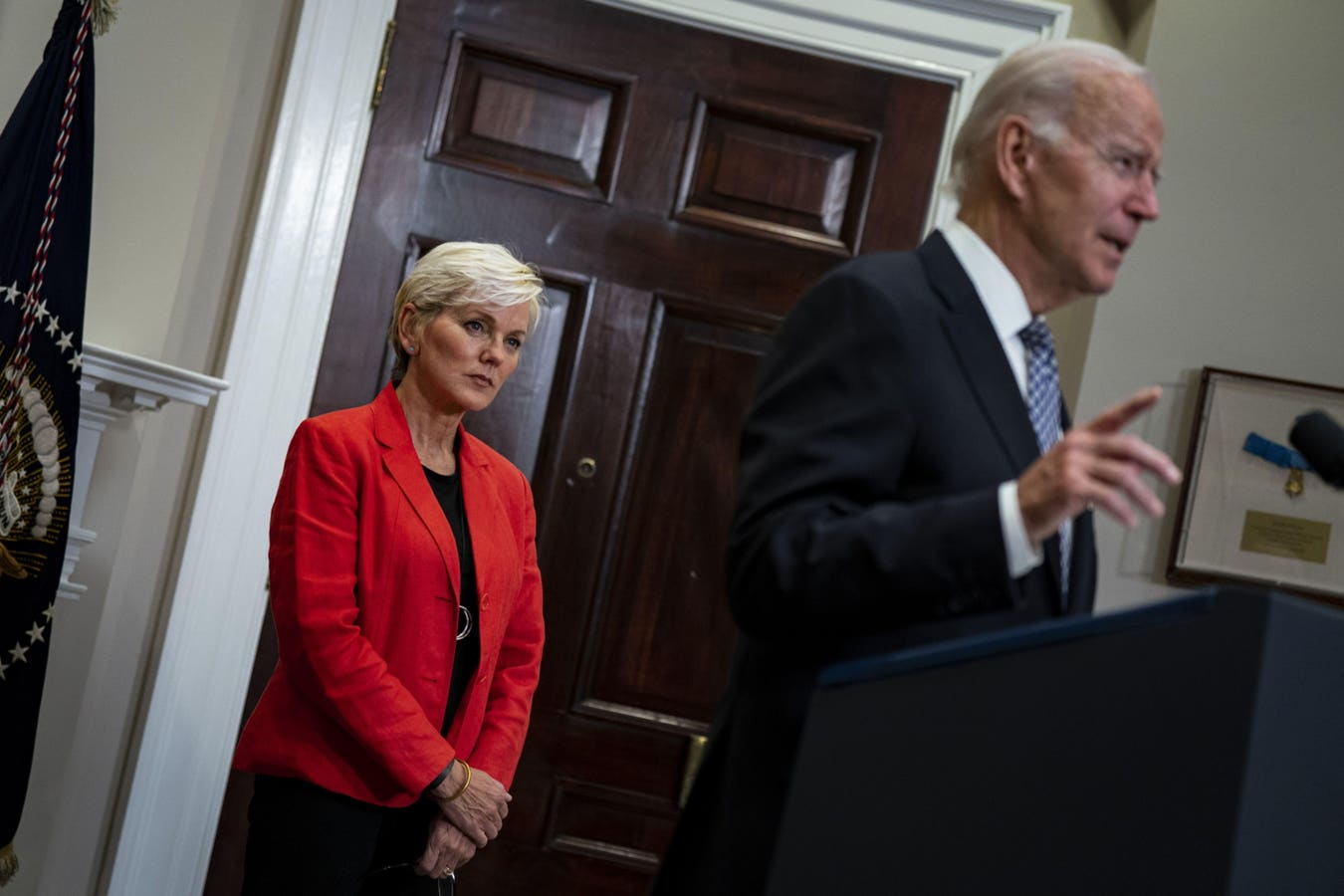

On Friday, President Joe Biden and Secretary of Energy Jennifer Granholm announced the selection of seven regional clean hydrogen hubs. These hubs will be targeted with shares of $7 billion allocated by the 2021 Bipartisan Infrastructure Law to help accelerate the domestic market for hydrogen in the United States. But the future viability of the hubs will be largely influenced by the Treasury Department’s interpretation of a key tax credit designed to jumpstart the industry.

More than a year after the passage of the 2022 Inflation Reduction Act into law, the U.S. Treasury Department’s IRS regulations governing the Section 45V hydrogen tax credit remain unresolved. This delay in finalizing the needed rule clarifying which projects will and will not qualify to benefit from the credit is the source of much concern from a broad variety of potential stakeholders.

At issue is the concept of “additionality,” a standard that would require electricity for production of hydrogen to be generated from new “green” sources, i.e., renewable energy. Given that the IRA itself did not specify any such requirement, many are concerned that an attempt by Biden Treasury officials to include one would inevitably lead to a raft of litigation that would in turn lead to delays and cost increases in pending new projects.

Writing at the Atlantic Council in late September, Landon Derentz advocates in favor of what he calls “an inclusive approach to hydrogen tax credits” as a means of jump-starting the nascent industry in the U.S. He further contends that “overly ambitious definitions for what constitutes ‘clean hydrogen’ could stifle the industry’s growth.”

In response to the Treasury Department’s solicitation for public comments, Clean Fuels Michigan, a trade association representing members from across the clean transportation industry, wrote, “Including an additionality requirement for hydrogen producers to qualify for the 45V tax credit could substantially hinder the growth of the hydrogen industry.” That position was echoed in comments by utility company Xcel Energy, which said that a rule excluding “hydrogen production that uses electricity generated from both existing and new nuclear plants from eligibility for the 45V credit…would limit the industry’s ability to develop the hydrogen market.”

Indeed, it seems as if most stakeholders with a real monetary investment in the nascent hydrogen industry oppose the introduction of this additionality provision, at least in the near term, until the industry has been able to scale up to self-sustaining levels.

Among those stakeholders is the Northern California Power Agency, a consortium of locally-owned electric utilities that engage in joint investments in power projects. One such investment is NCPA’s Lodi Energy Center, a fast-start natural gas generation facility that the agency investing heavily in converting to hydrogen technology in the coming years. The planned conversion is a centerpiece of NCPA’s strategic vision of meeting the state’s policy of a 60% renewable portfolio standard by 2030.

When I spoke with him recently, NCPA General Manager Randy Howard said he, too is concerned that the inclusion of an additionality standard in a final 45V regulation could lead to delays in his agency’s ability to complete this key project. The main concern is that such a rule would likely lead to litigation that could prolong uncertainty about the tax credit’s availability, thus delaying final investment decisions and inhibiting the industry’s ability to rapidly scale up.

“We need to move it. We need to demonstrate what we can do and we can’t be tied up in litigation,” he says.

This concern becomes especially heightened given that NCPA has already invested heavily in its project and has already begun partial operations. “We’ve already invested $50 million in a turbine capable of a 45% blend,” he points out. “Today it’s installed, it’s operating. Our next phase is to build out electrolyzers and then eventually get to 100% hydrogen in the facility. So, we made clear in our comments that additionality is not necessary.”

Stakeholders like NCPA and others are concerned that, if a final IRS regulation is not cemented into place before next year’s presidential election, a change in administrations and congressional majorities could result in the 45V benefit being taken away entirely. This is far from an invalid concern. As we have seen in every change of administration in recent decades, both the executive and legislative branches of government have found increasingly creative means of rapidly revoking major portions of the energy and environment-related policies invoked by their predecessors.

The Bottom Line

The ongoing debate over whether to include an additionality requirement in an IRS Section 45V final rule could become a make-or-break moment for America’s nascent hydrogen power generation business. The aggressive timelines set by the Biden administration as its goals for this energy transition dictate the need for government and the business sector both to move rapidly. But, as we see in this example, where businesses like NCPA are willing and able to move in such a manner, the federal government still lacks any such ability.

The Treasury Department can speed things up where hydrogen is concerned by disappointing the advocates for this additionality standard. But if political considerations overrule the industry’s practical needs, this key investment stimulation tool could be delayed for years to come.

Read the full article here