With American consumers keeping their fingers crossed for lower oil prices, all signs are that relief isn’t coming anytime soon. This bad news stems from various factors, including the unwelcome news that Saudi Arabia and Russia will prolong their unilateral oil production curbs by another three months, longer than most traders projected.

With the U.S. Energy Information Administration (EIA) forecasting sustained global demand for petroleum products, oil prices aren’t likely to trend downward from the $90 mark that the international Brent benchmark crude oil price surpassed recently.

As foreign oil suppliers rein in production, the American oil market is at a crossroads.

On one hand, analysts estimated U.S. crude oil inventories to fall by 5.5 million barrels earlier this month. On the other hand, further draws on U.S. crude oil inventory seem a practical response to major suppliers turning down the spigot. Something has to give.

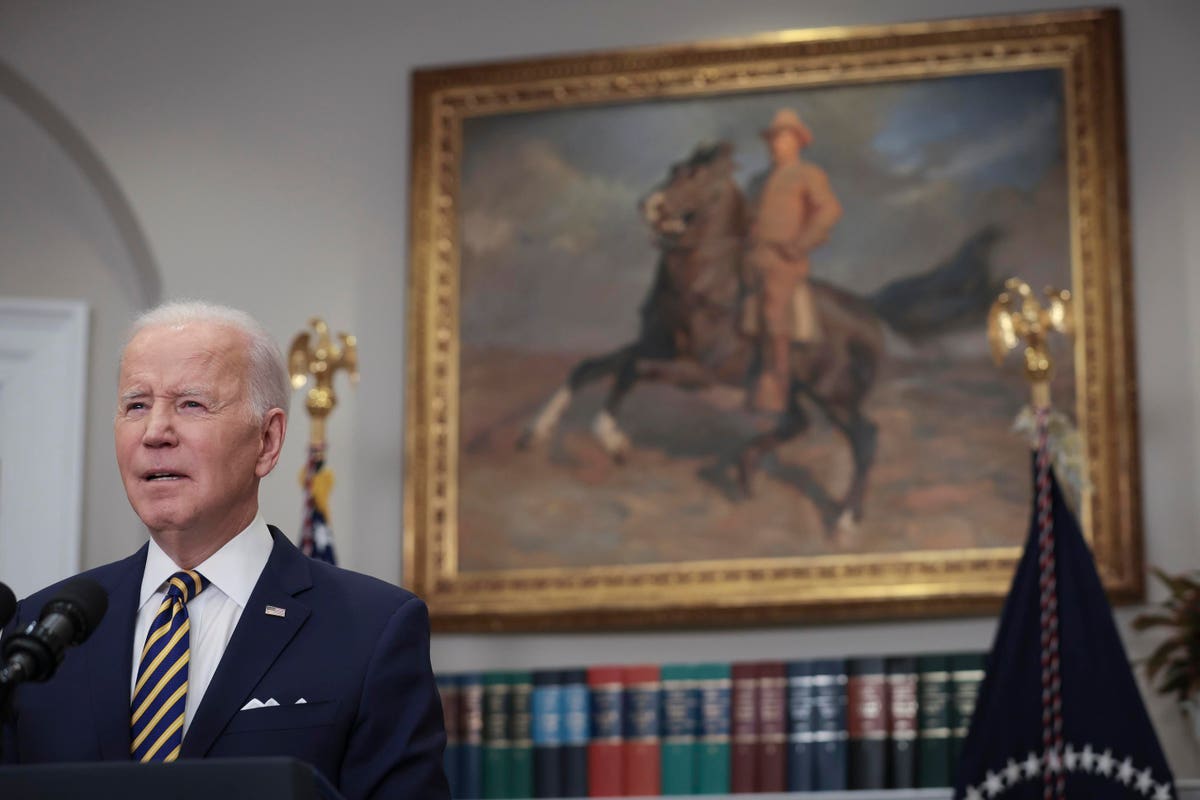

Unfortunately, ramping up American production isn’t as simple as turning on a faucet. That’s because federal policy, already replete with regulations that choke off supply to domestic energy resources, has grown more frustrating and harmful to the U.S. oil industry in the hands of the Biden administration. Consider two significant ways the administration is leading the country toward less oil supply instead of more.

First, the U.S. Department of the Interior has dragged its feet on developing future plans for drilling on federal lands and in federal waters. It’s been more than a year since Interior allowed the five-year program for federal offshore oil and natural gas leasing to lapse without a replacement. That has a chilling effect on oil markets and endangers the Gulf of Mexico federal offshore oil production, accounting for 15 percent of total U.S. crude and 5 percent of total dry natural gas production.

To its credit, Congress insisted on inserting provisions in the Inflation Reduction Act forcing Interior to hold lease sales, including one lease sale slated for the end of this month.

The Biden administration’s next roadblock to domestic production was an actual whale. The Rice’s whale, an endangered species whose core habitat is off the Florida panhandle in the northeastern Gulf of Mexico.

Shortly before publishing its Notice to Lessees, the Biden administration settled a lawsuit filed in 2020 by environmental groups that claimed Interior had not adequately assessed the risks posed to Rice’s whales by drilling activity. The consequence? The Final Notice of Sale issued by the Bureau of Ocean Energy Management (BOEM) for Lease Sale 261, the lease made possible by congressional intervention, included severe restrictions on operations and vessel traffic on nearly 6 million acres of the Gulf of Mexico.

The move, which critics argue, including myself, was orchestrated mainly behind closed doors, threw significant shade on what seemed a glimmer of hope for new oil and gas leases.

The new restrictions on the Gulf of Mexico acreage apply only to oil and gas producers, not other sectors moving large vessels through the Gulf, including the U.S. Military.

The move was not subtle, targeting oil and gas activity in a way that alters the economic viability of the lease and upends plans companies have worked on since the IRA became law. That’s one reason industry leaders have filed a lawsuit against BOEM and the Interior Department. As Steve Forbes told Fox News, the administration is going around lawmakers by creating policy behind closed doors.

The timing is horrible for U.S. energy security and consumers. Oil prices will likely rise through the end of this year due to production cuts by OPEC and its allies, creating urgency for more American oil production.

U.S. production is already expected to exceed 13 million barrels per day in early 2024, with federal authorities forecasting production to be 200,000 barrels a day higher than July estimates. At the same time, capital expenditure growth for oil-related companies has been much slower over the past two years, even with spiking oil prices. In short, mixed signals from the Biden administration have disrupted conventional wisdom, suppressing investment even though demand is rising.

It’s time to break the cycle of bad energy policy. Global markets are hungry for U.S. production to provide price relief. The Biden administration would do well to stop preventing that from happening with yet more federal regulation.

Read the full article here