions in these three categories.

The Permian basin roadmap includes a goal to reach net-zero emissions by 2030. This will be a challenge because 2030 is only 7 years away, and now ExxonMobil’s facilities have roughly doubled if Pioneer’s are included.

ExxonMobil has advanced plans to build a 1 bcfd blue hydrogen and ammonia production plant linked with a 7 million tons per year CCS system at its refinery in Baytown, Texas. The hydrogen would be used for ExxonMobil’s olefins production plant where carbon emissions could be reduced by 30%.

The Baytown project would be ExxonMobil’s contribution to a larger joint venture with other partners, to establish a CCS hub in Houston, valued at $100 billion.

ExxonMobil+Pioneer will be right in the middle of the HyVelocity Hub, and their influence on R&D, hydrogen production, and miles of hydrogen pipelines will be hugely valuable. Houston may become the energy capital of the world, not just the oil capital.

Given the massive projected growth of CCS to meet Paris’ net-zero emissions by 2050, the tax credit incentive could balloon investments up to $100 billion. With their expertise, ExxonMobil+Pioneer are poised to cash in on this dramatic growth. But more than this – they will have the position and power to influence how this kind of energy transition develops.

With its wide commitments in reducing emissions, carbon capture and storage, and hydrogen fuel, ExxonMobil+Pioneer will be an indispensable influence-shaper for the oilfield as well as climate projects in upcoming decades.

Read the full article here